Moving from the United States to Germany is a dream for many Americans—whether for career opportunities, quality of life, or a deep appreciation for European culture. But turning that dream into reality requires careful planning, patience, and attention to bureaucratic detail. Unlike moving between U.S. states, relocating internationally involves legal, financial, and logistical steps that can’t be rushed. This guide breaks down the process into clear, actionable phases so you can transition smoothly to life in Germany.

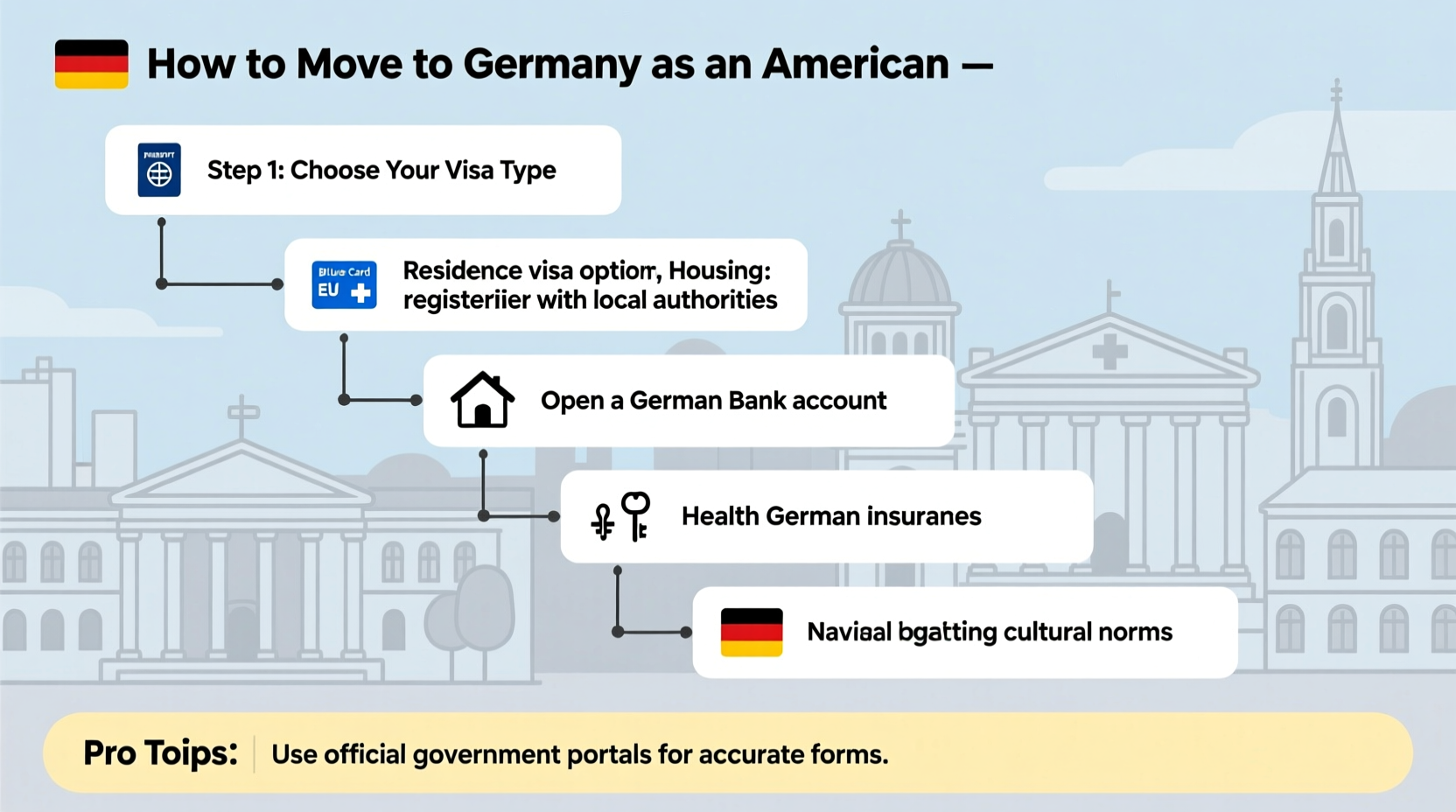

Step 1: Determine Your Purpose and Choose the Right Visa

Your reason for moving dictates the type of visa you’ll need. The German government issues residence permits based on specific criteria, and applying under the wrong category can delay or even deny your application.

Common visa options for Americans include:

- Employment Visa: For those with a job offer from a German employer. High-demand fields like IT, engineering, and healthcare often qualify.

- EU Blue Card: Designed for non-EU professionals with a university degree and a job offer paying above a threshold (€58,400 annually in 2024, lower for shortage occupations).

- Freelancer/Self-Employed Visa: Requires a viable business plan, proof of income potential, and approval from local immigration and tax authorities.

- Job Seeker Visa: Allows you to stay in Germany for up to six months to find qualified employment. Not available at all consulates—check availability before applying.

- Student Visa: For enrollment in a recognized German educational institution.

Applications are submitted through the German Embassy or Consulate in the U.S. You’ll need a valid passport, proof of health insurance, financial means, and documentation relevant to your visa type. Biometrics are required.

“Germany values skilled labor and structured applications. A well-prepared visa dossier can make the difference between approval and rejection.” — Dr. Lena Hoffmann, Immigration Consultant, Berlin

Step 2: Secure Housing Before Arrival

Finding housing in Germany—especially in cities like Munich, Frankfurt, or Berlin—can be highly competitive. Landlords often require documents that new arrivals don’t yet have, such as a Schufa (credit score) or a German bank account.

To overcome this:

- Start searching early using platforms like ImmobilienScout24, WG-Gesucht (for shared flats), or Kleinanzeigen.

