Writing a check may seem outdated in an age of digital payments, but it remains a vital skill for paying rent, making donations, or handling transactions where electronic options aren’t accepted. Whether you're opening your first checking account or haven't written a check in years, understanding the process ensures accuracy, prevents fraud, and builds financial confidence. This guide walks you through every detail—from filling out each field correctly to avoiding costly errors.

The Anatomy of a Check

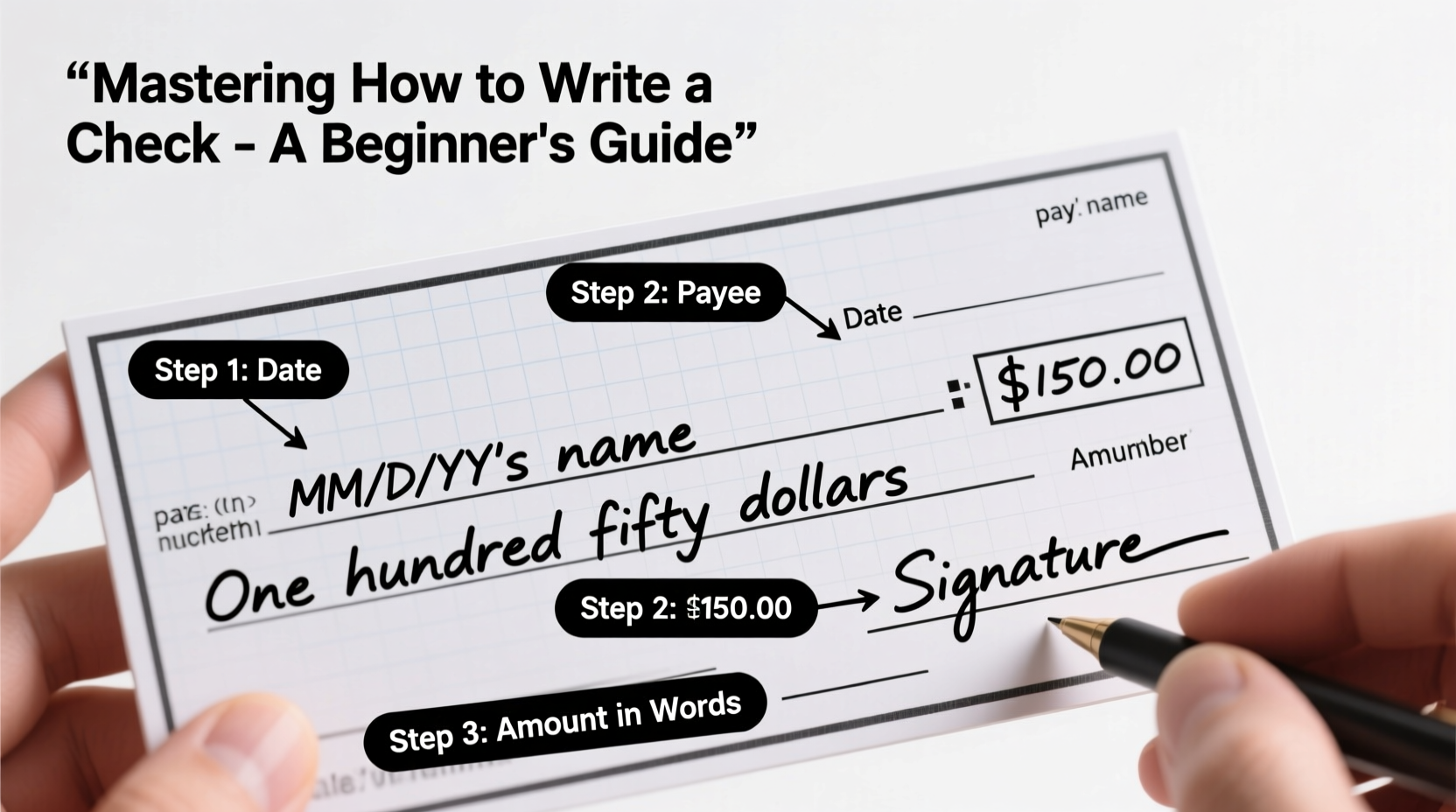

Before writing a check, it’s essential to understand its components. Each section serves a specific purpose in ensuring the payment is processed correctly:

- Check Number: Located in the upper right corner, this helps you track issued checks.

- Date Line: Where you record when the check was written.

- Payee Line: The name of the person or organization receiving the funds.

- Amount in Numbers: The dollar amount written numerically (e.g., $45.00).

- Amount in Words: The same amount spelled out (e.g., Forty-five and 00/100).

- Memo Line: Optional space for notes like “rent” or “birthday gift.”

- Signature Line: Your authorized signature releases the funds.

- Routing & Account Numbers: Found at the bottom, these identify your bank and account.

