Your credit score is one of the most important numbers in your financial life. It influences whether you’ll be approved for loans, credit cards, mortgages, and even rental agreements. Despite its importance, many people are unsure how to access their score—let alone do so securely. The good news is that checking your credit score doesn’t have to be complicated or risky. With the right approach, you can get an accurate reading quickly, without damaging your credit or exposing your personal information.

This guide walks you through the safest and simplest methods to discover your credit score, explains what different scores mean, and helps you avoid common pitfalls along the way.

Why Knowing Your Credit Score Matters

Your credit score is a three-digit number—typically ranging from 300 to 850—that reflects your creditworthiness. Lenders use it to assess the risk of lending you money. A higher score generally means better interest rates, higher approval odds, and more favorable terms.

But beyond borrowing, your credit score can affect insurance premiums, job applications (in some states), and utility deposits. Monitoring it regularly helps you spot errors, detect fraud early, and build stronger financial habits over time.

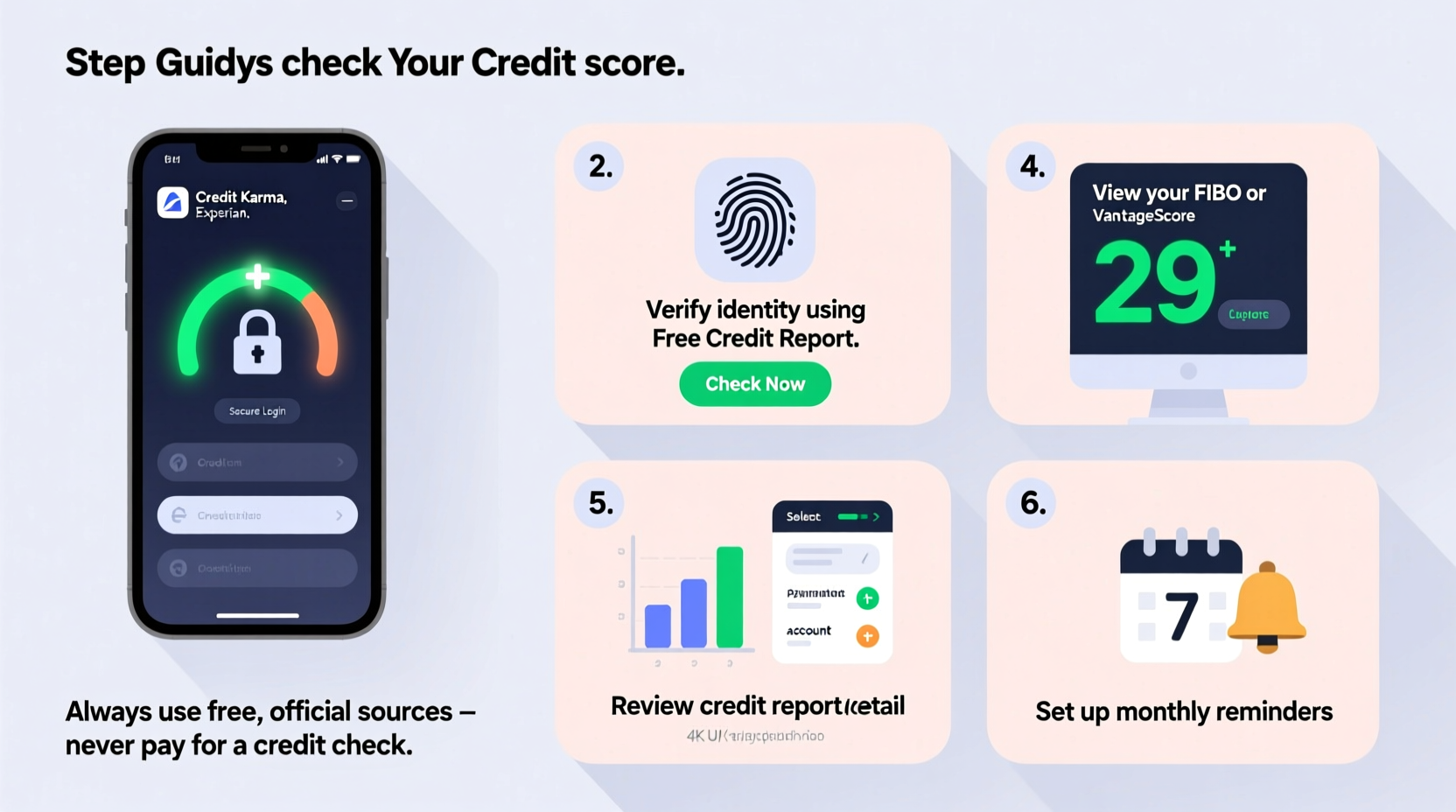

Step-by-Step Guide to Safely Access Your Credit Score

- Determine What Type of Credit Score You Need

There are multiple types of credit scores, but the most widely used is the FICO Score. VantageScore is another common model. While they use similar ranges, lenders may rely on specific versions depending on the loan type. For general monitoring, either is useful—but if you're applying for a mortgage, aim to see your FICO Score 8 or newer. - Use Free Tools from Reputable Sources

