The W-2 form is one of the most critical documents for filing your annual federal and state income taxes. It details your earnings, tax withholdings, and benefits from the previous year. While employers are required to mail or deliver W-2s by January 31st, delays can happen due to postal issues, incorrect addresses, or administrative backlogs. If you haven’t received your W-2 by mid-February, it’s time to take action. Knowing how to track your W-2 mailing status and verify its delivery can prevent late filings and unnecessary penalties.

Why Timely W-2 Delivery Matters

Filing your taxes without a W-2 leads to errors and potential IRS audits. The IRS uses the information on your W-2 to cross-check your reported income. If discrepancies arise, you may face fines or delayed refunds. Even if you estimate your income using pay stubs, the IRS strongly advises waiting for the official form when possible. Missing the April 15 deadline because of an unreceived W-2 could result in failure-to-file penalties—typically 5% of unpaid taxes per month, up to 25%.

Employers submit copies of all W-2s to the Social Security Administration (SSA) by the same January 31 deadline. This means the data exists in government systems even before you receive the physical copy. Leveraging this fact gives you multiple ways to confirm whether your W-2 has been processed and mailed.

Step-by-Step: How to Confirm Your W-2 Is on the Way

- Contact Your Employer or Payroll Department

Start by reaching out directly. Most companies have HR or payroll teams that can confirm whether your W-2 was printed and mailed. Provide your full name, employee ID, and current address to help them locate your record quickly. - Verify Your Mailing Address

Ensure the employer has your correct address on file. A common reason for non-delivery is outdated contact information. If you moved recently, update your address immediately—even retroactively, some employers can reissue to the correct location. - Check for Digital Access

Many employers now offer electronic W-2s through online portals like ADP, Workday, or Paychex. Log into your employee account to see if a digital version is available. E-W-2s are legally valid and often accessible earlier than paper copies. - Request Tracking Information (If Available)

Some larger organizations use tracked mailing services for sensitive documents. Ask if your W-2 was sent via certified or USPS Trackable Mail. If so, they should be able to provide a tracking number. - Wait Five Business Days After Confirmation

Once your employer confirms mailing, allow 5–7 business days for standard U.S. Postal Service delivery. If it hasn’t arrived within that window, proceed to next steps.

What to Do If You Haven’t Received Your W-2

If your employer confirms the W-2 was mailed but you still haven’t received it by February 15, escalate appropriately. First, ask if they can resend it—preferably via traceable mail or email if e-delivery is authorized. If they refuse or cannot assist, you have backup options.

The IRS offers Form 4852, known as the “Substitute W-2,” which allows you to estimate your wages and withholding based on your last pay stub. While not ideal, it enables on-time filing. However, always make every effort to obtain the original before resorting to substitution.

When to Contact the IRS

You can involve the IRS only after taking reasonable steps with your employer. According to the IRS, you should wait until February 22 if no response has been received despite contacting your employer. At that point, call the IRS at 800-829-1040 and provide:

- Your full name, address, and Social Security number

- Employer’s name and address

- Dates of employment

- Amount of wages and federal income tax withheld (from final pay stub)

The IRS will then contact your employer on your behalf and may issue a substitute form if necessary.

“We encourage taxpayers to first reach out to their employers, but we’re here to help when companies fail to meet their obligations.” — IRS Spokesperson, 2023 Tax Season Report

