In an increasingly digital world, checks may seem outdated—but they remain a trusted method for paying rent, settling personal debts, or making donations where electronic payments aren’t accepted. Despite their declining frequency, knowing how to write a check correctly is still a practical life skill. A single mistake can lead to delays, fees, or even fraud. This guide walks you through every element of a check, explains best practices, and helps you avoid common errors—so your payment clears smoothly and securely.

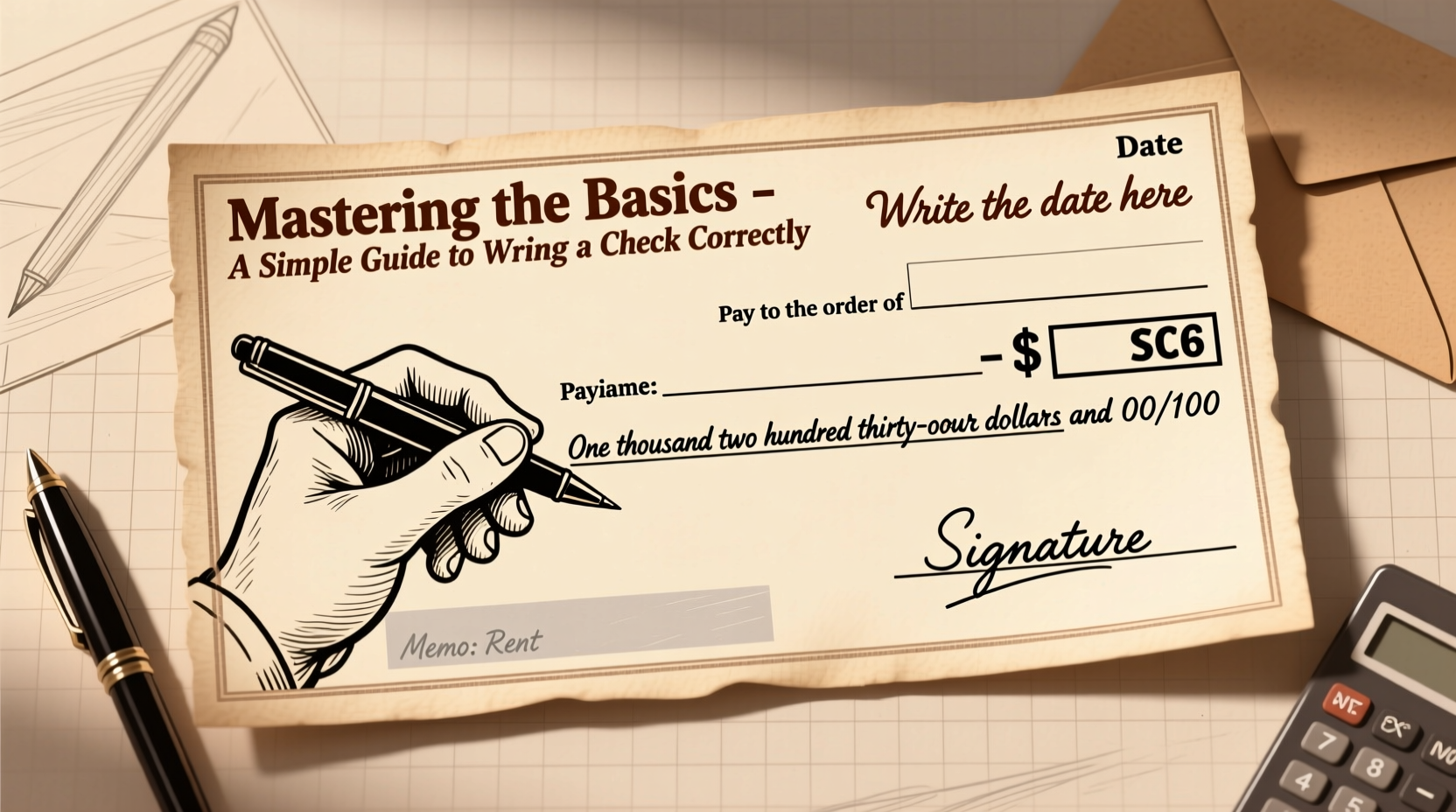

Understanding the Anatomy of a Check

A standard personal check contains several labeled fields, each serving a specific purpose. Familiarizing yourself with these components ensures accuracy and reduces risk.

| Field | Purpose | Example |

|---|---|---|

| Check Number | Tracks individual checks in your register | #1003 |

| Date Line | When the check is valid from | April 5, 2025 |

| Payee Line | Name of person or organization receiving funds | John Smith or ABC Plumbing Inc. |

| Amount in Numbers ($) | Numerical value of payment | $147.50 |

| Amount in Words | Written amount as backup for clarity | One hundred forty-seven and 50/100 |

| Memo Line | Optional note about payment purpose | Rent – April 2025 |

| Signature Line | Authorizes the bank to release funds | [Your handwritten signature] |

The routing number and account number at the bottom are pre-printed and used by banks to process transactions. Never alter these unless instructed by your financial institution.

