Checks remain a common method of payment despite the rise of digital transactions. Whether you're paying rent, sending money to a contractor, or depositing a paper check, understanding your check's components is essential. Among these, the check number plays a crucial role in tracking, reconciliation, and fraud prevention. Unlike account or routing numbers, the check number isn’t used for processing funds—but it’s indispensable for organization and verification. Knowing where to find it, how to use it, and why it matters can streamline your financial management and reduce errors.

Understanding the Anatomy of a Check

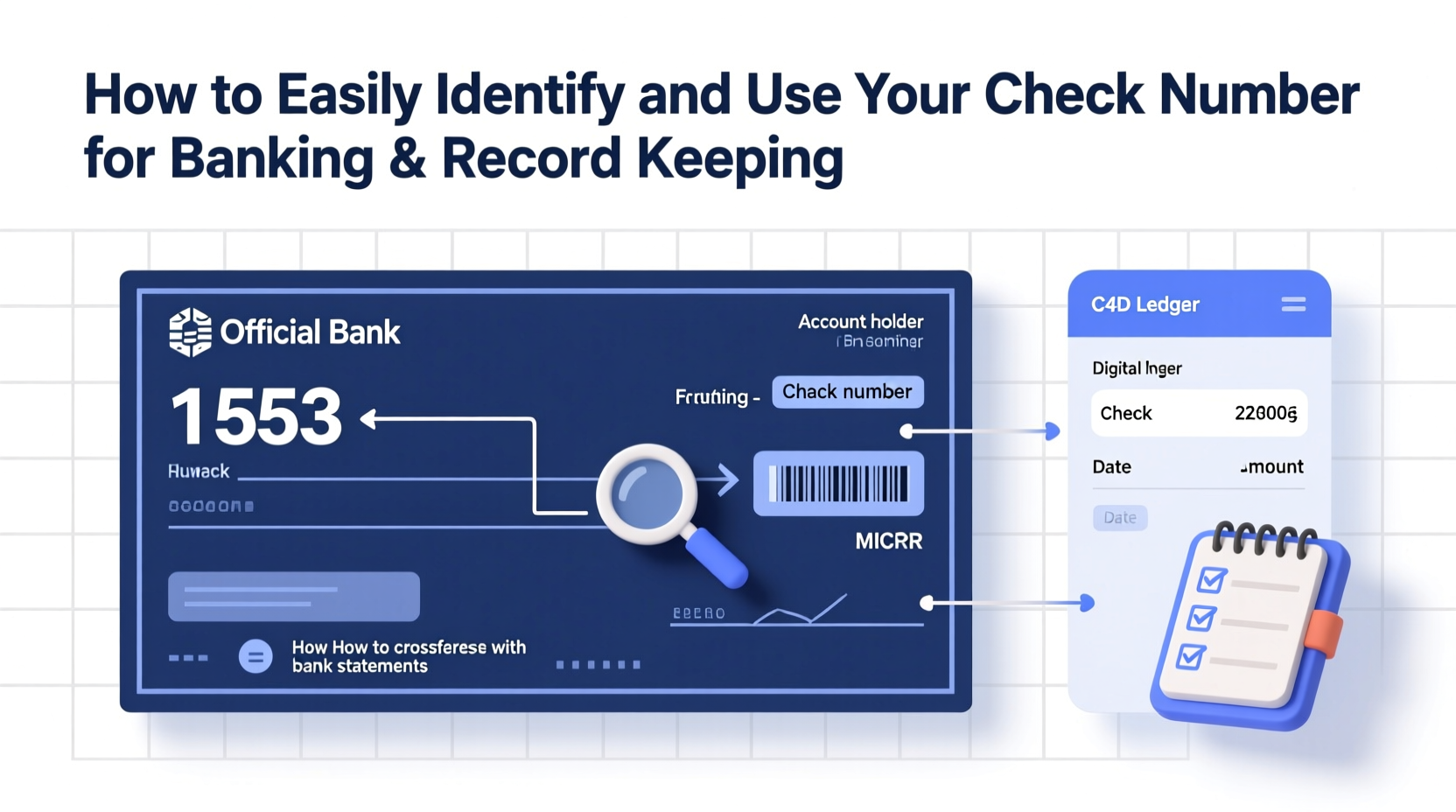

A standard personal or business check contains several numeric sequences, each serving a different purpose. These include the routing number, account number, and check number. While the first two are printed in magnetic ink at the bottom (using MICR technology), the check number appears in multiple locations.

The check number is typically a 3- or 4-digit code located in the top right corner of the check. It may also appear at the bottom, aligned to the far right, following the account number. This number uniquely identifies that specific check within your checkbook series.

For example, if your checks are numbered sequentially from 1001 to 2000, the current check might display \"1047\" as its identifier. Banks assign these numbers during printing, often starting above 100 to avoid confusion with single-digit entries.

