Walk into any coffee shop, grocery store, or transit hub today, and you’ll see people tapping their phones or cards on terminals to pay. The cashier might say “contactless,” while your phone displays an “NFC” prompt. It’s easy to assume these are two different technologies competing for your attention—but are they? Or is this just another case of marketing blurring technical lines?

The short answer: NFC is the technology; contactless payment is one of its most common applications. But unpacking that distinction reveals more nuance than most realize. Understanding how they relate—and where they diverge—can help consumers make smarter choices about security, compatibility, and future-proofing their digital wallets.

What Is NFC? The Foundation of Tap-to-Pay

Near Field Communication (NFC) is a set of communication protocols that enable two electronic devices—typically a smartphone and a point-of-sale terminal—to exchange data when within 4 cm (about 1.5 inches) of each other. It evolved from radio-frequency identification (RFID) but adds bidirectional communication, allowing not just reading but also writing data.

NFC operates at 13.56 MHz and transfers data at speeds up to 424 kbit/s. While slow by modern standards, this is more than sufficient for transmitting encrypted payment tokens, loyalty cards, or access credentials. Its limited range enhances security by reducing the risk of unintended interception.

Three primary modes define how NFC functions:

- Reader/Writer Mode: A device reads information from passive tags (e.g., smart posters).

- Card Emulation Mode: Your phone acts like a contactless card, used in payments via Apple Pay, Google Pay, etc.

- Peer-to-Peer Mode: Two NFC-enabled devices exchange data (e.g., sharing contacts).

Contactless Payment: The Consumer-Facing Experience

Contactless payment refers to any method of paying without physically inserting or swiping a card. This includes tapping a credit/debit card, key fob, wearable, or smartphone on or near a payment terminal. Under the hood, most contactless systems rely on either NFC or a closely related standard called RFID.

When you tap your Visa card with the wave symbol (🡒), you're using EMV Contactless technology—a specification built on top of NFC hardware. Banks and card networks adopted NFC because it supports secure element chips, dynamic encryption, and tokenization, all critical for financial transactions.

In practice, “contactless” is the term merchants and banks use to describe the user experience. You don’t need to know what’s under the hood—you just want to pay quickly and securely. That’s why ATMs and terminals display “Tap to Pay” rather than “NFC Enabled.”

“Consumers interact with contactless as a service, but NFC is the invisible engine making it possible.” — Dr. Lena Patel, Senior Researcher at the Mobile Payments Institute

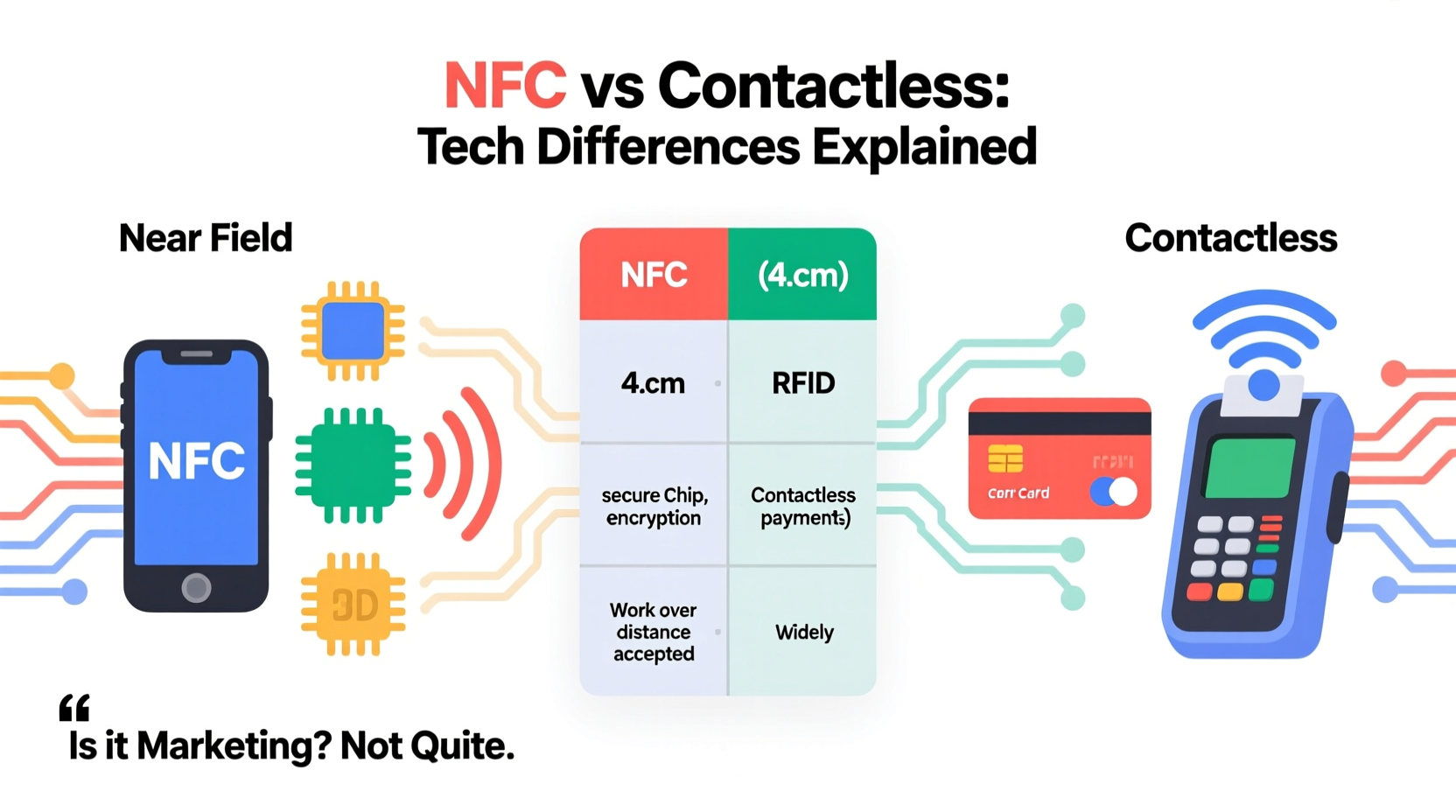

NFC vs Contactless: Breaking Down the Confusion

The confusion arises because the terms are often used interchangeably—even by companies selling payment solutions. But technically, they belong to different categories:

| Aspect | NFC | Contactless Payment |

|---|---|---|

| Definition | A wireless communication technology | A payment method using tap-based interaction |

| Scope | Broad: payments, access control, data transfer | Narrow: focused on financial transactions |

| Hardware Requirement | NFC chip in device | Either NFC chip or RFID-enabled card |

| Use Cases | Payments, ticketing, device pairing, smart home control | Only transactional scenarios |

| User Visibility | Hidden layer; users rarely see the term | Prominent branding on cards and terminals |

Think of it like Wi-Fi and web browsing: you browse the internet using Wi-Fi, but no one says “I’m Wi-Fiing” when checking email. Similarly, you make a contactless payment using NFC.

Real-World Example: Riding the London Underground

Consider a tourist arriving in London who wants to ride the Tube. They have two options:

- Buy an Oyster card (contactless smartcard using NFC).

- