The Chartered Financial Analyst (CFA) designation is one of the most respected credentials in the world of finance. It’s often seen as the gold standard for investment professionals, particularly those aiming for careers in portfolio management, equity research, or asset allocation. But behind its prestige lies a grueling journey—three rigorous exams, thousands of hours of study, and a commitment that spans years. So, is becoming a CFA worth it? For many, the answer depends on how they weigh the difficulty against the long-term rewards.

This article breaks down the realities of pursuing the CFA charter: the time investment, the mental toll, the career outcomes, and whether the payoff justifies the effort. If you're considering this path, understanding both sides of the equation is essential before committing to the process.

The Rigor of the CFA Program: What Makes It So Difficult?

The CFA program is not designed for casual learners. Administered by the CFA Institute, it consists of three levels of exams, each progressively more complex. Candidates must pass Level I, II, and III in sequence, with most taking between two and four years to complete all three. The global pass rates underscore the challenge: historically, only about 35–45% of candidates pass each level on their first attempt.

The curriculum spans over 300 hours of study per level, covering topics such as ethics, quantitative methods, economics, financial reporting, corporate finance, equity and fixed income investments, derivatives, and portfolio management. Unlike many certifications, the CFA doesn’t focus solely on theory—it demands deep analytical thinking, application of concepts, and mastery of ethical standards.

What makes the CFA especially demanding is the self-directed nature of preparation. Most candidates balance full-time jobs while studying nights and weekends. The recommended study time is 300+ hours per exam, meaning a total commitment of nearly 1,000 hours across all three levels.

“Passing the CFA exams isn’t about memorization—it’s about internalizing complex financial frameworks and applying them under pressure.” — Dr. Sarah Lin, Portfolio Manager and CFA Charterholder

Career Opportunities and Salary Potential

Despite the difficulty, the CFA charter opens doors to high-impact roles in finance. Common career paths include:

- Portfolio Manager

- Research Analyst (Equity, Fixed Income)

- Risk Manager

- Investment Advisor

- Chief Investment Officer (CIO)

- Financial Consultant

According to the CFA Institute’s 2023 compensation survey, charterholders earn a median total compensation of $165,000 globally, with significant variation based on region and experience. In major financial hubs like New York, London, or Hong Kong, senior-level CFAs can command salaries exceeding $250,000, especially when combined with performance-based bonuses.

More than just salary, the CFA credential enhances credibility. In client-facing or fiduciary roles, having the CFA after your name signals expertise, discipline, and adherence to ethical standards—qualities highly valued in wealth management and institutional investing.