Step-by-Step Guide to Writing a Check

- Fill in the Date

Write today's date on the line in the top right corner. Use the full date format (e.g., April 5, 2025) to prevent tampering. Avoid post-dating checks unless absolutely necessary, as some banks may still cash them early. - Write the Payee’s Name

On the “Pay to the order of” line, clearly print the recipient’s full legal name or business name. If paying an individual, use their full name. For businesses, match the name exactly as they require it (e.g., “ABC Plumbing LLC” not just “Plumbing”). - Enter the Amount in Numbers

In the small box next to the dollar sign ($), write the amount numerically. For example, for fifty dollars and twenty-five cents, write 50.25. Draw a line after the amount to prevent someone from adding extra digits. - Write the Amount in Words

On the longer line below, spell out the amount in words. Start at the far left. For $50.25, write “Fifty and 25/100.” The fraction format represents cents over 100. If the amount is a whole dollar, write “00/100” (e.g., Fifty and 00/100). This double-entry system protects against fraud. - Add a Memo (Optional)

Use the memo line to note the purpose of the check—such as “April Rent” or “Birthday Gift for Mom.” While not required, it helps both you and the recipient track the transaction. - Sign the Check

Sign on the bottom-right line using the same signature on file with your bank. An unsigned check is invalid. Never sign a blank check—this opens the door to misuse.

Double-Check Before You Hand It Over

Review all fields carefully. A mismatch between the numeric and written amounts can lead to processing delays or rejection. If you make a mistake, void the check by writing “VOID” across the front and record it in your register.

| Field | Example Entry | Common Mistakes |

|---|---|---|

| Date | April 5, 2025 | Using shorthand (4/5/25), skipping the year |

| Payee | City Water Department | Vague names like “Cash” or misspelled business names |

| Amount (Numbers) | $127.83 | Leaving space after the number, allowing tampering |

| Amount (Words) | One hundred twenty-seven and 83/100 | Spelling errors, missing fraction |

| Signature | [Your handwritten signature] | Signing in pencil, inconsistent signature |

Real-Life Example: Paying Rent with a Check

Sophia rents an apartment and needs to pay $1,100 monthly. Her landlord requires checks made payable to “Maplewood Properties LLC.” She fills out her check carefully:

- Date: May 1, 2025

- Payee: Maplewood Properties LLC

- Amount (Numbers): $1,100.00

- Amount (Words): One thousand one hundred and 00/100

- Memo: Rent – May 2025

- Signature: Signed in blue ink

She double-checks that the numbers and words match, signs neatly, and keeps a copy for her records. The check clears without issue, and her landlord appreciates the clear memo line for easy tracking.

Expert Insight: Why Accuracy Matters

“Even small errors—like writing ‘fifteen’ instead of ‘fifty’—can cause a check to be flagged or returned. Banks rely on consistency between the written and numerical amounts. When in doubt, write it twice and get it right.” — Linda Reyes, Senior Bank Teller with 18 years of experience at First National Trust

Avoiding Common Mistakes

Many first-time check writers encounter pitfalls that delay payments or incur fees. Here are key errors to avoid:

- Leaving Fields Blank: Never leave the payee or amount lines empty. A check made out to “Cash” is risky and can be cashed by anyone.

- Mismatched Amounts: If the written and numerical amounts differ, banks typically honor the written amount—but the check might be questioned.

- Using Pencil or Erasable Ink: These can be altered. Always use permanent ink.

- Signing Before Filling Out All Details: Signing a blank check gives others the power to fill in any amount.

- Forgetting to Record the Check: Update your check register or budgeting app immediately to avoid overdrafts.

Essential Checklist Before Writing a Check

Follow this quick checklist to ensure every check is complete and accurate:

- ✅ Confirm sufficient funds in your account

- ✅ Use a black or blue pen with permanent ink

- ✅ Write the current date

- ✅ Enter the correct payee name

- ✅ Fill in the amount in both numbers and words

- ✅ Add a memo if helpful

- ✅ Sign the check with your official signature

- ✅ Record the check in your register

Frequently Asked Questions

Can I write a check to myself?

Yes. Write your full name on the payee line and deposit it into another account or cash it at your bank. This is a safe way to transfer money between accounts.

What happens if I make a mistake on a check?

If you make an error, write “VOID” in large letters across the front and keep it with your canceled checks. Do not try to erase or white-out corrections—banks may reject the check.

How long is a check valid?

Most banks will honor personal checks for up to six months (180 days). After that, they may consider it stale-dated and refuse payment. Some businesses mark checks with “Valid for 90 days” to encourage timely deposits.

Final Thoughts: Confidence Through Clarity

Writing a check is more than a transaction—it’s a demonstration of financial responsibility. By mastering the format, respecting the details, and maintaining accurate records, you protect yourself and ensure smooth payments. Even as digital tools grow, checks remain relevant for specific needs, from formal gifts to rent payments. The ability to write one correctly is a practical life skill that pays off in reliability and trust.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?