Writing a check is still a common method of payment for rent, bills, or personal transactions. But what happens when you write a check today that you don’t want the recipient to cash until next month? That’s where post-dating comes in. While it may seem straightforward, post-dating a check incorrectly—or relying on it too heavily—can lead to confusion, bounced payments, or even legal complications. Understanding how to properly post-date a check and manage expectations around its clearance is essential for maintaining trust and financial control.

Understanding Post-Dated Checks: What They Are and How They Work

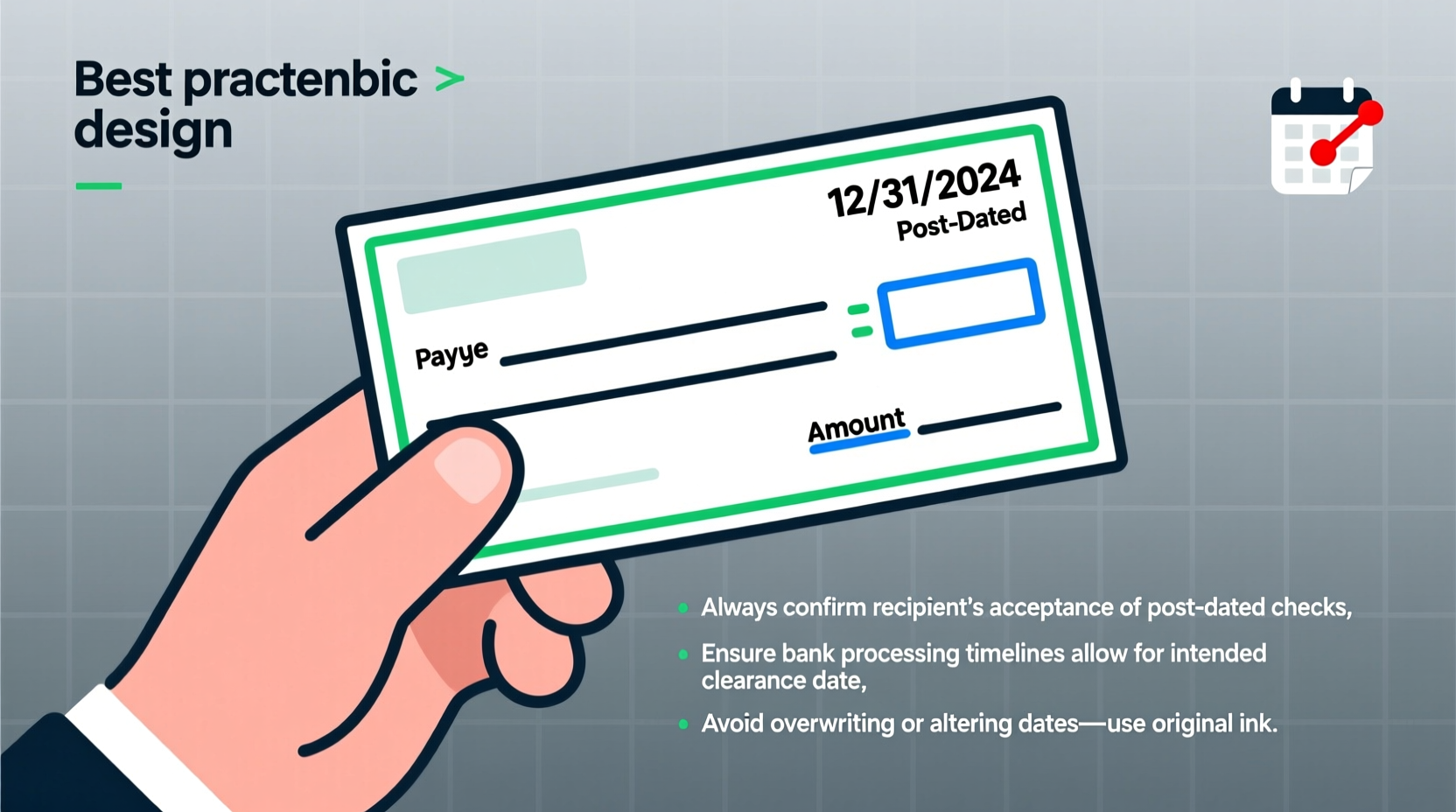

A post-dated check is a check written with a future date. For example, if today is March 5, but you write a check dated April 1, you are post-dating it. The intent is usually to delay payment until funds become available or to align with a specific billing cycle.

Legally, a post-dated check is still a valid negotiable instrument. According to the Uniform Commercial Code (UCC), which governs commercial transactions in the U.S., banks are generally allowed to cash or deposit a check even if it's post-dated. This means the recipient can technically deposit it before the date written on the check.

