The Downpayment Toward Equity Act (DTEA) is a proposed piece of legislation aimed at addressing long-standing disparities in homeownership among first-generation homebuyers, particularly those from historically underserved communities. While not yet enacted into federal law as of 2024, several pilot programs and state-level initiatives inspired by the DTEA are already operational, offering up to $25,000 in down payment and closing cost assistance. This guide walks you through how to determine your eligibility, gather necessary documents, and complete the application process efficiently.

Understanding the Downpayment Toward Equity Act

The core objective of the DTEA is to reduce barriers to homeownership by providing financial support to eligible first-time buyers. The program targets individuals and families who have been systematically excluded from building generational wealth through property ownership due to discriminatory housing policies, income inequality, or limited access to credit.

Under the proposed framework, qualified applicants may receive grants—often non-repayable—for down payments and closing costs. These funds can be combined with other federal or local homeownership programs such as FHA loans, USDA loans, or HUD Section 8 homeownership vouchers. Importantly, many versions of the program do not require repayment as long as the home remains the primary residence for a minimum period, typically five years.

“Homeownership is one of the most effective ways to build long-term wealth, yet millions remain locked out due to upfront costs. The DTEA represents a targeted solution to close that gap.” — Dr. Lisa Chen, Urban Policy Analyst at the Center for Economic Equity

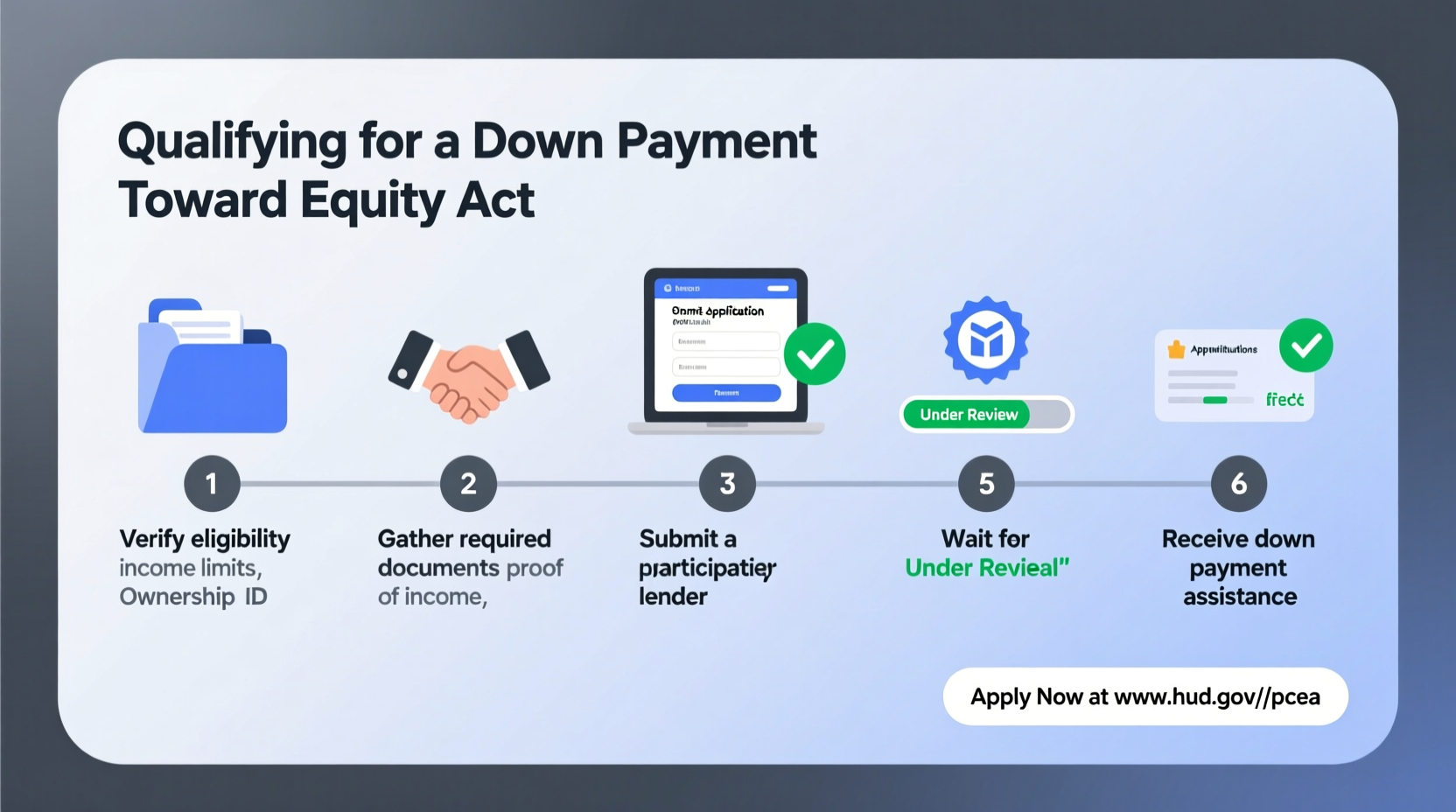

Step-by-Step Guide to Qualifying and Applying

While exact requirements vary depending on whether you're applying through a federal demonstration program, state housing authority, or nonprofit partner, the general qualification and application process follows a consistent structure.

