Keeping track of business or personal expenses is essential for budgeting, tax preparation, and financial clarity. For many people, a significant portion of their spending happens on Amazon—whether it’s office supplies, household essentials, or gifts. Yet, too often, those transactions go unrecorded simply because the receipt gets overlooked. Unlike physical stores, where you leave with a paper slip, Amazon purchases require proactive steps to access official receipts. The good news: retrieving and downloading your Amazon purchase history and associated receipts is straightforward once you know where to look.

This guide walks through practical methods to locate, view, and save your Amazon receipts in formats suitable for accounting software, reimbursement claims, or tax documentation—all without relying on email searches or guesswork.

Why Tracking Amazon Receipts Matters

Amazon doesn’t automatically send downloadable PDF receipts unless requested, and even then, they may land buried in your inbox. Over time, this creates gaps in expense records, especially during tax season or when justifying business reimbursements. Accurate expense tracking helps you:

- Deduct eligible business purchases on your taxes

- Monitor recurring subscriptions or auto-deliveries

- Resolve billing disputes with clear documentation

- Maintain organized financial records for audits or reviews

Manually sifting through hundreds of order emails isn't sustainable. A systematic approach ensures no transaction slips through the cracks.

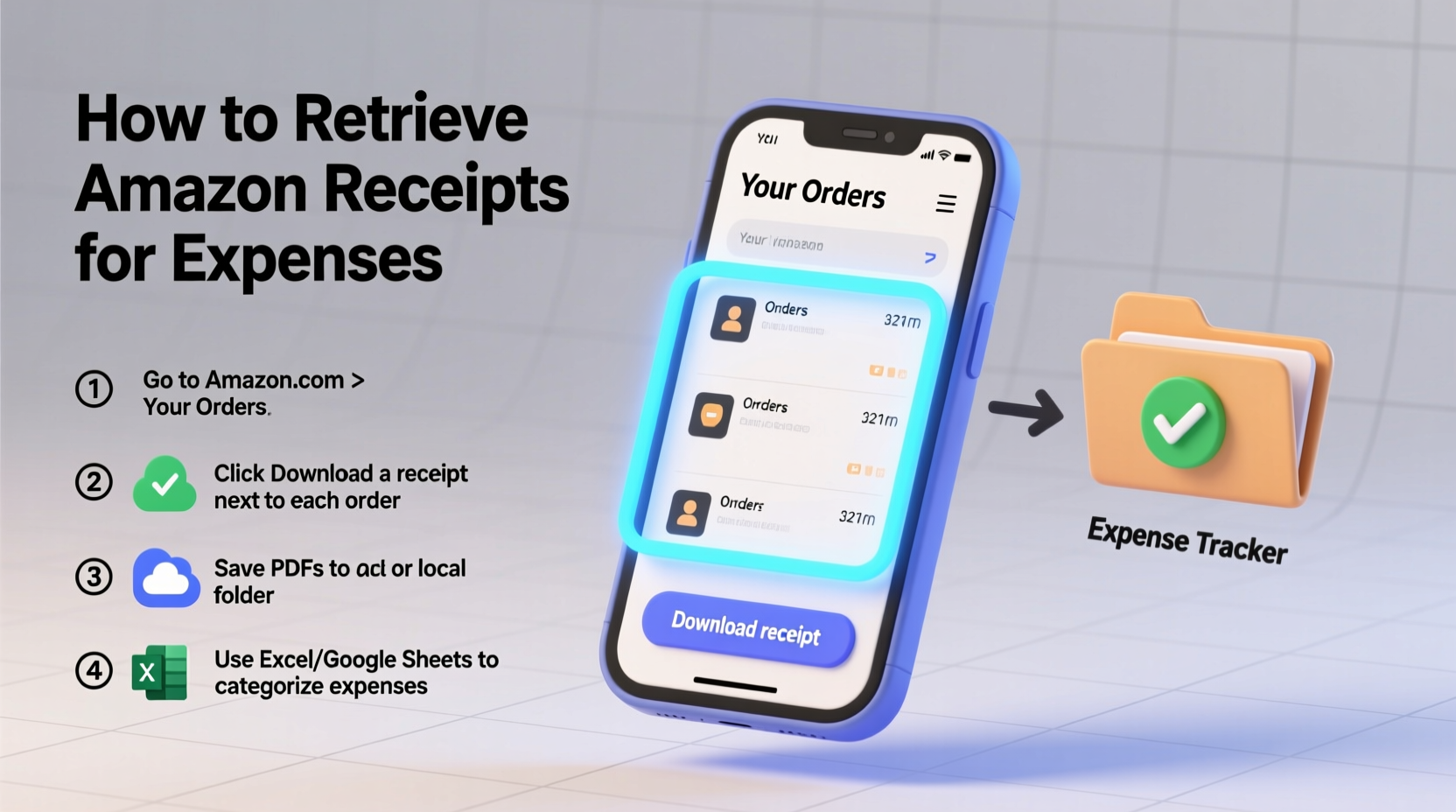

Step-by-Step Guide to Download Amazon Purchase Receipts

Amazon provides a centralized portal for all past orders, including digital copies of invoices and receipts. Follow these steps to retrieve them efficiently:

- Log in to Your Amazon Account

Go to amazon.com and sign in using your credentials. Ensure you're on the correct regional site (e.g., amazon.co.uk, amazon.ca) if applicable. - Navigate to “Your Orders”

Click on “Account & Lists” in the top-right corner, then select Your Orders. Alternatively, visit:https://www.amazon.com/your-orders/orders - Filter by Date Range

Use the dropdown menu labeled “Past 30 days” to choose a broader period such as “Past 3 months,” “Past year,” or enter a custom date range. This helps narrow down purchases relevant to your current tracking needs. - Select an Order

Click on the order number or “View Order” link to open detailed information about that purchase. - Download the Invoice

On the order details page, look for the option labeled Invoice or Download PDF Invoice. Click it to generate and save a formal receipt that includes itemized costs, taxes, shipping fees, and Amazon’s seller information. - Save or Organize the File

Once downloaded, rename the file clearly (e.g.,Amazon_Order_114-XXXXXXX-XXXXXX_2025-03-15.pdf) and store it in a dedicated folder like “Expense Receipts/Q1 2025” for easy retrieval later.

Repeat this process for each order requiring documentation. While manual downloads work well for occasional use, there are faster ways to handle bulk requests.

Exporting Multiple Orders at Once via Order History Report

If you need to analyze several months’ worth of Amazon spending—for example, preparing annual tax deductions—you can request an automated CSV report containing key transaction data.

Here’s how:

- From “Your Orders,” click the “Order Reports” tab near the top of the page.

- Select the desired report type: Items Ordered, Orders, or Cancellations.

- Choose a date range (up to 2 years maximum per report).

- Pick delivery format: Email (delivered within 24 hours) or direct download.

- Click “Request Report”.

The resulting CSV file will include columns such as:

| Column Name | Description |

|---|---|

| Order Date | Date the order was placed |

| Order ID | Unique identifier for the transaction |

| Product Name | Title of the purchased item |

| Quantity | Number of units bought |

| Total Charged | Final amount billed, including tax and shipping |

| Payment Method | Last four digits of the card used |

This structured data integrates seamlessly into spreadsheets or accounting tools like QuickBooks, Excel, or Google Sheets, enabling deeper analysis of spending patterns over time.

“We recommend clients pull quarterly Amazon reports to cross-check against credit card statements. It catches duplicate charges and forgotten subscriptions.” — Lisa Tran, CPA and Small Business Advisor

Real Example: Recovering Missing Q4 Expenses

Samantha, a freelance graphic designer, realized in January that she hadn’t saved receipts for six Amazon Business purchases made between October and December. These included a new graphics tablet, monitor mount, and software subscription—all legitimate business expenses.

Instead of searching through thousands of emails, she logged into her Amazon account, navigated to Order Reports, and generated a CSV for Q4. She filtered rows by “Total Charged” above $50 and exported individual PDF invoices for those transactions. Within 20 minutes, she had compiled a complete package for her accountant, saving nearly $400 in potential missed deductions.

Her system now includes a calendar event every quarter: “Download Amazon receipts + file digitally.”

Tips for Efficient Receipt Management

Staying ahead of expense tracking requires consistency more than complexity. Consider these best practices:

- Use Amazon Business? Switch to the Business Reports section to get tax-exempt status indicators and PO number fields included in exports.

- Automate naming conventions. Save files using a standard pattern:

[Vendor]_[Type]_[Date]_[Last4DigitsOfOrder].pdf - Back up cloud storage. Upload critical receipts to encrypted folders in Google Drive, Dropbox, or OneDrive with version control enabled.

- Check email settings. In Amazon Communication Preferences, ensure invoice emails aren’t being filtered as promotions or spam.

Frequently Asked Questions

Can I get a receipt for an Amazon purchase made years ago?

Yes. Amazon retains order data for up to 10 years. Navigate to “Your Orders,” adjust the date filter to the appropriate year, and download the PDF invoice from the specific order. If unavailable online, contact Amazon Customer Service with the approximate date and payment method for assistance.

Why doesn’t my order show a “Download Invoice” button?

Not all orders generate formal invoices—especially digital content (e-books, music) or third-party marketplace sellers who issue their own receipts. In such cases, check your email for a confirmation message or reach out to the seller directly through Amazon Messages.

Are Amazon PDF invoices acceptable for tax purposes?

Generally, yes. As long as the document includes the seller’s name (Amazon Services LLC or equivalent entity), transaction date, itemized list, and total paid, it meets IRS requirements for substantiation. Keep both the summary report and individual invoices for full compliance.

Stay Organized with Proactive Habits

Financial clarity starts with small, consistent actions. Retrieving Amazon purchase receipts doesn’t have to be tedious or reactive. By leveraging Amazon’s built-in reporting tools and establishing a routine—such as downloading invoices monthly or quarterly—you turn what could be a stressful task into a seamless part of your financial hygiene.

Whether you're a remote worker buying home office gear, a parent managing household budgets, or a small business owner tracking deductible costs, taking control of your Amazon transaction history empowers smarter decisions and smoother tax filings. Start today: log in, pull one report, and experience how simple it is to bring order to your digital spending trail.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?