Despite the rise of digital payments, checks remain a vital tool for rent payments, tax refunds, business transactions, and personal gifts. Yet, one small error—such as a misspelled name or incorrect dollar amount—can delay processing, incur bank fees, or even lead to fraud. Mastering the art of filling out a check correctly ensures your payment is accepted, secure, and professional.

Whether you're writing your first check or refreshing your knowledge, attention to detail is critical. This guide breaks down every element of a check, outlines best practices, and provides actionable strategies to protect your financial information.

The Anatomy of a Check: What Each Field Means

A standard personal check contains several labeled fields, each serving a specific purpose. Understanding these components helps prevent errors and enhances clarity.

| Field | Purpose | Example |

|---|---|---|

| Check Number | Tracks individual checks in your book; auto-filled by printer | 1003 |

| Date Line | When the check is valid from; protects against early cashing | April 5, 2025 |

| Payee Line | Name of the person or organization receiving funds | John Smith |

| Dollar Box ($) | Numerical amount being paid | 150.75 |

| Legal Line (Words) | Amount written in words; matches dollar box | One hundred fifty and 75/100 |

| Memo Line | Optional note about payment purpose | Rent – April 2025 |

| Signature Line | Your authorized signature; required for validity | [Your handwritten signature] |

Each field must be completed clearly and accurately. Banks often reject checks with discrepancies between the numerical and written amounts or missing signatures.

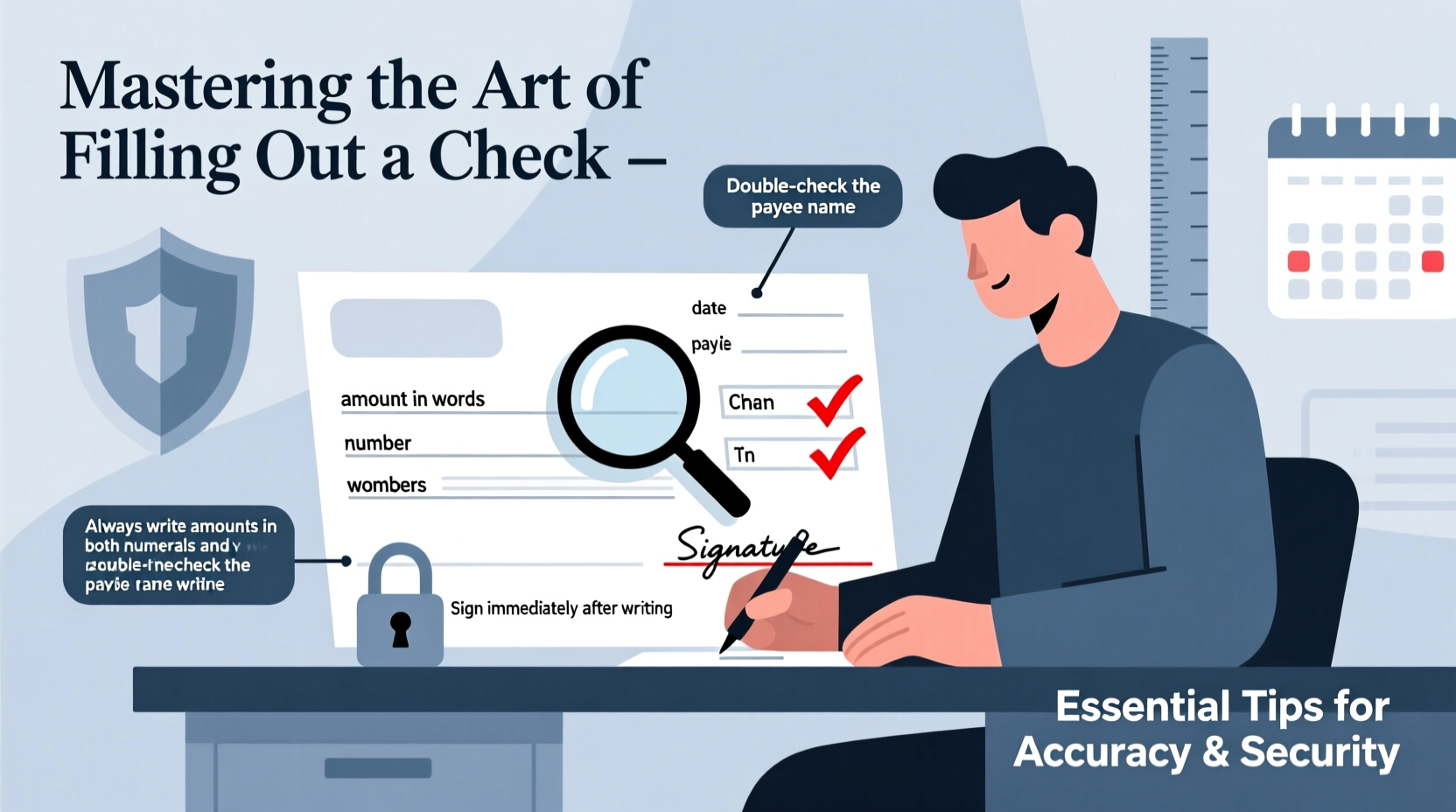

Step-by-Step Guide to Writing a Check Correctly

Follow this sequence to ensure your check is processed without issues:

