Deactivating your Coinbase account may be necessary for various reasons—whether you're switching platforms, consolidating wallets, or simply no longer using the service. However, closing a cryptocurrency exchange account isn’t as simple as deleting an app. Done incorrectly, it can expose you to financial loss, security risks, or unintended tax consequences. This guide walks you through every critical step to ensure your Coinbase account is deactivated securely, completely, and without compromising your digital assets or personal information.

Why Secure Deactivation Matters

Cryptocurrency accounts are gateways to valuable digital assets. Unlike traditional bank accounts, most crypto exchanges—including Coinbase—do not offer chargebacks or reversals. Once funds are lost due to negligence or missteps during deactivation, recovery is often impossible.

Securely deactivating your Coinbase account means more than just requesting closure. It involves transferring all assets, revoking third-party access, removing payment methods, and ensuring no residual data remains vulnerable. Skipping even one of these steps could leave you exposed to phishing attempts, unauthorized trading, or identity misuse.

“Closing a crypto account requires the same diligence as securing physical assets. The digital nature doesn’t reduce risk—it amplifies it.” — Sarah Lin, Cybersecurity Analyst at ChainShield Labs

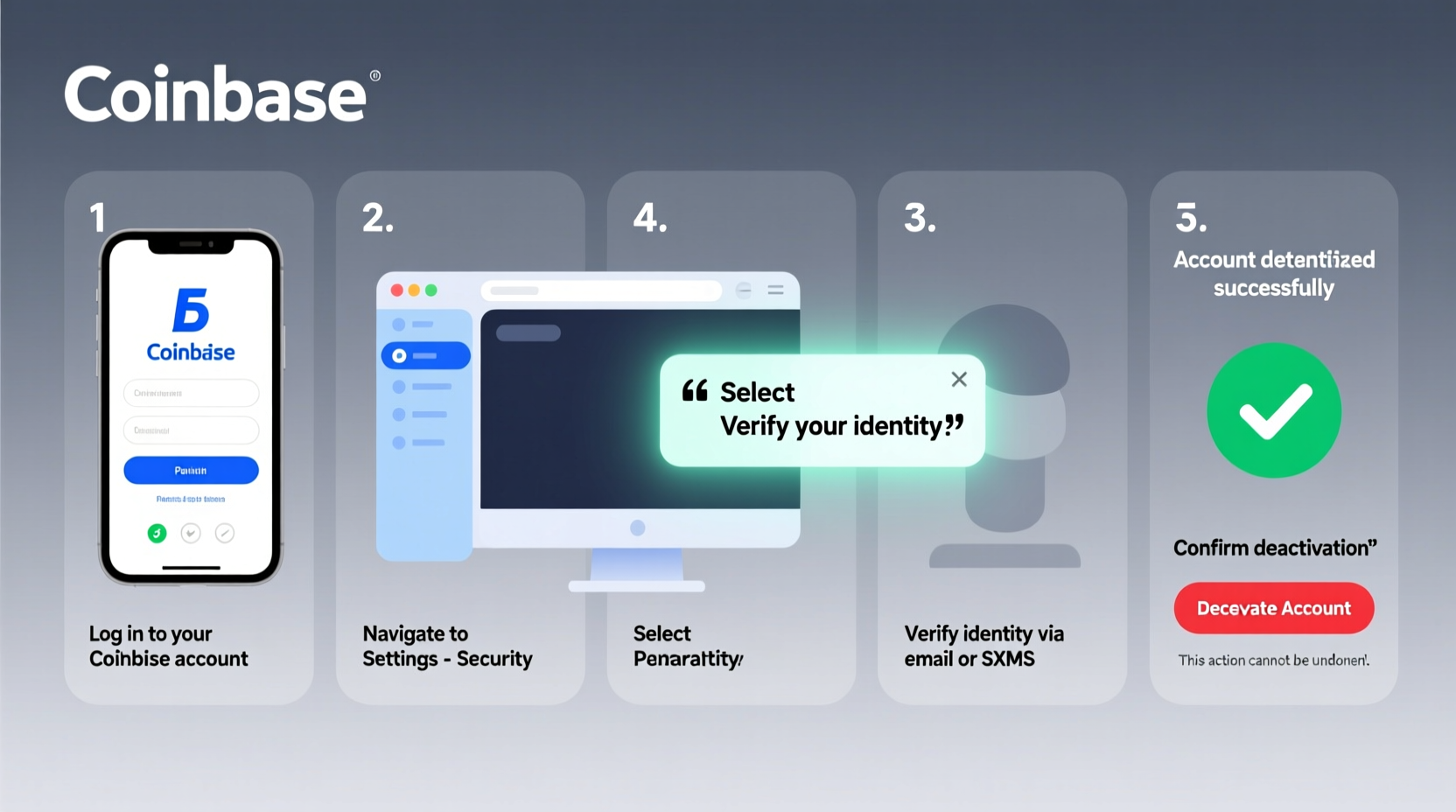

Step-by-Step Guide to Deactivating Your Coinbase Account

Follow this structured process to deactivate your Coinbase account without leaving loose ends. Each step is designed to protect your funds and privacy.

