Google Pay has transformed the way we make digital transactions—offering speed, convenience, and a layer of security by design. However, users often encounter situations where they need their full card number: for online account verification, booking platforms, or customer service inquiries. Unlike physical cards, Google Pay does not display the complete card number directly in the app for security reasons. Understanding how to access this information safely—and when it's appropriate—is essential to protecting your financial data.

This guide walks through the secure methods available to retrieve your full card number via Google Pay, explains the limitations built into the system for protection, and provides best practices for managing sensitive payment details without compromising your account.

Why Google Pay Hides Your Full Card Number

Google Pay uses tokenization to protect your actual card information during transactions. Instead of sharing your real credit or debit card number with merchants, Google issues a virtual account number (token) that’s unique to your device and card. This means even if a merchant’s system is compromised, your real card details remain secure.

Because of this architecture, your full card number is intentionally obscured within the Google Pay interface. You’ll typically see only the last four digits of your card. This design choice reduces the risk of exposure, especially on lost or stolen devices.

“Tokenization is one of the most effective consumer protections in modern digital wallets. It ensures that your real card data never touches third-party systems.” — Raj Mehta, Senior Security Analyst at FinTech Shield

How to Access Your Full Card Number Through Your Bank

The most reliable and secure method to view your full card number linked to Google Pay is through your issuing bank—not Google itself. Here’s how:

- Open your bank’s official mobile app or log in to your online banking portal.

- Navigate to the “Cards” or “Accounts” section.

- Select the card you’ve added to Google Pay.

- Look for an option labeled “View full card number,” “Card details,” or similar.

- If prompted, verify your identity using two-factor authentication (2FA), biometrics, or a security question.

- Once verified, your full card number, expiration date, and CVV will be revealed temporarily.

Not all banks allow full card number visibility online. Some may require you to call customer service or visit a branch in person for security verification.

