Losing your Social Security number (SSN) or suspecting it has been compromised is one of the most serious threats to your personal and financial security. Unlike a lost wallet or misplaced credit card, your SSN cannot be replaced—and once exposed, it can be used for identity theft, fraudulent loans, tax fraud, or unauthorized medical services. The good news: swift, informed action can significantly reduce the damage. This guide walks you through every critical step to report, secure, and protect yourself after losing your SSN.

Why Your SSN Is So Valuable to Criminals

Your Social Security number is more than just a government identifier—it's the key to accessing your financial history, employment records, healthcare benefits, and legal identity. Fraudsters use stolen SSNs to:

- Open new credit accounts in your name

- File false tax returns to claim refunds

- Obtain medical care using your insurance

- Secure employment under your identity

- Apply for government benefits

According to the Federal Trade Commission (FTC), identity theft reports involving SSN misuse increased by over 45% between 2020 and 2023. Once criminals have your number, they can operate undetected for months—making early intervention essential.

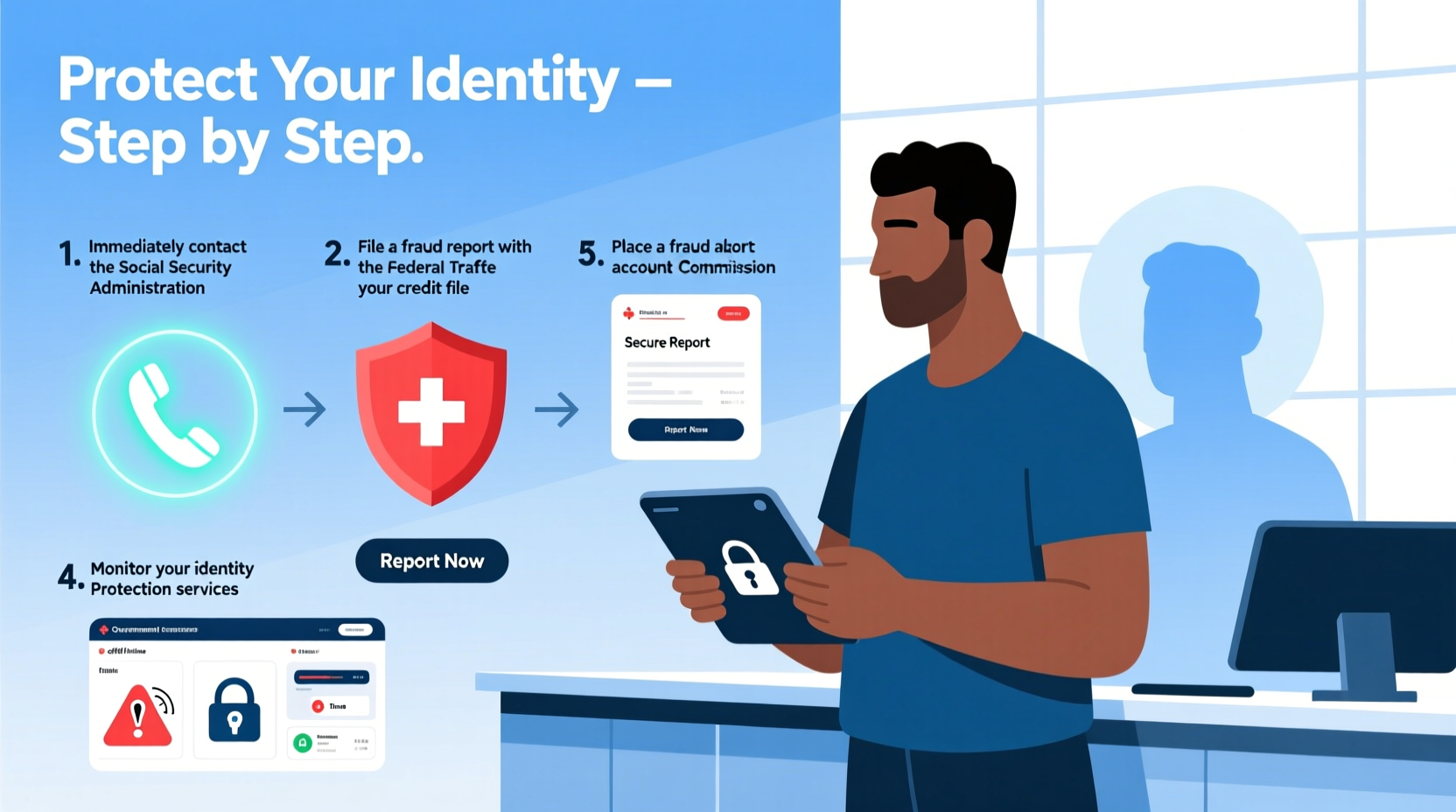

Step-by-Step: What to Do Immediately After Losing Your SSN

- Determine How It Was Lost

Was your wallet stolen? Did you accidentally share it online? Knowing how the exposure occurred helps assess risk and informs reporting steps. - Place a Fraud Alert on Your Credit Reports

Contact one of the three major credit bureaus—Equifax, Experian, or TransUnion—to request a one-year fraud alert. By law, that bureau must notify the other two.

