Despite the rise of digital payments, paper checks remain a trusted method for paying rent, settling bills, or making personal transactions. A $100 check may seem simple, but even small errors—like an incorrect date or misspelled payee name—can lead to delays, rejection, or potential fraud. Writing a check correctly isn’t just about filling in blanks; it’s about precision, legibility, and protecting your financial information. Whether you're writing your first check or refreshing your knowledge, mastering this fundamental skill ensures your payment is processed without issues.

Why Accuracy Matters on a $100 Check

A $100 check might not be a large sum, but inaccuracies can still create significant problems. Banks often reject checks with discrepancies between the numeric and written amounts, unclear endorsements, or missing signatures. In some cases, ambiguous handwriting can lead to altered figures—such as turning “one hundred” into “one thousand”—exposing you to unauthorized withdrawals. Beyond processing delays, sloppy checks reflect poorly in professional or landlord-tenant relationships, where attention to detail signals reliability.

Moreover, financial institutions follow strict verification protocols. According to the American Bankers Association, nearly 30% of rejected checks are due to mismatched amounts or illegible information. Taking the time to fill out a check properly protects both you and the recipient while maintaining trust in traditional payment methods.

Step-by-Step Guide to Writing a $100 Check Correctly

Follow this clear sequence to complete a check accurately and securely. Each field serves a specific purpose, and skipping one could invalidate the transaction.

- Date the check: Write today’s date in the top right corner (e.g., April 5, 2025). Avoid post-dating checks unless absolutely necessary, as this can cause confusion or premature cashing.

- Fill in the payee line: On the “Pay to the Order of” line, clearly print the full name of the individual or business receiving the funds. For example, “John Smith” or “ABC Cleaning Services.” Never leave this blank.

- Enter the amount numerically: In the small box next to the dollar sign ($), write “100.00.” Include the cents—even if they’re zero—to prevent someone from adding digits later.

- Write the amount in words: On the longer line below, write “One hundred and 00/100.” The fraction format (00/100) specifies the cents and aligns with banking standards. Draw a line from the end of the amount to the end of the space to prevent tampering.

- Add a memo (optional): Use the lower left field to note the purpose—“April Rent,” “Gift,” or “Reimbursement.” This helps both parties track the transaction.

- Sign the check: Sign exactly as your name appears on the account. Use consistent handwriting. An unsigned check is invalid.