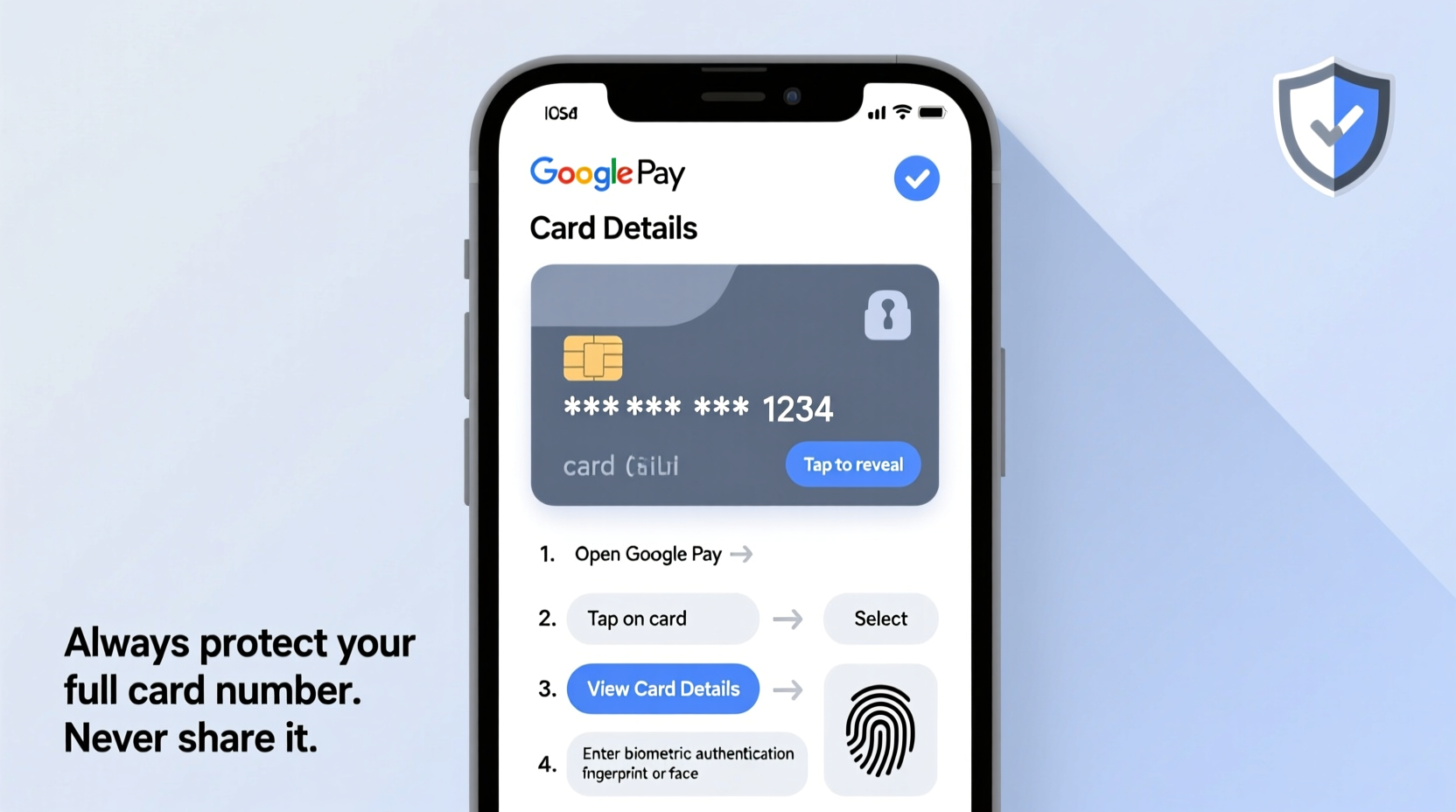

Step-by-Step: Managing Card Information in Google Pay

While you can’t see the full card number inside Google Pay, you can still manage how your card is used and ensure it remains secure. Follow this sequence to review and control your payment settings:

- Open Google Pay on your Android device or visit pay.google.com on your browser.

- Select your card from the list of saved payment methods.

- Review transaction history to confirm recent activity and detect unauthorized use.

- Edit settings such as default payment method, contactless limits, or spending alerts.

- Remove or suspend the card if it’s lost, compromised, or no longer needed.

- Enable notifications for every transaction to stay informed in real time.

If you suspect fraud, immediately suspend the card through Google Pay. This action disables its use for future transactions while leaving your physical card functional unless you also report it to your bank.

Do’s and Don’ts When Handling Card Information

| Do’s | Don’ts |

|---|---|

| Use your bank’s secure portal to view full card details | Take screenshots of your full card number on any device |

| Verify the website before entering card details online | Share your card number over email or messaging apps |

| Clear browser history after entering sensitive info | Store card numbers in unencrypted notes or spreadsheets |

| Enable multi-factor authentication on banking and Google accounts | Use public Wi-Fi to access banking or payment apps |

| Regularly monitor statements for unrecognized charges | Assume digital wallet protection eliminates all risks |

Real Example: Recovering Card Details After Device Loss

Sarah, a frequent traveler, misplaced her phone while abroad. She had been using Google Pay exclusively and didn’t have her physical card on hand. Needing her full card number to book a hotel, she followed these steps:

- She remotely locked her phone using Android’s Find My Device.

- From a friend’s tablet, she logged into her bank’s app using her credentials and biometric backup.

- After verifying her identity via SMS code, she accessed her card details under “Digital Wallets & Cards.”

- She completed her reservation and then suspended the card in Google Pay as a precaution.

- Later, she contacted her bank to issue a replacement card.

Sarah avoided potential fraud by acting quickly and relying on her bank’s infrastructure rather than attempting risky workarounds.

Frequently Asked Questions

Can I see my full card number in the Google Pay app?

No. For security reasons, Google Pay only displays the last four digits of your card. The full number is not accessible within the app or website interface due to tokenization protocols.

Why won’t my bank show me the full card number online?

Some financial institutions restrict full card visibility as part of their fraud prevention policy. In such cases, you may need to call customer support or visit a branch with valid ID to retrieve the information securely.

Is it safe to enter my Google Pay-linked card number on websites?

Yes, but only if the site is legitimate and encrypted (look for HTTPS and a padlock icon). Never enter your card details on untrusted or public networks. Remember, using the physical card or bank-provided number is independent of Google Pay’s tokenized system.

Best Practices for Ongoing Card Security

Managing your payment information goes beyond accessing numbers—it involves proactive habits that reduce exposure:

- Limit device access: Use strong passcodes, fingerprint locks, or facial recognition on devices with Google Pay installed.

- Update software regularly: Ensure your phone’s OS and Google Pay app are up to date to benefit from the latest security patches.

- Review permissions: Check which apps have access to your Google account and revoke unnecessary ones.

- Set up alerts: Enable transaction notifications from both your bank and Google Pay to catch suspicious activity early.

- Use virtual cards when possible: Some banks offer disposable virtual card numbers for one-time purchases, adding another layer of separation from your primary account.

Conclusion: Stay Informed, Stay Secure

Accessing your full card number from Google Pay isn’t about bypassing security—it’s about knowing the right channels and procedures to retrieve critical information safely. By relying on your bank’s secure systems, understanding Google Pay’s protective design, and practicing vigilant digital hygiene, you maintain control without exposing yourself to unnecessary risk.

Your financial safety depends not just on technology, but on how you interact with it. Take the time today to review your saved cards, update your authentication methods, and familiarize yourself with your bank’s digital tools. A few minutes now could prevent hours of stress later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?