Whether you're setting up direct deposit, scheduling automatic bill payments, or wiring money between banks, knowing your routing number is essential. While it might seem like just another string of digits printed on a check, the routing number plays a crucial role in ensuring your money moves accurately through the financial system. The good news? It’s simple to find—once you know where to look. This guide walks you through exactly how to locate your routing number on any personal or business check, explains what it means, and helps you avoid common mistakes that could delay transactions.

What Is a Routing Number?

A routing number, also known as an ABA (American Bankers Association) routing transit number, is a nine-digit code used to identify a specific financial institution within the United States. Think of it as a ZIP code for your bank—it tells other banks and payment processors exactly where your account is held so they can route funds correctly.

This number ensures that when you make an electronic transfer, direct deposit, or pay bills online, the money goes to—or comes from—the right bank. Every bank has at least one unique routing number, though larger institutions may have multiple ones based on geographic regions or types of transactions.

“Routing numbers are foundational to the U.S. banking infrastructure. Without them, automated clearing house (ACH) systems wouldn’t function efficiently.” — James Lin, Financial Systems Analyst

Where to Find the Routing Number on a Check

The easiest way to find your routing number is directly on a physical check. All standard checks issued by U.S. banks include three critical pieces of information at the bottom: the routing number, your account number, and the check number. These appear in a special machine-readable font called MICR (Magnetic Ink Character Recognition), designed for high-speed processing.

Here's how to break down the sequence:

- First set of nine digits on the left: This is your routing number.

- Middle set of numbers (usually 10–12 digits): Your personal account number.

- Last set (typically 3–4 digits): The individual check number.

All three sets are separated by small symbols that resemble dashes but are actually part of the encoding system. The routing number always appears first, followed by your account number, then the check number.

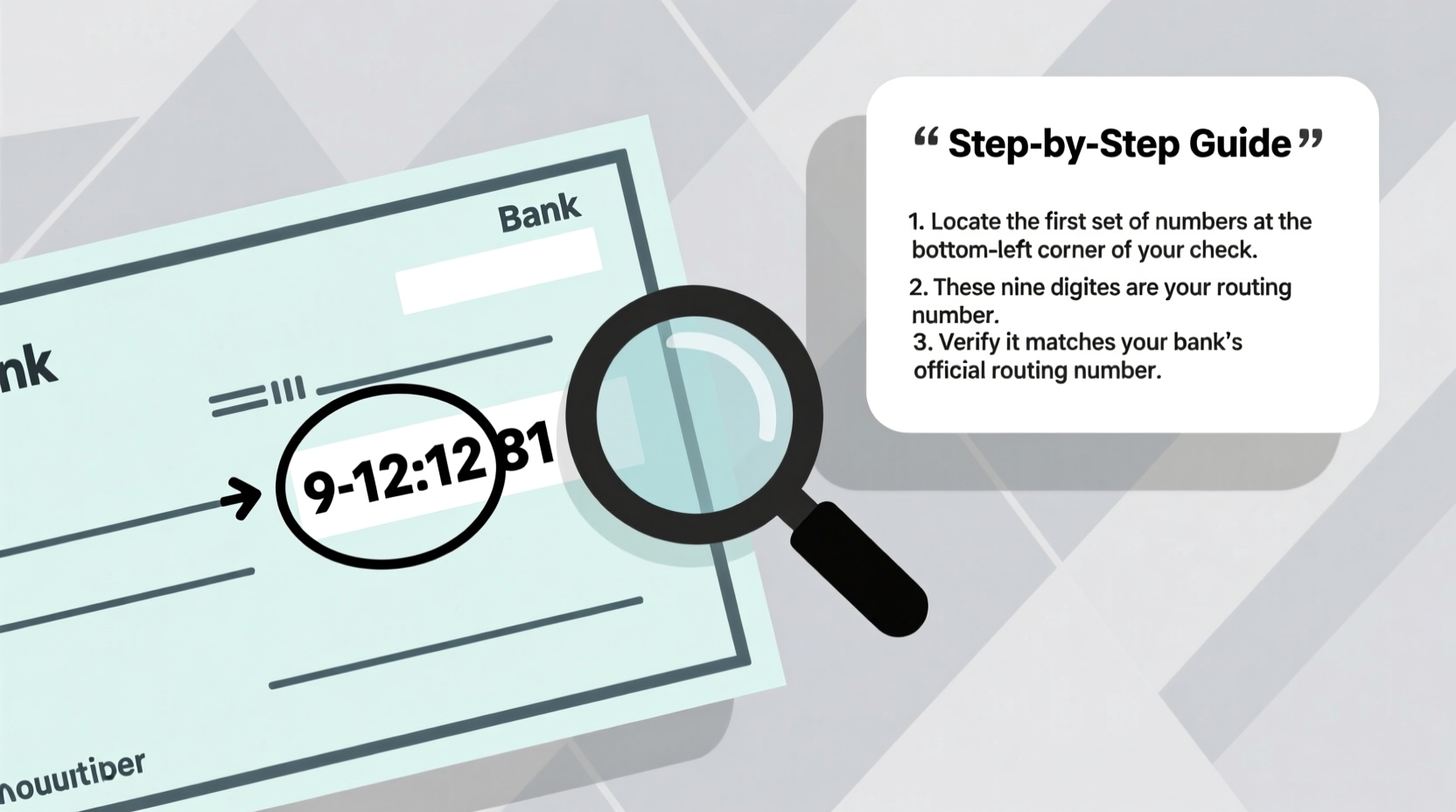

Step-by-Step Guide to Identifying Your Routing Number

Follow these five straightforward steps to accurately locate your routing number every time:

- Obtain a blank or used check from your checkbook. Even a canceled check works as long as the bottom line is legible.

