Whether you're applying for a mortgage, refinancing student loans, or verifying income for a visa application, there are many situations where you’ll need access to past tax returns. The good news is that retrieving them from the Internal Revenue Service (IRS) doesn’t have to be complicated. With the right approach, you can obtain official copies—either full returns or detailed transcripts—within days or weeks, depending on your method. This guide walks you through every option available, including online tools, mail-in requests, and third-party alternatives, so you can choose the fastest, most secure path for your needs.

Why You Might Need Old Tax Returns

Tax records are among the most trusted documents for proving income and financial history. Lenders, universities, immigration offices, and even landlords often require proof of past earnings. While tax transcripts serve many verification purposes, some institutions still ask for complete copies of filed returns (Form 1040 series). Knowing the difference between what’s available—and how to get it—can save you time and frustration.

- Mortgage or loan applications

- College financial aid processing

- Immigration documentation (e.g., visa or green card petitions)

- Disaster relief or government assistance programs

- Audit preparation or personal record-keeping

Understanding What the IRS Can Provide

The IRS offers several types of documents related to your prior-year filings. Not all serve the same purpose, and availability depends on how far back you're looking.

| Type of Document | Description | Available For | Delivery Time |

|---|---|---|---|

| Tax Return Transcript | Line-by-line data from your original Form 1040, including adjustments and payments | Up to 3 years | 5–10 business days |

| Tax Account Transcript | Shows changes made after filing (e.g., audits, amended returns) | Up to 3 years | 5–10 business days |

| Wage & Income Transcript | Aggregated data from Forms W-2, 1099, etc. | Up to 10 years | 10–15 business days |

| Record of Account Transcript | Detailed account activity, including balances and penalties | Current year + prior 3 years | 10–15 business days |

| Copy of Actual Filed Return (Form 4506) | Photocopy of your originally submitted return, signed and stamped | Up to 7 years | 60 days |

“Transcripts are sufficient for most verifications. Only request actual returns when explicitly required.” — IRS Publication 5498

Step-by-Step Guide to Requesting Your Tax Documents

Follow these steps based on the type of document you need and your preferred method of delivery.

- Determine which document you actually need. Ask the requesting party whether a transcript or full return is acceptable.

- Gather identifying information: SSN, filing status, exact address on file, and prior-year Adjusted Gross Income (AGI).

- Choose your method: Online, phone, or mail.

- Submit your request using the appropriate form or portal.

- Wait for delivery and verify accuracy upon receipt.

