Incorporating your business is one of the most impactful decisions you can make as an entrepreneur. It separates your personal assets from your company’s liabilities, enhances credibility, and opens doors to tax advantages and funding opportunities. While the process may seem complex, breaking it down into manageable steps makes it accessible—even for first-time founders. This guide walks you through everything you need to know to successfully incorporate your business and operate with confidence.

Why Incorporation Matters

Operating as a sole proprietorship or general partnership exposes your personal finances to business risks. If your company faces a lawsuit or accumulates debt, your home, savings, and personal property could be at risk. Incorporation creates a legal entity—typically a corporation (Inc.) or limited liability company (LLC)—that stands apart from its owners.

According to the U.S. Small Business Administration, over 60% of new businesses choose some form of incorporation within their first three years. The primary reasons include liability protection, tax flexibility, and long-term scalability. A formal structure also signals professionalism to clients, investors, and financial institutions.

The Step-by-Step Process of Incorporation

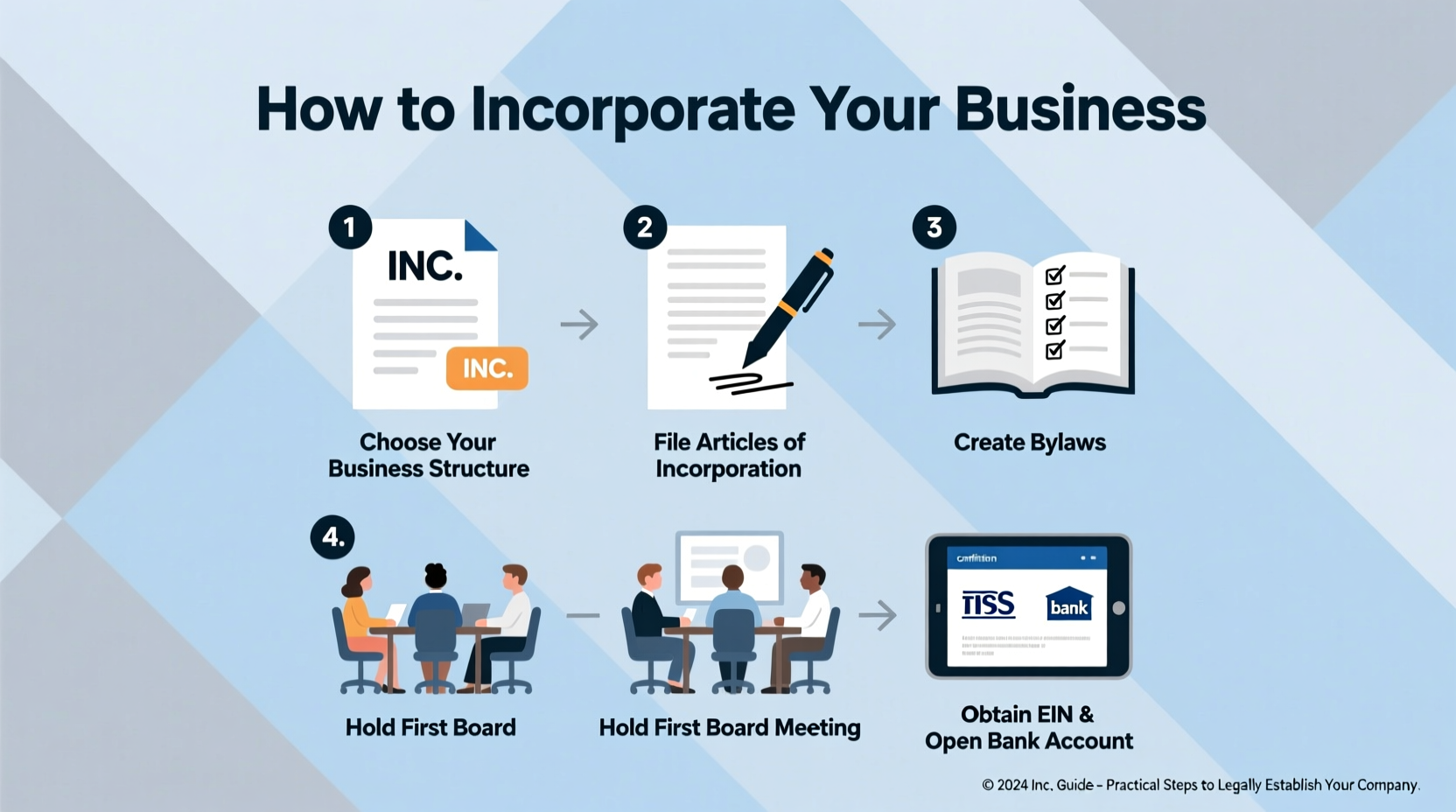

Becoming an incorporated business involves more than filing a single document. It's a structured process that requires planning, compliance, and ongoing maintenance. Follow these steps to ensure a smooth transition:

- Choose Your Business Structure: Decide between a C Corporation, S Corporation, or LLC. Each has distinct tax and operational implications.