- Fill in the date on the top right corner. Use the current date unless post-dating is intentional (e.g., for future rent).

- Write the payee’s full legal name on the “Pay to the Order of” line. Avoid nicknames or vague terms like “Cash” unless necessary.

- Enter the payment amount numerically in the dollar box. For example, $245.30 should appear as 245.30.

- Write the same amount in words on the legal line. Start at the far left. For $245.30, write: Two hundred forty-five and 30/100. Use fractions for cents (e.g., 30/100), not decimals.

- Add a memo if helpful—like “Birthday Gift” or “Utility Bill #8821.” This aids record-keeping but isn’t required.

- Sign the check on the bottom right line. Use the same signature on file with your bank. Unsigned checks are invalid.

Security Best Practices When Writing Checks

Checks contain sensitive data: your name, address, account number, and routing number. If lost or stolen, they can be exploited for fraud. Protect yourself with these precautions:

- Never pre-sign blank checks.

- Store checkbooks in a locked drawer or safe.

- Shred voided or unused checks instead of discarding them whole.

- Avoid writing sensitive information (like driver’s license numbers) on the memo line.

- Monitor your bank statements regularly for unauthorized activity.

Fraud experts emphasize vigilance. According to the American Bankers Association, paper checks still accounted for over $25 trillion in transactions annually as of 2023, making them a persistent target for scammers.

“Even in a digital age, checks carry real risk. One misplaced checkbook can lead to months of account recovery.” — Linda Chavez, Senior Fraud Analyst at National Consumer Protection Bureau

Common Mistakes and How to Avoid Them

Errors happen, but many are preventable. Below is a checklist to help avoid frequent pitfalls:

- ✅ Date is correct and legible

- ✅ Payee name matches official records

- ✅ Numerical and written amounts match exactly

- ✅ Signature is present and consistent

- ✅ No corrections or smudges

- ✅ Memo includes reference if applicable

- ✅ Used permanent ink and filled all lines completely

One common error is mismatched amounts. If the dollar box says $80.00 but the legal line reads “Eighty-five and 00/100,” banks typically honor the written amount. This discrepancy can cause confusion or rejection.

Another issue is leaving blank spaces after the amount in words. For example, writing “One hundred dollars__________” leaves room for someone to add “and fifty more.” Always draw a line to the end of the legal line after writing the amount.

Real-World Example: A Costly Oversight

Sarah, a freelance designer, mailed a rent check to her landlord. In a hurry, she wrote “One hundred fifty” but forgot to include “and 00/100” on the legal line. Her bank processed it successfully, but the landlord’s bank flagged the check for review due to incomplete wording. The delay triggered a late fee, which Sarah had to dispute with both her landlord and financial institution.

Though resolved, the incident took two weeks and unnecessary stress. Had she followed a simple checklist and double-checked the legal line, the problem could have been avoided entirely.

Frequently Asked Questions

Can I correct a mistake on a check?

Minor errors can be corrected by drawing a single line through the mistake, writing the correction above, and initialing it. However, banks may still reject altered checks. It’s safer to void the check and write a new one.

What happens if I write a check with insufficient funds?

If your account lacks enough money, the check will bounce. Your bank may charge a non-sufficient funds (NSF) fee, and the payee might also impose penalties. Repeated incidents can lead to account closure or reporting to credit agencies.

Is it safe to mail checks?

Mailing checks is generally safe when using official U.S. Postal Service envelopes and tracking. For added security, consider sending checks via certified mail. Never send checks through unsecured email or messaging apps.

Final Thoughts: Confidence Through Care

Writing a check may seem outdated, but its role in finance remains relevant. Whether paying a contractor, settling a personal debt, or sending a gift, a properly completed check reflects responsibility and attention to detail.

Accuracy prevents delays. Security prevents fraud. And consistency builds trust—with banks, recipients, and yourself. By mastering the fundamentals and adopting disciplined habits, you turn a simple transaction into a reliable, professional act.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?