Tax season can feel overwhelming, but knowing your current tax status is one of the most empowering financial moves you can make. Whether you're waiting for a refund, verifying if your return was accepted, or ensuring you're compliant with federal requirements, understanding your tax standing helps avoid surprises and supports smarter money decisions. The good news? Checking your tax status is faster and more accessible than ever—especially with digital tools from official sources like the IRS. This guide walks through exactly how to access your tax information, interpret key statuses, and take action based on what you find.

Why Your Tax Status Matters

Your tax status isn’t just about whether you’ve filed—it reflects your entire relationship with the Internal Revenue Service at any given moment. It includes whether your return has been received, processed, approved, or flagged for review. It also reveals critical details such as refund amounts, payment plans, outstanding balances, and eligibility for credits.

Ignoring your tax status can lead to delayed refunds, unexpected penalties, or even issues when applying for loans, mortgages, or government benefits. For example, if the IRS holds your refund due to identity verification issues and you’re unaware, it could disrupt budgeting plans or debt repayment strategies.

“Knowing your tax status gives you control. It’s not just about compliance—it’s about financial clarity.” — Laura Simmons, CPA and Tax Advisor

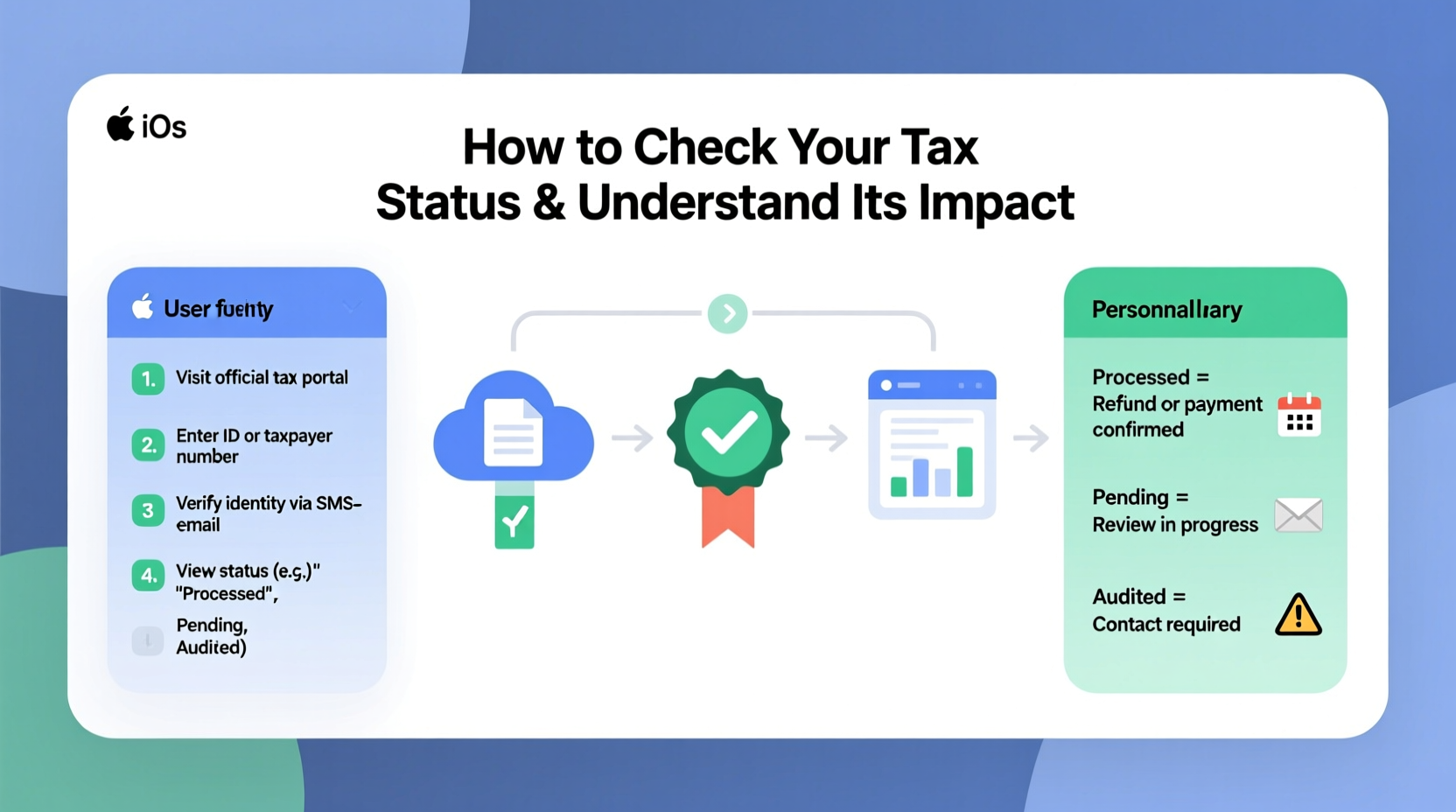

Step-by-Step: How to Check Your Tax Status Online

The IRS offers a secure, free tool called “Where’s My Refund?” that allows taxpayers to check the status of their federal return within 24 hours after e-filing (or up to four weeks for paper returns). Here’s how to use it:

- Visit the official IRS website: Go to IRS.gov/refunds. Avoid third-party sites that may charge fees or collect personal data.

