In an era where convenience often trumps scrutiny, subscription services have become a staple of modern life. From streaming platforms and meal kits to cloud storage and fitness apps, recurring payments offer seamless access to goods and services. But beneath the surface of these seemingly simple transactions lies a growing problem: hidden fees that quietly erode your budget. These aren't always labeled as \"fees\" — they come disguised as automatic renewals, price hikes, trial-to-paid traps, or bundled charges. The average consumer unknowingly spends hundreds per year on subscriptions they no longer use or didn’t fully understand. Recognizing and eliminating these invisible drains is not just about saving money — it's about regaining control over your finances.

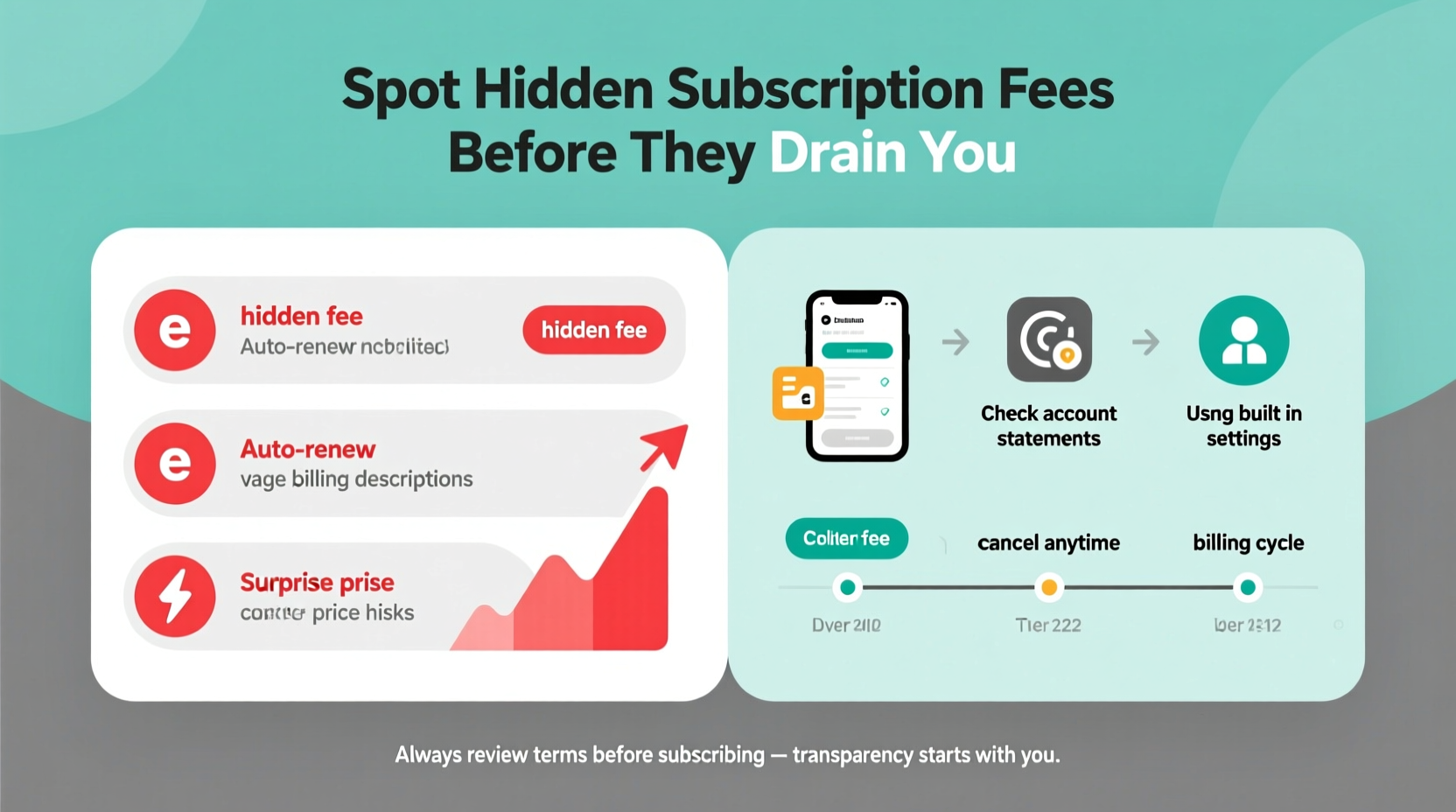

Understanding the Anatomy of Hidden Subscription Fees

Hidden fees in subscription models are rarely itemized like bank overdraft charges. Instead, they’re embedded in the structure of the service itself. A free trial that auto-enrolls into a paid plan after seven days is one example. Another is a “family plan” that appears affordable but adds extra costs per additional user beyond a certain limit. Some services introduce dynamic pricing, where your monthly rate increases based on usage, location, or time of year. Others bundle multiple services under one subscription, making it difficult to assess the true cost of each component.

The most insidious aspect? Many of these charges fly under the radar because they appear as small, consistent line items on your bank statement — $9.99 here, $14.95 there. Individually, they seem harmless. Combined, they can total over $300 annually without delivering proportional value.

“Consumers lose an average of $348 per year to unused or misunderstood subscriptions.” — Consumer Financial Protection Bureau (CFPB), 2023 Report on Recurring Payments

Step-by-Step Guide to Uncovering Hidden Charges

Finding hidden fees requires more than scanning your bank statement. It demands a methodical approach to dissect every recurring charge. Follow this five-step process to identify what’s really being deducted from your account.

- Gather all financial statements: Collect at least three months’ worth of bank and credit card statements. Use digital banking tools to export transaction histories for easier analysis.

- Highlight recurring transactions: Scan for any payment that repeats monthly or quarterly. Look beyond familiar names — some companies use parent company billing descriptors (e.g., “AMZN Prime” instead of “Amazon Prime Video”).

