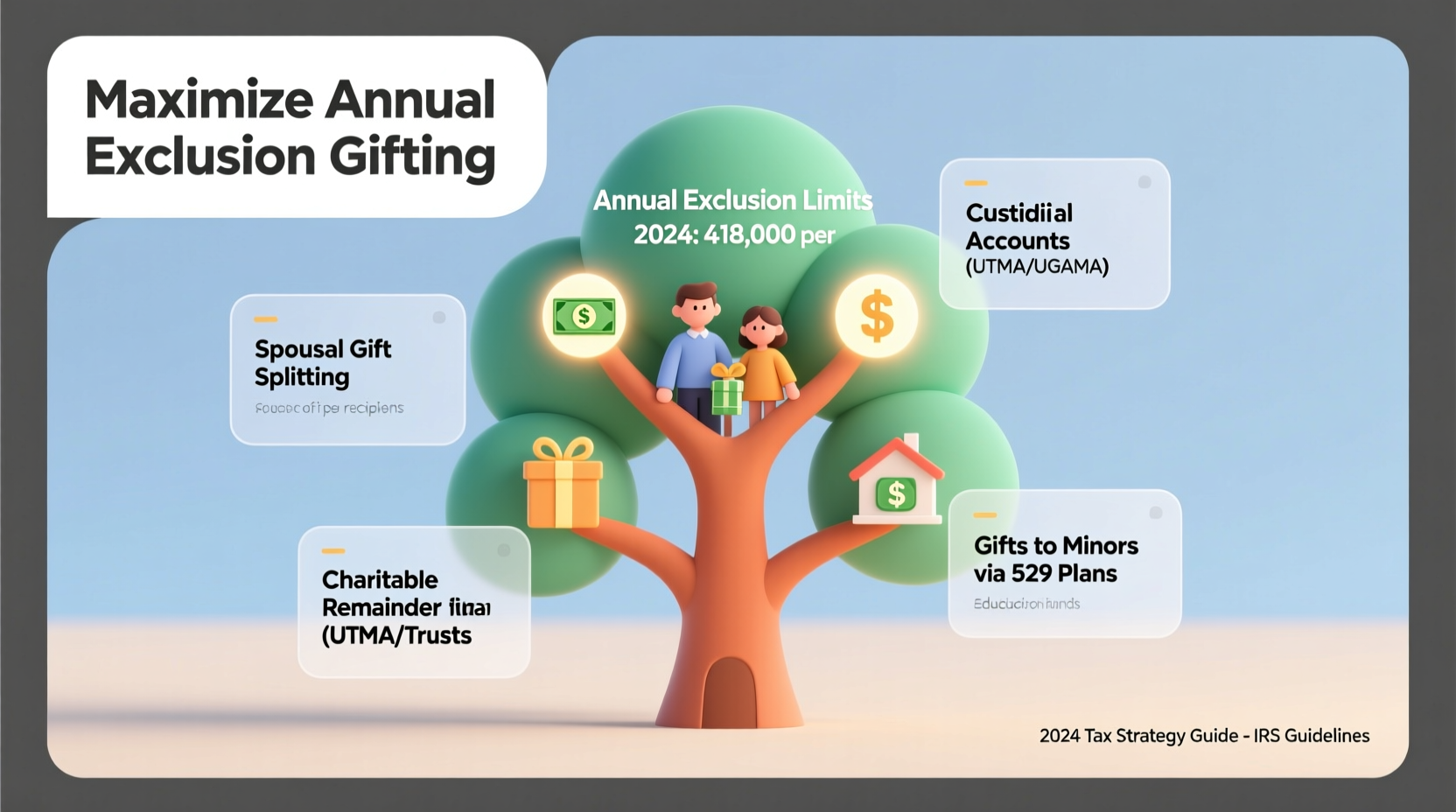

Gifting assets during your lifetime isn’t just a generous act—it’s a powerful financial planning tool. With the right approach, you can transfer significant wealth to loved ones without triggering gift taxes by leveraging the IRS annual exclusion. For 2024, the annual exclusion allows individuals to gift up to $18,000 per recipient ($36,000 for married couples filing jointly) each year, tax-free. Over time, these gifts compound into substantial transfers that reduce your taxable estate. But simply writing checks isn't enough. To truly maximize this opportunity, you need strategic planning, coordination, and foresight.

Understanding the Annual Exclusion Basics

The annual gift tax exclusion is one of the most underutilized tools in estate planning. It permits taxpayers to give away a set amount each year to any number of people without reporting the gift or using any portion of their lifetime gift and estate tax exemption. As of 2024, that amount is $18,000 per donor per recipient. This means a married couple can gift $36,000 annually to a single individual without filing a gift tax return.

These gifts must be present-interest gifts—meaning the recipient has immediate access to the funds or property. Future interests, such as placing money in a trust with delayed access, don’t qualify unless special elections like Crummey powers are used.

