Updating your mobile number with your bank is one of the most important yet overlooked steps when switching phones or carriers. Your registered phone number isn’t just for receiving promotions—it’s often tied to two-factor authentication, transaction alerts, password resets, and fraud detection systems. If you don’t update it promptly, you risk missing critical notifications or even getting locked out of your own account.

This guide walks you through the entire process clearly and safely, covering digital and in-branch methods, what documents you’ll need, and how to avoid common pitfalls. Whether you're upgrading your smartphone or relocating internationally, keeping your contact details current ensures uninterrupted access to your finances.

Why Updating Your Mobile Number Matters

Your mobile number acts as a digital key to your financial identity. Banks use it to verify your actions across multiple platforms. When it's outdated, several risks emerge:

- Inability to receive one-time passwords (OTPs) during login or fund transfers

- Lack of real-time fraud alerts for suspicious transactions

- Delays in resetting passwords if locked out

- Potential miscommunication during service upgrades or security incidents

“Keeping your contact information up to date is not just convenient—it's a fundamental part of personal financial security.” — Raj Mehta, Cybersecurity Advisor at FinTrust Solutions

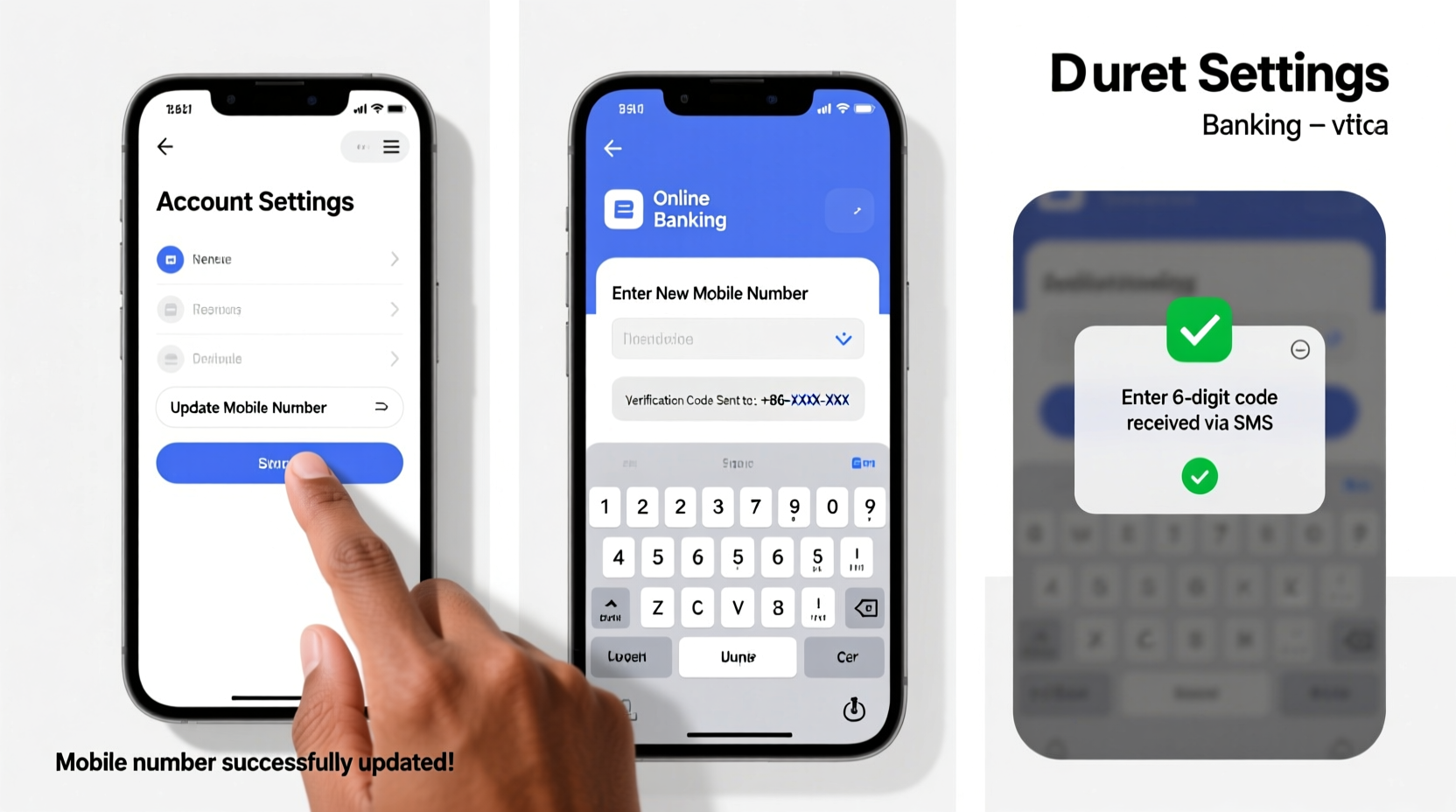

Step-by-Step: How to Update Your Mobile Number Online

Most major banks now allow customers to change their mobile number directly through their official website or mobile app. Here’s how to do it securely:

- Log in to your online banking portal or app using your credentials. Ensure you’re on the official site (look for “https://” and a padlock icon).

- Navigate to the Profile Settings or Personal Information section—this is usually under a menu labeled “My Profile,” “Settings,” or “Security.”

- Look for an option like Update Contact Details or Change Mobile Number.

- Enter your new mobile number carefully. Double-check the country code and digits.

- The system will send an OTP to your new number to confirm ownership. Some banks may still require verification via the old number if it’s active.

- After entering the OTP correctly, your number will be updated instantly in most cases.

- Log out and back in to test whether alerts and login verifications are now sent to the correct device.

When You Need to Visit a Branch

Not all banks support full mobile number updates online. Smaller institutions, credit unions, or accounts opened long ago may require in-person verification. This also applies if:

- You no longer have access to your old number

- Your account has been flagged for unusual activity

- You’re updating other personal details simultaneously (e.g., address, email)

- The online system fails repeatedly despite correct inputs

Here’s what to expect at the branch:

- Carry a valid government-issued ID (passport, driver’s license, national ID).

- Bring proof of your new number (recent phone bill or SIM activation receipt).

- Request a Contact Information Update Form from customer service.

- Fill it out completely and submit it along with copies of your documents.

- The representative will verify your identity and initiate the update.

- Processing time varies—some changes go live within 24 hours; others may take up to 72.

Mini Case Study: Recovering Access After a Lost Phone

Sophia, a freelance designer in Toronto, lost her phone while traveling. She replaced it the next day but couldn’t log into her bank app because OTPs were being sent to her old device. Her old number had been deactivated automatically by her carrier after 48 hours.

She called customer support and was instructed to visit a local branch with her passport and new SIM receipt. Within one business day of submitting the request, her number was updated. She re-enabled multi-factor authentication and restored full control over her account.

This scenario underscores why proactive updates matter—even temporary gaps in connectivity can trigger serious access issues.

Do’s and Don’ts When Changing Your Bank Contact Info

| Do’s | Don’ts |

|---|---|

| Verify the update worked by initiating a small transaction or requesting a test alert | Share OTPs with anyone, even if they claim to be from the bank |

| Update your number with all linked services (e.g., payment apps, investment platforms) | Use unsecured networks to make the change |

| Keep a record of confirmation emails or reference numbers | Ignore follow-up messages asking for additional verification |

| Contact support immediately if you don’t receive the OTP | Assume the change is instant—always confirm completion |

Checklist: Before, During, and After the Update

- ✅ Back up any SMS-based authenticator codes before changing devices

- ✅ Ensure your new phone has signal and can receive text messages

- ✅ Log in to online banking from a secure location

- ✅ Confirm both old and new numbers are accessible during transition

- ✅ Test login and transaction flow post-update

- ✅ Notify joint account holders or authorized users about the change

- ✅ Update your number with related financial apps (PayPal, Venmo, etc.)

Frequently Asked Questions

Can I update my mobile number without visiting a branch?

Yes, most major banks allow this through their mobile app or website. However, if you’ve lost access to your old number or your account has heightened security settings, a branch visit or video KYC session may be required.

How long does it take for the new number to become active?

In online-only updates, changes are typically immediate. For branch submissions or manual reviews, allow 24–72 hours. Some banks send a confirmation message once the update is fully processed.

Will I still receive alerts on my old number after the change?

No. Once the update is confirmed, all future alerts, OTPs, and notifications will go exclusively to your new number. Old-number access is permanently disconnected for security reasons.

Secure Your Financial Access Today

Updating your mobile number with your bank might seem minor, but it plays a crucial role in maintaining seamless, secure access to your money. With cyber threats rising and digital banking becoming the norm, staying current isn’t optional—it’s essential.

Take five minutes today to ensure your contact details are accurate. Whether you complete the update online or schedule a quick branch appointment, that small action strengthens your financial safety net and prevents frustrating disruptions down the line.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?