- Categorize each subscription: Group them by type — entertainment, software, wellness, shopping clubs, etc. This helps identify spending patterns and redundancies (e.g., two video streaming services).

- Verify the current terms: Log into each service and review your active plan. Check if you're on a promotional rate that has expired, whether usage limits have been exceeded, or if additional users have triggered surcharges.

- Contact customer support when unclear: If a charge doesn’t match your expectations, reach out. Ask for a breakdown of the billing cycle, renewal date, and any附加 fees applied.

Common Types of Hidden Fees and How They Work

Not all hidden fees look the same. Below are the most prevalent types found across subscription platforms, along with real-world examples of how they operate.

- Trial-to-Paid Traps: Services offer a “free” 7-day or 30-day trial but require a credit card upfront. If you forget to cancel, you’re automatically billed — sometimes at a premium rate.

- Price Creep: Your initial plan starts at $7.99/month, but after six months, the provider raises the rate to $10.99 without explicit consent. While legal, this practice catches many users off guard.

- Overage Charges: Cloud storage services may charge extra if you exceed your data limit. Similarly, mobile hotspot plans often bill per GB once the cap is breached.

- Bundled Add-Ons: You sign up for a basic gym membership, but later discover you’re also paying for towel service, locker rental, or app access — features you never opted into.

- Family Plan Surcharges: Platforms like Spotify or Apple One allow sharing, but add $3–$5 per additional member after the first few. These accumulate quickly in large households.

- International Surcharges: Using a U.S.-based Netflix or Adobe Creative Cloud account while traveling abroad may trigger regional pricing adjustments or currency conversion fees.

Mini Case Study: The $18.99 “Free Trial” That Lasted Two Years

Sarah, a freelance designer from Portland, signed up for a 30-day free trial of a premium design tool in early 2021. She used it briefly, then forgot about it. Nine months later, she noticed a recurring $18.99 charge on her credit card. Assuming it was a billing error, she contacted the company — only to learn she had been enrolled in the annual plan after the trial ended. Worse, the contract auto-renewed each year unless canceled 30 days prior. By the time she discovered the charge, she had paid over $400 for a service she hadn’t used in months.