- Back up your transaction history and tax records

Before making any changes, export your complete transaction history. Coinbase allows you to download CSV files of trades, deposits, withdrawals, and fees. This data is essential for tax reporting and future audits. - Transfer all cryptocurrency holdings

Move every asset from your Coinbase wallet to a secure non-custodial wallet (e.g., Ledger, Trezor, or a trusted software wallet). Double-check addresses and test with a small amount first. Never leave funds in an account you plan to close. - Sell or transfer fiat currency balance

Withdraw any remaining USD or other fiat balances to your linked bank account. Ensure the withdrawal completes successfully before proceeding. - Cancel recurring purchases and active subscriptions

Visit the “Recurring Buys” section and disable any automated purchases. These will continue unless manually turned off, potentially depositing funds into a soon-to-be-closed account. - Remove linked payment methods

Delete bank accounts, debit cards, and PayPal links under the “Payment Methods” tab. This prevents accidental use and reduces exposure if your credentials are ever compromised. - Revoke API and third-party access

If you’ve connected external services (like tax tools or portfolio trackers), go to Settings > Applications and remove authorized apps. Leaving API keys active can allow continued access even after account closure. - Log out of all devices

Navigate to Settings > Security and review active sessions. Log out of any unfamiliar or unused devices to cut remote access points. - Submit account deactivation request

Contact Coinbase Support via the Help Center and request permanent account closure. Note: Coinbase does not allow self-service deactivation—this must be done through customer support. - Confirm deactivation via email

Coinbase will send a confirmation email. Respond promptly to verify your intent. Failure to respond may delay or cancel the request. - Wait for final confirmation

Processing typically takes 3–7 business days. You’ll receive a final email confirming the account has been deactivated.

Do’s and Don’ts When Closing Your Coinbase Account

| Do’s | Don’ts |

|---|---|

| ✅ Export full transaction history | ❌ Assume your account closes automatically after fund withdrawal |

| ✅ Use hardware wallets for fund transfers | ❌ Share recovery phrases during the process |

| ✅ Disable two-factor authentication only after closure | ❌ Leave recurring buys active |

| ✅ Revoke third-party app permissions | ❌ Request closure before withdrawing all assets |

| ✅ Keep a copy of closure confirmation | ❌ Ignore follow-up emails from Coinbase |

Real Example: A Cautionary Case

Jamal, a long-time Coinbase user, decided to switch to a decentralized platform. He withdrew his Bitcoin and Ethereum to his Ledger but overlooked his stablecoin balance (USDC) and a small amount of ADA. After contacting support to close his account, he assumed everything was resolved. Two months later, he received a tax form from Coinbase reporting capital gains on trades he didn’t remember making.

Upon investigation, he discovered that Coinbase had reactivated his account temporarily due to the remaining USDC triggering a compliance alert. During that window, automated market movements were recorded as taxable events. Jamal spent hours reconciling discrepancies with his accountant—all preventable if he had fully cleared his balance and confirmed closure status.

This case underscores the importance of completeness and verification when deactivating any financial account, especially in the crypto space where automation and compliance systems operate continuously.

Essential Checklist Before Closure

- ☑ All cryptocurrencies transferred to secure external wallet

- ☑ Fiat balances fully withdrawn to bank account

- ☑ Recurring buys canceled

- ☑ Payment methods removed

- ☑ Third-party apps and API access revoked

- ☑ Transaction history exported and saved

- ☑ Active sessions logged out

- ☑ Deactivation request submitted via Coinbase Support

- ☑ Final confirmation email received and archived

Frequently Asked Questions

Can I reopen my Coinbase account after deactivation?

No. Once your account is deactivated, it cannot be restored. You would need to create a new account, undergo KYC verification again, and rebuild your transaction history. Consider freezing or limiting access instead if you’re unsure about permanent closure.

Will Coinbase delete my personal data after deactivation?

Coinbase retains certain data for legal, regulatory, and compliance purposes, such as transaction records and identity verification documents. While you won’t have access, some information may be stored per U.S. financial regulations. Review their Privacy Policy for details on data retention timelines.

What happens to my verified ID and documents after closure?

Your uploaded documents (ID, passport, etc.) remain in Coinbase’s secure systems for compliance but are no longer accessible to you. They are not shared externally, but they are not immediately deleted. This is standard practice across regulated financial institutions.

Final Steps and Ongoing Vigilance

Deactivating your Coinbase account is not a one-click task—it’s a security process. Treat it like closing a bank vault: every mechanism must be checked, every key accounted for. Even after receiving confirmation, remain vigilant. Watch for phishing emails impersonating Coinbase support, and never reuse passwords associated with the account.

If you plan to stay active in crypto, consider using self-custody wallets and decentralized exchanges to maintain greater control over your assets. Centralized platforms offer convenience, but with that comes dependency on third-party policies and procedures.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?