- Equifax: 1-800-525-6285 | equifax.com

- Experian: 1-888-397-3742 | experian.com

- TransUnion: 1-800-680-7289 | transunion.com

- Review All Credit Reports

Visit AnnualCreditReport.com—the only federally authorized site—to get free weekly reports from all three bureaus. Look for unfamiliar accounts, inquiries, or addresses. - Freeze Your Credit

A credit freeze prevents creditors from accessing your credit file, effectively blocking new account openings. Unlike a fraud alert, a freeze must be placed with each bureau individually. There is no cost. - Report to the Federal Trade Commission (FTC)

File an official identity theft report at identitytheft.gov. This generates a recovery plan and provides legal documentation useful when disputing fraudulent charges. - Contact the Social Security Administration (SSA)

If you believe your SSN has been misused for employment or tax purposes, call the SSA at 1-800-772-1213. While they typically don’t issue new numbers unless under extreme circumstances, they can flag suspicious activity.

Protecting Yourself Long-Term: Ongoing Vigilance

Reporting the loss is just the beginning. Lasting protection requires consistent monitoring and proactive habits.

Monitor Financial Accounts Regularly

Check bank, credit card, and investment statements weekly. Set up transaction alerts for any unusual activity. Consider using a financial aggregation tool like Mint or Credit Karma to centralize monitoring.

Enroll in Identity Theft Protection Services

Services such as IdentityForce, LifeLock, or Aura offer real-time monitoring of SSN usage across dark web networks, public records, and credit applications. Many include insurance coverage for recovery costs.

File Taxes Early

Criminals often use stolen SSNs to file fraudulent tax returns early in the season. Filing your return as soon as possible reduces this risk. If someone files first, the IRS will reject your return—triggering a lengthy verification process.

“Time is the enemy in identity theft cases. The longer a stolen SSN goes unreported, the deeper the fraud can embed.” — Sarah Lin, Senior Investigator, Identity Theft Resource Center

Do’s and Don’ts When Handling a Lost SSN

| Do’s | Don’ts |

|---|---|

| ✔ Report to the FTC immediately | ✘ Ignore suspicious emails claiming to “verify” your SSN |

| ✔ Freeze your credit files | ✘ Share your SSN over the phone unless you initiated the call |

| ✔ Use strong, unique passwords for financial accounts | ✘ Respond to unsolicited requests for personal information |

| ✔ Shred documents containing your SSN | ✘ Carry your SSN card routinely |

| ✔ Check your credit reports quarterly | ✘ Assume one fraud alert is enough long-term |

Real-World Example: A Recovered Identity Theft Case

In 2022, Maria R., a teacher from Phoenix, discovered her SSN had been used to open three credit cards and obtain a car loan. She noticed the breach only after receiving a collection notice for a $28,000 debt she didn’t owe. Maria acted quickly: she filed a report with the FTC, froze her credit, and contacted all three bureaus. With the FTC affidavit in hand, she disputed each fraudulent account. Within six weeks, all fraudulent lines were removed, and her credit score rebounded. Her key insight: “I wasted two weeks thinking it was a mistake. I should’ve acted the day I saw the letter.”

When You Might Qualify for a New SSN

The Social Security Administration rarely issues new numbers. However, you may qualify if:

- You’re a victim of persistent identity theft that remains unresolved despite efforts.

- You’re in a domestic violence situation where the abuser has access to your SSN.

- You can prove ongoing harm due to misuse (e.g., repeated denials of employment or credit).

To apply, visit a local SSA office with evidence such as police reports, FTC affidavits, and denial letters. Approval is not guaranteed and requires thorough documentation.

Frequently Asked Questions

Can someone steal my identity with just my SSN?

While a SSN alone isn’t always enough, it’s often the missing piece criminals need. Combined with your name, date of birth, or address—information commonly found online—a thief can impersonate you effectively. Always limit who has access to your SSN.

Will freezing my credit affect my credit score?

No. A credit freeze does not impact your credit score. It only restricts access to your credit file. You can lift the freeze temporarily when applying for loans or credit.

How long does a fraud alert last?

An initial fraud alert lasts one year. If you’ve been a confirmed victim of identity theft, you can place an extended fraud alert that lasts seven years. Both are free.

Final Checklist: Immediate Actions to Take

- ✅ Place a fraud alert with one credit bureau

- ✅ Review credit reports from all three agencies

- ✅ Freeze your credit files

- ✅ File a report at identitytheft.gov

- ✅ Contact banks and credit card issuers to alert them

- ✅ Notify the Social Security Administration if misuse is suspected

- ✅ Monitor accounts and set up alerts

Take Control Before Damage Spreads

Losing your Social Security number doesn’t have to mean losing control of your life. The steps you take in the first 72 hours can determine whether a minor incident becomes a years-long battle. By acting decisively—freezing credit, reporting to authorities, and maintaining vigilance—you reclaim power over your identity. Protecting your SSN isn’t just about damage control; it’s about building a resilient defense for the future. Start today. Your financial and personal well-being depends on it.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?