This scenario is far from unique. According to a 2022 study by Truebill, nearly 68% of consumers have experienced unintended subscription renewals after free trials. Sarah’s story underscores the importance of tracking trial end dates and setting reminders to reassess value before automatic billing kicks in.

Do’s and Don’ts of Subscription Management

| Do’s | Don’ts |

|---|---|

| ✔ Read the fine print during signup, especially around auto-renewal policies | ✘ Assume a “free trial” won’t lead to charges |

| ✔ Use a dedicated email address for subscriptions to track communications | ✘ Ignore confirmation emails or renewal notices |

| ✔ Cancel immediately if you don’t plan to continue post-trial | ✘ Rely solely on memory — set calendar alerts |

| ✔ Audit your subscriptions quarterly | ✘ Keep subscriptions “just in case” you might use them |

| ✔ Use third-party apps to monitor recurring payments | ✘ Share payment methods across family plans without monitoring usage |

Tools and Strategies to Stay in Control

Manual tracking works, but automation makes long-term management sustainable. Several tools can help you detect and eliminate hidden fees before they compound.

- Subscription Tracking Apps: Services like Rocket Money, Trim, and SubscriptMe sync with your bank accounts to identify recurring charges. They flag unusual increases, notify you of upcoming renewals, and even assist with cancellations.

- Bank Alerts: Most major banks now offer customizable notifications for recurring payments. Enable alerts for any new subscription or unexpected amount change.

- Dedicated Payment Cards: Consider using a separate debit or credit card exclusively for subscriptions. This isolates recurring expenses and simplifies monthly reviews.

- Virtual Card Numbers: Banks like Citi and Capital One offer virtual card generators. Assign a unique number to each subscription. If fraud or unauthorized charges occur, you can disable that specific number without affecting others.

Expert Insight: What Financial Advisors Recommend

“The biggest mistake people make is treating subscriptions as fixed costs. They’re not. Every recurring payment should be evaluated quarterly like a utility bill. If it’s not delivering value, cut it.” — Marcus Tran, Certified Financial Planner and Founder of ClearPath Wealth Advisors

Tran emphasizes proactive management: “I advise clients to schedule a ‘subscription audit’ every 90 days. In less than 30 minutes, they typically uncover $100–$200 in unnecessary or forgotten charges. That’s immediate cash flow improvement without lifestyle sacrifice.”

Essential Checklist: Eliminate Hidden Fees in 7 Actions

Use this checklist monthly or quarterly to maintain full visibility over your subscription ecosystem.

- Download last three months of bank/credit card statements

- Identify all recurring charges — including micro-payments under $5

- Visit each service’s account page to confirm current plan and pricing

- Check if promotional rates have expired or prices have increased

- Cancel any unused, redundant, or unexpectedly expensive subscriptions

- Set calendar reminders for next renewal dates of retained services

- Enable transaction alerts for future recurring payments

Frequently Asked Questions

Can companies raise subscription prices without telling me?

Yes, most subscription agreements include clauses allowing price changes with notice — often delivered via email or posted in account dashboards. While they must inform you, the notification may be buried in a newsletter or policy update. Always review your subscriber agreement for details on pricing adjustments.

Are free trials safe to use?

They can be — if managed carefully. To stay safe, set a reminder for two days before the trial ends. Use a temporary email or virtual card to reduce risk. Avoid trials that require ID verification or long-term commitments.

What if I can’t find the cancellation option?

If a service makes cancellation difficult — a tactic known as a “dark pattern” — try contacting support directly via live chat or phone. Document your request. Under FTC guidelines, consumers have the right to cancel easily. Persistent issues can be reported to the Better Business Bureau or state attorney general.

Conclusion: Take Back Control of Your Finances

Hidden fees in subscription services thrive on inattention. The systems are designed for inertia — once you’re in, the default is to keep paying. But awareness is power. By systematically reviewing your recurring charges, understanding billing structures, and using available tools, you can reclaim hundreds of dollars each year. More importantly, you cultivate financial mindfulness that extends beyond subscriptions to every area of spending.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?