Step 1: Confirm Your Eligibility

Eligibility hinges on several key criteria. Review each carefully before proceeding:

- First-time homebuyer status: You must not have owned a principal residence in the past three years. Married couples qualify if neither spouse has owned a home during this time.

- Income limits: Household income must fall below 120% of the area median income (AMI), adjusted for family size. In high-cost areas, exceptions may apply.

- Credit score: Minimum FICO score of 620 is typically required, though some programs accept alternative credit histories.

- Property location: The home must be located in a designated census tract or community priority zone, often defined by historical disinvestment or low homeownership rates.

- Homebuyer education: Completion of an approved homeownership counseling course is mandatory in nearly all cases.

Step 2: Gather Required Documentation

Having your paperwork ready accelerates the application. Collect the following:

- Government-issued ID (driver’s license or passport)

- Proof of income (last two years of tax returns, W-2s, pay stubs)

- Bank statements (last 60 days)

- Rental history or mortgage statements (if applicable)

- Certification of homebuyer education completion

- Signed purchase agreement (in later stages)

- Copy of loan pre-approval letter

Step 3: Enroll in a Homebuyer Education Course

Federally recognized courses cover budgeting, mortgage types, credit management, and maintenance responsibilities. Courses typically take 8–12 hours and are available online or in person through HUD-approved agencies. Upon completion, you’ll receive a certificate—keep this safe, as it’s required for submission.

Step 4: Choose a Participating Lender

Not all lenders participate in DTEA-aligned programs. Work with a mortgage provider approved by your state housing finance agency (HFA) or a nonprofit housing partner. They will coordinate the grant disbursement with the funding body.

Step 5: Submit Your Application

Applications are usually submitted through your lender or directly via your state’s HFA portal. Be sure to:

- Double-check all entries for accuracy

- Attach scanned copies of all required documents

- Submit before any deadlines (some programs operate on a first-come, first-served basis)

Processing times vary but generally range from 10 to 21 business days. If approved, the grant funds are sent directly to the title company at closing.

Eligibility Comparison Table: Federal vs. State Programs

| Criteria | Federal Demonstration Program | California DTEA Pilot | Texas Equity Access Program |

|---|---|---|---|

| Max Grant Amount | $25,000 | $30,000 | $20,000 |

| Income Limit (1-person household) | $78,000 | $95,000 | $82,000 |

| Min Credit Score | 620 | 600 | 640 |

| Homebuyer Education Required? | Yes | Yes | Yes |

| Repayment Required? | No, if resident 5+ years | No, if resident 7+ years | Forgiven after 10 years |

Real Example: Maria’s Successful Application

Maria Rodriguez, a 34-year-old public school teacher in Austin, Texas, had wanted to buy a home for years but struggled with saving for a down payment. After learning about the Texas Equity Access Program—a state initiative modeled after the DTEA—she took action.

She enrolled in a free HUD-approved homebuyer course offered by a local nonprofit, improved her credit score from 590 to 650 by paying down debt, and secured pre-approval for a $275,000 FHA loan. Her household income of $78,000 fell within the program’s limit. She found a townhouse in a designated priority zone and applied for the $20,000 grant through her lender.

Within two weeks, her application was approved. At closing, the grant covered her full down payment and most closing costs. Today, Maria is building equity and stability for her daughter—all made possible by understanding and navigating the DTEA-inspired program effectively.

Common Mistakes to Avoid

Even qualified applicants get denied due to preventable errors. Watch out for these pitfalls:

- Missing documentation: One missing pay stub or unsigned form can delay or disqualify your application.

- Applying too late: Some programs cap funding annually. Apply as soon as you’re pre-approved.

- Choosing a non-participating lender: Confirm your lender is certified with the program before starting.

- Overestimating affordability: Just because you’re approved doesn’t mean you should stretch your budget. Stick to homes within 3x your annual income.

Checklist: Are You Ready to Apply?

- ✅ I am a first-time homebuyer (no ownership in past 3 years)

- ✅ My household income is below 120% of AMI for my area

- ✅ I have a credit score of at least 620 (or improving toward it)

- ✅ I’ve completed a homebuyer education course

- ✅ I have six months of bank and income statements ready

- ✅ I’m working with a participating lender

- ✅ I’ve found a home in a qualified area

Frequently Asked Questions

Is the Downpayment Toward Equity Act currently a federal law?

No, as of 2024, the DTEA has not passed Congress as permanent federal legislation. However, multiple states—including California, Illinois, and Texas—have launched pilot programs based on its principles. Additionally, the U.S. Department of Housing and Urban Development (HUD) funds demonstration projects in select cities.

Do I have to repay the grant?

In most cases, no—if you remain in the home as your primary residence for at least five to ten years, the grant is fully forgiven. Early sale or rental of the property may trigger partial repayment, so review your program’s terms carefully.

Can I combine the DTEA grant with other down payment assistance?

It depends on the program. Some allow stacking with local incentives or employer-assisted housing benefits, while others prohibit it. Always disclose all funding sources to avoid disqualification.

Take Action Today

Homeownership remains one of the most powerful tools for financial security and intergenerational wealth. The Downpayment Toward Equity Act—and its growing network of state and local counterparts—offers a real pathway for those historically locked out of the market. By understanding eligibility, preparing documentation early, and partnering with the right professionals, you can position yourself for success.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?