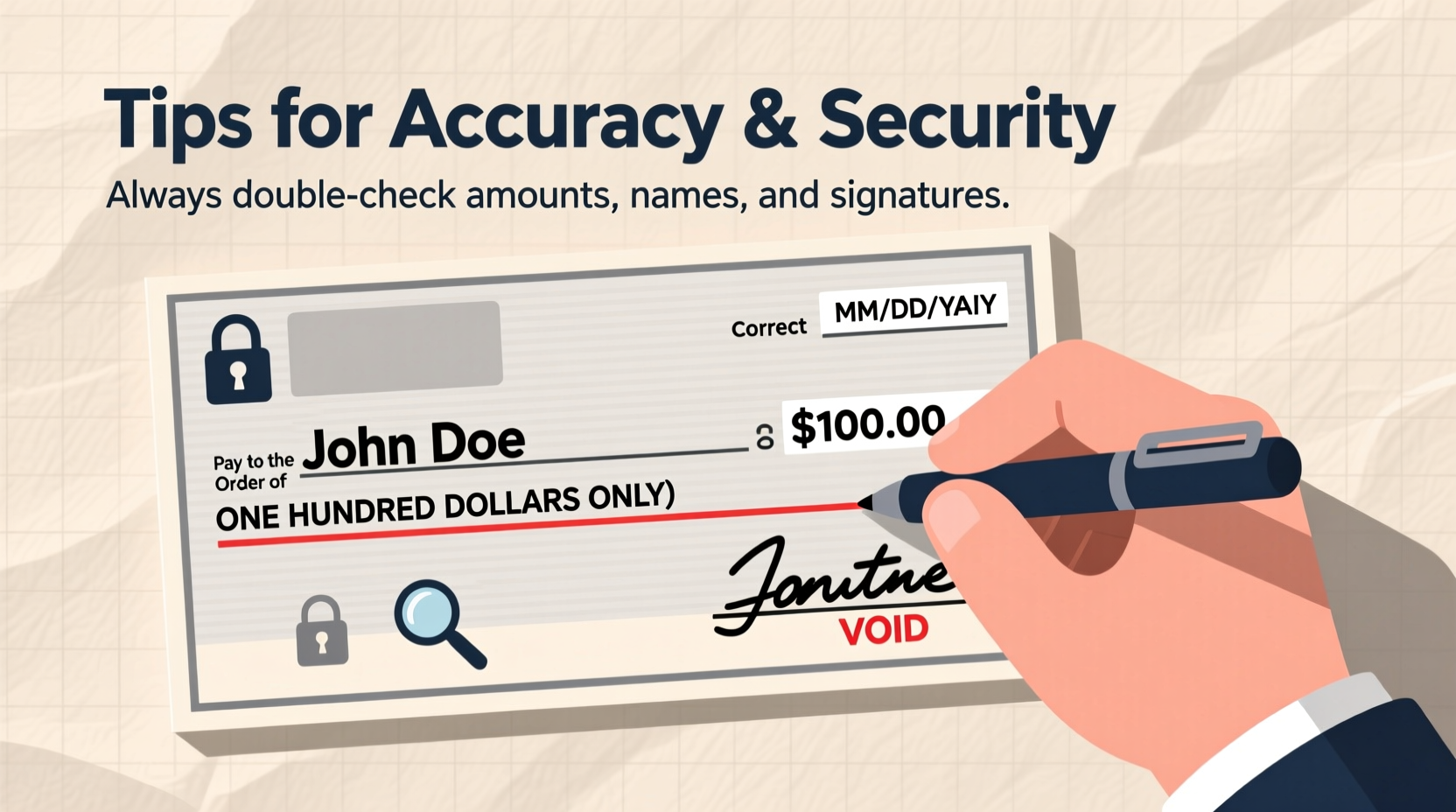

Double-Check Before Delivery

Before handing over the check, verify that:

- The numeric and written amounts match.

- The payee name is correct and spelled properly.

- Your signature is present and legible.

- No fields are left incomplete or smudged.

Common Mistakes to Avoid

Even experienced check writers make avoidable errors. Here are the most frequent missteps and how to prevent them:

| Mistake | Why It’s a Problem | How to Fix It |

|---|---|---|

| Omitting cents (writing “100” instead of “100.00”) | Leaves room for alteration | Always include “.00” in the dollar box |

| Writing “One hundred dollars” without fraction | Lacks specificity; increases fraud risk | Use “One hundred and 00/100” |

| Using pencil or erasable ink | Enables tampering | Use only black or blue permanent ink |

| Incorrect or skipped date | May cause hold-ups or suspicion | Write current date; never omit |

| Signature mismatch | Bank may reject the check | Sign consistently with your bank records |

Security Best Practices When Writing Checks

Checks contain sensitive data: your name, address, account number, and routing number. Protect yourself from identity theft and fraud with these precautions.

Never share blank checks or allow others to complete them on your behalf. Store unused checks in a locked drawer or safe. When mailing a check, use a secure envelope and consider tracking services for important payments like rent.

“Over 10 million Americans fall victim to check fraud annually. Simple habits—like using carbon-copy checks or monitoring bank statements—can stop theft before it starts.” — Lisa Tran, Senior Fraud Analyst at National Financial Security Group

Consider using duplicate checks that create a paper trail. These allow you to retain a record of every check issued, including the payee, amount, and date. Regularly review your bank statements to confirm all checks cleared as expected and report any discrepancies immediately.

Real Example: A Preventable Incident

Sarah mailed a $100 rent check to her landlord but forgot to draw a line after “One hundred and 00/100.” A dishonest mail handler altered the line to “One thousand and 00/100,” cashing $1,000 instead. Because Sarah hadn’t reviewed her monthly statement for weeks, the fraud went unnoticed until her account was overdrawn. Her bank could not fully reimburse her due to delayed reporting. Had she drawn a closing line and monitored her account weekly, the loss could have been avoided.

Essential Checklist for Writing a Secure $100 Check

Use this quick-reference checklist every time you write a check to ensure completeness and safety:

- ☐ Date is current and legible

- ☐ Payee name is accurate and spelled correctly

- ☐ Numeric amount is written as “100.00”

- ☐ Written amount reads “One hundred and 00/100”

- ☐ Line extends from text to edge of space

- ☐ Memo includes purpose (recommended)

- ☐ Signature matches bank records

- ☐ Permanent ink used throughout

- ☐ Check stored securely until delivered

- ☐ Copy retained for personal records

Frequently Asked Questions

Can I write “One hundred” without “and 00/100”?

While some banks may accept it, omitting the fraction leaves the check vulnerable to alteration. Including “and 00/100” is the standard practice and strongly recommended for security.

What if I make a typo in the written amount?

If you make an error in the written amount, void the check immediately by writing “VOID” in large letters across the front. Do not attempt to cross out and rewrite, as this may invalidate the check or raise red flags.

Is it safe to mail a $100 check?

Yes, if proper precautions are taken. Use a stamped, sealed envelope addressed correctly. For added security, send it via certified or tracked mail. Avoid leaving outgoing checks in unsecured mailboxes.

Final Thoughts: Confidence in Every Transaction

Writing a $100 check correctly is more than a basic task—it's a reflection of financial responsibility. With attention to detail, adherence to best practices, and awareness of potential risks, you can ensure your payments are processed smoothly and securely. Whether you're paying a contractor, sending a gift, or covering a monthly expense, a well-written check builds trust and prevents avoidable complications.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?