Finding your Wells Fargo account number doesn’t have to be complicated. Whether you're setting up direct deposit, authorizing automatic payments, or verifying your identity for a financial service, having quick access to your account number is essential. While it’s not printed on your debit card or visible in every communication from the bank, there are several secure and straightforward ways to locate it. This guide walks you through each method with clear instructions, practical tips, and real-world examples so you can retrieve your account information confidently and safely.

Why Your Account Number Matters

Your Wells Fargo account number is a unique identifier assigned to your checking, savings, or other deposit accounts. It works in tandem with the bank’s routing number to route transactions accurately—whether it’s a direct deposit from your employer, a bill payment, or a transfer between banks. Unlike your debit card number, which is tied to a specific card, your account number links directly to your banking relationship with Wells Fargo.

Mistaking your card number for your account number is a common error that can delay payments or trigger fraud alerts. Knowing where to find the correct number—and how to protect it—is crucial for smooth financial operations.

Step-by-Step: How to Find Your Account Number Online

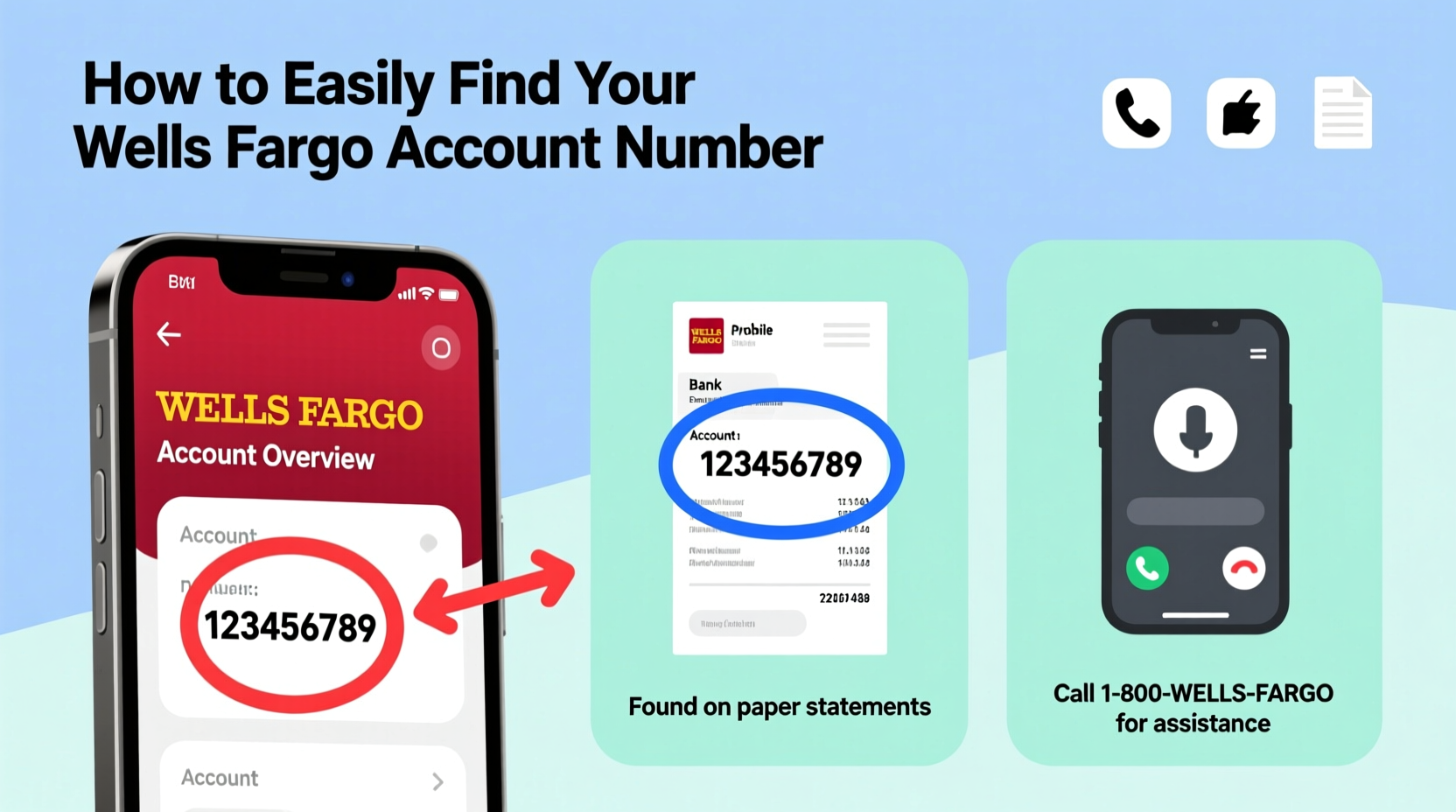

The fastest and most reliable way to access your Wells Fargo account number is through your online banking portal. If you’re already enrolled, follow these steps:

- Log in to Wells Fargo Online: Visit wellsfargo.com and enter your username and password.

