Life is unpredictable. Whether you're between jobs, waiting for Medicare eligibility, or navigating a gap in employer coverage, there are moments when traditional health insurance isn't an option. Short term health insurance can bridge that gap—but only if you choose wisely. These plans offer temporary medical coverage, often for up to 364 days (and sometimes renewable depending on state regulations), but they vary widely in scope, cost, and benefits.

Unlike comprehensive major medical plans under the Affordable Care Act (ACA), short term policies are not required to cover essential health benefits like maternity care, mental health services, or pre-existing conditions. That’s why selecting the right plan demands careful evaluation—not just of price, but of what’s actually covered, how claims are processed, and whether the network aligns with your healthcare providers.

Understanding When Short Term Health Insurance Makes Sense

Short term health insurance isn’t designed to replace long-term coverage. Instead, it serves as a stopgap solution during transitional periods. Common scenarios include:

- Graduating from college and losing student health coverage

- Leaving a job before enrolling in a new employer’s plan

- Retiring early before qualifying for Medicare at age 65

- Waiting for a spouse’s employment-based plan to activate

- Moving to a new state where ACA enrollment isn’t immediately available

These plans typically have lower premiums than ACA-compliant plans, making them attractive for budget-conscious individuals. However, lower cost often comes with trade-offs: higher deductibles, limited provider networks, and exclusions for certain treatments.

“Short term plans can be a lifeline during coverage gaps, but consumers must read the fine print. They’re not one-size-fits-all.” — Dr. Linda Chen, Health Policy Analyst at the Commonwealth Fund

Key Factors to Evaluate in a Short Term Plan

To ensure your short term plan meets your actual health needs, consider these five critical factors before enrolling:

1. Coverage Scope and Exclusions

Review exactly what services are included. Most short term plans cover emergency care, hospitalization, and some outpatient visits, but may exclude:

- Preventive screenings (e.g., annual physicals)

- Prescription drugs (or cover only select generics)

- Maternity care

- Mental health and substance abuse treatment

- Chronic condition management (e.g., diabetes, hypertension)

2. Provider Network Access

Some short term insurers partner with PPO or EPO networks, while others operate on a fee-for-service model. Check if your preferred doctors, hospitals, and labs are in-network. Out-of-network care may require full upfront payment and offer little or no reimbursement.

3. Deductibles, Copays, and Coinsurance

A low monthly premium can be misleading if the deductible is $10,000. Calculate your potential out-of-pocket maximum. For example:

| Plan Tier | Premium (Monthly) | Deductible | Out-of-Pocket Max | Doctor Visit Copay |

|---|---|---|---|---|

| Basic | $120 | $7,500 | $15,000 | $75 (after deductible) |

| Enhanced | $210 | $3,000 | $8,000 | $40 |

| Premium | $320 | $5,000 | $25 |

The most affordable plan might cost more in the long run if you need care.

4. Duration and Renewability

Laws vary by state. Some allow initial terms of 364 days with renewals up to 36 months; others cap total duration at six months. Make sure the plan can last through your coverage gap.

5. Application Process and Medical Underwriting

Unlike ACA plans, short term insurance uses medical underwriting. You’ll answer health questions, and pre-existing conditions can lead to denial or exclusion. Be honest—misrepresentation can void your policy later.

