Choosing how to buy a new iPhone is more than just deciding on storage or color—it’s about understanding your financial options. While Apple offers direct purchase with flexible financing, carriers like AT&T provide installment plans bundled with service. But which route truly benefits you in the long run? The answer depends on your priorities: cost control, carrier freedom, upgrade frequency, and credit impact. Breaking down both options reveals that while AT&T’s payment plan may seem convenient, buying directly from Apple often provides greater transparency, flexibility, and long-term savings.

Understanding the Two Purchase Models

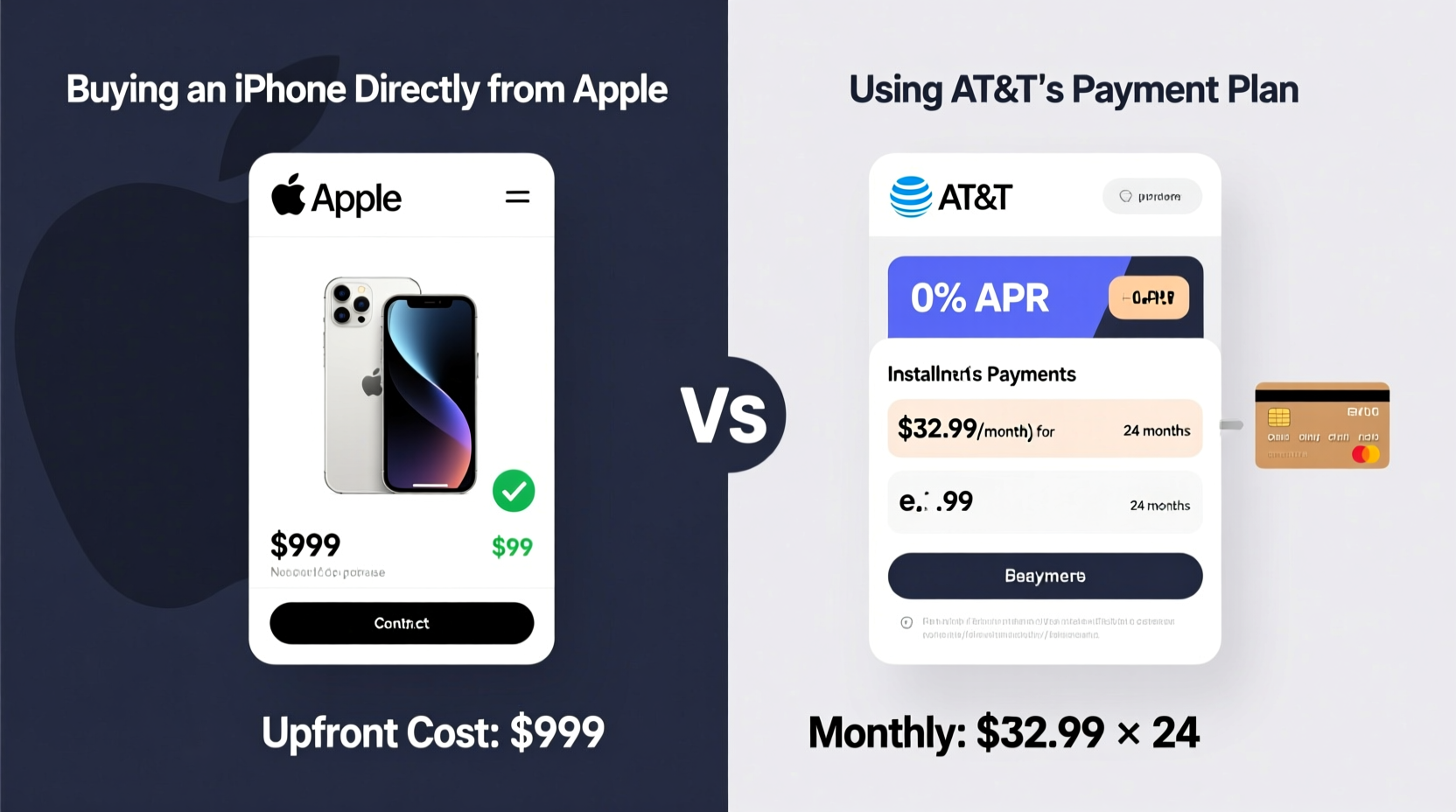

When acquiring a new iPhone, most consumers face two primary paths: purchasing directly from Apple (with or without financing) or enrolling in a carrier installment plan through AT&T. Each method has distinct mechanics.

Buying from Apple: You pay the full price of the device upfront or use Apple’s monthly payment option via Apple Card Monthly Installments or another credit card. Apple does not tie the phone to a carrier contract, meaning it’s unlocked by default and compatible with any network that supports the model.

AT&T Payment Plan: This is typically part of AT&T’s “Next Up” or “Installment Plan,” where you pay for the phone over 30 or 36 months. However, this plan is usually tied to an active service agreement. Until the phone is fully paid off, it remains locked to AT&T, and early termination may incur fees or require full balance repayment.

Cost Comparison: Total Price Over Time

At first glance, both options may appear similar in monthly cost. But when examining total outlay, interest equivalents, and hidden conditions, differences emerge.

| Feature | Apple Direct Purchase | AT&T Payment Plan |

|---|---|---|

| iPhone 15 (128GB) Base Price | $799 | $799 (spread over 36 months) |

| Monthly Payment (36 months) | $22.20 (no interest with Apple Card) | $22.20 (interest-free if eligible) |

| Interest Charges | None with Apple Card; possible with other cards | Typically none, but subject to credit check |

| Carrier Lock | No – unlocked at purchase | Yes – until paid in full |

| Upgrade Eligibility | Anytime, or via iPhone Upgrade Program | After 12–24 months, depending on plan |

| Network Flexibility | Full – works on any compatible carrier | Limited – must stay with AT&T until paid |

The sticker price may be identical, but the constraints differ significantly. AT&T’s plan requires ongoing service with them, effectively tying your phone bill and service into one obligation. If you cancel service before paying off the device, you’ll likely owe the remainder immediately. Apple’s model separates device cost from service, giving you control over both.

Flexibility and Long-Term Value

One of the strongest advantages of buying from Apple is freedom. An unlocked iPhone can be used with any carrier—switching from AT&T to T-Mobile, Verizon, or even a low-cost MVNO like Mint Mobile is seamless. This flexibility becomes crucial if you move, travel frequently, or find a better deal elsewhere.

In contrast, AT&T’s installment plan locks you into their network. Even if you’re paying monthly, the device is registered on their system, and removing it prematurely can trigger automatic balance due notices. This reduces your ability to negotiate better service rates or take advantage of competitor promotions.

“Consumers often underestimate how much carrier lock-in affects their mobility. Owning your device outright means you own your choices.” — Lena Patel, Consumer Technology Analyst at TechInsight Group

Additionally, resale value is higher for unlocked phones bought directly from Apple. Secondhand buyers prefer devices not tied to carrier contracts, and platforms like Swappa or eBay reflect this premium. A phone purchased through AT&T may require proof of payoff or account access to unlock, creating friction in resale.

Mini Case Study: Sarah’s Upgrade Dilemma

Sarah wanted the iPhone 15 when it launched. She was already an AT&T customer and received a promotion: $0 down and $22.20/month for 36 months. It sounded ideal. She signed up without reading the fine print.

Nine months later, she moved to a rural area where AT&T’s coverage was spotty. Her friend recommended switching to Verizon, which had better local towers. But when Sarah called AT&T to cancel service, she was told she’d have to pay the remaining $600 on her phone immediately or risk collections and credit damage.

Frustrated, she stayed with AT&T despite poor service. Had she bought the same phone directly from Apple—even on a 36-month payment plan—she could have switched carriers anytime, keeping her phone and lowering her bill.

Sarah’s experience highlights a common pitfall: mistaking monthly convenience for true affordability. The real cost includes opportunity cost and loss of control.

Step-by-Step Guide: How to Decide What’s Best for You

Follow this timeline to evaluate your best option:

- Assess your carrier loyalty: Do you plan to stay with AT&T long-term? If not, avoid carrier financing.

- Check your credit: Both Apple and AT&T perform soft checks, but poor credit may limit financing options.

- Compare total cost: Include taxes, trade-in values, and promotional discounts. Sometimes Apple offers instant trade-in credits; AT&T may offer bill credits over time.

- Determine upgrade needs: If you upgrade every 1–2 years, Apple’s iPhone Upgrade Program lets you switch annually. AT&T typically requires longer commitment.

- Decide on payment method: Using Apple Card gives 3% cash back and no interest. Other credit cards may charge interest unless paid in full.

- Purchase and activate: Buy from Apple for full control, or from AT&T only if you’re certain about long-term service.

Expert Tips for Maximizing Value

- If using Apple’s financing, pair it with Apple Card for interest-free payments and daily cash back.

- Avoid third-party credit card financing unless you have excellent credit and a 0% introductory APR.

- Always confirm whether a carrier deal includes bill credits (which can expire) versus instant discounts.

- Consider buying a previous-generation iPhone directly from Apple—it’s often hundreds cheaper and still supported.

FAQ

Can I switch carriers if I’m still paying for my iPhone on AT&T?

Technically yes, but only after paying off the device in full. Until then, the phone is locked to AT&T, and canceling service triggers immediate balance due.

Does buying from Apple include a warranty?

All iPhones come with a standard one-year limited warranty. You can extend coverage with AppleCare+, regardless of purchase method.

Is Apple’s payment plan a credit check?

Yes, Apple performs a soft credit inquiry when you apply for Apple Card Monthly Installments. It doesn’t impact your score significantly, but multiple inquiries over time might.

Conclusion: Make the Choice That Puts You in Control

While AT&T’s payment plan offers surface-level convenience, especially for existing customers, it comes with strings attached. Buying your iPhone directly from Apple gives you ownership, flexibility, and long-term financial clarity. You’re not locked into a carrier, you can resell or upgrade freely, and you avoid the risk of surprise charges if life changes your plans.

The smartest decision isn’t always the easiest one in the moment. Taking control of your device purchase today means more freedom tomorrow—whether you’re switching carriers, traveling abroad, or simply seeking better value. Evaluate your lifestyle, usage patterns, and future plans. Then choose the path that empowers you, not the provider.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?