In times of economic uncertainty or national crisis, stimulus checks serve as a vital financial lifeline for millions of Americans. Whether introduced during a pandemic, recession, or other emergency, these payments are designed to boost consumer spending and support households facing hardship. However, not everyone automatically qualifies — and even those who do may miss out if they don’t take the right steps to claim their funds. Understanding eligibility, verifying your status, and knowing how to act quickly can make the difference between receiving timely assistance or being left behind.

This guide breaks down exactly how to determine if you’re eligible for a stimulus check, what documentation you’ll need, and how to ensure your payment is processed without delays. From IRS tools to real-life examples, we’ll walk through every step so you can confidently navigate the system and get what you’re entitled to.

Understanding Stimulus Check Eligibility Criteria

Eligibility for stimulus payments typically depends on three key factors: income level, filing status, and citizenship or residency status. While specific thresholds may vary depending on the legislation authorizing the payment, past programs like the Economic Impact Payments (EIPs) from 2020–2021 offer a reliable blueprint for what to expect in future rounds.

The Internal Revenue Service (IRS) uses adjusted gross income (AGI) from your most recent tax return to determine qualification. For example, under the third round of EIPs:

- Single filers with AGI up to $75,000 received the full $1,400 payment.

- Married couples filing jointly with AGI up to $150,000 received $2,800.

- Payments phased out gradually above those limits and stopped entirely at $80,000 (single) or $160,000 (joint).

Dependents also played a role. Parents could receive an additional $1,400 per qualifying child or dependent adult, expanding the total benefit for families.

“Stimulus eligibility hinges on accurate, up-to-date tax information. If you haven’t filed recently, especially as a low-income earner or gig worker, you may be invisible to the system.” — Sarah Lin, Tax Policy Analyst at the Urban-Brookings Tax Institute