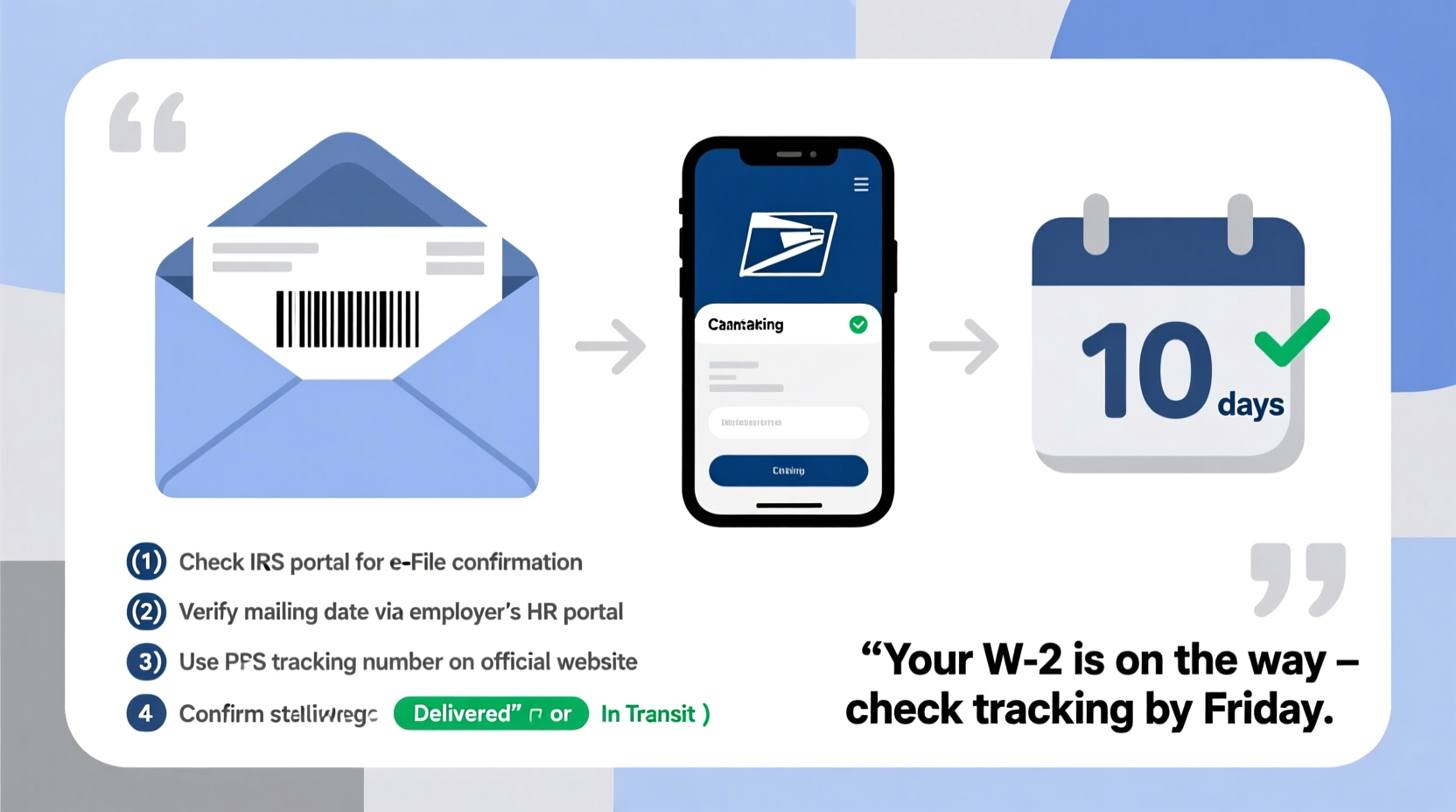

Checklist: Actions to Take When Tracking Your W-2

- ☑ Check your employer’s online payroll portal for e-W-2 availability

- ☑ Confirm your current mailing address is on file with HR

- ☑ Call payroll to verify the W-2 was issued and mailed

- ☑ Request tracking details if available

- ☑ Wait 5–7 business days for delivery

- ☑ Follow up with employer if not received by February 15

- ☑ Contact IRS after February 22 if unresolved

- ☑ Prepare to file Form 4852 as a last resort

Real Example: Sarah’s Late W-2 Recovery

Sarah, a marketing coordinator in Austin, TX, changed her address in December but forgot to update it with her employer. By February 10, she hadn’t received her W-2. She logged into her company’s ADP portal and discovered the form had been issued electronically—but she hadn’t enrolled in e-delivery. After contacting HR, they resent the W-2 both digitally and by mail to her new address. The digital copy arrived within hours, allowing her to file early and receive her refund by March 1.

Sarah’s experience highlights two key points: many W-2s are available electronically before paper versions arrive, and timely communication with payroll can resolve issues fast. Her oversight with the address change could have caused serious delays, but proactive follow-up saved the day.

Do’s and Don’ts of W-2 Tracking

| Do’s | Don’ts |

|---|---|

| Enroll in e-delivery if your employer offers it | Assume your W-2 will arrive without checking |

| Update your address with HR promptly after moving | Wait until April to address a missing W-2 |

| Keep your final pay stub as a backup | File estimated taxes without documentation |

| Contact the IRS only after exhausting employer options | Ignore digital access options in payroll portals |

Frequently Asked Questions

Can I file taxes without a W-2?

Yes, but only as a last resort. Use IRS Form 4852, the Substitute for Form W-2. Fill it out using your last pay stub, which should show total wages and taxes withheld. Accuracy is crucial—errors can trigger audits or delays. Note: Some tax software won’t accept returns with Form 4852, so consult a professional if needed.

Is an electronic W-2 valid for filing?

Absolutely. An e-W-2 downloaded from your employer’s secure portal is just as valid as a paper copy. Print it or save it digitally for your records. The IRS accepts electronically delivered W-2s as long as they come from an authorized source and contain all required information.

What if my employer refuses to send a W-2?

Employers who fail to provide W-2s by the deadline may face penalties from the IRS—up to $280 per form if filed late, with higher fines for intentional disregard. If your employer refuses to cooperate, report them to the IRS using Form 3949-A or by calling 800-829-1040. Include all relevant details about your employment and attempts to obtain the form.

Final Steps and Proactive Habits

Tracking your W-2 doesn’t have to be stressful. By staying informed and acting early, you maintain control over your tax timeline. Going forward, consider enrolling in e-delivery to eliminate mailing risks entirely. Set calendar reminders each January to check for W-2 availability, especially if you’ve changed jobs or moved.

Remember, the IRS receives your W-2 data regardless of whether you do. Taking initiative ensures you’re not left guessing when tax season arrives.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?