- Turn the check over and look at the bottom edge. You’ll see a series of numbers printed in a special dark font.

- Locate the first group of nine digits on the far left. It will be enclosed between two identical symbols (often resembling a vertical rectangle or a colon). This is your routing number.

- Double-check the length. A valid routing number is always nine digits. If you count fewer or more, you may be looking at the wrong set.

- Verify accuracy by cross-referencing with your bank’s website or customer service portal to confirm it matches their official routing number for your region.

Example Breakdown of a Real Check Line

| Symbol | Digits | Description |

|---|---|---|

| || | 021000021 | Routing Number – Identifies the bank (e.g., Chase Bank in New York) |

| | | 123456789012 | Account Number – Unique to your personal checking account |

| | | 0042 | Check Number – Tracks individual checks for recordkeeping |

In this example, \"021000021\" is the routing number. Note how each segment is separated by special delimiters, which machines use to parse the data quickly.

Common Mistakes to Avoid

Even experienced users sometimes mix up the routing number with other numbers on the check. Here are the most frequent errors and how to prevent them:

- Confusing routing and account numbers: Because both are long strings of digits, it’s easy to enter the middle number instead of the first. Always double-check position: routing number = first nine digits.

- Using the wrong routing number for wire transfers: Some banks use different routing numbers for ACH transfers versus wire transfers. If you’re sending a wire, verify the correct number via your bank’s website or support line.

- Copying numbers from mobile deposit apps incorrectly: While many banking apps auto-detect routing numbers during deposits, manually entering them later increases error risk. Rely on physical checks or official sources when possible.

“Over 30% of failed ACH transfers stem from incorrect routing numbers. Taking 30 seconds to verify can save days of delays.” — National Automated Clearing House Association (NACHA)

Alternative Ways to Find Your Routing Number

If you don’t have access to a check, don’t worry—you can still find your routing number through several reliable methods:

- Bank Website: Log into your online banking portal. Navigate to account details or settings, where routing numbers are typically listed under “Account Information” or “Direct Deposit Setup.”

- Customer Service: Call your bank’s toll-free number. After verifying your identity, a representative can provide the correct routing number for your branch or transaction type.

- Mobile Banking App: Open your app, go to your account dashboard, tap “Account Details,” and look for “Routing Number” or “Direct Deposit Info.”

- Federal Reserve’s Public List: The Federal Reserve maintains a searchable database of routing numbers. Visit www.fededirectory.frb.org and search by bank name or number.

Mini Case Study: Sarah’s Direct Deposit Delay

Sarah, a marketing consultant, switched jobs and needed to set up direct deposit with her new employer. She pulled out an old check, copied the middle number (her account number), and entered it as the routing number on the payroll form. Two weeks later, her paycheck hadn’t arrived.

After contacting HR, she discovered the error: the system rejected the deposit because the “routing number” wasn’t valid. Once she reviewed this guide, located the correct nine-digit code on the left side of her check, and resubmitted the form, her next paycheck was deposited without issue.

This common mistake cost her nearly $1,200 in delayed income. By taking an extra minute to verify the routing number, she avoided future disruptions.

Do’s and Don’ts When Using Routing Numbers

| Action | Do | Don't |

|---|---|---|

| Entering for direct deposit | Use the ACH routing number from your bank’s official site | Guess or rely on memory |

| Setting up bill pay | Cross-reference with a recent check | Copy from an unverified third-party website |

| Wire transfers | Call your bank for the wire-specific routing number | Use the same number as for ACH payments |

FAQ

Can one bank have multiple routing numbers?

Yes. Large national banks often assign different routing numbers based on location, account type, or transaction method (e.g., ACH vs. wire transfers). Always confirm which one applies to your situation.

Is the routing number the same for all my accounts at the same bank?

Typically yes—for accounts opened at the same branch or region. However, joint accounts, business accounts, or accounts opened in different states may have different routing numbers. Verify each individually.

Is it safe to share my routing number?

Your routing number alone cannot be used to steal money, as it only identifies the bank, not your specific account. However, combined with your account number, address, or Social Security number, it could pose a risk. Share it only with trusted entities for legitimate purposes like direct deposit or recurring payments.

Final Thoughts and Action Steps

Identifying your routing number doesn’t require technical knowledge—just attention to detail. Whether you're filling out a direct deposit form, linking a savings account, or transferring money between institutions, accuracy matters. One misplaced digit can result in bounced transactions, delayed paychecks, or administrative headaches.

Take a moment now to locate a check or log into your online banking. Write down your routing number and store it securely—perhaps in a password manager or personal finance file. Having it on hand will save time and stress the next time you need to set up a payment or transfer.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?