Tax season often brings stress, confusion, and last-minute surprises. But it doesn’t have to. With the right tools—like a reliable tax calculator—you can take control of your finances long before April 15. A tax calculator isn't just for accountants or tax pros; it's an essential resource for anyone who earns income, claims deductions, or wants to plan smarter throughout the year. This guide walks you through exactly how to use a tax calculator effectively, avoid common errors, and get a realistic picture of what you owe—or what you might get back.

Why Use a Tax Calculator?

Estimating your taxes manually is time-consuming and error-prone. Even small miscalculations can lead to underpayment penalties or missed refund opportunities. A tax calculator simplifies this process by automating complex formulas based on current IRS rules, tax brackets, and standard or itemized deductions.

More importantly, using a tax calculator helps with financial foresight. Whether you're self-employed, have multiple income streams, or are adjusting your W-4 after a life change, knowing your estimated liability early allows you to set aside funds, adjust withholdings, or make strategic moves before year-end.

“Taxpayers who estimate their liabilities quarterly are 68% less likely to face unexpected tax bills.” — National Association of Enrolled Agents (NAEA)

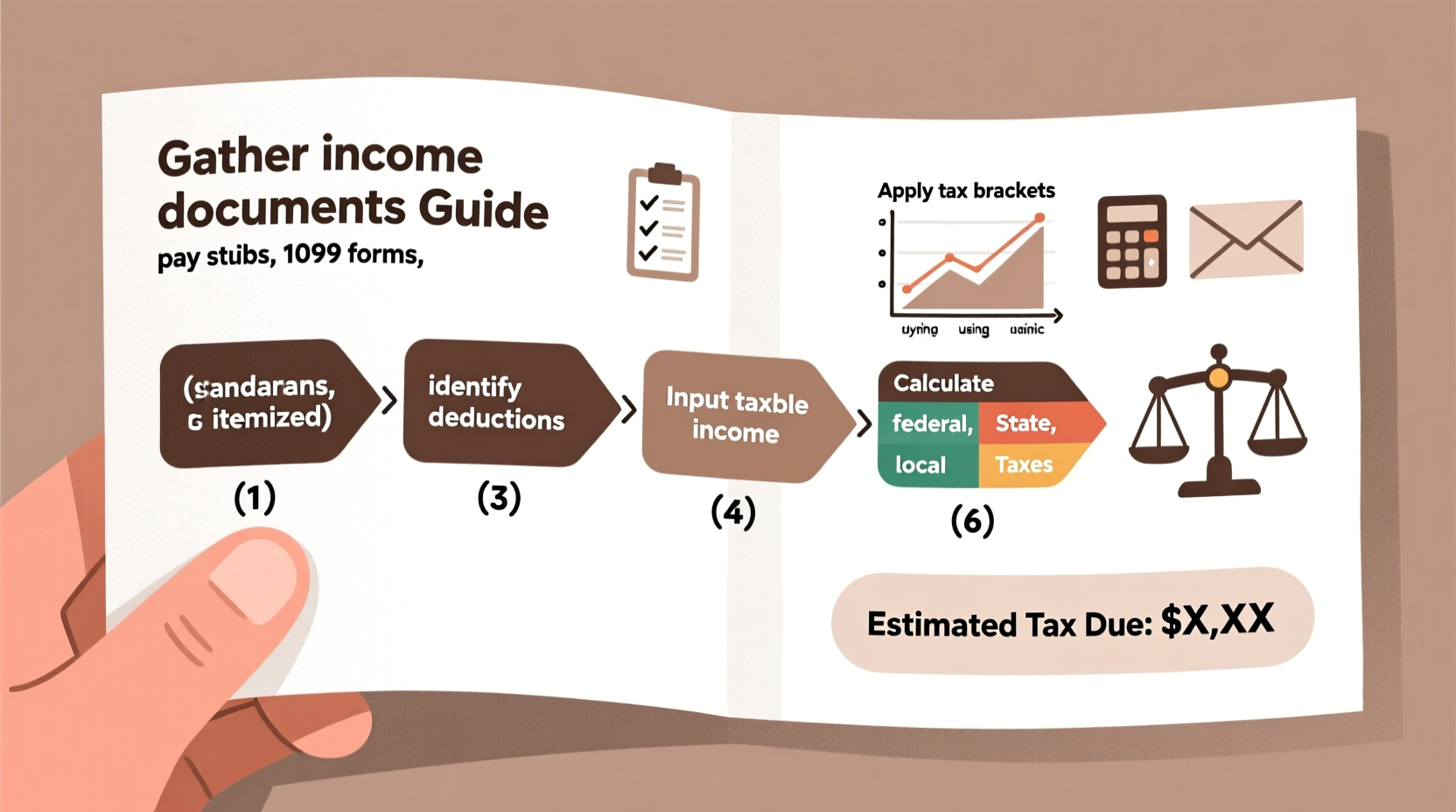

Step-by-Step Guide to Using a Tax Calculator

To get accurate results from any tax calculator, follow these steps in order. Skipping one could compromise your entire estimate.