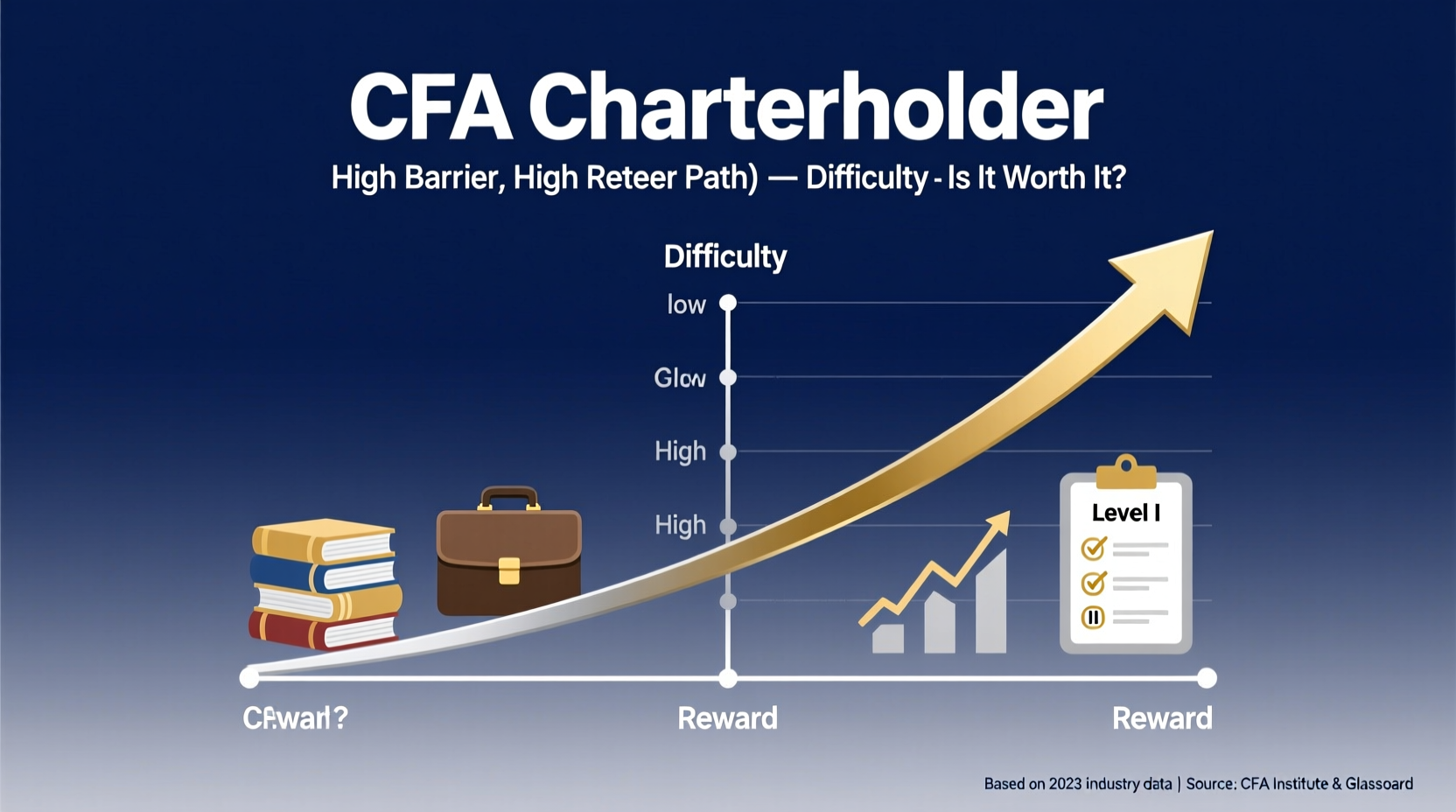

Difficulty vs Reward: A Balanced Comparison

To assess whether the CFA is a worthwhile pursuit, consider both tangible and intangible factors. The table below summarizes key aspects of the difficulty versus the potential rewards.

| Factor | Difficulty / Challenges | Reward / Benefits |

|---|---|---|

| Time Commitment | 3–4 years on average; 300+ hours per exam | Deep, comprehensive knowledge base in finance |

| Pass Rates | Average ~40% per level; cumulative pass rate under 20% | High selectivity increases credential value |

| Opportunity Cost | Lost leisure time, stress, potential impact on work-life balance | Promotions, higher earning potential, job security |

| Cost | $3,000–$5,000 in fees and study materials | ROI typically positive within 5 years post-charter |

| Career Mobility | Requires relevant experience (4,000 hours over 3 years) | Global recognition; opportunities across continents |

The data suggests that while the upfront cost—in time, money, and effort—is steep, the long-term professional payoff is substantial. However, the benefits are not automatic. Success depends on leveraging the credential strategically within the right subfield of finance.

Real-World Example: From Analyst to Fund Manager

Consider the case of James Tran, an equity research analyst at a mid-sized asset management firm in Chicago. After graduating with a finance degree, James landed a role paying $70,000 but quickly realized advancement required differentiation. He enrolled in the CFA program shortly after starting his job.

Over the next three years, James studied 15–20 hours per week, sacrificing weekends and delaying personal milestones. He failed Level II on his first attempt but retook it six months later and passed. By the time he earned his charter, he had been promoted to senior analyst and was leading sector coverage for technology stocks.

Two years after becoming a charterholder, James transitioned into a junior portfolio manager role with a base salary of $140,000 and a bonus structure tied to fund performance. “The CFA didn’t guarantee the promotion,” he says, “but it gave me the confidence—and my employer the trust—to take on more responsibility.”

