An Employer Identification Number (EIN), also known as a Federal Tax ID Number, is a unique nine-digit identifier assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. It functions much like a Social Security number for your company, enabling you to open business bank accounts, file taxes, hire employees, and apply for business licenses. For new entrepreneurs, securing an EIN is one of the first formal steps in legitimizing a business. While the process is straightforward, confusion often arises around eligibility, application methods, and timing. This guide walks through each phase clearly and accurately, helping beginners avoid common pitfalls and complete the process efficiently.

Understanding When You Need an EIN

Not every business requires an EIN, but many do. The IRS mandates an EIN under specific circumstances. Knowing whether your business falls into one of these categories prevents delays in banking, payroll, or tax compliance.

- You have employees

- You operate your business as a corporation or partnership

- You file business tax returns such as employment, excise, or alcohol/tobacco/firearms returns

- You withhold taxes on income (other than wages) paid to a non-resident alien

- You contribute to a Keogh plan (a type of retirement plan for self-employed individuals)

- You are involved with trusts, estates, nonprofits, or certain types of agricultural cooperatives

If you're a sole proprietor with no employees, you may use your Social Security Number (SSN) for federal tax purposes. However, obtaining an EIN is still advisable—it enhances privacy, simplifies banking, and prepares your business for future growth.

“An EIN is not just a tax requirement—it’s a foundational tool that separates personal and business finances.” — Laura Simmons, CPA and Small Business Advisor

Step-by-Step Guide to Applying for an EIN

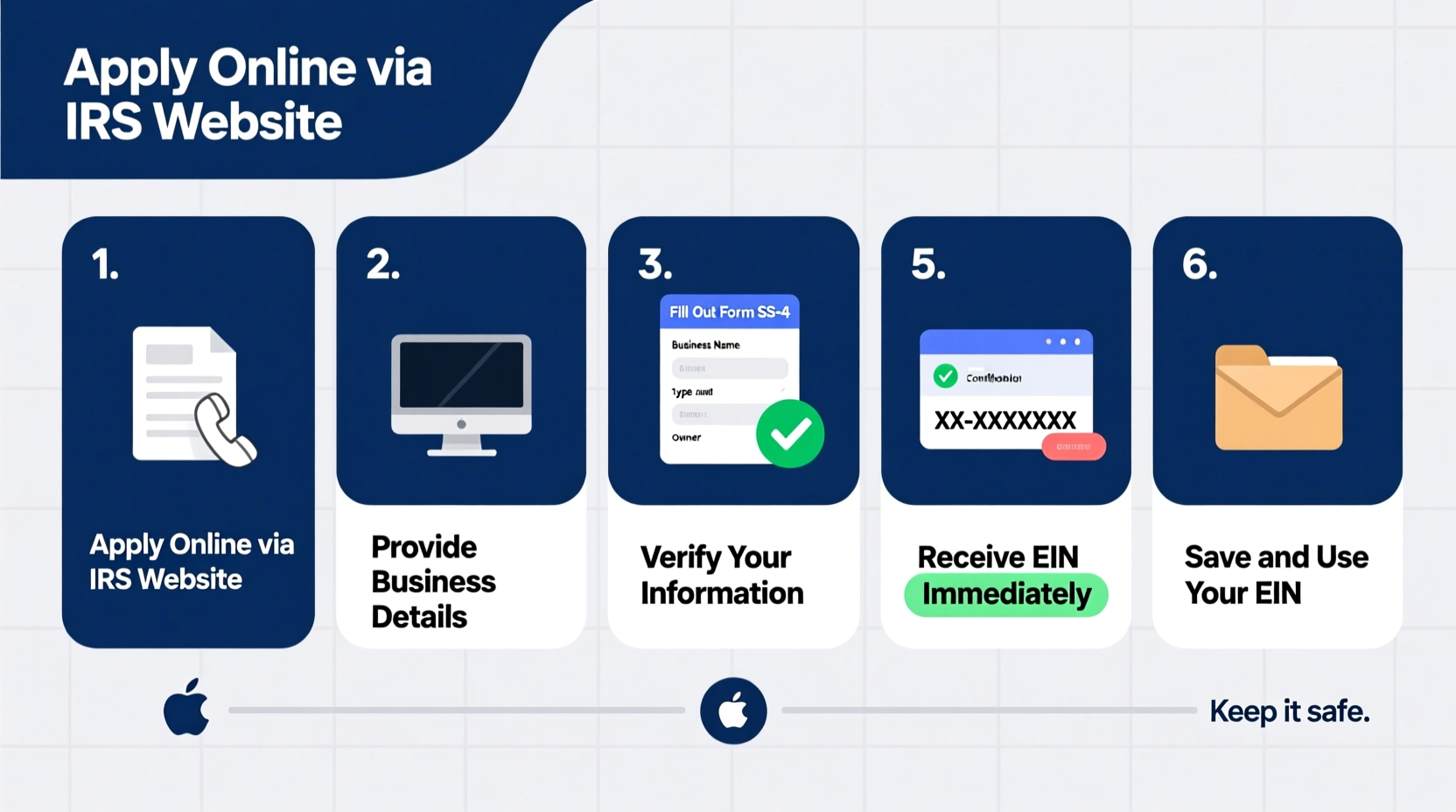

The IRS offers multiple ways to obtain an EIN, but the fastest and most reliable method is online. Follow this timeline to secure your number efficiently.

