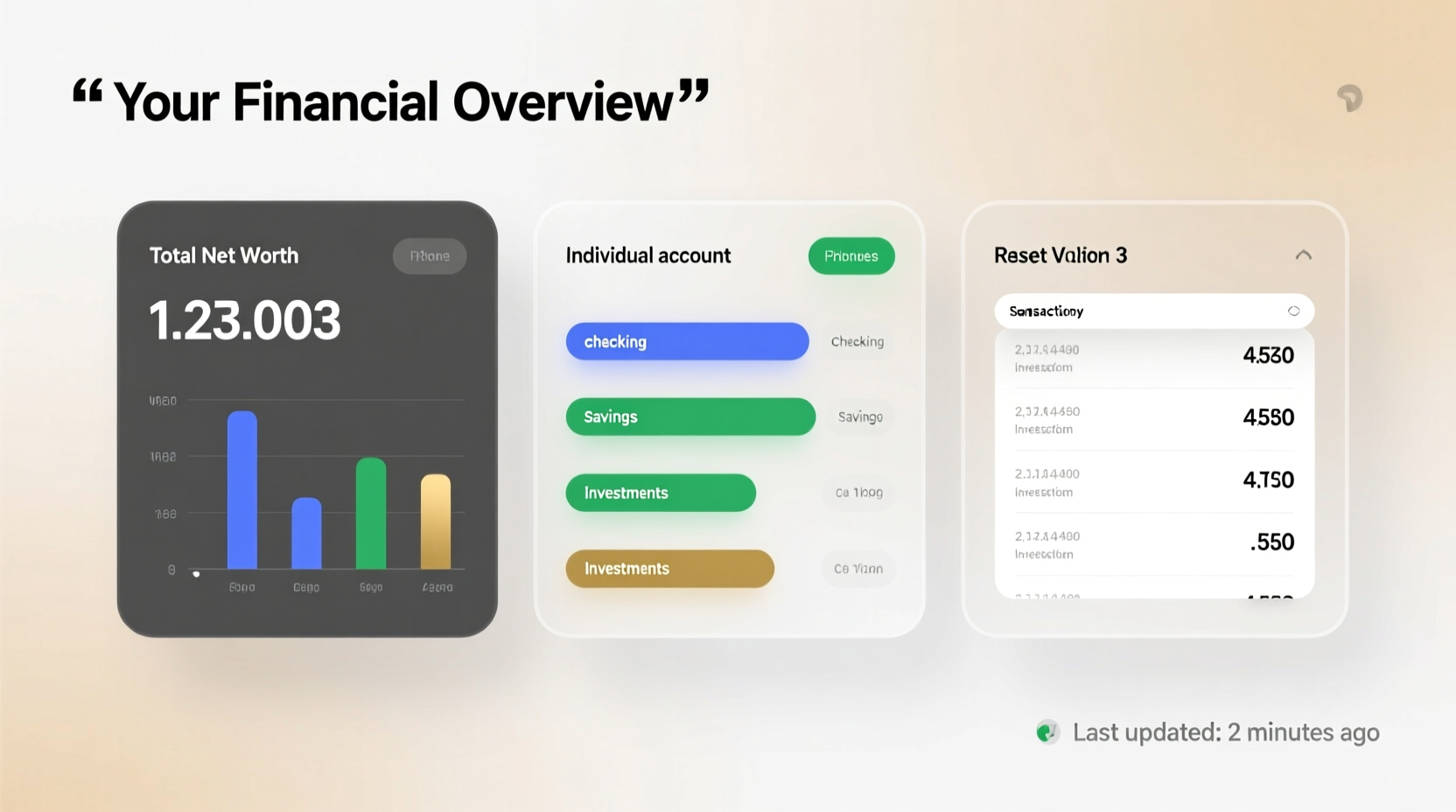

Knowing exactly how much you have—whether in your bank accounts, investments, retirement funds, or personal assets—is the foundation of sound financial management. Yet many people operate without a clear picture of their total net worth, relying instead on estimates or outdated information. The good news is that checking your balances and valuing your assets has never been easier. With digital tools, secure portals, and smart strategies, you can get an accurate snapshot of your financial standing in minutes.

Why Knowing Your Balances Matters

Financial clarity starts with visibility. When you know how much money you have across all accounts and what your assets are worth, you’re better equipped to make informed decisions about spending, saving, investing, and planning for major life events. Without this awareness, it’s easy to overspend, miss growth opportunities, or feel anxious about your financial future.

A 2023 study by the National Financial Educators Council found that individuals who regularly monitor their finances report 34% higher financial confidence than those who don’t. Moreover, tracking your balances helps detect fraud early, ensures bill payments don’t overdraw accounts, and supports smarter budgeting.

“Transparency breeds control. If you don’t know where your money is, you can’t manage it effectively.” — Lisa Chen, Certified Financial Planner

Step-by-Step Guide to Check Your Financial Balances

Follow this straightforward process to gather up-to-date information on your financial position. These steps work whether you're assessing your situation for budgeting, loan applications, or long-term planning.