James’s story illustrates a common trajectory: the CFA acts as a catalyst for growth, especially in firms where technical rigor and ethical standards are prioritized.

When the CFA Makes the Most Sense

The CFA is not universally beneficial. Its value is highest in specific niches. Consider pursuing the charter if:

- You aim to work in investment management, equity research, or wealth advisory.

- Your current or target employer values or requires the designation.

- You thrive in structured, detail-oriented learning environments.

- You’re committed to a long-term career in finance rather than short-term gains.

Conversely, the CFA may be less impactful if you’re targeting roles in investment banking, fintech startups, or corporate finance, where other skills (like modeling or deal execution) dominate. An MBA or specialized certifications (e.g., FRM, CAIA) might offer better ROI in those areas.

Step-by-Step Guide to Starting Your CFA Journey

If you’ve decided the CFA path aligns with your goals, follow this practical timeline to get started:

- Assess Your Readiness (Month 1): Evaluate your background in finance, math, and accounting. Brush up on basics if needed.

- Register for Level I (Months 2–3): Choose an exam window (February, May, August, November). Pay registration and enrollment fees (~$1,200).

- Create a Study Plan (Month 4): Allocate 6–8 months for preparation. Use a calendar to block weekly study sessions.

- Use Quality Materials (Ongoing): Combine the CFA Institute curriculum with third-party prep providers like Kaplan Schweser or Mark Meldrum for better retention.

- Practice Consistently (Months 5–9): Focus on topic quizzes early, then shift to full mock exams under timed conditions.

- Take the Exam (Exam Month): Arrive rested and prepared. Remember: even if you don’t pass, the experience builds foundation.

- Repeat for Levels II and III: Adjust strategy based on prior results. Level II emphasizes valuation models; Level III focuses on portfolio management and essay-style questions.

- Submit Experience & Earn Charter (After Passing All Levels): Document 4,000 hours of qualified work experience and obtain references from supervisors.

Frequently Asked Questions

Can I pass the CFA exams without a finance background?

Yes, but it will require significantly more effort. Candidates from non-finance backgrounds often spend extra time mastering accounting fundamentals, financial statement analysis, and quantitative methods. Many succeed with disciplined study and supplemental coursework.

How does the CFA compare to an MBA?

The CFA is specialized and technical, focused exclusively on investment analysis and portfolio management. An MBA offers broader business training (leadership, marketing, strategy) and stronger networking opportunities. Some professionals pursue both, using the CFA for technical depth and the MBA for leadership advancement.

Do employers really care about the CFA?

In asset management, research, and wealth management firms, yes—many job postings list the CFA as preferred or required. In other sectors, awareness varies. However, even outside traditional finance roles, the CFA signals intellectual rigor and commitment, which can positively influence hiring decisions.

Final Verdict: Is the CFA Worth It?

The Chartered Financial Analyst designation is not a shortcut. It’s a marathon that tests perseverance, intellect, and professional dedication. The difficulty is real: the exams are tough, the schedule is relentless, and failure is common. But so are the rewards—for those who complete it, the CFA often leads to higher salaries, greater responsibility, and long-term career resilience.

The key is alignment. If your aspirations lie in investment decision-making, risk analysis, or managing capital, the CFA is one of the strongest credentials you can earn. It commands respect, builds expertise, and creates opportunities that might otherwise remain out of reach.

But if your goals are elsewhere—say, entrepreneurship, corporate finance, or technology—the same energy might be better spent elsewhere. The CFA shines brightest when it serves a clear professional purpose.

“The CFA won’t change your life overnight. But over time, it changes who you become as a professional.” — Michael Torres, CFA, Head of Research at Global Asset Partners

Take the Next Step

If you're serious about a career rooted in financial analysis and investment excellence, the CFA charter is more than a title—it's a transformation. Start by researching the curriculum, speaking to current charterholders, and honestly assessing your capacity for sustained effort. The journey is demanding, but for those committed to mastery, the payoff extends far beyond a salary bump. It’s about building a reputation for integrity, insight, and long-term value creation in the world of finance.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?