If you're struggling to make your federal student loan payments, Aidvantage—formerly known as FedLoan Servicing—offers forbearance as a temporary relief option. Forbearance allows you to pause or reduce your monthly payments for up to 12 months at a time. However, interest continues to accrue during this period, so it's not a long-term solution. Knowing how to properly request and extend your forbearance can help you avoid missed payments, late fees, and potential default. This guide walks you through the entire process with clarity and precision.

Understanding Aidvantage Forbearance

Aidvantage is one of the U.S. Department of Education’s federal student loan servicers. If you have Direct Loans, FFEL Program loans, or Perkins Loans managed by Aidvantage, you may qualify for forbearance if you're experiencing financial hardship, medical expenses, job loss, or other qualifying circumstances.

There are two main types of forbearance available:

- General Forbearance: Granted at the servicer’s discretion due to financial difficulties, medical expenses, or changes in employment.

- Mandatory Forbearance: Required by law if you meet specific criteria, such as serving in a medical or dental internship/residency or being enrolled in a qualifying repayment plan.

Each forbearance period typically lasts up to 12 months, but you can apply for extensions if you still face hardship. Total general forbearance is limited to 36 months over the life of the loan.

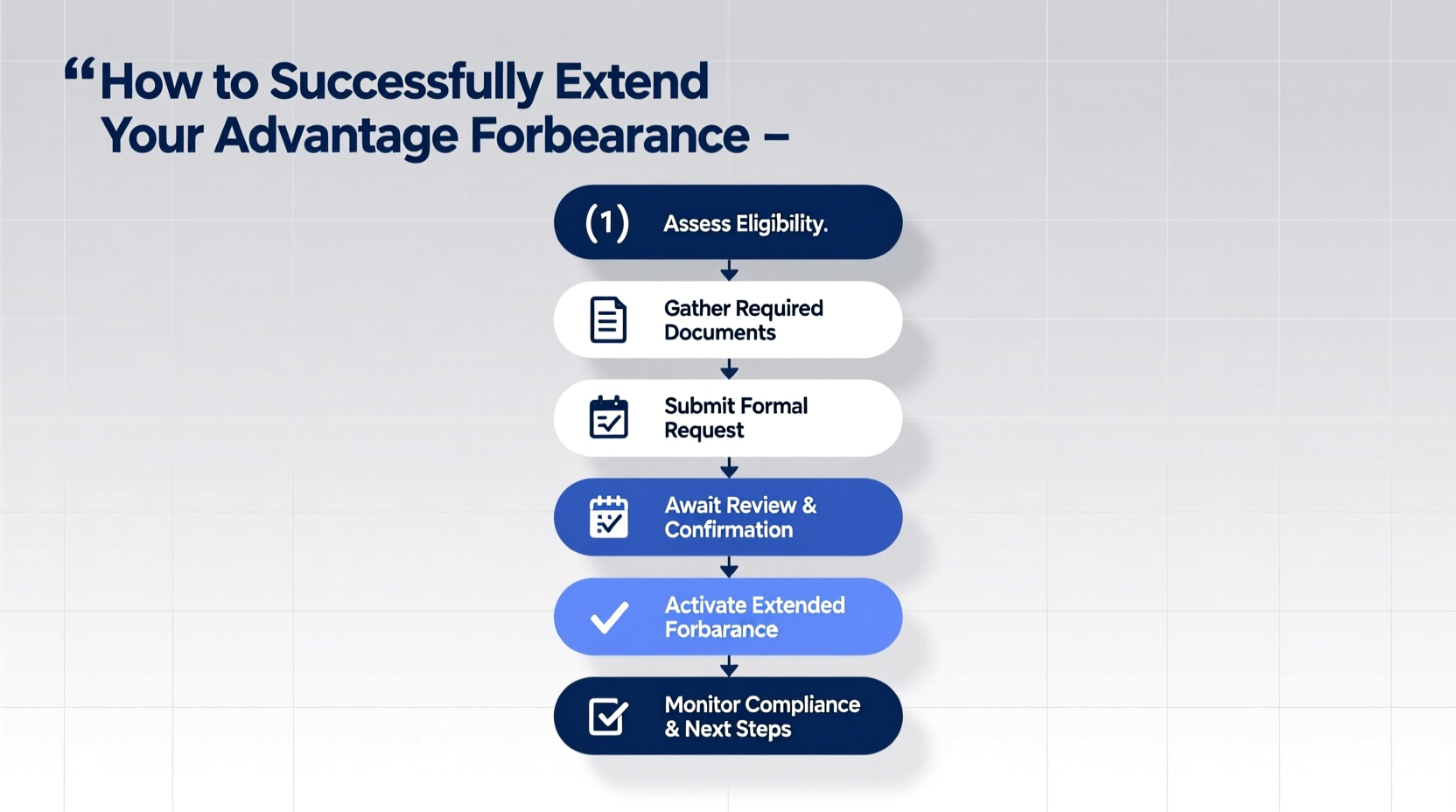

Step-by-Step Guide to Extend Your Aidvantage Forbearance

Extending your forbearance isn’t automatic—you must reapply before your current period ends. Follow these steps carefully to ensure approval and continuity of relief.

