In the evolving world of blockchain and distributed ledger technologies, efficiency, speed, and scalability remain central challenges. As developers and enterprises push for faster transaction processing and lower latency, new concepts like \"nano blocks\" and \"micro blocks\" have emerged. But what exactly are they? How do they differ? And more importantly, are nano blocks truly a breakthrough—or just another buzzword wrapped in marketing hype?

Understanding the distinction between nano and micro blocks isn't just academic—it has tangible implications for system design, energy consumption, and real-time application performance. Let’s cut through the noise and examine these two approaches with clarity and depth.

What Are Micro Blocks and Nano Blocks?

Micro blocks are small batches of transactions aggregated at frequent intervals—typically every few seconds—to reduce network congestion and improve throughput. They originated as part of solutions like IOTA’s Tangle and later influenced other high-performance chains. Micro blocks don’t replace full blocks; instead, they act as incremental updates that keep the ledger moving while waiting for periodic consensus on larger block intervals.

Nano blocks, by contrast, represent an even more granular approach. These are ultra-lightweight data structures designed to carry minimal transaction payloads—sometimes just a single transfer or state update—with near-instant finality. The term “nano” reflects their size and speed rather than a standardized protocol. In some systems, such as Nano (the cryptocurrency), the architecture is built around this concept from the ground up using a block-lattice model where each account has its own chain of one-block-per-transaction entries.

Key Differences: A Side-by-Side Comparison

| Feature | Nano Blocks | Micro Blocks |

|---|---|---|

| Average Size | 50–200 bytes | 1–10 KB |

| Frequency | Per transaction (as needed) | Every 1–5 seconds |

| Finality Time | <1 second (immediate in some models) | 1–3 seconds |

| Consensus Mechanism | Often DAG-based or vote-driven | Leader-based batching within main chain |

| Use Case Fit | IoT, micropayments, instant settlements | High-throughput dApps, gaming, DeFi |

| Energy Efficiency | Very high (low compute per block) | Moderate to high |

Performance in Real-World Applications

The theoretical advantages of nano blocks—speed, low cost, and scalability—are compelling. But how do they perform outside whitepapers?

Take the cryptocurrency **Nano** (formerly RaiBlocks), which uses a block-lattice structure. Each user has their own blockchain, and every transaction is a single block signed by the sender and receiver. This allows for zero-fee, instant transactions. In practice, users report confirmation times under half a second during peak loads, making it ideal for vending machines, tipping bots, and real-time service payments.

On the other hand, platforms like Hedera Hashgraph use micro blocks to batch thousands of transactions per second across a global network. While not quite as fast per individual operation, the system achieves high aggregate throughput with strong consistency guarantees—better suited for enterprise applications requiring auditability and compliance.

“Nano-scale architectures shift the paradigm from ‘batch optimization’ to ‘event immediacy.’ It’s not about doing more at once—it’s about reacting instantly.” — Dr. Lena Patel, Distributed Systems Researcher at MIT

Mini Case Study: Coffee Shop Payment Pilot

A pilot program in Berlin tested both nano and micro block systems for contactless coffee purchases. Using a wallet built on the Nano protocol, customers completed payments in an average of 0.4 seconds with no fees. During rush hour, the system handled over 120 transactions per minute without lag.

The same shop trialed a micro block-enabled platform (based on a private Hedera mirror node). Transactions were confirmed in ~1.8 seconds on average and required minor backend infrastructure to manage node synchronization. While reliable, the delay was noticeable enough that baristas preferred the immediacy of the nano block solution.

The takeaway? For consumer-facing, low-latency interactions, nano blocks delivered a smoother experience. However, when integrated into broader accounting systems, the structured nature of micro blocks made reconciliation easier.

