Property taxes are a significant part of homeownership, yet many people struggle to understand how their tax bill is calculated. Unlike income or sales taxes, property taxes vary widely based on location, home value, and local government policies. Without clarity, it's easy to overpay—or miss out on savings through available exemptions and appeals. This guide breaks down the process into clear, actionable steps so you can confidently calculate your property tax, verify its accuracy, and explore opportunities to reduce it.

Understanding the Property Tax Formula

At its core, property tax is calculated using three key components: assessed value, tax rate (also known as millage rate), and any applicable exemptions. The basic formula looks like this:

Property Tax = (Assessed Value – Exemptions) × Tax Rate

The assessed value is typically a percentage of your home’s market value—often between 70% and 100%, depending on your jurisdiction. For example, if your home is worth $400,000 and your county uses a 90% assessment ratio, the assessed value would be $360,000.

The tax rate is set by local governments and can be expressed as a percentage or in mills (where one mill equals $1 per $1,000 of assessed value). A rate of 20 mills equals 2%, so $360,000 assessed value at 20 mills results in $7,200 in annual taxes.

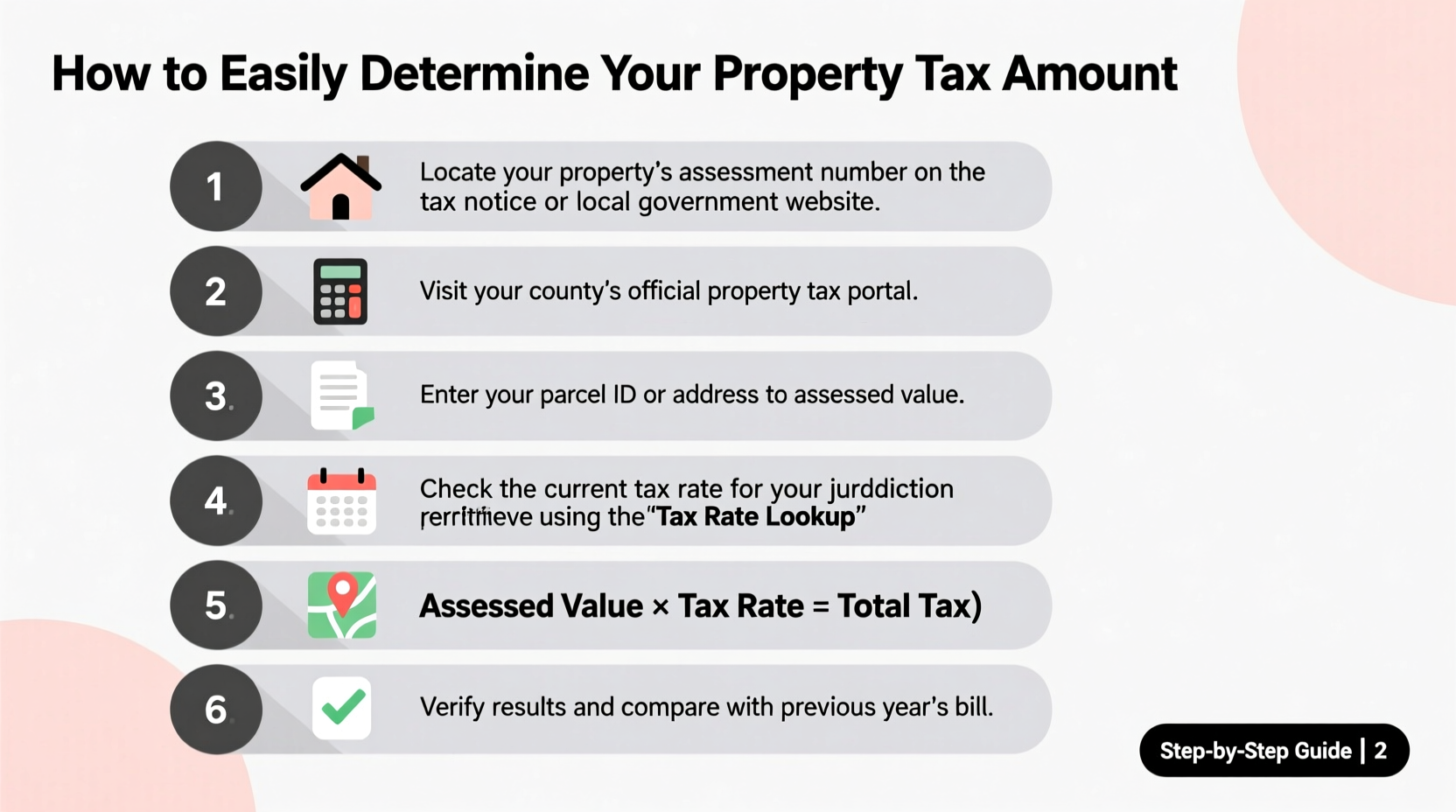

Step-by-Step Guide to Calculating Your Property Tax

- Gather your property details. Start with your most recent property deed, appraisal notice, or tax statement. You’ll need the property’s market value, legal description, and parcel number.