- Gather Your Financial Information

Collect recent pay stubs, 1099s, investment statements, records of deductions (charitable contributions, medical expenses), and details about dependents. The more complete your data, the more precise your calculation will be. - Choose the Right Type of Tax Calculator

Not all calculators are equal. For most individuals, a federal income tax estimator that includes state options is sufficient. Self-employed workers should look for calculators that include self-employment tax (15.3%) and allow Schedule C inputs. - Select Your Filing Status

Your status—Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er)—directly affects your tax bracket and standard deduction. Choose carefully, as this impacts every other number. - Enter Total Income

Include wages, freelance earnings, interest, dividends, rental income, unemployment benefits, and taxable portions of retirement distributions. Be sure to enter gross amounts—not net after payroll deductions. - Input Deductions and Credits

Decide whether to take the standard deduction or itemize. Enter mortgage interest, charitable donations, medical expenses over 7.5% of AGI, and education credits like the American Opportunity Credit. Also include above-the-line deductions such as student loan interest or IRA contributions if applicable. - Review Estimated Tax Liability

Once all fields are filled, the calculator will display your estimated federal and state tax owed, average tax rate, marginal tax rate, and potential refund or balance due based on withholding. - Adjust Variables to Test Scenarios

Run “what-if” analyses: What happens if you contribute $6,000 to a traditional IRA? How much would you save by donating $2,000 to charity? These simulations help optimize your tax strategy.

Common Mistakes to Avoid When Using a Tax Calculator

Even experienced users make errors that skew results. Watch out for these pitfalls:

- Using outdated tax rates: Tax brackets and deductions change annually for inflation. Ensure your calculator adjusts for the correct tax year.

- Forgetting state taxes: Some calculators focus only on federal returns. If you live in a state with income tax (e.g., California, New York), include it for accuracy.

- Overlooking self-employment tax: Independent contractors must pay both employer and employee portions of Social Security and Medicare. Missing this adds up fast.

- Double-dipping deductions: You cannot claim both the standard deduction and full itemized deductions. The calculator should prevent this, but verify logic manually.

- Ignoring estimated tax payments: If you’ve already made quarterly payments, input them so the final balance reflects actual liability.

Real Example: Estimating Taxes for a Freelance Designer

Meet Sarah, a 32-year-old freelance graphic designer living in Denver. She earned $85,000 in 2024 from client projects, paid $1,200 in health insurance premiums, contributed $5,000 to a SEP-IRA, donated $1,800 to her local arts nonprofit, and has no dependents. She files as Single.

She uses a reputable tax calculator and enters her data:

- Gross income: $85,000

- Business expenses: $4,000 (software, home office)

- Retirement contribution: $5,000 (deductible via SEP-IRA)

- Charitable donation: $1,800

- Health insurance: Self-paid, not eligible for deduction unless over AGI threshold

The calculator applies the 2024 standard deduction ($14,600) since her itemized total ($1,800) is lower. Her taxable income becomes $65,400. Federal tax comes to approximately $8,230. She also owes $5,559 in self-employment tax. After subtracting estimated quarterly payments of $10,000, she sees she still owes about $3,789.

This early insight prompts her to increase savings for next year and consider deferring income into January to reduce next year’s bill.

Do’s and Don’ts When Estimating Your Taxes

| Do | Don’t |

|---|---|

| Use updated calculators reflecting current IRS guidelines | Rely on generic spreadsheet templates without built-in tax rule updates |

| Include all sources of taxable income | Assume side gig income is tax-free |

| Factor in both federal and state tax obligations | Ignore local city or municipal taxes (e.g., New York City) |

| Save estimates and inputs for future reference | Delete results after viewing—keep records for comparison |

| Consult a CPA if results seem unusually high or low | Trust calculator output blindly without reviewing assumptions |

FAQ

Can a tax calculator replace my accountant?

No. While tax calculators provide strong estimates, they don’t offer personalized advice, audit support, or complex planning for estates, investments, or business structures. They’re best used as a planning tool—not a substitute for professional guidance.

Are free tax calculators accurate?

Many are surprisingly accurate, especially those offered by established financial institutions (e.g., NerdWallet, Kiplinger, H&R Block). However, always check when the tool was last updated and whether it accounts for phaseouts, AMT, or state-specific rules.

How often should I use a tax calculator?

At minimum, run an estimate each quarter—especially if you're self-employed or receive irregular income. Major life events (marriage, new job, home purchase) also warrant immediate recalculations.

Final Checklist Before Running Your Estimate

Checklist: Prepare for Accurate Results

- ☐ Gather W-2s, 1099s, and investment income summaries

- ☐ Confirm your filing status and number of dependents

- ☐ List all expected deductions (standard or itemized)

- ☐ Note any tax credits you qualify for (EITC, Child Tax Credit, etc.)

- ☐ Record previous estimated payments or withholdings

- ☐ Verify calculator uses 2024 tax rates and inflation adjustments

Take Control of Your Tax Future

Understanding your tax obligation isn’t about fear—it’s about empowerment. By using a tax calculator correctly and consistently, you turn uncertainty into clarity. You’ll make smarter decisions about retirement contributions, charitable giving, and income timing. Most importantly, you’ll walk into tax season prepared, not panicked.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?