- Consider short-term rentals (Airbnb, serviced apartments) for your first few weeks while you settle.

- Ask your employer if they offer relocation assistance or temporary housing.

- Have rental funds ready in a German bank account. Many landlords require 2–3 months’ rent as a deposit.

Renting typically includes “warm rent” (Kaltmiete + Nebenkosten), which covers utilities like water, heating, and waste. Electricity and internet are usually billed separately.

| Housing Type | Avg. Monthly Cost (2024) | Best For |

|---|---|---|

| Shared Apartment (WG) | €400–€700 | Singles, students, short-term stays |

| One-Bedroom Apartment (City Center) | €900–€1,500 | Professionals, couples |

| Two-Bedroom Apartment (Suburbs) | €800–€1,200 | Families, remote workers |

Step 3: Register Your Residence and Open a Bank Account

Within two weeks of arrival, you must register your address at the local Einwohnermeldeamt (Resident Registration Office). Bring your passport, rental contract, and completed registration form (usually provided by your landlord).

This registration (Anmeldung) is essential for:

- Obtaining a tax ID

- Opening a German bank account

- Signing up for health insurance

- Applying for a residence permit at the Foreigners’ Office (Ausländerbehörde)

After registration, open a German bank account. Major banks like Deutsche Bank, Commerzbank, and N26 offer accounts for expats. You’ll need your passport, Anmeldung, and possibly your employment contract. Some banks allow online sign-up, but identity verification may require an in-person appointment or video call.

Step 4: Understand Healthcare and Insurance Requirements

Germany has a mandatory public health insurance system (Gesetzliche Krankenversicherung). Most residents earning under €69,300/year (2024) must enroll in public insurance; higher earners can opt for private coverage.

Popular public insurers include:

- TK (Techniker Krankenkasse)

- AOK (Allgemeine Ortskrankenkasse)

- Barmer

Monthly premiums are around 14.6% of your gross income, split evenly between employee and employer. Coverage includes doctor visits, prescriptions, maternity care, and preventive services.

If you’re self-employed or earn above the threshold, private insurance offers more flexibility—but costs vary widely based on age, health, and coverage level.

Regardless of type, you’ll receive an insurance card (eGK) within a few weeks. Keep it with you—doctors and pharmacies require it.

Step 5: Navigate Taxes, Work, and Daily Life

Germany uses a progressive income tax system, and your employer will withhold taxes automatically if you’re employed. Freelancers must file annual returns and may need to make quarterly prepayments.

Key steps for financial integration:

- Apply for a tax identification number (Steuer-ID) after registration—it arrives by mail within 2–4 weeks.

- Understand your tax class (Steuerklasse), especially if married or working multiple jobs.

- Keep all receipts and invoices—Germany is meticulous about record-keeping.

- Consider hiring a Steuerberater (tax advisor) for your first return if self-employed.

Culturally, Germans value punctuality, privacy, and direct communication. Don’t take bluntness personally—it’s not rudeness, but efficiency. Recycling is strictly enforced; learn your city’s bin system. And always sign emails formally with your full name and contact details.

Mini Case Study: Sarah’s Move from Chicago to Hamburg

Sarah, a UX designer, moved to Hamburg after securing a job with a tech startup. She applied for her EU Blue Card from Chicago, providing her degree transcripts, job contract, and proof of health insurance. Two months later, she arrived with a short-term apartment booked for three weeks.

She registered at the Einwohnermeldeamt on day five, opened an N26 account online, and enrolled with TK for health insurance. Her employer handled much of the paperwork with the Ausländerbehörde, and she received her residence permit in six weeks. Within three months, she found a long-term flat and began learning German through a company-sponsored course.

Her advice? “Don’t underestimate how long bureaucracy takes. Build in buffer time—and learn basic German phrases before you land.”

Relocation Checklist

Use this checklist to ensure nothing slips through the cracks:

- ✅ Research and apply for the correct visa

- ✅ Book flights and short-term accommodation

- ✅ Arrange international health insurance (if not covered by employer)

- ✅ Ship or pack essentials (include adapters, important documents, medications)

- ✅ Register at the Einwohnermeldeamt within 14 days

- ✅ Apply for residence permit at the Ausländerbehörde

- ✅ Open a German bank account

- ✅ Enroll in public or private health insurance

- ✅ Obtain tax ID and understand your Steuerklasse

- ✅ Begin learning German—even basics help daily interactions

Frequently Asked Questions

Can I work remotely for a U.S. company while living in Germany?

Yes, but you must comply with German tax laws. Income earned while residing in Germany is generally taxable there. You’ll need a freelance visa or residence permit that allows self-employment. Consult a tax advisor to avoid double taxation under the U.S.-Germany tax treaty.

Do I need to speak German to live in Germany?

Not immediately, especially in larger cities where English is widely spoken in professional settings. However, daily life—dealing with officials, landlords, or doctors—is much easier with German. Most residency permits require at least A1 or B1 level after several years.

How long does it take to get permanent residency?

Generally, you can apply for permanent residency (Niederlassungserlaubnis) after five years of legal residence, continuous employment, and sufficient German language skills (B1 level). Exceptions exist for EU Blue Card holders, who may qualify after 21–33 months with B1 proficiency.

Final Steps and Moving Forward

Moving to Germany as an American is a rewarding journey that blends opportunity with structure. The country offers strong worker protections, excellent public services, and a high standard of living—but it also demands respect for rules and procedures. By planning ahead, staying organized, and embracing the cultural nuances, you’ll not only adapt but thrive.

Start today: review visa requirements, connect with expat communities online, and begin building your German support network. Every step forward brings you closer to a new life across the Atlantic.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?