- Gather your account information: List all banks, credit unions, investment platforms, retirement accounts (401(k), IRA), and any other financial institutions where you hold funds. <

- Log in to each online portal: Use secure internet connections and trusted devices to access your accounts. Enable two-factor authentication if not already active.

- Record current balances: Note down the available balance for each checking, savings, and money market account. For investment accounts, record the current market value.

- Check recent transactions: Verify no unauthorized activity and confirm pending deposits or withdrawals are accounted for.

- Update monthly: Schedule a recurring time—such as the first day of each month—to review and refresh your numbers.

How to Value Personal Assets Beyond Bank Accounts

Your total financial picture includes more than just cash in the bank. Personal assets like real estate, vehicles, jewelry, and collectibles contribute to your net worth. While these values fluctuate, estimating them gives a fuller understanding of your wealth.

- Real Estate: Use online valuation tools like Zillow’s Zestimate or Redfin Estimate. For accuracy, consider a recent appraisal or comparable local sales.

- Vehicles: Consult Kelley Blue Book (KBB) or Edmunds. Input your car’s year, make, model, mileage, and condition for a realistic trade-in or private sale value.

- Jewelry & Collectibles: Obtain professional appraisals for high-value items. For general estimates, research recent auction or resale prices on trusted platforms.

- Retirement Accounts: Log into your provider’s website (e.g., Fidelity, Vanguard) to view current balances and performance history.

| Asset Type | Valuation Method | Recommended Frequency |

|---|---|---|

| Checking/Savings | Online banking portal | Weekly or daily |

| Investment Accounts | Brokerage dashboard | Monthly |

| Home Equity | Zillow, Redfin, or appraisal | Annually or after major renovations |

| Vehicle | Kelley Blue Book (KBB) | Every 6 months or before selling |

| Retirement Funds | Provider login (Fidelity, etc.) | Quarterly |

Mini Case Study: Sarah Gains Control of Her Finances

Sarah, a 35-year-old graphic designer, felt overwhelmed by her finances. She had three different banks, a 401(k), and an old Roth IRA she hadn’t checked in years. After reading about net worth tracking, she decided to take action.

Over one weekend, she logged into each account, recorded her balances, and used KBB to estimate her car’s value. She discovered $2,300 in a dormant savings account and realized her retirement portfolio had grown significantly due to market gains. By consolidating her data into a simple spreadsheet, Sarah updated her budget, increased her emergency fund contribution, and felt a renewed sense of control.

Within three months, she refinanced her car loan using her improved credit score—something she only noticed because she was now monitoring her finances closely.

Common Mistakes to Avoid When Checking Balances

Even with easy access to digital tools, people often make errors that distort their financial picture. Being aware of these pitfalls can help you maintain accuracy.

- Mixing up current vs. available balance: Pending transactions can create discrepancies. Always check the “available” balance for what you can actually spend.

- Ignoring liabilities: Net worth is assets minus debts. Don’t forget to subtract credit card balances, loans, and mortgages.

- Relying solely on apps: Aggregator apps like Mint or YNAB are helpful but may sync late or miss accounts. Double-check directly with institutions.

- Not updating regularly: Values change daily. A one-time check isn’t enough for ongoing financial health.

- Overvaluing personal items: Sentimental value doesn’t equal market value. Be objective when estimating non-financial assets.

Checklist: How to Audit Your Financial Position

Use this checklist to conduct a thorough financial balance check:

- ☐ List all bank accounts (checking, savings, CDs)

- ☐ Log in and record current available balances

- ☐ Review investment accounts and note market value

- ☐ Access retirement accounts (401(k), IRA, pension)

- ☐ Estimate home value using online tools or appraisal

- ☐ Check vehicle value via KBB or Edmunds

- ☐ Appraise valuable personal property (jewelry, art)

- ☐ Subtract outstanding debts (credit cards, loans)

- ☐ Update net worth spreadsheet or tracker

- ☐ Schedule next review date

Frequently Asked Questions

How often should I check my account balances?

For checking and savings, weekly checks are ideal to catch fraud and manage cash flow. Investment and retirement accounts should be reviewed at least monthly. Asset valuations like homes and cars can be updated annually or semi-annually unless you're preparing for a major transaction.

Are financial aggregator apps safe to use?

Most reputable apps (like Mint, Personal Capital, or Empower) use bank-level encryption and read-only access. However, some experts recommend logging in directly to financial institutions for the most accurate and secure data. If you use aggregators, enable multi-factor authentication and avoid public Wi-Fi when accessing them.

What if my balance seems off?

If a balance appears incorrect, first check for pending transactions, holds, or automatic payments. If discrepancies persist, contact your financial institution immediately. Most banks have fraud resolution departments that can investigate and correct errors within a few business days.

Take Charge of Your Financial Picture Today

Understanding how much you have isn’t reserved for accountants or finance professionals—it’s a basic right and responsibility for every individual. With just a few minutes each week, you can stay informed, avoid surprises, and build a clearer path toward your goals. Whether you're saving for a home, planning retirement, or simply seeking peace of mind, knowing your balances and values puts you in control.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?