- Find your assessed value. Visit your county assessor’s website and search for your property using the address or parcel ID. Look for “assessed value” or “taxable value.”

- Identify all applicable exemptions. Common ones include homestead, senior citizen, veteran, or disability exemptions. These directly reduce your taxable value.

- Determine the current tax rate. Check your city, county, school district, and special district rates. These are usually published on municipal websites or included in past tax bills.

- Apply the formula. Subtract exemptions from assessed value, then multiply by the combined tax rate to get your estimated annual tax.

- Verify with official sources. Cross-check your calculation with the latest tax notice or contact your local tax assessor’s office for confirmation.

Common Exemptions That Lower Your Tax Bill

Many homeowners pay more than necessary simply because they’re unaware of available exemptions. These are not automatic in most areas—you must apply.

| Exemption Type | Typical Savings | Eligibility Requirements |

|---|---|---|

| Homestead | $5,000–$50,000 off assessed value | Primary residence; varies by state |

| School Tax Ceiling (TX) | Limits annual increases for seniors | Age 65+, continuous ownership |

| Veteran Disability | Full or partial exemption | Service-connected disability (10%+) |

| Senior Citizen | Reduced rate or freeze | Age 65+, income limits may apply |

| Energy Efficiency | Tax credit or abatement | Installation of solar panels, insulation |

“Over 30% of eligible homeowners fail to claim their homestead exemption, leaving hundreds or even thousands on the table each year.” — National Association of County Assessors

Real Example: How Maria Reduced Her Annual Tax by 18%

Maria, a homeowner in Harris County, Texas, received her property tax bill for $6,200—up 12% from the previous year. Concerned, she followed this guide to investigate. She discovered her home’s market value was listed at $520,000, with an assessed value of $468,000 (90% ratio).

She found she hadn’t claimed her homestead exemption, which removes $40,000 from taxable value. After applying, her taxable value dropped to $428,000. Additionally, as a disabled veteran, she qualified for a full exemption on school taxes—a saving of nearly $1,200 annually.

By taking two simple actions—filing for exemptions and verifying her assessment—Maria lowered her tax bill to $5,080, a reduction of $1,120 per year.

Avoiding Costly Mistakes When Reviewing Your Tax

- Ignoring the appraisal notice. This document shows your proposed assessed value before taxes are due. It’s your first opportunity to appeal.

- Assuming your tax rate is fixed. Rates change annually based on budget needs. A rising rate can increase your bill even if your home value stays flat.

- Failing to compare similar properties. If your neighbor’s comparable home has a lower assessment, you may have grounds for appeal.

- Not checking for errors in property details. Incorrect square footage, bedroom count, or lot size can inflate your value.

- Missing the appeal deadline. Most jurisdictions allow 30 days from the appraisal notice to file a protest.

When and How to Appeal Your Assessment

If you believe your home is overvalued, you have the right to appeal. The process generally follows these steps:

- Receive your annual appraisal notice (usually mailed in spring).

- Review the assessed value and property characteristics for accuracy.

- Gather evidence: recent comparable sales (“comps”), photos of needed repairs, or a professional appraisal.

- File a formal appeal with your local review board—often online or by mail.

- Attend a hearing if required and present your case clearly and calmly.

- Wait for a decision. If denied, you may escalate to higher boards or court in some states.

Appeals are most successful when supported by data. For instance, if three similar homes recently sold for $380,000 but your home is assessed at $420,000 without justification, that discrepancy strengthens your case.

FAQ

How often are property values reassessed?

Reassessment frequency varies by state and county. Some areas reassess annually (e.g., Michigan), while others do so every two to four years (e.g., California under Prop 13). Check with your county assessor’s office for local schedules.

Can I lower my property tax if my home value drops?

Yes. If your area allows it, you can file for a “decline in value” review, especially during economic downturns. These are common in states like California and Arizona where assessments are tied to market fluctuations.

Do renovations always increase my tax bill?

Not always—but major improvements like adding a room, garage, or pool typically do. Routine maintenance (e.g., replacing a roof or flooring) usually doesn’t trigger a reassessment unless it increases square footage or market value significantly.

Final Checklist Before Paying Your Tax Bill

- ✅ Verified assessed value on the assessor’s website

- ✅ Confirmed eligibility for homestead or other exemptions

- ✅ Applied for all applicable exemptions this year

- ✅ Compared your assessment to similar nearby properties

- ✅ Reviewed property details (bedrooms, sq. ft., age) for errors

- ✅ Considered filing an appeal if the value seems too high

- ✅ Calculated total tax using the correct millage rate

Take Control of Your Property Tax

Understanding your property tax isn’t just about crunching numbers—it’s about protecting your financial interests as a homeowner. With the right information, you can ensure you're paying only what’s fair and take advantage of every legal opportunity to reduce your burden. Whether it’s claiming an overlooked exemption, correcting an error, or appealing an inflated assessment, small actions today can lead to meaningful savings for years to come.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?