Carrying high-interest credit card debt can feel like running on a financial treadmill—making payments without gaining ground. One of the most effective ways to break free is through a balance transfer. By moving existing debt to a new credit card with a lower interest rate—ideally 0% for an introductory period—you can reduce or eliminate interest charges and pay down your balance faster. But not all balance transfer cards are created equal. The key is knowing what to look for and how to compare offers strategically.

Understand How Balance Transfers Work

A balance transfer involves moving debt from one or more high-interest credit cards to a new card that offers a lower promotional interest rate, often 0% for a set period. This promotional rate typically lasts between 12 and 21 months. During this time, you can pay off your balance without accruing additional interest—provided you stay within the terms of the offer.

However, once the introductory period ends, the standard APR (Annual Percentage Rate) kicks in. If you haven’t paid off the balance by then, you’ll start paying interest at the higher ongoing rate. Additionally, most cards charge a balance transfer fee—usually 3% to 5% of the amount transferred—which must be factored into your savings calculation.

“Balance transfers can be powerful tools when used correctly, but they’re not magic. Success depends on discipline and planning.” — Laura Adams, Personal Finance Expert and Author

Key Factors to Evaluate in a Balance Transfer Card

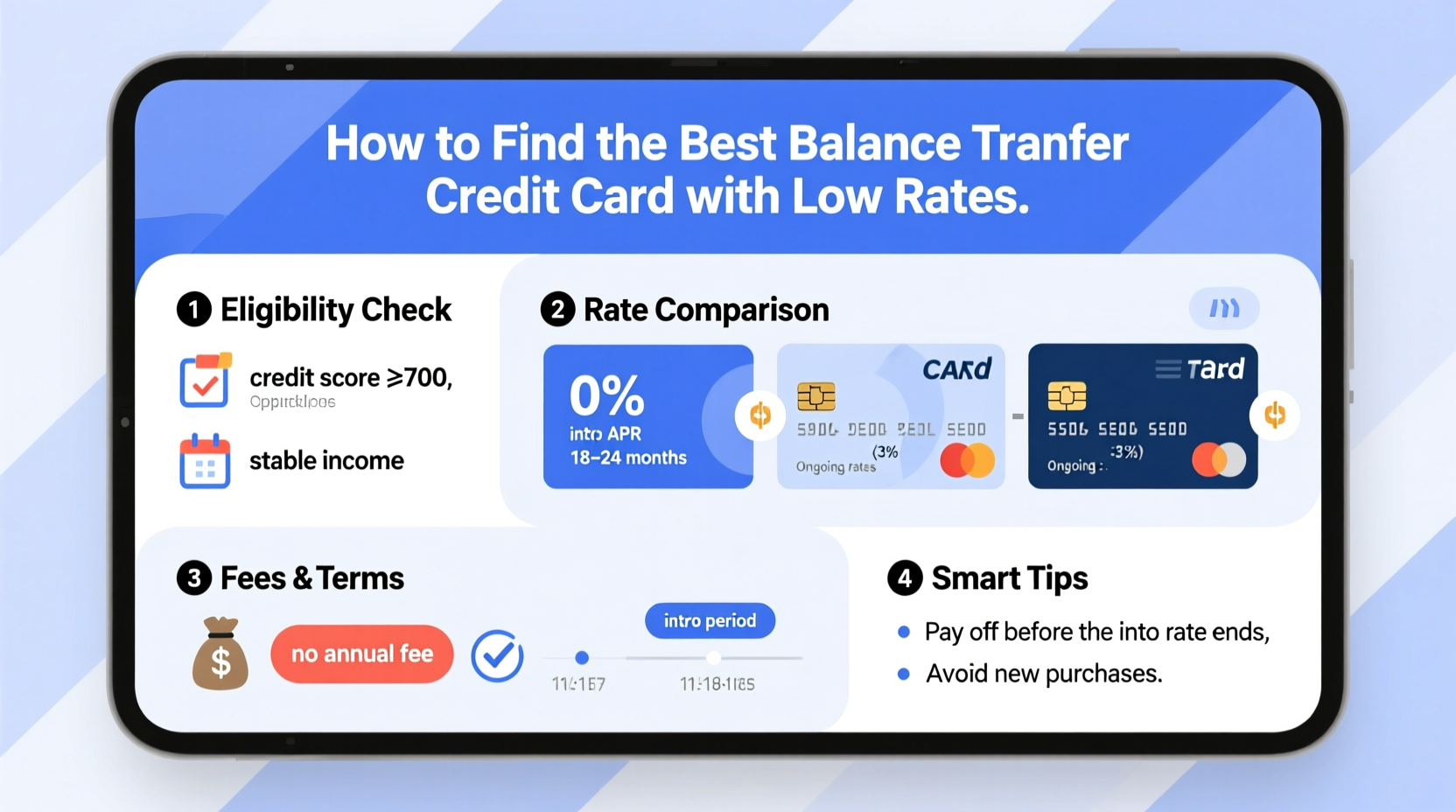

To find the best card for your needs, consider these five critical factors:

- Introductory APR duration: Longer 0% periods give you more time to pay off debt without interest.