- Select Your Account: From the dashboard, click on the account you need (e.g., “Checking” or “Savings”).

- View Account Details: On the account summary page, look for the section labeled “Account Information.” Here, you’ll see the last four digits of your account number displayed by default.

- Show Full Account Number: Click the “Show” link next to the masked number. You may be prompted to verify your identity using a one-time passcode sent to your phone or email.

- Copy or Note the Number: Once revealed, write it down or copy it securely for your records.

Using the Wells Fargo Mobile App

If you prefer managing your finances on the go, the Wells Fargo mobile app offers the same functionality as the desktop site—with added convenience.

- Open the Wells Fargo app and log in using your credentials or biometric authentication (Face ID or fingerprint).

- Navigate to your desired account by tapping on it from the home screen.

- Tap the “Account Details” option—this may appear as an “i” icon or under a “More” menu.

- Select “View Account Number” and authenticate if prompted.

- The full account number will appear on-screen for a limited time before auto-hiding for security.

The app also allows you to quickly share your account and routing numbers via secure messaging when setting up external transfers, reducing the risk of manual entry errors.

Locating Your Account Number on Paper Statements and Checks

If you receive paper statements or still use checks, your account number is embedded in multiple places—but not always obviously.

On a Personal Check

Look at the bottom of any personal check issued from your account. Three sets of numbers appear in magnetic ink character recognition (MICR) format:

- Routing Number: First set of nine digits on the left (identifies Wells Fargo as the institution).

- Account Number: Middle set of numbers (typically 10–12 digits; length varies by account type).

- Check Number: Last set on the right (unique to each check).

| Position | Digits | Purpose |

|---|---|---|

| Left | 031100209 | Wells Fargo Routing Number (varies by state) |

| Middle | 1234567890 | Your Account Number |

| Right | 1001 | Check Number |

On Monthly Statements

Paper or PDF statements list your account number near the top right corner, usually labeled “Account Number” followed by a series of digits. Only the last four may be visible unless you download the full version from the secure documents section of your online account.

“Customers who understand where their account number appears on checks and statements reduce processing delays by 60% when setting up new services.” — Financial Literacy Institute, 2023 Report

What to Do If You Don’t Have Access to Online Banking

Not everyone uses digital banking regularly. If you don’t have login access or haven’t activated online services, you still have options.

Contact Customer Service

Call Wells Fargo’s general customer service line at 1-800-869-3557. After navigating the automated system or speaking with a representative, you can request your account number. Be prepared to verify your identity with:

- Social Security Number

- Date of birth

- Last statement balance

- Recent transaction details

Note: For security reasons, representatives may only confirm the number over the phone—they typically won’t provide it via email or text.

Visit a Local Branch

For in-person assistance, bring a government-issued photo ID and, if possible, a recent statement or your debit card. A banker can pull up your account and show you the full number on-screen or print a temporary document with the information.

Security Best Practices When Sharing Your Account Number

Your account number is sensitive data. While it’s not enough on its own for someone to withdraw funds, pairing it with your routing number and personal details could enable unauthorized ACH transfers or phishing scams.

Do’s and Don’ts

| Do | Don’t |

|---|---|

| Share your number only with trusted entities (employers, utility providers, etc.) | Post your account number on social media or public forums |

| Use secure websites (look for HTTPS) when entering banking details online | Email your full account number without encryption |

| Verify the recipient’s legitimacy before sending information | Give your number to unsolicited callers claiming to be from the bank |

When in doubt, initiate contact through official channels rather than responding to requests.

Mini Case Study: Resolving a Direct Deposit Delay

Samantha, a freelance graphic designer, switched banks and updated her direct deposit information with a client. She mistakenly entered her debit card number instead of her account number. Two weeks later, her payment hadn’t arrived.

After reviewing the error, she logged into her Wells Fargo account online, revealed her correct checking account number, and resent the form. The client corrected the details, and the deposit posted within 48 hours. The issue was resolved quickly because Samantha knew exactly where to find the right number—and caught the mistake early.

This scenario underscores the importance of double-checking account details and understanding where to retrieve accurate information when needed.

FAQ

Is my Wells Fargo account number the same as my customer number?

No. Your account number identifies a specific deposit account (like checking or savings), while your customer number (or online ID) is used to log in to your online banking profile. They serve different purposes and should not be confused.

Can I find my account number without a check or online access?

Yes. You can call customer service or visit a local branch with proper identification. These methods allow secure retrieval even if you lack digital tools or physical checks.

Why does Wells Fargo hide the full account number online?

This is a security measure designed to prevent unauthorized access. By requiring additional verification to reveal the full number, the bank reduces the risk of fraud if your device or account is compromised.

Conclusion

Knowing how to find your Wells Fargo account number empowers you to manage your finances efficiently and securely. Whether you’re accessing it through online banking, reading the bottom of a check, or speaking with a representative, the process is simple once you know where to look. Protect this information carefully, verify its accuracy when sharing, and keep your financial operations running smoothly.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?