- Check Your Current Forbearance Status

Log in to your Aidvantage account at aidvantage.com. Navigate to the “Account Summary” section to confirm when your current forbearance expires. This helps you time your extension request appropriately—ideally 15–30 days before expiration. - Determine Your Eligibility

Review whether your financial situation still qualifies for forbearance. Common reasons include:- Unemployment or reduced income

- High medical or dental expenses

- Participation in an approved internship or residency

- Inability to make payments under your current plan

- Gather Supporting Documentation

While not always required, having documentation strengthens your case. Examples include:- Recent pay stubs showing reduced income

- Medical bills or treatment plans

- Proof of unemployment (e.g., termination letter)

- Enrollment verification from a training program

- Submit a New Forbearance Request

You can apply online or via mail:- Online: Go to the “Relief Options” tab in your Aidvantage portal, select “Request Forbearance,” choose the type, and complete the form.

- By Mail: Download Form SL-50 from the Aidvantage website, fill it out, attach supporting documents, and send it to:

Aidvantage

P.O. Box 9655

Wilkes-Barre, PA 18773-9655

- Follow Up and Confirm Approval

After submitting, check your account every 5–7 business days. Aidvantage will notify you via email or mail once a decision is made. If approved, your new forbearance period begins immediately after the previous one ends, ensuring no gap in protection.

Forbearance Do’s and Don’ts

| Do’s | Don’ts |

|---|---|

| Apply early—before your current forbearance ends | Wait until the last minute to apply |

| Keep records of all submissions and communications | Assume your request is approved without confirmation |

| Review your interest accrual monthly | Ignore accumulating interest that capitalizes later |

| Explore income-driven repayment (IDR) plans as an alternative | Rely solely on forbearance for years without planning |

| Contact customer service if you’re denied | Miss payments if your extension is rejected |

Real Example: How Maria Extended Her Forbearance Successfully

Maria, a teacher in Ohio, lost her part-time tutoring job during the summer, making her federal loan payment a burden. She had been on a 12-month general forbearance through Aidvantage but needed more time. Three weeks before her forbearance expired, she logged into her Aidvantage account, submitted a new general forbearance request, and uploaded her termination letter and bank statements showing lower income.

Within 10 days, she received an email confirming her extension for another 12 months. During this time, she applied for an Income-Contingent Repayment (ICR) plan, which lowered her monthly payment significantly. When her forbearance ended, she transitioned smoothly into the new plan—without missing a single payment.

Maria’s proactive approach prevented delinquency and gave her breathing room to find a sustainable solution.

Expert Insight on Forbearance Management

“While forbearance can provide immediate relief, borrowers often underestimate how quickly interest accumulates. I recommend using the pause to explore long-term solutions like income-driven repayment or Public Service Loan Forgiveness.” — James Reed, Student Loan Counselor and Financial Wellness Advocate

Key Tips for Managing Forbearance Effectively

Frequently Asked Questions

Can I extend my Aidvantage forbearance more than once?

Yes, you can extend your forbearance multiple times, as long as you don’t exceed the lifetime limit of 36 months for general forbearance. Each request is reviewed individually based on your current circumstances.

What happens if my forbearance extension is denied?

If denied, your regular payment schedule resumes. You can appeal the decision or immediately apply for an income-driven repayment plan to lower your monthly obligation. Contact Aidvantage customer service at 1-800-724-0028 to discuss alternatives.

Does forbearance affect my credit score?

No, forbearance itself does not hurt your credit. In fact, it can protect your score by preventing late payments. However, the growing loan balance due to accrued interest may impact your debt-to-income ratio, which lenders consider during credit evaluations.

Action Checklist: Extending Your Aidvantage Forbearance

- ✅ Log in to your Aidvantage account and check your forbearance end date

- ✅ Assess whether you still qualify for financial hardship relief

- ✅ Gather documentation (pay stubs, medical bills, etc.)

- ✅ Submit a new forbearance request online or by mail

- ✅ Track your application status weekly

- ✅ Confirm approval and review the new end date

- ✅ Plan your next steps—consider switching to an IDR plan before the next expiration

Final Thoughts and Next Steps

Successfully extending your Aidvantage forbearance requires timely action, proper documentation, and awareness of your long-term repayment goals. While it offers valuable short-term relief, it's essential to use this window wisely. Interest doesn't stop during forbearance, so the longer you delay active repayment, the more your total debt can grow.

Your ultimate goal should be transitioning to a sustainable repayment plan—whether that’s an income-driven option, consolidation, or refinancing. For those in public service, this could also be a chance to advance progress toward Public Service Loan Forgiveness.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?