Understanding the time value of money is foundational to smart financial decision-making. Whether you're planning retirement, evaluating an investment opportunity, or studying for a finance exam, calculating future value (FV) is a skill you can't afford to overlook. While the concept may seem abstract at first, your financial calculator—whether it’s a Texas Instruments BA II Plus, HP 12C, or similar model—can turn complex equations into simple keystrokes. This guide walks you through the mechanics of future value calculations with clarity, practical examples, and expert-backed strategies.

Why Future Value Matters in Real Financial Decisions

The future value of money represents what a sum invested today will grow to over time, given a specific interest rate and compounding frequency. It’s not just a theoretical number—it directly influences how much you’ll have in your retirement account, how profitable a bond investment might be, or whether saving $500 per month will get you to your dream home down payment in ten years.

For example, if you invest $10,000 today at 6% annual interest compounded yearly, in 20 years it will grow to over $32,000. That insight comes from a future value calculation. Without understanding this growth potential, you risk under-saving or misjudging opportunities.

“Time is the most powerful force in investing. The ability to calculate future value transforms abstract time into tangible outcomes.” — Dr. Linda Chen, Professor of Financial Economics, Wharton School

Core Components of Future Value Formulas

Before using your calculator, understand the variables that shape any future value calculation:

- PV (Present Value): The amount you’re investing today.

- FV (Future Value): The amount your investment will grow to.

- r (Interest Rate): The annual return, expressed as a percentage.

- n (Number of Periods): How many years, months, or quarters the money will grow.

- PMT (Payment): Any recurring deposits or withdrawals (used in annuity calculations).

- m (Compounding Frequency): How often interest is applied (e.g., annually, monthly).

The basic formula for future value with compound interest is:

FV = PV × (1 + r/m)^(n×m)

While you can compute this manually, your financial calculator handles it instantly—and reduces errors.

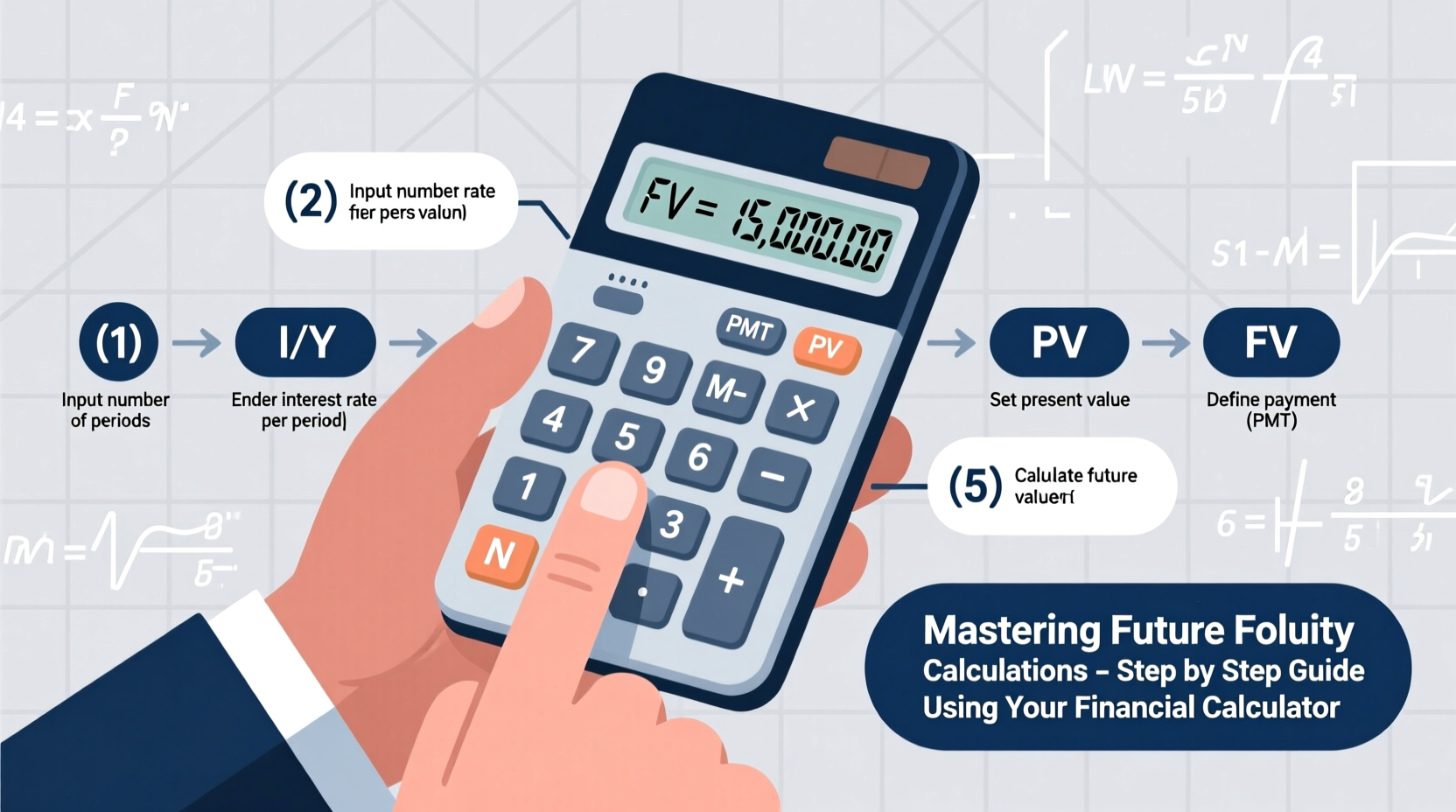

Step-by-Step Guide to Calculating Future Value

Follow this sequence to master future value calculations on a standard financial calculator like the TI BA II Plus:

- Clear previous data: Press [2ND] then [CLR TVM]. This resets N, I/Y, PV, PMT, and FV.