- Ongoing APR: What happens after the intro period? A high regular rate could hurt you if you carry a balance.

- Balance transfer fees: Even a 3% fee adds up. Some cards waive fees for transfers made within a certain window.

- Credit requirements: Most 0% APR cards require good to excellent credit (typically FICO 690+).

- Additional benefits: Cash back, rewards, or no annual fee may add value—but only if they don’t come at the cost of a weaker transfer offer.

Step-by-Step Guide to Choosing the Right Card

- Check your credit score. Know where you stand. Use free services like Credit Karma or your bank’s portal to review your score. Cards with the best rates usually require at least a “good” credit rating.

- Determine your total balance. Add up all debts you plan to transfer. This helps estimate fees and ensures you stay under the new card’s credit limit.

- Compare top balance transfer offers. Look beyond the headline 0% rate. Examine the length of the intro period, transfer fees, and regular APR.

- Apply strategically. Submit applications only after narrowing your choices. Multiple hard inquiries in a short span can hurt your credit score.

- Transfer and consolidate. Once approved, initiate transfers promptly. Pay attention to deadlines—some fee waivers only apply to transfers completed within 60 days of account opening.

- Create a payoff plan. Divide your total balance by the number of months in the intro period. Stick to that monthly payment religiously.

Comparison Table: Top Balance Transfer Cards (2024)

| Card Name | Intro APR | Duration | Balance Transfer Fee | Ongoing APR | Best For |

|---|---|---|---|---|---|

| Citi Simplicity® Card | 0% | 21 months | 5% (waived if transferred within 120 days) | 19.24%–29.99% | Longest intro period |

| Chase Freedom Unlimited® | 0% | 15 months | Either $5 or 5% of each transfer, whichever is greater | 20.49%–29.24% | Mixed use (purchases + transfers) |

| Banks.com Card (by Barclays) | 0% | 18 months | 3% of each transfer | 17.99%–28.99% | Low ongoing APR |

| U.S. Bank Visa Platinum | 0% | 20 months | 3% ($10 minimum) | 19.24%–29.24% | No annual fee + long intro |

Note: Offers subject to change based on creditworthiness and market conditions. Always confirm terms directly with the issuer.

Mini Case Study: How Sarah Reduced Her Debt by $4,000 in Interest

Sarah had $8,500 in credit card debt across two cards, both charging 24.99% APR. She was paying $400 a month but barely making a dent in the principal due to compounding interest. After checking her FICO score (742), she researched balance transfer options and applied for the Citi Simplicity® Card, attracted by its 21-month 0% intro period.

She transferred her full balance and paid a one-time 5% fee—$425—but qualified for a waiver because she completed the transfer within 120 days. With no interest for nearly two years, she committed to paying $405 per month—just above the minimum required to clear the balance on time.

By the end of 21 months, she was debt-free and saved over $4,000 in interest compared to staying on her original cards. More importantly, she avoided new charges on the card and didn’t open other lines of credit during the process.

Avoid These Common Mistakes

- Missing payments: Even one late payment can trigger penalty APRs and void your 0% offer.

- Transferring balances between cards from the same issuer: Many banks prohibit this. For example, you can’t transfer from one Chase card to another Chase balance transfer card.

- Ignoring the clock: Falling into the trap of feeling “relieved” during the intro period and slowing down repayments.

- Applying for multiple cards at once: This dings your credit and suggests financial distress to lenders.

- Not reading the fine print: Some cards exclude certain types of debt (e.g., student loans) from transfers.

Checklist: Before You Apply

- ✅ Checked my credit score and confirmed eligibility

- ✅ Calculated total balance to transfer

- ✅ Estimated balance transfer fees

- ✅ Compared intro period length and ongoing APR

- ✅ Confirmed I can make on-time payments every month

- ✅ Avoided applying for other credit simultaneously

- ✅ Created a monthly repayment target to finish before intro ends

Frequently Asked Questions

Can I transfer a balance from someone else’s card?

No, most issuers only allow transfers from accounts in your name. However, if you’re an authorized user, you may still be able to transfer the balance to your own card—check with the issuer first.

Will a balance transfer hurt my credit score?

It may cause a small, temporary dip due to the hard inquiry and increased credit utilization on the new card. However, if you reduce overall debt and make on-time payments, your score will likely improve over time.

What happens if I don’t pay off the balance before the intro period ends?

The remaining balance will start accruing interest at the card’s standard APR. Consider transferring again to another 0% card—if eligible—or adjust your budget to accelerate payments.

Final Thoughts: Turn Savings Into Strategy

Finding the best credit card to transfer balances with low rates isn’t just about chasing the longest 0% offer. It’s about aligning the right card with a disciplined repayment plan. The real benefit comes not from the card itself, but from what you do with the opportunity it provides.

If you're serious about becoming debt-free, take action today. Pull your credit report, assess your current debt load, and compare the top balance transfer offers side by side. Use the checklist and table above to narrow your choices. Then commit—not just to the transfer, but to the monthly payments that will close the chapter for good.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?