Opening a bank account is one of the most essential financial steps anyone can take. Whether you're a student, a new resident, or simply starting your financial journey, having a bank account provides security, convenience, and access to tools that help manage money effectively. While the process may seem overwhelming at first, it’s actually straightforward when you know what to expect. This guide walks you through every stage—from choosing the right bank to making your first deposit—with practical advice and real-world examples.

Step 1: Determine the Type of Account You Need

Not all bank accounts are the same. The type you choose should align with your financial habits and goals. Most banks offer two primary types:

- Checking Account: Best for daily transactions like paying bills, using a debit card, or setting up direct deposits.

- Savings Account: Designed to store money safely while earning interest over time. Ideal for emergency funds or saving toward specific goals.

Some institutions also offer specialized accounts such as student accounts, joint accounts, or high-yield savings options. Consider your income frequency, spending patterns, and long-term objectives before deciding.

Step 2: Choose the Right Bank or Credit Union

Selecting a financial institution is more than just picking the closest branch. Key factors include fees, customer service, digital tools, and ATM accessibility.

| Factor | What to Look For | Red Flags |

|---|---|---|

| Fees | No monthly maintenance fees or low balance requirements | Hidden charges for statements, transfers, or inactivity |

| Online Banking | User-friendly mobile app, mobile check deposit, alerts | Poor app reviews or limited digital features |

| ATM Access | Reimbursement for out-of-network ATM fees or large network access | High withdrawal fees or very few nearby ATMs |

| Customer Support | 24/7 phone support, live chat, local branches | Long wait times or no weekend availability |

Credit unions often provide lower fees and higher interest rates but may have membership restrictions based on location, employer, or affiliation. Online banks typically offer better rates and fewer fees due to lower overhead, though they lack physical branches.

“Choosing a bank isn’t about brand recognition—it’s about finding a partner that supports your financial behavior.” — Marcus Reed, Financial Literacy Advocate

Step 3: Gather Required Documents

To comply with federal regulations, all banks require identity verification under the Customer Identification Program (CIP). Missing documents can delay or prevent account opening, so prepare these essentials in advance:

- Government-issued photo ID (e.g., driver’s license, passport, state ID)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of address (e.g., utility bill, lease agreement, or official mail with your name and address)

- Initial deposit (amount varies by bank; typically $25–$100)

If you’re not a U.S. citizen, some banks accept alternative documentation such as a foreign passport with a visa, I-20 form for students, or employment authorization documents.

Mini Case Study: Opening an Account as a College Student

Jamal, a freshman at a public university, needed a checking account for his part-time job paycheck and textbook purchases. He compared three banks: a national chain, a local credit union, and an online-only bank. The credit union offered free checks, no ATM fees, and in-person advising at a campus kiosk—but required him to join through his school’s alumni association. After verifying eligibility, Jamal opened the account with his student ID, SSN, and dorm address from his housing contract. His first direct deposit arrived within five business days, and he began using mobile banking to track expenses.