- Enter the number of periods (N): For 10 years, input 10 and press [N].

- Input the interest rate per period (I/Y): For 5% annual interest, enter 5 and press [I/Y].

- Enter present value (PV): Input the initial investment as a negative number (e.g., -5000). Use negative to represent cash outflow.

- Set payments (PMT): If no additional contributions, enter 0 and press [PMT].

- Solve for FV: Press [CPT] then [FV]. The result is the future value.

Example: You invest $5,000 at 5% annual interest for 10 years with no additional deposits.

| Variable | Value |

|---|---|

| N | 10 |

| I/Y | 5 |

| PV | -5000 |

| PMT | 0 |

| FV | ? |

After entering these values, pressing [CPT] [FV] returns **8,144.47**. Your $5,000 grows to $8,144.47 in a decade.

Handling Annuities: Regular Contributions Over Time

If you’re making regular deposits—like contributing $200 per month to a retirement fund—the process changes slightly.

Use the same steps, but adjust for monthly compounding:

- Convert annual interest to monthly: e.g., 6% annual becomes 0.5% monthly.

- Convert years to months: 20 years = 240 months.

- Enter PMT as a negative value representing each deposit.

Example: Monthly savings of $200 at 6% annual interest over 20 years.

| Variable | Value |

|---|---|

| N | 240 (20 × 12) |

| I/Y | 0.5 (6 ÷ 12) |

| PV | 0 |

| PMT | -200 |

| FV | ? |

Result: **$92,408.18**. Consistent monthly investing nearly doubles your total contributions thanks to compounding.

Avoiding Common Calculator Mistakes

Even experienced users make errors when rushing through calculations. Here are frequent pitfalls and how to avoid them:

| Mistake | Consequence | Fix |

|---|---|---|

| Forgetting to clear TVM registers | Old values skew results | Always press [2ND] [CLR TVM] |

| Entering PV as positive | FV shows negative or incorrect sign | Treat investments as cash outflows (negative) |

| Ignoring compounding frequency | Overestimates or underestimates growth | Adjust N and I/Y to match periods (monthly, quarterly) |

| Mixing nominal and effective rates | Inaccurate returns | Ensure I/Y matches compounding period |

Real-World Example: Planning for College Savings

Sarah wants to save for her newborn’s college education. She plans to invest $10,000 today and add $150 per month for 18 years. Assuming a conservative 5% annual return compounded monthly, how much will she accumulate?

Calculator Inputs:

- N = 18 × 12 = 216

- I/Y = 5 ÷ 12 ≈ 0.4167

- PV = -10,000

- PMT = -150

- FV = ?

Press [CPT] [FV]: Result is **$67,355.14**.

This number gives Sarah confidence. She now knows her plan will generate significant funds, though she may still consider increasing contributions if tuition inflation exceeds expectations.

Checklist: Mastering Future Value in Practice

Use this checklist every time you perform a future value calculation:

- ☐ Clear the TVM worksheet before starting

- ☐ Confirm compounding frequency (annual, monthly, etc.)

- ☐ Convert interest rate and number of periods to match frequency

- ☐ Enter PV and PMT as negative values (cash outflows)

- ☐ Verify payment mode (END for most cases)

- ☐ Cross-check result with a rough mental estimate (e.g., “Will this roughly double?”)

- ☐ Document assumptions for future reference

FAQ: Common Questions About Future Value Calculations

Can future value be negative?

No—not in typical investment scenarios. A negative FV usually indicates incorrect sign entries. Ensure PV and PMT are negative when representing money you’re investing. The FV should appear positive, showing growth.

What if interest rates change over time?

Standard calculators assume a constant rate. For variable rates, break the timeline into segments. Calculate FV for the first period, use that as PV for the next, and repeat. Alternatively, use spreadsheet software like Excel for more complex modeling.

Does inflation affect future value calculations?

The standard FV calculation reflects nominal growth. To account for inflation, subtract the inflation rate from your interest rate to get the real rate of return. For example, a 6% return with 3% inflation yields a 3% real return. Use the real rate to assess purchasing power in the future.

Conclusion: Turn Theory Into Financial Confidence

Mastering future value calculations isn’t about memorizing formulas—it’s about leveraging your financial calculator to make informed decisions. Whether you’re building wealth, planning major purchases, or analyzing investment options, the ability to project growth accurately puts you in control. These skills compound just like your investments: small efforts today lead to powerful advantages tomorrow.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?