“While post-dating is a common practice, it’s not a guaranteed hold mechanism. The responsibility lies with both the payer and payee to communicate clearly.” — Sarah Lin, Banking Compliance Specialist

The key takeaway: post-dating is more of a courtesy than a legal barrier. It signals intent, but it doesn't enforce timing. Relying solely on the future date without additional safeguards can be risky.

Step-by-Step Guide to Writing a Post-Dated Check Correctly

Writing a post-dated check involves more than just changing the date. To minimize issues, follow this clear process:

- Determine the correct future date – Choose a date when you’re confident funds will be available in your account.

- Fill out all check fields accurately – Include the payee’s name, amount in numbers and words, memo line (optional), and your signature.

- Write the future date clearly – Place it in the designated date field. Use the full format (e.g., “April 1, 2024”) to avoid confusion.

- Inform the recipient – Verbally or in writing, let them know the check should not be deposited before the specified date.

- Keep a record – Save a copy of the check or note the details in your ledger for tracking purposes.

Do’s and Don’ts of Post-Dating Checks

| Do’s | Don’ts |

|---|---|

| ✓ Communicate the post-date clearly to the recipient | ✗ Assume the bank will honor the future date automatically |

| ✓ Ensure sufficient funds will be available by the post-dated day | ✗ Write a post-dated check if you're unsure about future balances |

| ✓ Use post-dating only for trusted parties (landlords, family, established vendors) | ✗ Use post-dating as a long-term solution for cash flow problems |

| ✓ Keep proof of communication (text, email) about the intended deposit date | ✗ Rely on post-dating instead of setting up formal payment plans |

Real Example: When Post-Dating Prevented a Financial Crisis

Jamal, a freelance graphic designer, agreed to pay his monthly office rent on the first of each month. In January, a client delayed payment, leaving Jamal short on February 1st. Instead of defaulting, he spoke with his landlord and issued a post-dated check for February 10—when he expected the client’s funds to arrive.

He wrote the check with the date February 10, included a note on the memo line stating “For deposit on or after 2/10,” and followed up with an email confirming the arrangement. The landlord honored the request, waited until February 10 to deposit, and Jamal’s account cleared without incident.

This case shows that while post-dating isn’t foolproof, combining it with transparency and documentation can prevent overdrafts and maintain good relationships.

Tips to Increase the Effectiveness of a Post-Dated Check

Since banks can legally cash post-dated checks early, extra precautions help ensure your intentions are respected:

- Add a memo notation – Write “Do not deposit before [date]” in the memo field. While not legally binding, it serves as a clear signal.

- Send a written notice – Email or text the recipient with a reminder about the deposit timeline.

- Request a deposit hold – Some banks allow payees to place a hold on deposit timing through online banking. Ask the recipient to use this feature if available.

- Monitor your account – Set up low-balance alerts so you’re notified if the check is cashed prematurely.

- Consider alternatives – For recurring payments, use scheduled bill pay or automatic transfers instead of physical checks.

FAQ: Common Questions About Post-Dating Checks

Can a bank refuse to cash a post-dated check before the date?

Banks are not required to honor the future date on a check. While some may allow customers to flag checks for delayed processing upon request, most institutions process checks based on availability of funds, not the written date. The decision to cash it early rests with the bank and the recipient.

Is it illegal to deposit a post-dated check early?

No, it is not illegal. As long as the check is legitimate and signed, the payee has the right to deposit it at any time. However, if they do so knowingly while violating a prior agreement, it could damage trust or lead to disputes—though legal recourse may be limited unless fraud is involved.

What should I do if a post-dated check is cashed early?

If the check clears before the intended date and causes an overdraft, contact your bank immediately. Some banks may reverse the transaction if caught quickly, especially if you have a history of responsible banking. You can also reach out to the payee to request reimbursement, particularly if there was a verbal or written agreement to wait.

Checklist: Ensuring Your Post-Dated Check Works as Intended

Before handing over a post-dated check, go through this checklist to protect yourself:

- ☑ Confirm the future date aligns with your income schedule

- ☑ Verify the check includes accurate payee name, amount, and signature

- ☑ Write “Do not deposit before [date]” in the memo line

- ☑ Notify the recipient verbally or via message about the deposit timeline

- ☑ Save proof of communication (email, text, receipt)

- ☑ Monitor your account leading up to the post-dated day

- ☑ Consider setting up a temporary overdraft protection if needed

Conclusion: Use Post-Dating Wisely and Proactively

Post-dating a check can be a practical tool for managing payments when used responsibly. However, it’s not a failsafe mechanism. The date on the check alone won’t stop a determined recipient or an automated banking system from processing it early. Success depends on preparation, communication, and mutual understanding.

To truly ensure your payment clears when intended, combine proper check-writing techniques with proactive dialogue and financial planning. Avoid making post-dating a habit due to cash flow issues—instead, explore budgeting tools, emergency savings, or formal payment arrangements.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?