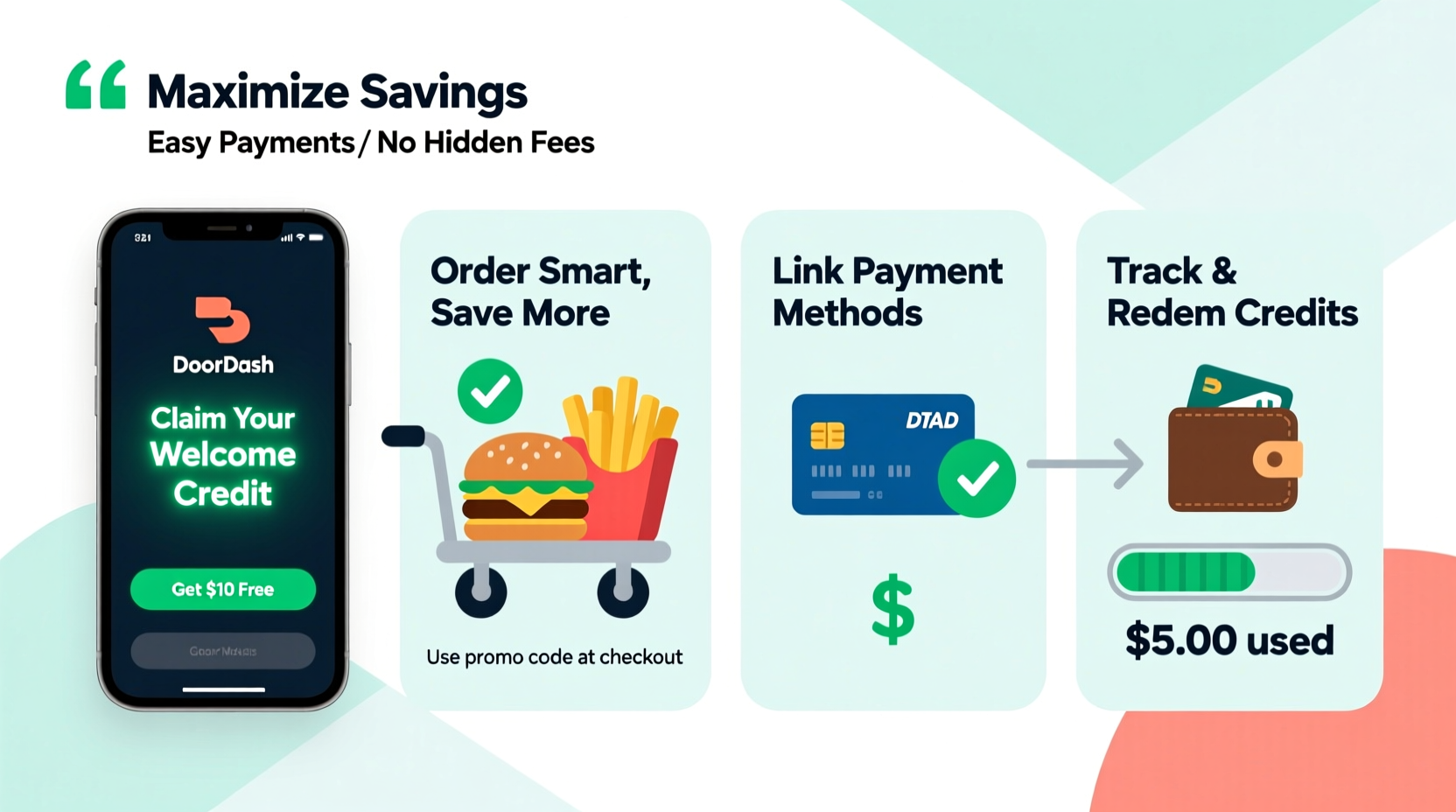

DoorDash has transformed the way millions of people access food, offering convenience at their fingertips. But convenience shouldn’t come at a premium—especially when you’re using DoorDash credit. Whether it’s a promotional balance, a gift card, or funds added directly to your account, making the most of your credit requires strategy. Understanding how DoorDash processes payments, applies credits, and structures fees is essential to stretch every dollar. With the right approach, you can reduce delivery costs, avoid surprise charges, and enjoy smoother transactions across restaurants, dashers, and peak times.

Understanding How DoorDash Credit Works

DoorDash credit comes in several forms: promotional balances from referrals, gift cards, DashCash (added funds), and rewards from loyalty programs like DashPass. While all appear as “credit” in your account, they don’t function identically. For example, promotional credits often have expiration dates or usage restrictions, while DashCash behaves like prepaid funds usable on any order.

The platform applies available credit automatically during checkout—but not always optimally. If multiple credits are available, DoorDash may prioritize older or expiring balances first. However, users cannot manually select which credit to use. This means timing and awareness matter. Knowing what type of credit you hold—and its limitations—can prevent wasted opportunities.