- Determine Eligibility: The principal business must be located in the U.S. or U.S. territories. The applicant (known as the “responsible party”) must have a valid SSN, Individual Taxpayer Identification Number (ITIN), or existing EIN.

- Gather Required Information: Before starting the application, collect key details including your legal name, business address, Social Security Number, date of formation, and the number of employees expected within the next 12 months.

- Choose Your Business Structure: Clearly identify if your business is a sole proprietorship, LLC, corporation, partnership, nonprofit, or government entity. This affects how the EIN is issued and used.

- Access the IRS EIN Assistant: Visit the official IRS website at IRS.gov and navigate to the EIN Assistant page.

- Complete the Online Application: Fill out the interactive form, which typically takes 10–15 minutes. The system will validate your information in real time.

- Receive Your EIN Instantly: Upon successful submission, the IRS issues your EIN immediately. You can download, save, or print the confirmation notice (Form SS-4).

Alternative Application Methods

While the online method is preferred, not all entities qualify for digital filing. The IRS provides two other options:

| Method | Eligibility | Processing Time | How to Submit |

|---|---|---|---|

| Online Application | U.S.-based entities with a responsible party holding SSN/ITIN | Immediate | IRS EIN Assistant (available Monday–Friday, 7 a.m. – 10 p.m. ET) |

| Mail or Fax | All eligible entities, including foreign applicants | 4 weeks (mail), 4 days (fax) | Complete Form SS-4 and send to the appropriate IRS address or fax number |

| Phone (International Applicants Only) | Entities outside the U.S. or its territories | Immediate upon call | Call 267-941-1099 (not toll-free) between 6 a.m. – 11 p.m. ET, Monday–Friday |

Note: Domestic applicants cannot apply by phone. Only international applicants are eligible for telephonic EIN issuance.

Common Mistakes to Avoid

Errors during the EIN application can delay processing or lead to mismatched records with banks and agencies. Be mindful of these frequent missteps:

- Using incorrect business names: The legal name must match state filings exactly. Avoid abbreviations unless officially registered.

- Mismatched responsible party information: The SSN or ITIN provided must belong to the individual authorized to control the entity’s funds and assets.

- Applying too late: Secure your EIN before opening a business bank account or hiring staff. Banks require the number upfront.

- Losing the confirmation letter: The IRS does not reissue EINs easily. Store Form SS-4 securely alongside other business documents.

Real Example: A First-Time LLC Owner’s Experience

Sarah launched a graphic design LLC in Austin, Texas. After registering her business with the state, she tried opening a bank account but was denied because she lacked an EIN. She visited the IRS website, completed the online EIN application using her SSN as the responsible party, and received her number within 10 minutes. With the EIN in hand, she successfully opened a business checking account and hired her first contractor—all within 48 hours. Her only regret? Not applying for the EIN sooner.

After You Receive Your EIN: What Comes Next?

Securing your EIN is just the beginning. Use it strategically to build a compliant and professional business infrastructure.

- Open a business bank account: Most financial institutions require your EIN, formation documents, and operating agreement.

- Register for state and local taxes: Many states require separate registration for sales tax, unemployment insurance, or employer withholding.

- Hire employees legally: An EIN is necessary to report wages, pay payroll taxes, and issue W-2 forms.

- File annual tax returns: Depending on your structure, you’ll use the EIN when filing Form 1120 (corporation), Form 1065 (partnership), or Schedule C (sole proprietorship with employees).

Frequently Asked Questions

Can I get an EIN without an SSN?

Yes, but your options depend on your location. U.S.-based applicants without an SSN can use an Individual Taxpayer Identification Number (ITIN). Foreign applicants may apply by fax or phone and provide their passport or other identifying documentation.

Do I need a new EIN if I change my business structure?

Generally, yes. If you convert from a sole proprietorship to an LLC, or from an LLC to a corporation, the IRS considers this a new taxable entity, requiring a new EIN. Changes in ownership or bankruptcy may also necessitate a new number.

Is there a fee to get an EIN?

No. Applying for an EIN through the IRS is completely free. Beware of third-party websites that charge for this service—they often offer no added value beyond what the IRS provides directly.

Final Checklist: Getting Your EIN Right the First Time

- Confirm your business needs an EIN based on structure or activity

- Ensure your business is legally registered with your state (if applicable)

- Collect required information: legal name, address, SSN/ITIN, business start date

- Designate the correct responsible party

- Apply via the IRS EIN Assistant during available hours

- Save and print your EIN confirmation notice (Form SS-4)

- Store your EIN securely and use it to set up banking, payroll, and tax accounts

Take Action Today

Obtaining an Employer Identification Number is a simple yet critical milestone for any new business. Whether you're launching a side hustle or building a full-scale enterprise, having an EIN streamlines operations, strengthens credibility, and ensures compliance from day one. The entire online process takes less than 15 minutes—and the number is yours permanently. Don’t let uncertainty delay your progress. Visit the IRS website now, follow the steps outlined here, and take confident control of your business’s financial identity.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?