How to Locate Your Check Number Quickly

Finding your check number should be second nature, especially when reconciling statements or reporting lost checks. Here’s where to look:

- Top Right Corner: The most visible location. Printed in large digits, this is the primary reference point.

- Bottom Row (Far Right): In the same line as the routing and account numbers, the check number appears last, usually preceded by a symbol like ⑈ or just spaced apart.

- Check Register: If you maintain a physical or digital register, the check number corresponds to the entry for that transaction.

It’s important not to confuse the check number with the other digits on the check. The nine-digit routing number identifies your bank, while the account number—typically 10 to 12 digits—identifies your personal account. The check number is shorter and changes with each new check.

Practical Uses of the Check Number

The check number is more than just an identifier—it serves multiple practical purposes in day-to-day banking and long-term financial tracking.

Tracking Payments and Reconciling Accounts

When balancing your checkbook or reviewing your monthly statement, the check number helps match issued checks with cleared transactions. For instance, if check #1052 hasn’t appeared on your statement, you can quickly identify it as outstanding and follow up if necessary.

Reporting Lost or Stolen Checks

If your checkbook is misplaced, contacting your bank with the range of missing check numbers allows them to flag those checks and prevent unauthorized use. Providing exact numbers speeds up the stop-payment process.

Resolving Discrepancies with Vendors

Vendors often request the check number when confirming receipt of payment. It provides proof that a specific check was issued and aids in tracing payments through their accounting system.

Digital Deposits and Mobile Banking

While the check number isn’t required to deposit a check via mobile app, some banks ask you to enter it after scanning to confirm authenticity and prevent resubmission of the same check.

“Accurate check numbering reduces reconciliation errors by over 60% in small businesses.” — National Federation of Independent Business (NFIB) Financial Practices Report

Step-by-Step Guide to Using Check Numbers Effectively

To maximize the utility of check numbers, follow this simple workflow:

- Record Immediately: As soon as you write a check, log the check number, payee, date, and amount in your register or accounting software.

- Verify Sequential Use: Ensure you’re using checks in order. Skipping numbers can lead to confusion or gaps in records.

- Match Against Bank Statements: During monthly reconciliation, mark off cleared checks using their numbers.

- Flag Outstanding Checks: Note any checks that haven’t cleared after 30 days. Follow up with the recipient or your bank if needed.

- Securely Store Cancelled Checks: Keep copies or images of cancelled checks organized by number for audit or tax purposes.

Common Mistakes and How to Avoid Them

Even experienced check users can make errors related to check numbers. Below are frequent pitfalls and how to prevent them:

| Mistake | Consequence | Prevention |

|---|---|---|

| Skipping check numbers | Gaps in records; difficulty tracking missing checks | Use checks in sequence; note skipped numbers intentionally |

| Failing to record check numbers | Inaccurate reconciliation; double payments | Log every check immediately in a register or app |

| Reusing a check number | Confusion, potential fraud, audit red flags | Each check must have a unique number |

| Ignoring mismatched numbers during deposit | Deposit rejection or delayed processing | Double-check the number entered vs. the physical check |

Real-World Example: Resolving a Payment Dispute

Sarah, a freelance graphic designer, invoiced a client for $1,200 and mailed check #1105 as payment. Two weeks later, the client claimed they hadn’t received it. Sarah checked her bank statement and saw the check had cleared. She contacted the client with the check number, which they used to trace the payment in their accounting system. The check had been deposited under a different invoice by mistake. With the check number as proof, the client corrected the error and updated Sarah’s account status—all without needing additional documentation.

This case illustrates how a simple check number can resolve disputes quickly and professionally, minimizing delays and preserving business relationships.

FAQ: Common Questions About Check Numbers

Can two checks have the same number?

No. Each check in a checkbook has a unique number to ensure traceability. If you accidentally write two checks with the same number, one must be voided and properly documented to avoid confusion.

Do I need the check number to deposit a check?

Not always. Most banks only require the routing and account numbers for processing. However, some mobile banking apps prompt you to enter the check number after scanning to confirm it’s being deposited only once.

What should I do if my checkbook doesn’t have numbers?

Numberless checks are rare but possible with custom designs. In such cases, manually number your checks in ascending order and record them diligently. Speak with your bank about reprinting if necessary, as unnumbered checks may raise red flags during audits.

Final Thoughts and Action Steps

The check number is a small but powerful tool in personal and business finance. It brings order to your transactions, strengthens accountability, and simplifies communication with banks and payees. While digital payments grow in popularity, paper checks still play a vital role—and mastering their details ensures you stay in control of your money.

Start today by reviewing your last five checks. Are they properly recorded? Do the numbers align with your register? Take a few minutes to organize your check usage habits and eliminate any gaps. Your future self will thank you during tax season or when resolving a surprise discrepancy.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?