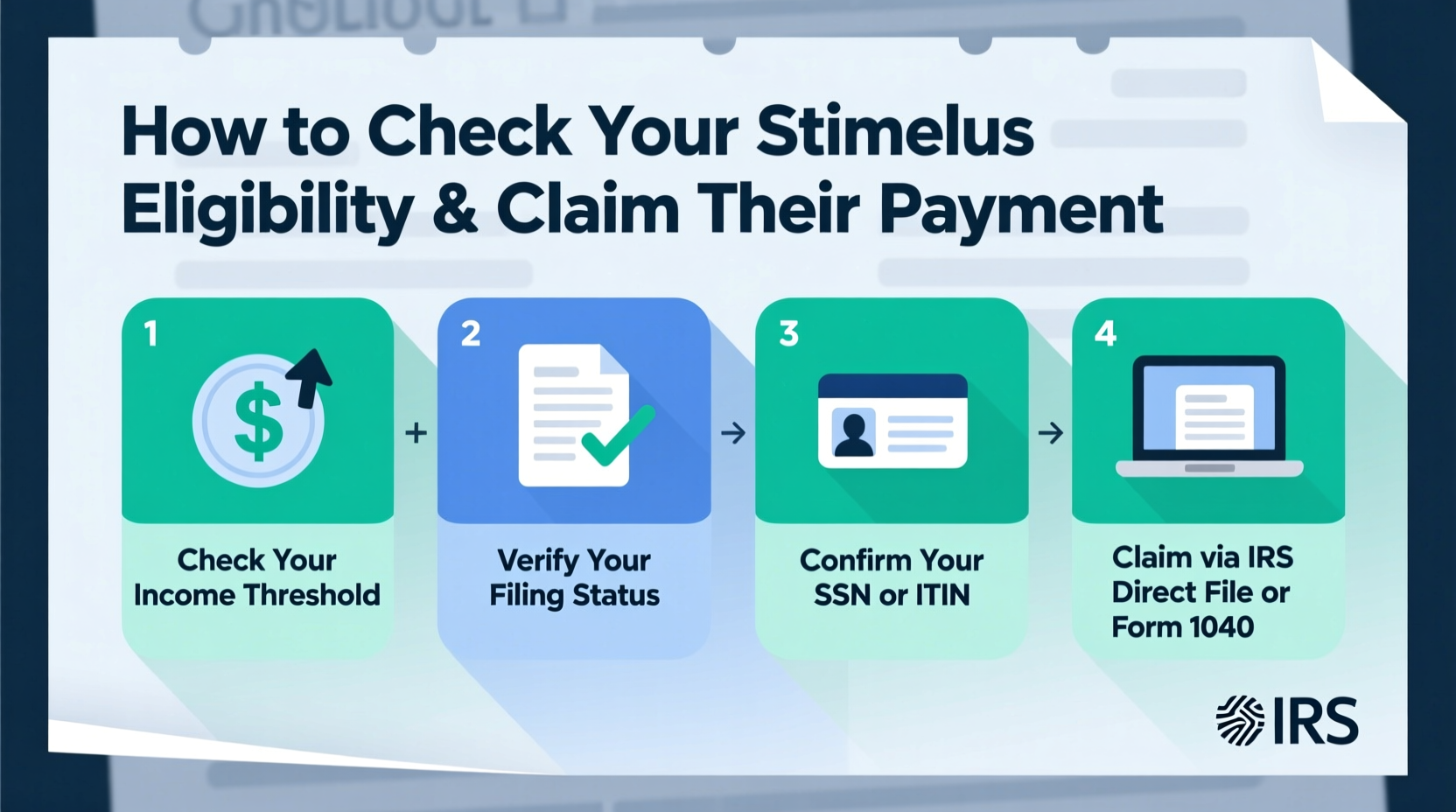

Step-by-Step Guide to Verify Your Eligibility

Verifying whether you qualify doesn’t require guesswork. The IRS provides free, secure tools that allow you to check your status in minutes. Follow this timeline to confirm your eligibility and track your payment:

- Gather your latest tax documents: Pull your most recently filed federal tax return (Form 1040). This will contain your AGI, filing status, and dependent details.

- Visit the IRS “Get My Payment” tool: Go to IRS.gov/get-my-payment. This portal was used during previous stimulus cycles and is likely to be reactivated for future programs.

- Enter personal information: Input your Social Security number, date of birth, and mailing address exactly as they appear on your tax return.

- Review your status: The tool will display whether you qualify, the expected amount, and the delivery method (direct deposit or paper check).

- Update banking details if necessary: In some cases, the IRS allows limited updates to direct deposit information through the portal — but only before the payment is processed.

If the tool states you're ineligible, double-check your AGI and dependent claims. Errors in prior filings can disqualify otherwise eligible individuals.

Who Might Be Overlooked — And How to Fix It

Not all eligible recipients receive automatic payments. Certain groups often fall through the cracks due to lack of recent tax filings or unique circumstances:

- Low-income individuals who earned too little to file taxes.

- Homeless individuals without a fixed address or bank account.

- Non-filers, including seniors living on Social Security benefits.

- Immigrants with ITINs — unless specifically included by law (e.g., mixed-status families were excluded from earlier rounds).

To correct omissions, use the IRS Non-Filer Tool. This simplified portal lets you submit basic income and household data to register for benefits without completing a full tax return.

Real Example: Claiming After Missing the First Round

Jamal, a freelance delivery driver, earned $11,000 in 2020 but didn’t file taxes because he believed he wasn’t required to. When the first stimulus check went out, he received nothing. After learning about the Non-Filer Tool from a community center workshop, he submitted his information in June 2020. By July, he received both his $1,200 payment and was automatically enrolled for the second round. His experience highlights the importance of proactive registration — even when you think you’re off the government’s radar.

Do’s and Don’ts When Claiming Your Stimulus Payment

| Do’s | Don’ts |

|---|---|

| File a tax return even if you have no income | Assume you’re not eligible based on income alone |

| Use official IRS websites only | Click on unsolicited emails claiming to help with stimulus checks |

| Keep records of all submissions and confirmation numbers | Pay third-party services to file simple forms the IRS offers for free |

| Check your payment status weekly during rollout periods | Ignore notices from the IRS about missing information |

Frequently Asked Questions

What if I didn’t receive a stimulus check I was eligible for?

You may still be able to claim it by filing a Recovery Rebate Credit on your next tax return. Use Form 1040 and include documentation showing you met eligibility criteria at the time of distribution.

Can I get a stimulus check if I’m on Social Security?

Yes, if you receive Social Security retirement, disability (SSDI), or Railroad Retirement benefits and are not claimed as a dependent, the IRS can issue payments based on Form SSA-1099 or RRB-1099 without requiring a tax return.

Will stimulus checks affect my tax refund or increase my taxes?

No. These payments are advances on a refundable tax credit and do not count as taxable income. They won’t reduce your refund or create a tax liability.

Action Checklist: Secure Your Stimulus Payment

Stay prepared for any future stimulus initiative with this actionable checklist:

- ✅ File a tax return annually, even with minimal income.

- ✅ Register dependents on your return, including adult family members you support.

- ✅ Sign up for direct deposit through the IRS website to speed up delivery.

- ✅ Bookmark the official IRS Get My Payment page for quick access.

- ✅ Monitor trusted news sources and IRS announcements during economic emergencies.

- ✅ Help vulnerable loved ones — such as elderly parents or disabled relatives — verify eligibility and file if needed.

Final Steps: Stay Informed and Take Control

Government relief programs move quickly, and silence can mean exclusion. Verifying your eligibility isn’t just about checking a box — it’s an act of financial self-advocacy. By staying informed, using IRS tools responsibly, and acting promptly, you protect your household’s stability during uncertain times.

Remember, stimulus checks are not gifts — they are rights tied to your status as a taxpayer or resident. If you qualify, the system is designed to deliver support directly to you. But it only works if you engage with it.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?