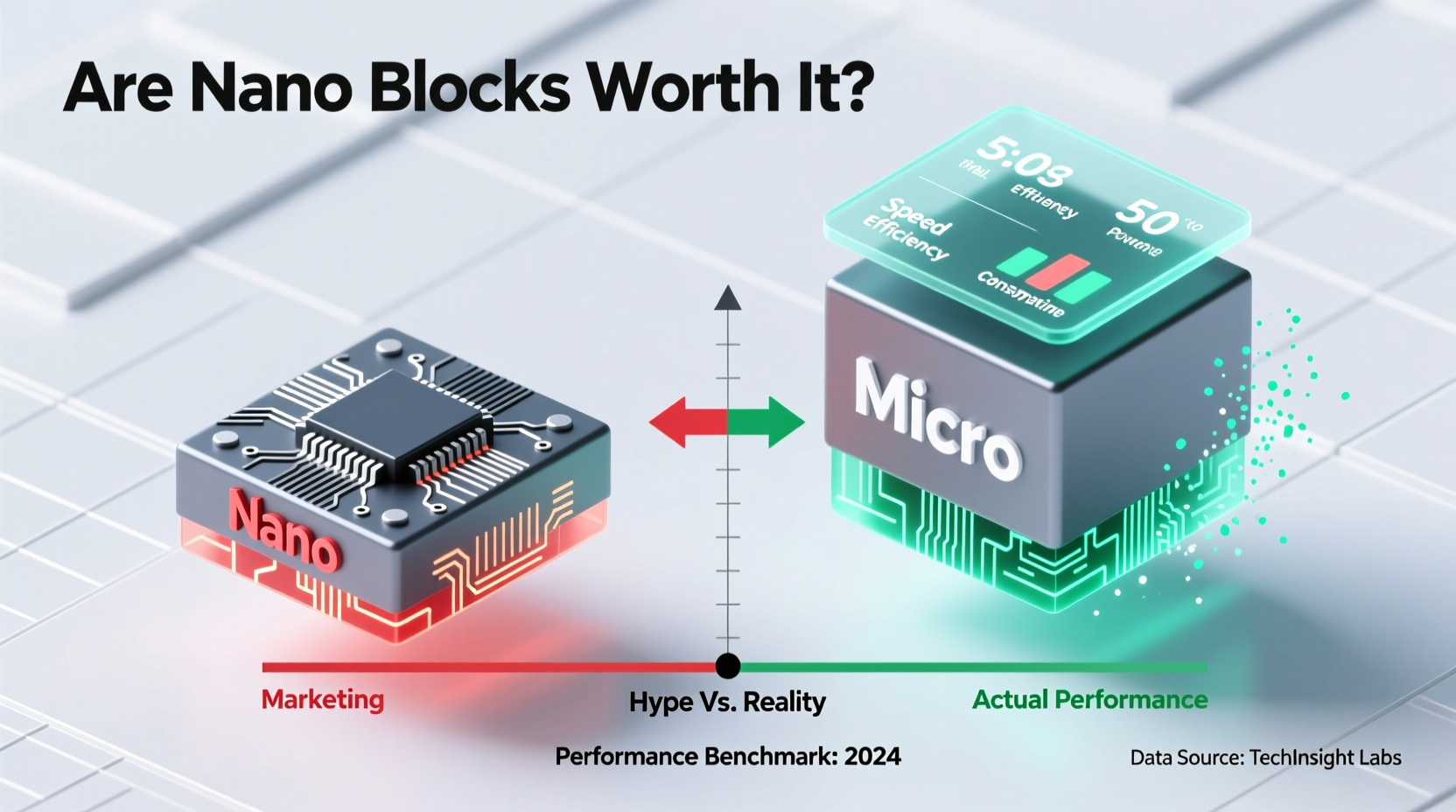

Is the Hype Around Nano Blocks Justified?

The answer depends on your definition of value. If you prioritize raw speed and minimal resource usage, then yes—nano blocks offer genuine innovation. Their ability to process discrete events with negligible overhead opens doors for machine-to-machine economies, smart cities, and embedded finance.

But calling them universally superior would be misleading. Nano blocks often sacrifice global ordering and rely heavily on asynchronous consensus mechanisms, which can complicate dispute resolution. Some implementations also face criticism for centralization risks—such as reliance on representative nodes for voting.

Marketing teams have certainly latched onto the term “nano” as synonymous with futuristic efficiency. Yet, unlike many tech fads, there’s functional substance behind it. What’s missing is context: nano blocks aren’t replacing traditional or micro block systems—they’re complementing them in niches where microseconds matter.

Implementation Checklist: Choosing the Right Approach

Before adopting either technology, consider the following checklist:

- ✅ Define your primary performance metric: Is it speed, cost, auditability, or throughput?

- ✅ Assess network conditions: Will nodes operate in low-bandwidth environments?

- ✅ Determine finality requirements: Can you tolerate probabilistic confirmation?

- ✅ Evaluate developer tooling: Are SDKs mature and well-documented?

- ✅ Review governance model: Who controls validators or voting representatives?

- ✅ Test failover behavior: How does the system handle partitions or malicious actors?

Common Misconceptions Debunked

Misconception 1: “Smaller blocks always mean faster networks.”

Not necessarily. Smaller blocks reduce propagation time, but if consensus requires multiple rounds of communication (e.g., votes or endorsements), overall latency may increase.

Misconception 2: “Nano blocks eliminate miners/validators.”

Most nano block systems still require coordination. In Nano (the currency), for example, representatives vote to confirm transactions. The absence of mining doesn’t imply absence of trust assumptions.

Misconception 3: “Micro blocks are outdated.”

Far from it. Ethereum’s proposed merge into slot-based consensus with proposer-builder separation relies on micro-timing principles. Speed isn’t only about block size—it’s about orchestration.

Frequently Asked Questions

Can nano blocks scale to global payment volumes?

Potentially, yes—but scalability depends on network topology and anti-spam mechanisms. Systems like Nano use delegated voting and require lightweight Proof-of-Work for spam deterrence. Under stress tests, the network has sustained over 7,000 TPS, though long-term resilience under adversarial conditions remains debated.

Do micro blocks consume more energy?

Generally, no. Energy use correlates more with consensus mechanism than block frequency. A micro block system using proof-of-stake (like Cardano) consumes far less power than a PoW chain, regardless of block size.

Are nano blocks secure against double-spending?

They can be, provided the underlying consensus is robust. In the Nano cryptocurrency, conflicting transactions are resolved via a voting mechanism weighted by stake. However, if a majority of representatives collude, rollback is possible—a known trade-off for speed.

Conclusion: Beyond the Buzzwords

The debate between nano blocks and micro blocks isn’t about declaring a winner—it’s about matching architecture to intent. Nano blocks excel in scenarios demanding immediacy and frugality: think sensors, wearables, or peer-to-peer tipping. Micro blocks shine in ecosystems needing structured throughput and compatibility with existing infrastructure, such as financial services or supply chain tracking.

The real danger lies not in choosing one over the other, but in being swayed by terminology devoid of technical grounding. “Nano” sounds sleek, but engineering decisions should stem from requirements, not labels.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?