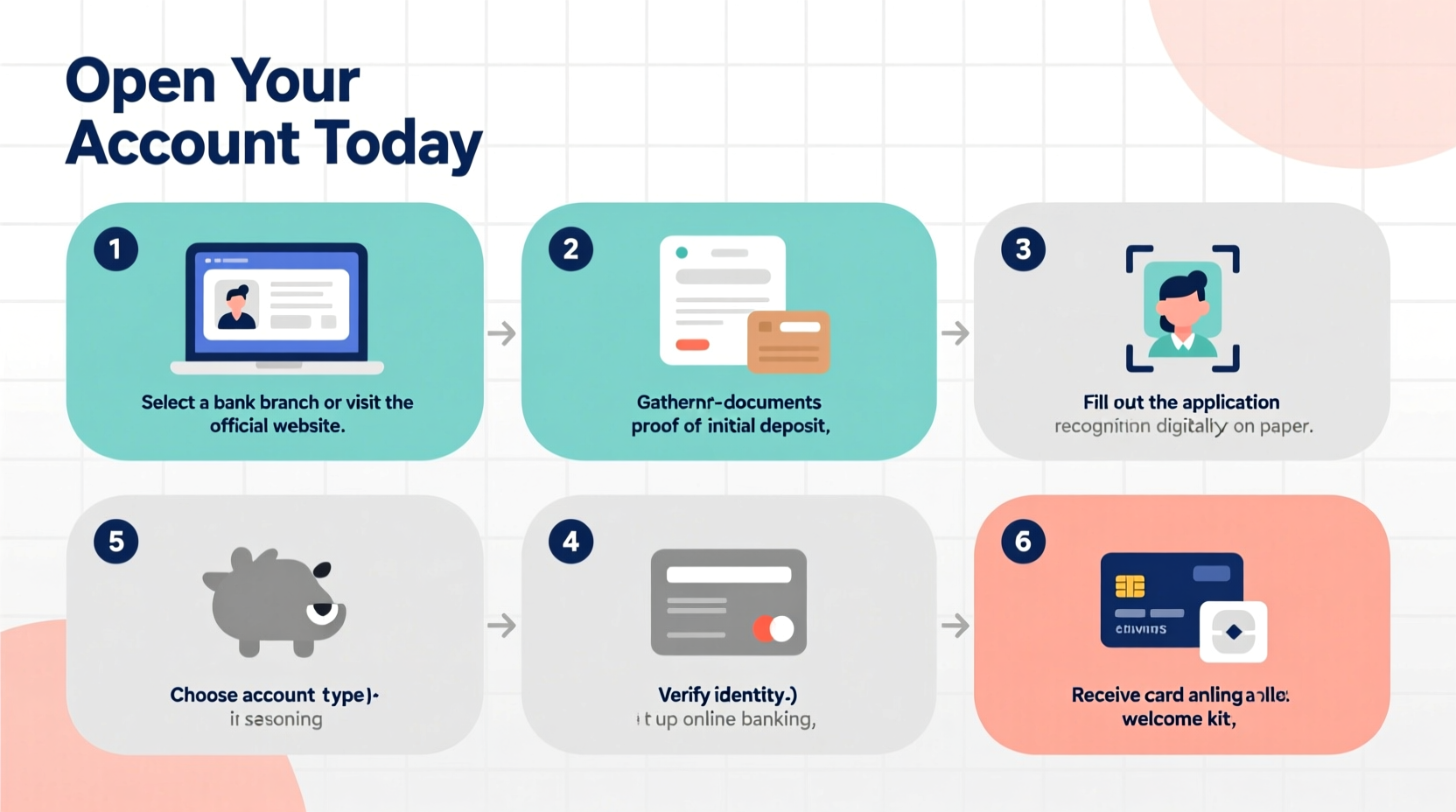

Step 4: Complete the Application Process

You can open a bank account either online or in person. Each method has advantages:

In-Person vs. Online: What’s Better?

Visiting a branch allows you to speak directly with a representative, ask questions, and resolve issues immediately. It’s ideal if you’re unfamiliar with the process or prefer face-to-face interaction.

Online applications are faster and available 24/7. Most major banks allow full account setup digitally, including e-signing documents and uploading ID photos via smartphone.

Timeline: How Long Does It Take?

- Preparation (1–2 days): Gather IDs and decide on account type.

- Application (15–30 minutes): Fill out personal details and submit documents.

- Verification (Instant to 2 business days): The bank confirms your identity and funding source.

- Account Activation (Same day to 3 days): Receive confirmation email or letter; debit card arrives by mail in 7–10 days.

Step 5: Activate and Secure Your Account

Once approved, take immediate steps to protect your finances:

- Set up strong login credentials for online banking.

- Enable multi-factor authentication (MFA).

- Sign your debit card upon receipt.

- Memorize your PIN—never write it on the card.

- Link external accounts for transfers or set up direct deposit.

Many banks offer introductory bonuses—such as $50–$200—for maintaining a minimum balance or setting up direct deposit within the first 60 days. Check eligibility terms before committing.

Checklist: Opening a Bank Account Successfully

- ☐ Decide between checking, savings, or both

- ☐ Research banks or credit unions with low fees and good service

- ☐ Collect government ID, SSN/ITIN, and proof of address

- ☐ Prepare initial deposit (cash or check)

- ☐ Complete application online or in person

- ☐ Verify identity and fund the account

- ☐ Set up online and mobile banking

- ☐ Activate debit card and enable security features

Frequently Asked Questions

Can I open a bank account with bad or no credit?

Yes. Most banks do not run a credit check to open a standard checking or savings account. However, some may use a consumer reporting service like ChexSystems to review past banking behavior. If you’ve had accounts closed due to fraud or unpaid fees, you might face denials—but second-chance banking options exist.

Do I need a permanent address to open an account?

While most banks require a verifiable residential address, some accept temporary addresses such as shelters, transitional housing, or even P.O. boxes in certain cases. Homeless individuals or those in unstable situations should contact local credit unions or nonprofit financial programs for assistance.

Is my money safe in a bank?

Absolutely. Accounts at federally insured banks (FDIC) or credit unions (NCUA) are protected up to $250,000 per depositor, per institution. Always confirm insurance status before opening an account.

Final Steps and Moving Forward

Opening a bank account marks the beginning of greater financial control. From here, consider automating savings, building credit with a secured card, or setting up budget alerts. Avoid common pitfalls like overdrafts by monitoring your balance regularly and opting out of overdraft protection unless absolutely necessary.

The key to success lies not just in opening the account, but in using it wisely. Treat your bank relationship as a foundation—one that grows stronger with responsible habits and informed decisions.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?