Step-by-Step Guide to Maximizing Your Credit

- Consolidate and Track All Credit Types

Review your payment section regularly. Identify active balances, including partial gift cards, referral bonuses, and DashPass perks. Group them by expiration date to prioritize usage. - Use Credit During Off-Peak Hours

Place orders between 2–5 PM or late morning when delivery fees are lower and surge pricing is rare. This increases the effective value of your credit. - Stack Credit with DashPass Benefits

If subscribed to DashPass ($9.99/month), combine your credit with $0 delivery fees on eligible orders. A $20 credit goes further when service and delivery fees are eliminated. - Avoid High-Fee Restaurants

Some restaurants charge elevated service fees (up to 25%). Use filters to sort by “Low Service Fee” or check the breakdown before ordering. - Time Orders Around Promotions

Sync credit usage with seasonal deals like “$10 off $25+” or free delivery weekends. Your credit covers food cost, while promotions reduce or eliminate fees.

Smart Payment Strategies to Reduce Out-of-Pocket Costs

Your goal should be minimizing cash outlay while preserving credit longevity. One overlooked tactic is splitting payments. DoorDash allows combining one credit method (like DashCash) with a saved card for the remainder. This flexibility lets you use small credit amounts without losing them to rounding or minimums.

For example, if you have $7.50 in credit and order a $15 meal, apply the full credit and pay $7.50 plus tip via card. Without this option, you might feel pressured to overspend to “use it all,” leading to unnecessary purchases.

| Strategy | Benefit | Risk to Avoid |

|---|---|---|

| Use credit + card combo | Preserve partial balances | Forgetting to update default payment method |

| Order from low-fee kitchens | More credit goes toward food | Assuming all local spots are equal |

| Schedule non-urgent orders | Avoid surge pricing | Missing time-sensitive deals |

Real Example: How Sarah Saved 38% on Monthly Takeout

Sarah, a marketing professional in Austin, used to spend around $200 monthly on delivery. After reviewing her spending, she realized only $140 went to food—the rest was fees, tips, and taxes. She switched tactics: she referred three friends (earning $30 in credit), activated DashPass, and began placing weekday lunch orders between 1–3 PM from restaurants with sub-10% service fees.

She now uses her monthly $30 credit strategically, stacking it with DashPass’ fee-free benefit. Her average order cost dropped to $125, with $95 going directly to meals. Over a year, she saved $900—equivalent to 15 free dinners.

“Many users treat credit like an afterthought, but it’s a tool. When paired with behavioral changes, even small balances create measurable savings.” — Jamal Reed, Fintech Consumer Analyst

Avoiding Common Pitfalls That Waste Credit

- Ignoring Expiration Dates: Promotional credits often expire in 30–60 days. Set calendar reminders for balances nearing expiry.

- Over-Tipping Automatically: Default tip suggestions are based on total cost, including fees. Manually adjust tips to reflect actual food value.

- Using Credit for Urgent Orders: Rush deliveries during dinner hours incur higher demand fees. Delay non-essential orders to save credit for better conditions.

- Not Checking Restaurant Markups: Some chains increase menu prices on third-party apps. Compare in-store vs. app pricing to ensure value.

Checklist: Optimize Your DoorDash Credit in 7 Actions

- ✅ Audit all available credit types and expiration dates monthly

- ✅ Subscribe to DashPass if ordering 2+ times per month

- ✅ Filter restaurants by low service fees and delivery costs

- ✅ Schedule non-urgent orders during off-peak hours

- ✅ Combine partial credit with a backup payment method

- ✅ Disable auto-tipping or manually adjust suggested amounts

- ✅ Stack credit usage with active promotions or holiday deals

Frequently Asked Questions

Can I use multiple gift cards or credits on one order?

No. DoorDash combines available credit into a single balance. You cannot selectively apply specific gift cards. However, all eligible funds will be used automatically up to the order total before charging your card.

Does DoorDash credit cover tips?

Yes, unless restricted by promotion terms. Most credit types—including DashCash and gift cards—can be applied to tips. However, some referral bonuses exclude tipping. Always check the terms in your payment settings.

Why didn’t my credit fully apply to my order?

This typically happens when the credit balance is less than the pre-tip total. DoorDash applies credit first, then charges the remaining amount to your default payment method. Ensure your backup card is updated to avoid failed transactions.

Conclusion: Turn Small Credits Into Big Savings

Maximizing your DoorDash credit isn’t about chasing discounts—it’s about disciplined spending, strategic timing, and understanding the platform’s mechanics. By tracking balances, avoiding high-fee traps, and aligning orders with optimal conditions, you gain control over your takeout budget. Every dollar saved on fees is a dollar that stretches further. Whether you're an occasional user or a daily diner, these practices transform credit from a minor perk into a powerful financial tool. Start today: review your current balance, refine your preferences, and make your next order your most efficient yet.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?