Many banks, credit card issuers, and financial platforms now offer free access to credit scores. Check if your current bank or credit card provider includes this feature in online banking. Examples include Chase, Discover, Capital One, and American Express—all provide free monthly FICO or VantageScores. - Visit Official Credit Bureaus’ Websites

The three major credit bureaus—Equifax, Experian, and TransUnion—are required by law to provide you with free weekly credit reports via AnnualCreditReport.com. While reports don't always include scores by default, you can often purchase them directly from each bureau’s site. However, better options exist at no cost. - Sign Up for Trusted Free Credit Services

Platforms like Credit Karma, Credit Sesame, and NerdWallet offer free credit monitoring using VantageScore data from TransUnion and Equifax. These services require registration but do not charge fees or require credit cards. They also alert you to changes in your report, helping you stay proactive. - Avoid “Free Trial” Traps

Some websites advertise “free credit scores” but enroll you in costly subscription services after a trial period. Always read the fine print. Stick to well-known, transparent providers that don’t auto-enroll you in paid plans.

Do’s and Don’ts When Checking Your Credit Score

| Do’s | Don’ts |

|---|---|

| Check your score through your bank or a reputable free service | Use unknown sites that ask for your Social Security number upfront |

| Review your full credit report annually for errors | Assume all “free” services are truly free—watch for hidden subscriptions |

| Monitor changes over time to track progress | Apply for multiple credit products in a short span just to check eligibility |

| Use soft inquiries (self-checks) to monitor your score | Mix up soft inquiries with hard ones—only hard pulls affect your score |

Real Example: How Sarah Improved Her Financial Standing

Sarah, a 32-year-old teacher, wanted to buy her first home but wasn’t sure where to start. She had never checked her credit score and assumed it was “okay.” After hearing about free tools from a friend, she signed up for a no-cost account with Credit Karma. Her initial VantageScore was 642—below the threshold for the best mortgage rates.

Instead of feeling discouraged, Sarah used the platform’s breakdown of factors affecting her score. She discovered high credit utilization on one card and a late payment from two years ago still impacting her rating. Over the next six months, she paid down balances and set up autopay for minimums. By rechecking every few weeks, she watched her score climb to 705. When she applied for a mortgage, she qualified for a significantly lower interest rate than expected.

Sarah’s experience shows that simply knowing your score isn’t enough—you need context and consistent follow-up to make meaningful improvements.

“Understanding your credit score starts with safe, regular access. The real power comes from acting on what the number tells you.” — Laura Adams, Personal Finance Expert and Author of *The Debt-Free Millionaire*

Common Myths About Credit Scores Debunked

- Myth: Checking my credit score lowers it.

Truth: Only hard inquiries (like when a lender checks for approval) impact your score. Soft inquiries—including self-checks—have no effect. - Myth: All credit scores are the same.

Truth: You have dozens of credit scores across different models and bureaus. A score from one source may differ slightly from another. - Myth: Closing old accounts improves my score.

Truth: Closing accounts can shorten your credit history and reduce available credit, potentially lowering your score.

Frequently Asked Questions

How often should I check my credit score?

You can check your credit score as often as you like without penalty. Monthly checks are ideal for tracking trends, especially if you’re working to improve your credit. At minimum, review your full credit report once per year from each bureau via AnnualCreditReport.com.

Will checking my credit score hurt my credit?

No. When you check your own score, it’s considered a soft inquiry, which has no impact on your credit. Hard inquiries occur only when a lender evaluates your application for credit, and even those typically deduct fewer than five points—if any.

Can I get my FICO Score for free?

Yes. Many financial institutions partner with FICO to offer free scores to customers. Additionally, Experian provides one free FICO Score per month through its website. Other FICO scores (such as those for auto or credit card lending) may require a paid subscription, but the base version is increasingly available at no cost.

Final Checklist: How to Safely Find Your Credit Score

- Confirm whether you want a FICO or VantageScore (FICO preferred for major loans)

- Check if your bank or credit card issuer offers free score access

- Register with a trusted free service like Credit Karma or Experian

- Avoid sites requiring payment details for “free trials”

- Review your full credit report annually for inaccuracies

- Track changes over time and address negative factors

Take Control of Your Financial Future Today

Your credit score is not a fixed number—it evolves based on your financial behavior. By learning how to access it safely and understand what drives it, you gain control over one of the most influential aspects of your economic life. Whether you're planning a big purchase, rebuilding after setbacks, or simply staying informed, regular monitoring is a powerful habit.

Start today: log into your bank account, visit a reputable free credit site, or request your report. Knowledge is the first step toward improvement. Once you know your score, you're already ahead of the game.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?