Smart Strategies to Maximize Gifting Efficiency

While the mechanics of gifting seem straightforward, the real value lies in how you structure and scale these transfers over time. Consider these proven strategies to get the most out of your annual exclusion.

1. Leverage Spousal Gifting

If you're married, both spouses can independently use their annual exclusions. By splitting gifts, a couple can transfer $36,000 per year to a single recipient. This doubles the impact and accelerates wealth transfer without tapping into the unified credit.

2. Gift to Multiple Recipients

There's no limit on the number of recipients. A grandparent with five children and ten grandchildren can gift $18,000 to each—totaling $270,000 annually (or $540,000 if married). This strategy works best when coordinated across generations to minimize estate taxes down the line.

3. Use 5-Year Averaging for Large Upfront Gifts

You’re allowed to pre-pay up to five years of annual exclusions in a single year. For example, you can gift $90,000 now to one person and elect to treat it as $18,000 per year over five years. If you die within that period, the prorated unused portion reverts to your estate. However, for healthy individuals, this is a safe way to front-load gifting.

“Front-loading gifts using the five-year election can accelerate wealth transfer by nearly half a decade.” — Laura Simmons, CPA and Estate Planning Advisor

4. Combine Gifting with 529 College Savings Plans

One of the most effective applications of accelerated gifting is funding 529 plans. You can contribute five years’ worth of annual exclusions—$90,000 per donor ($180,000 for couples)—into a child’s 529 account in one lump sum. The funds grow tax-free and can be used for qualified education expenses, including K–12 tuition and student loan repayments.

Do’s and Don’ts of Annual Exclusion Gifting

| Do’s | Don’ts |

|---|---|

| Do coordinate gifting with your spouse to double exclusion amounts | Don’t assume all transfers count—only present-interest gifts qualify |

| Do use 5-year averaging for large contributions like 529 plans | Don’t forget to file Form 709 if required (e.g., for split gifts) |

| Do keep records of all gifts for audit purposes | Don’t make indirect gifts (e.g., paying someone’s rent directly to them may not qualify) |

| Do consider gifting appreciating assets to lock in lower values | Don’t exceed exclusions without understanding reporting requirements |

Real-World Example: The Johnson Family Strategy

The Johnsons, a retired couple in Texas, wanted to help their three children and seven grandchildren build financial security. They structured their gifting plan as follows:

- Each year, they gift $36,000 to each of their 10 heirs (3 children + 7 grandchildren).

- Total annual transfer: $360,000.

- Every five years, they front-load 529 plans with $180,000 per grandchild ($90,000 from each grandparent).

- They also gifted low-basis stock to adult children, removing future appreciation from their estate.

Over 10 years, they transferred $3.6 million—entirely outside the gift tax system. Their estate shrank significantly, reducing potential estate tax exposure and providing meaningful support to younger generations.

Step-by-Step Guide to Implementing Your Gifting Plan

- Assess your goals: Determine whether you’re focused on education funding, estate reduction, or general wealth transfer.

- List all potential recipients: Include children, grandchildren, nieces, nephews, or even close friends.

- Calculate total gifting capacity: Multiply $18,000 by the number of recipients, then double it if married.

- Decide on asset type: Cash is simplest, but consider gifting appreciated securities (held over a year) to avoid capital gains for the recipient.

- Execute transfers before year-end: Ensure checks clear or electronic transfers complete by December 31.

- Document everything: Save copies of checks, transfer confirmations, and notes indicating the gift’s purpose.

- Consult your advisor: Review with a CPA or estate attorney to ensure compliance and optimize tax outcomes.

Frequently Asked Questions

Can I gift more than $18,000 to someone in one year?

Yes, but amounts exceeding the annual exclusion count against your lifetime gift and estate tax exemption ($13.61 million in 2024). While no tax is due immediately, you’ll need to file IRS Form 709 to report the gift. Exceptions include direct payments for medical or educational expenses, which are unlimited and don’t count toward the exclusion.

What happens if I accidentally exceed the annual exclusion?

You won’t owe gift tax immediately. Instead, the excess reduces your remaining lifetime exemption. However, failing to file Form 709 when required can lead to penalties. It’s better to over-report than under-report.

Can I revoke a gift after it’s made?

No. Once a gift qualifies as a completed present-interest transfer, it’s irrevocable. The recipient owns the asset outright. This is why gifting should be done thoughtfully, especially with large sums or volatile assets.

Conclusion: Start Today to Build Lasting Wealth Transfer

Maximizing the annual exclusion isn’t about aggressive tax avoidance—it’s about smart, intentional wealth stewardship. Every dollar gifted today is a dollar that won’t be taxed in your estate tomorrow. Whether you’re funding education, supporting family, or simplifying future inheritance, consistent annual gifting offers compounding benefits over time.

The strategies outlined here are accessible to anyone with a will or estate plan. But timing, documentation, and coordination matter. Talk to your financial advisor, update your recipient list, and make gifting a regular part of your financial rhythm. Small actions now can create generational impact later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?