- Select “Where’s My Refund?”: Click the link to enter the tracking tool.

- Enter required information: You’ll need:

- Social Security Number (or Individual Taxpayer Identification Number)

- Filing status (e.g., Single, Married Filing Jointly)

- Exact refund amount claimed on your return

- Review your status: The system will display one of three stages:

- Return Received: The IRS has your return and is beginning processing.

- Refund Approved: Your refund has been authorized and is being prepared for dispatch.

- Refund Sent: The funds have been issued via direct deposit or mailed as a check.

Understanding Key Tax Statuses and What They Mean

Not all tax statuses are created equal. Each stage carries implications for your next steps. Below is a breakdown of common statuses and their practical meaning:

| Status | What It Means | Action Required |

|---|---|---|

| Return Received | The IRS has acknowledged receipt of your return but hasn't started processing it. | Wait. No action needed unless contacted by the IRS. |

| Being Processed | Your return is under review. The IRS may verify information or request documentation. | Monitor mail/email for notices. Respond promptly if asked for proof. |

| Refund Approved | Refund amount confirmed and scheduled for delivery. | Confirm your bank account info if using direct deposit; otherwise, track mail delivery. |

| Refund Sent | Payment has been dispatched. | Check your bank in 1–5 days (direct deposit) or allow 10 business days for checks. |

| Audit Pending | Selected for review due to discrepancies or red flags. | Gather records. Consider consulting a tax professional. |

| Balance Due | You owe taxes not yet paid. | Pay immediately or set up an installment agreement to reduce penalties. |

Mini Case Study: Resolving a Delayed Refund

Samantha, a freelance graphic designer, filed her 2023 return in February and expected a $2,800 refund by mid-March. When no update appeared after three weeks, she used “Where’s My Refund?” and saw her status stuck at “Return Received.” Concerned, she checked her IRS account and discovered a notice requesting proof of self-employment income. She uploaded copies of 1099 forms and invoices through the IRS Document Upload Tool. Within five days, her status changed to “Being Processed,” and her refund was issued two weeks later.

This case highlights how proactive monitoring prevents long delays. Had Samantha not checked her status, she might have waited months before realizing the holdup.

Accessing Additional Tools: IRS Account Portal

Beyond refund tracking, the IRS offers a full online account portal where you can view detailed tax transcripts, payment history, and outstanding liabilities. To access it:

- Create an account at IRS.gov/account.

- Verify your identity using personal details and a mobile phone number.

- Log in to see:

- Tax records from previous years

- Current balance and payment options

- Estimated payments made

- Digital copies of notices

This portal is especially useful for freelancers, gig workers, and those with complex filings who need ongoing visibility into their tax footprint.

Tax Status Checklist: Stay Informed and Prepared

Use this checklist annually to maintain control over your tax situation:

- ✅ File your return by the April deadline (or request an extension).

- ✅ Confirm electronic submission with a filing acknowledgment.

- ✅ Use “Where’s My Refund?” to track your status starting 24 hours post-e-filing.

- ✅ Review IRS notices immediately—don’t ignore letters or emails.

- ✅ Log into your IRS online account to verify balances and payment plans.

- ✅ Update banking information if changing direct deposit accounts.

- ✅ Keep copies of all tax documents for at least three years.

Frequently Asked Questions

How long does it take for my tax status to update?

If you e-file, your status typically updates within 24 hours of IRS receipt. Full processing takes 10–21 days under normal conditions. Paper returns may take up to four weeks to appear in the system and several months to process.

What should I do if my refund is taking longer than expected?

First, confirm your return wasn’t rejected due to errors (e.g., mismatched SSN). If accepted but delayed beyond 21 days, call the IRS at 800-829-1040 or visit a local Tax Assistance Center. Common causes include identity verification, claims for certain credits (like EITC or ACTC), or incomplete forms.

Can someone else check my tax status?

No—one must have your Social Security Number, filing status, and exact refund amount. These safeguards protect against unauthorized access. However, authorized representatives (e.g., enrolled agents or CPAs) can access your account if granted permission via Form 8821.

Final Thoughts: Take Control of Your Financial Picture

Checking your tax status isn’t just a seasonal chore—it’s a vital part of financial health. With just a few minutes online, you can gain clarity on refunds, detect potential fraud, resolve issues early, and ensure you're in good standing with the IRS. Digital tools have made this process simpler than ever, removing guesswork and reducing anxiety.

Don’t wait for a letter in the mail. Proactively monitor your status, keep records organized, and act quickly when updates require your attention. Knowledge is power, especially when it comes to your money.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?