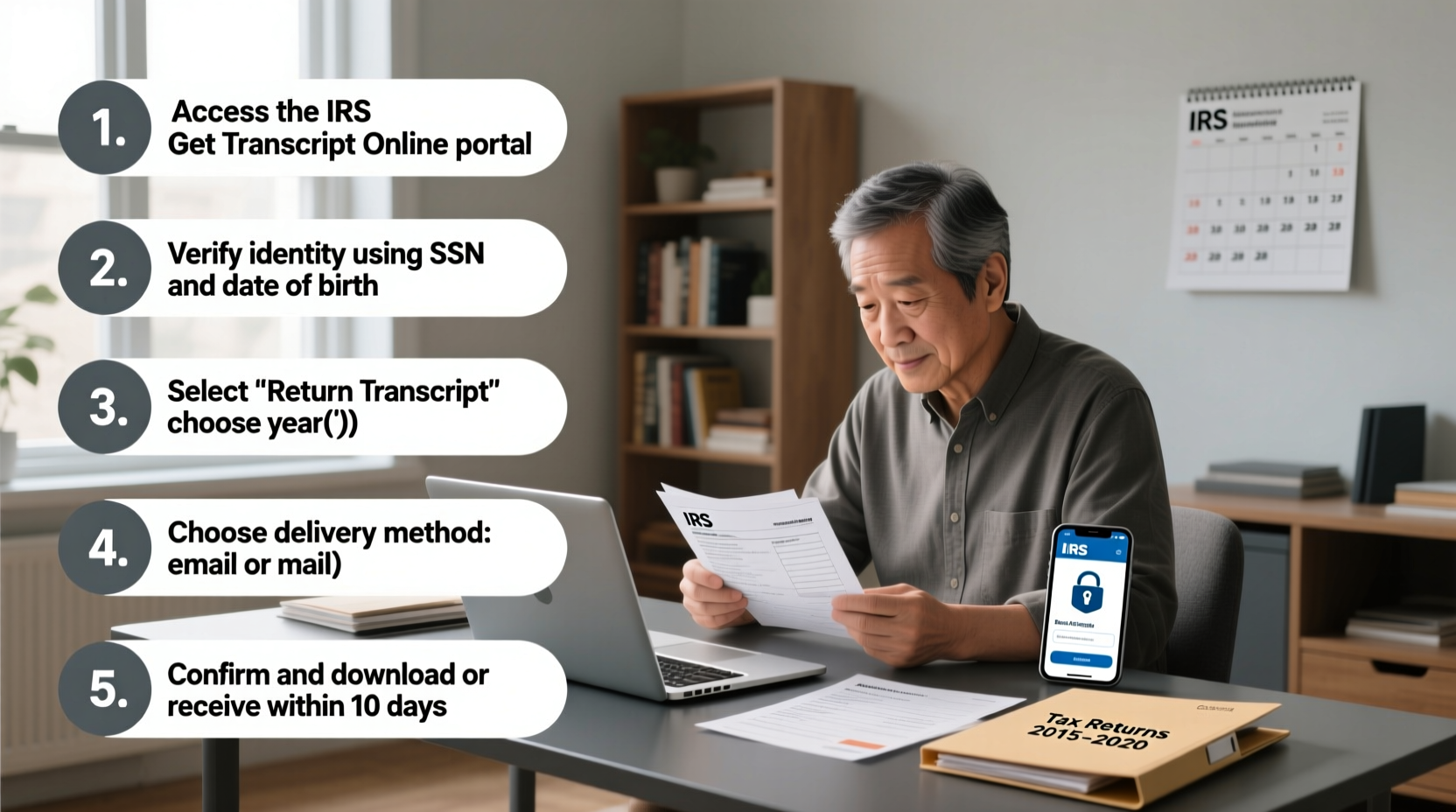

Option 1: Get Free Transcripts Online (Fastest Method)

The quickest way to access tax return or account transcripts is through the IRS Get Transcript portal at irs.gov.

- Visit https://www.irs.gov/individuals/get-transcript

- Select “Get Transcript Online”

- Create or log in to your IRS Individual Online Account

- Verify identity using SSN, date of birth, mailing address, and mobile phone number

- Select transcript type and tax year(s)

- Download immediately as a PDF

This service provides instant access to tax return and account transcripts for the current year and up to three prior years.

Option 2: Request by Mail Using Form 4506-T

If you prefer paper delivery or don’t qualify for online access, use Form 4506-T, Request for Transcript of Tax Return.

- Download Form 4506-T from IRS.gov/Form4506T

- Fill in your name, SSN, address, and select transcript type(s)

- Sign and date the form—unsigned forms are rejected

- Mail to the address listed on the form (varies by state)

- Allow 5–10 business days for processing

Option 3: Request a Full Copy of Your Return (Form 4506)

Only use this if a transcript won’t suffice. A full copy includes your signature and any attachments.

- Complete Form 4506, Request for Copy of Tax Return

- Include $50 per tax year requested (check or money order to “United States Treasury”)

- Mail to the IRS address corresponding to your state (listed on the form)

- Processing takes up to 60 calendar days

Note: You cannot get full returns online or by phone.

Real Example: Maria’s Mortgage Application

Maria applied for a home loan and was asked to provide her last two federal tax returns. She hadn’t kept copies and wasn’t sure where to start. Her lender clarified they would accept IRS transcripts instead of full returns. She went to Get Transcript Online, verified her identity, and downloaded both tax return transcripts within 15 minutes. She uploaded them to her mortgage portal the same day, avoiding delays in underwriting. By understanding the options, she saved over a month compared to mailing Form 4506.

Common Mistakes to Avoid

- Using outdated forms: Always download the latest version from IRS.gov.

- Skipping the signature: All paper requests require a handwritten signature.

- Requesting full returns unnecessarily: Transcripts are faster, free, and accepted in most cases.

- Mailing to the wrong address: Delivery varies by state and form type—double-check before sending.

- Not keeping a copy: Once received, store digital or physical copies in a secure location.

Frequently Asked Questions

Can I get tax returns from more than seven years ago?

The IRS generally only maintains copies of filed returns for seven years. After that, they may no longer be available. However, wage and income data may still be retrievable through other means, such as contacting employers or using Social Security Administration records.

Is there a fee for tax transcripts?

No. Tax transcripts via Form 4506-T or the online portal are completely free. You only pay a fee ($50 per year) when requesting actual copies of returns using Form 4506.

What if my request is denied or delayed?

If your identity can’t be verified online, you’ll receive a notice explaining next steps. For mailed requests, delays often occur due to incomplete forms or mismatched addresses. Call the IRS at 800-908-9946 for updates or visit a local Taxpayer Assistance Center for in-person help.

Checklist: How to Successfully Obtain Old Tax Returns

- ☐ Confirm whether a transcript or full return is needed

- ☐ Collect your SSN, filing status, AGI, and current address

- ☐ Try the Get Transcript Online tool first

- ☐ If ineligible, complete Form 4506-T for transcripts or Form 4506 for full returns

- ☐ Sign and mail forms using a trackable method

- ☐ Keep copies of all submitted forms and correspondence

- ☐ Store retrieved documents securely—digitally encrypted or physically locked

Final Thoughts and Next Steps

Accessing old tax returns is simpler than many people assume—especially now that the IRS offers instant online transcripts. The key is knowing what kind of document you need and choosing the most efficient method. In most cases, a free transcript will meet requirements and arrive much faster than a full return. Whether you’re preparing for a major life event or organizing your financial records, taking the time to retrieve and store these documents properly gives you greater control and peace of mind.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?