Step-by-Step Guide to Writing a Check Correctly

Follow this sequence carefully to ensure your check is valid and secure:

- Fill in the date. Write today’s date unless you’re post-dating (not recommended). Use month/day/year format for clarity.

- Write the payee’s name. Be precise—avoid nicknames or vague terms like “Cash” unless absolutely necessary.

- Enter the amount numerically. In the small box next to the dollar sign, write the amount using numbers (e.g., 89.25).

- Write the amount in words. On the longer line, spell out the dollar amount and add cents as a fraction over 100 (e.g., Eighty-nine and 25/100).

- Add a memo (optional but helpful). Note what the payment is for—rent, utilities, loan repayment, etc.

- Sign the check. Use the same signature on file with your bank. Unsigned checks are invalid.

- Record it in your check register. Track the check number, date, payee, and amount to prevent overdrafts.

Common Mistakes and How to Avoid Them

Even small errors can invalidate a check or raise red flags. Here are frequent missteps and how to correct them:

- Mismatched amounts. If the number and word amounts differ, banks usually honor the written amount—but this can cause processing delays or rejection.

- Leaving lines blank. Draw a line through empty space after the amount in words to prevent tampering.

- Using “Cash” as payee. This turns the check into a bearer instrument—anyone can cash it. Only do this if you must, and never mail such checks.

- Signing before filling other fields. Accidentally discarding a signed but incomplete check poses a fraud risk.

- Post-dating checks unnecessarily. While legal, post-dated checks can still be cashed early. Relying on this delay is risky.

“Over 60% of rejected checks are due to mismatched amounts or missing signatures. Accuracy and consistency are non-negotiable.” — Linda Reyes, Senior Bank Teller, Midtown Federal Credit Union

Real Example: A Rent Payment Gone Wrong

Sarah needed to pay her landlord $1,200 in rent. She wrote the numerical amount as $1,200.00 but mistakenly wrote “One thousand two hundred and 15/100” in the word field. When the landlord deposited the check, the bank flagged the discrepancy. It took three days to resolve, and Sarah incurred a late fee. The fix? Double-check both amount fields before signing. Even one digit off can trigger manual review or rejection.

This scenario underscores why precision matters. Taking an extra minute to verify details prevents costly misunderstandings.

Security Best Practices When Writing Checks

Checks contain sensitive information: your name, address, account number, and routing number. Protect yourself with these strategies:

- Use checks only when necessary. Opt for electronic transfers, money orders, or digital payment apps when possible.

- Store checks securely. Keep unused checks in a locked drawer or safe, separate from your checkbook register.

- Shred voided checks. Don’t toss them in the trash—shred them to prevent identity theft.

- Monitor your account regularly. Set up alerts to detect unauthorized check withdrawals immediately.

- Report lost or stolen checks promptly. Contact your bank to stop payment and close compromised accounts if needed.

Checklist: Before You Hand Over a Check

Run through this quick verification list to ensure your check is complete and secure:

- ✅ Date is filled in (current or intended date)

- ✅ Payee name is accurate and legible

- ✅ Amount in numbers matches amount in words

- ✅ No blank spaces—draw a line after the written amount

- ✅ Memo includes purpose (recommended)

- ✅ Signature is present and matches bank records

- ✅ Transaction recorded in your register or budget app

Frequently Asked Questions

Can I correct a mistake on a check?

Minor errors can be corrected by drawing a single line through the mistake, writing the correction above, and initialing it. However, many banks prefer you void the check and start fresh to avoid confusion or fraud concerns.

What happens if I write a check with insufficient funds?

You’ll likely incur an overdraft or nonsufficient funds (NSF) fee from your bank. The recipient may also charge a returned check fee. Repeated incidents can damage your banking relationship or result in account closure.

Do checks expire?

Most banks consider personal checks stale after six months (180 days). Some institutions may still honor older checks at their discretion, but it’s not guaranteed. For long-term payments, use a money order or certified check instead.

Conclusion: Confidence Comes with Clarity

Writing a check correctly isn’t complicated—but it demands attention to detail. Whether you're paying a contractor, sending a gift, or covering monthly expenses, a properly completed check reflects responsibility and protects your finances. By understanding each field, following a consistent process, and applying security best practices, you maintain control over your money and minimize risks.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?