- Select a Unique Business Name: Verify availability in your state and consider securing a domain name.

- Appoint a Registered Agent: This individual or service receives legal documents on behalf of your company.

- File Articles of Incorporation: Submit this document to your state’s Secretary of State office, along with required fees.

- Create Corporate Bylaws or an Operating Agreement: Outline internal governance, roles, and decision-making processes.

- Obtain an EIN from the IRS: Essential for opening a bank account and filing taxes.

- Issue Stock (for Corporations): Document initial equity distribution among founders and investors.

- Comply with Ongoing Requirements: File annual reports, pay franchise taxes, and maintain accurate records.

Choosing the Right Entity Type

Your choice of entity affects taxation, fundraising ability, and administrative workload. Below is a comparison to help you decide:

| Entity Type | Liability Protection | Tax Treatment | Ownership Flexibility | Administrative Burden |

|---|---|---|---|---|

| C Corporation | Yes | Double taxation (corporate + shareholder dividends) | Unlimited shareholders; ideal for investors | High (board meetings, minutes, filings) |

| S Corporation | Yes | Pass-through taxation (avoids corporate tax) | Limited to 100 U.S. shareholders | Moderate (must meet IRS criteria) |

| LLC | Yes | Flexible (default pass-through; can elect corporate tax) | High flexibility in profit sharing | Low to moderate |

“Founders who delay incorporation often regret it when they seek investment or face litigation. The cost of setting up an entity is minimal compared to the risks of operating without one.” — Sarah Lin, Corporate Law Attorney, Perkins & Reed LLP

Avoiding Common Incorporation Mistakes

Even well-intentioned entrepreneurs make errors during incorporation that can lead to delays, penalties, or legal exposure. Awareness is the first step toward prevention.

- Filing in the wrong state: Most businesses should incorporate in the state where they primarily operate, not necessarily where taxes are lower.

- Mixing personal and business finances: Co-mingling funds undermines liability protection.

- Skipping bylaws or operating agreements: These documents prevent disputes among co-founders.

- Missing annual filings: Failure to file reports can result in administrative dissolution.

- Ignoring intellectual property assignment: Founders must formally assign IP rights to the company.

Real-World Example: From Freelancer to Incorporated Agency

Jamal started as a freelance graphic designer working from his apartment. After landing several high-profile clients, he began hiring contractors and investing in software tools. When a client sued him over a branding dispute—claiming lost revenue due to design delays—his personal savings were at risk because he operated as a sole proprietor.

He quickly consulted a local attorney and formed an LLC in his home state of Colorado. He transferred contracts, opened a business bank account, and drafted an operating agreement outlining ownership and responsibilities. Within six months, he secured a small business loan to hire two full-time designers. Today, his incorporated agency bills over $500,000 annually—and his personal assets remain protected.

This case illustrates how timely incorporation transforms vulnerability into stability and growth.

Incorporation Checklist

Use this checklist to stay organized throughout the process:

- ☐ Research and select business structure (LLC, S-Corp, C-Corp)

- ☐ Confirm business name availability in your state

- ☐ Reserve the name (if needed) via state portal

- ☐ Appoint a registered agent

- ☐ Draft and file Articles of Incorporation or Organization

- ☐ Obtain EIN from IRS website

- ☐ Create corporate bylaws or LLC operating agreement

- ☐ Issue stock certificates or membership units

- ☐ Open a business bank account

- ☐ Apply for necessary licenses and permits

- ☐ Set up accounting system and record-keeping process

- ☐ Schedule annual compliance deadlines (e.g., report filings)

Frequently Asked Questions

Do I need a lawyer to incorporate my business?

While not legally required, consulting an attorney ensures your documents are properly structured and compliant. For straightforward cases, online services like Incfile or LegalZoom can suffice—but complex ownership arrangements benefit from legal counsel.

Can I change my business structure after incorporation?

Yes, but it can be complicated. Converting from an LLC to a C Corp, for example, may trigger tax events and require re-filing with the state. Plan carefully and consult a CPA before making changes.

What’s the difference between “incorporated” and “LLC”?

“Incorporated” typically refers to corporations (C or S), which have boards, shares, and stricter governance rules. An LLC combines liability protection with operational simplicity and pass-through taxation. Both offer legal separation, but LLCs are generally easier to manage for small businesses.

Final Steps and Moving Forward

Incorporation isn’t just a legal formality—it’s a strategic milestone. Once your entity is established, focus on maintaining compliance, building business credit, and protecting intellectual property. Keep detailed records, hold annual meetings (if applicable), and review your structure annually with your accountant.

Remember, incorporation is not a one-time event. It’s the foundation of a scalable, resilient business. Whether you’re running a consulting practice, e-commerce store, or tech startup, formalizing your business structure empowers you to grow with confidence.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?