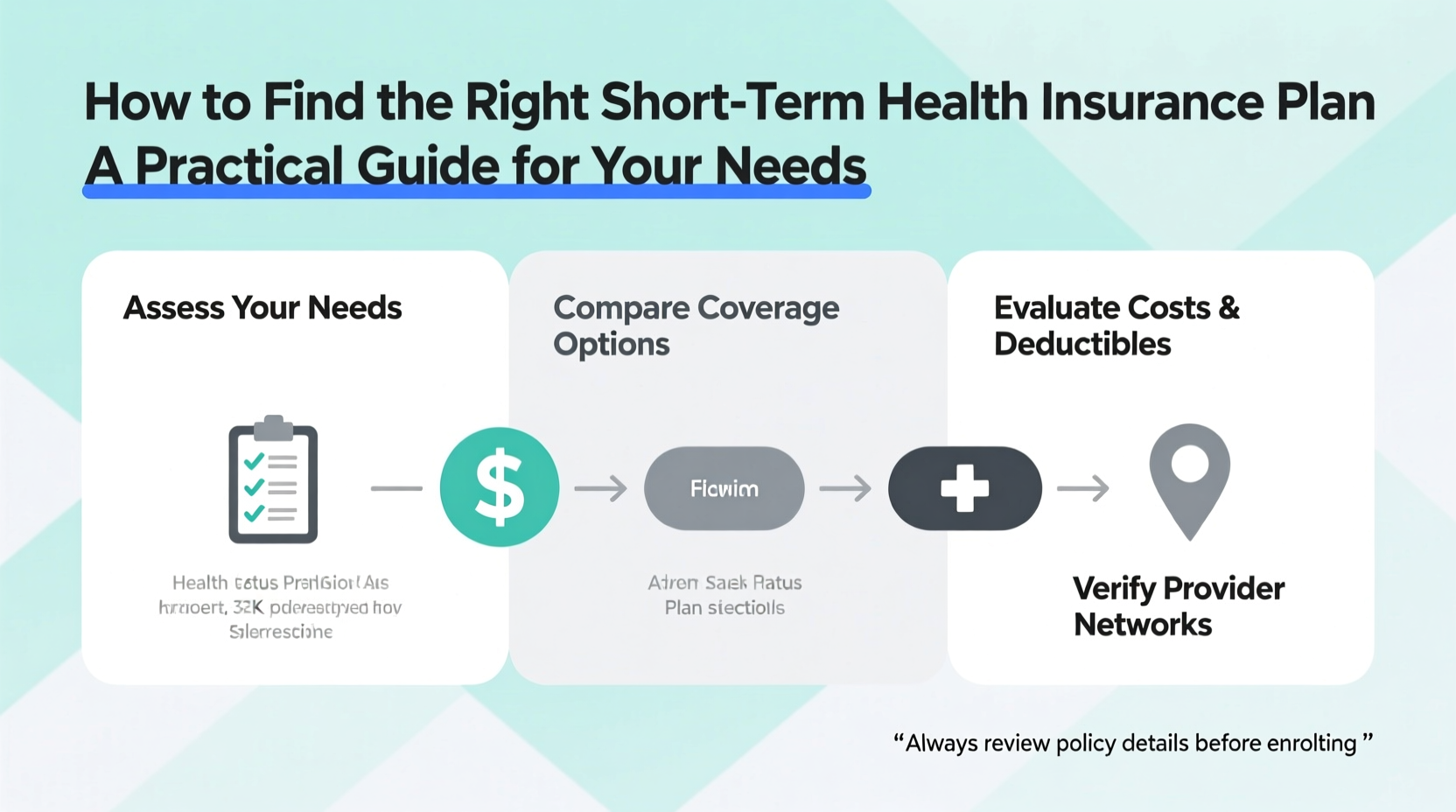

Step-by-Step Guide to Choosing Your Plan

- Assess Your Current Situation: Determine how long you need coverage and whether you expect any medical care in the next few months.

- List Your Healthcare Needs: Include prescriptions, ongoing therapy, planned procedures, and preferred providers.

- Compare at Least Three Quotes: Use trusted comparison sites or consult a licensed broker who specializes in temporary coverage.

- Read the Summary of Benefits and Coverage (SBC): This standardized document outlines what’s covered, cost-sharing details, and claim procedures.

- Check Reviews and Complaint History: Look up the insurer with your state’s Department of Insurance. High complaint ratios signal poor customer service.

- Enroll Before Your Gap Begins: Allow 5–7 business days for approval and activation. Don’t wait until your old plan ends.

Mini Case Study: Sarah’s Job Transition

Sarah, a 34-year-old graphic designer in Colorado, left her full-time role to freelance. Her employer-sponsored plan ended March 31st, and she wouldn’t qualify for a special enrollment period until April 15th through a new client’s group plan.

Rather than pay COBRA’s $680 monthly premium, she explored short term options. After comparing three plans, she chose one with a $225 monthly premium, $4,000 deductible, and access to her local clinic network. It didn’t cover her birth control prescription, so she continued buying it out-of-pocket via a discount card.

When she developed pneumonia in May, the plan covered 80% of ER and hospital charges after the deductible. Because she’d anticipated the gap and acted early, she avoided financial disaster.

Sarah’s experience underscores the importance of timing, transparency about limitations, and realistic expectations.

Checklist: Before You Enroll

- ✅ Confirm the exact start and end dates you need coverage

- ✅ Verify that your primary care doctor accepts the plan

- ✅ Review exclusions for pre-existing conditions

- ✅ Understand how to file claims and access customer support

- ✅ Save a copy of the policy documents and SBC

- ✅ Set a calendar reminder to reevaluate coverage before expiration

Frequently Asked Questions

Can I get short term insurance if I have a pre-existing condition?

No, not effectively. While you can apply, insurers can deny coverage or exclude treatment related to pre-existing conditions such as asthma, cancer, or heart disease. These plans are best suited for relatively healthy individuals expecting minimal care.

Will short term insurance satisfy the ACA’s individual mandate?

At the federal level, there is no longer a tax penalty for being uninsured. However, some states—including California, Massachusetts, New Jersey, and Rhode Island—still impose penalties. Short term plans generally do not count as minimum essential coverage, so you may owe a state tax penalty.

Can I cancel my short term plan early?

Yes, most plans allow cancellation at any time without penalty. Premiums are typically non-refundable beyond the current month, so time your cancellation carefully.

Conclusion: Take Control of Your Coverage Gap

Finding the right short term health insurance plan doesn’t have to be overwhelming. By understanding your personal health needs, evaluating key plan features, and using a structured approach, you can secure affordable, functional protection during life’s transitions. Remember, the cheapest option isn’t always the best—coverage that fails when you need it most carries hidden costs far beyond the monthly premium.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?