Falling behind on auto loan payments is stressful, but in some cases, voluntarily surrendering your vehicle may be the most responsible financial decision. Unlike involuntary repossession, where a lender takes your car without notice—often damaging your credit more severely—voluntary surrender allows you to maintain some control over the process. This guide walks you through each step of the process, explains the financial implications, and offers practical alternatives and recovery strategies.

Understanding Voluntary Repossession

Voluntary repossession, or voluntary surrender, occurs when you return your financed vehicle to the lender because you can no longer afford the payments. While this does not erase your debt, it demonstrates cooperation and may reduce additional fees associated with forced repossession, such as towing and storage charges.

Lenders typically prefer voluntary returns because they lower their recovery costs. However, you remain liable for the difference between what you owe and what the car sells for at auction—a shortfall known as a deficiency balance.

“Voluntary surrender doesn’t eliminate your obligation, but it can prevent extra penalties and show creditors you’re acting in good faith.” — Rachel Nguyen, Consumer Credit Counselor at National Debt Relief

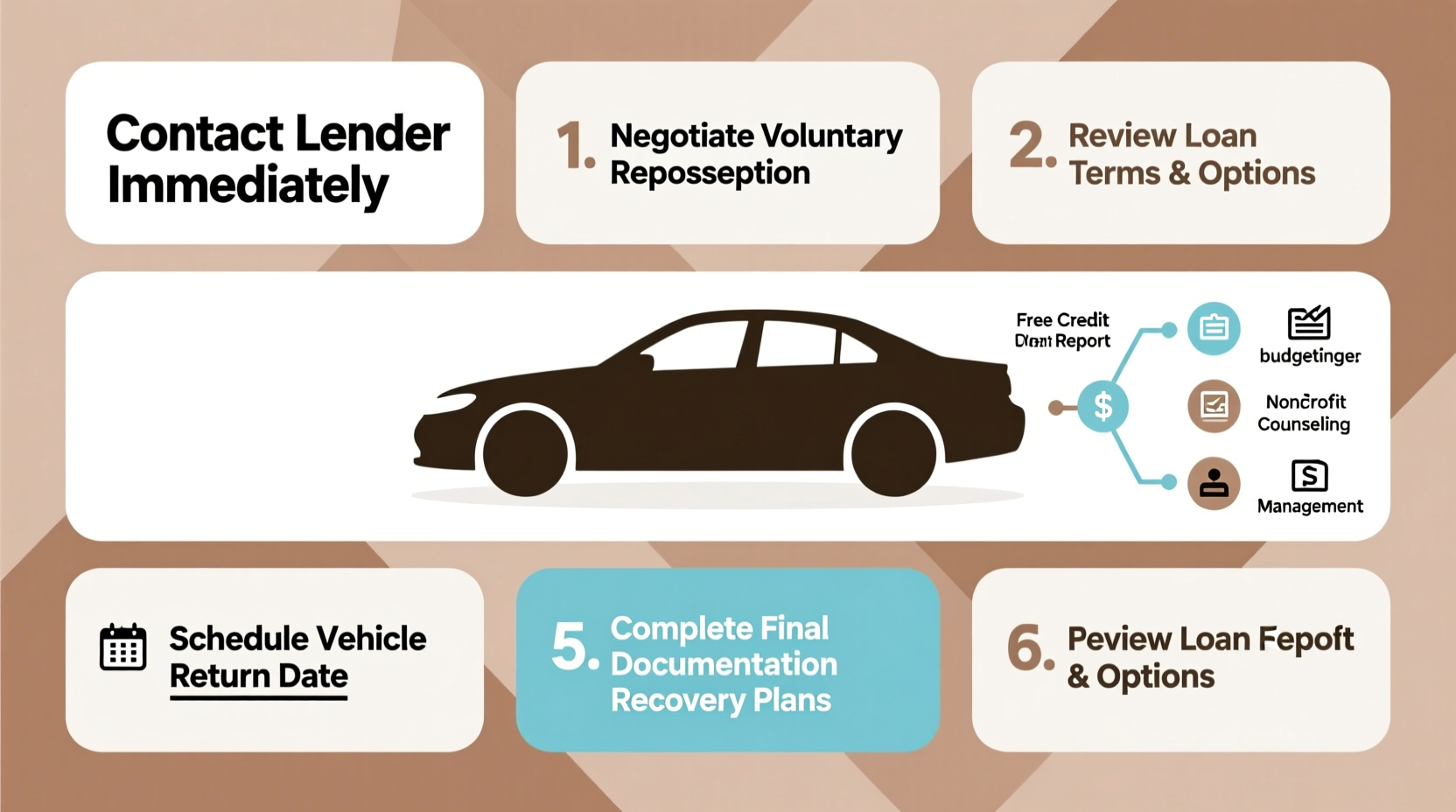

Step-by-Step Guide to Surrendering Your Car

Approaching this process methodically helps minimize stress and financial fallout. Follow these steps carefully:

- Assess Your Financial Situation: Review your income, expenses, and outstanding loan balance. Determine whether your hardship is temporary or long-term.

- Contact Your Lender Immediately: Call your loan servicer before missing any payments if possible. Explain your situation honestly and ask about voluntary surrender options.

- Request Written Terms: If the lender agrees, insist on receiving all terms in writing, including any waived fees, pickup arrangements, and details about the deficiency balance.

- Prepare the Vehicle: Remove all personal belongings, cancel insurance (after confirming pickup), and clean the car. Take photos to document its condition.

- Surrender the Vehicle: Deliver the car and keys to the designated location or allow scheduled pickup. Obtain a receipt confirming the surrender.

- Monitor Post-Surrender Communication: Watch for statements regarding the sale of the vehicle and any remaining balance due.

- Address the Deficiency Balance: Negotiate payment plans or settlements if you owe money after the sale.

Financial Implications and Credit Impact

Voluntary repossession will appear on your credit report and negatively affect your score, typically for up to seven years. However, it’s generally less damaging than a forced repossession because it shows proactive effort to resolve the debt.

The actual impact depends on several factors:

- Your current credit score

- Whether you settle the deficiency balance

- How quickly you rebuild credit afterward

Most lenders sell repossessed vehicles at auction, often for significantly less than retail value. If the sale price doesn’t cover your loan balance, you’re still responsible for the difference.

| Factor | Voluntary Repossession | Involuntary Repossession |

|---|---|---|

| Credit Score Impact | Severe (100+ point drop) | More severe (120+ point drop) |

| Towing/Storage Fees | Often waived or reduced | Added to your balance |

| Lender Cooperation | Higher likelihood | Minimal |

| Deficiency Balance | Possible, but negotiable | Common, with added fees |

Alternatives to Consider Before Surrender

Before deciding to surrender your car, explore other options that might preserve your credit and keep you mobile:

- Loan Modification: Ask your lender to extend the loan term or reduce interest rates to lower monthly payments.

- Repayment Plan: Propose catching up on missed payments over time.

- Refinance the Loan: If your credit has improved, refinancing could secure better terms.

- Sell the Car Privately: You may get more money selling it yourself than through auction, helping pay off the loan.

- Trade-In for a Cheaper Vehicle: Some dealerships accept negative equity, especially during promotions.

“I helped a client avoid repossession by negotiating a three-month payment freeze followed by a loan extension. It saved her credit and kept her employed.” — Marcus Bell, Financial Advisor at ClearPath Solutions

Mini Case Study: Sarah’s Path Through Voluntary Surrender

Sarah, a single mother from Ohio, lost her part-time job during a company restructuring. Her $450 monthly car payment became unsustainable. After two missed payments, she contacted her lender instead of waiting for repossession.

The lender agreed to a voluntary surrender and waived $350 in administrative fees. The car sold for $8,000 at auction, but she owed $10,500. She negotiated a $2,000 settlement on the $2,500 deficiency balance and paid it over six months.

While her credit score dropped from 680 to 570, she avoided wage garnishment and used the freed-up income to secure a new job and begin rebuilding her credit with a secured credit card.

Checklist: Preparing for Voluntary Surrender

- ✔️ Review your budget and confirm inability to continue payments

- ✔️ Contact lender to discuss voluntary surrender options

- ✔️ Request written confirmation of all agreed terms

- ✔️ Remove license plates, personal items, and GPS devices

- ✔️ Cancel auto insurance only after vehicle handover is complete

- ✔️ Document the car’s condition with dated photos

- ✔️ Obtain a signed surrender receipt from the lender

- ✔️ Monitor mail for post-sale statements and deficiency notices

- ✔️ Respond promptly to any balance due with negotiation or payment plan

Frequently Asked Questions

Will I still owe money after surrendering my car?

Yes, in most cases. If the car sells for less than your loan balance, you are responsible for the deficiency. For example, if you owe $12,000 and the car sells for $9,000, you may owe the remaining $3,000 plus fees unless settled otherwise.

Can I get my car back after voluntary surrender?

Possibly, but only if you act quickly. Some lenders allow redemption within a short window—usually 10 to 30 days—by paying the full outstanding balance plus fees. This option is costly and rarely feasible for those already struggling financially.

How bad is voluntary repossession for my credit?

It’s serious but not catastrophic. Expect a significant drop in your credit score, but because it’s marked as “voluntary,” future lenders may view it as a sign of responsibility compared to a surprise repossession. Recovery is possible within 1–2 years with disciplined credit rebuilding.

Rebuilding After Surrender: Next Steps

After surrendering your car, focus shifts to financial recovery. Start by creating a lean budget that prioritizes essentials. Consider using public transportation, ride-sharing, or carpooling temporarily.

To rebuild credit:

- Open a secured credit card with a low limit and pay it off monthly.

- Use credit-builder loans from credit unions.

- Check your credit report regularly for errors and dispute inaccuracies.

Within 6–12 months of consistent behavior, you can begin qualifying for subprime auto loans—though at higher interest rates. Aim to save for a reliable, affordable used car to avoid financing pitfalls again.

Conclusion

Voluntarily surrendering your car is never an easy choice, but it can be a strategic move to limit financial damage and regain control. By acting early, communicating with your lender, and understanding your obligations, you protect yourself from worse outcomes like lawsuits or wage garnishment. More importantly, it marks the beginning of a fresh start—not the end of your financial journey.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?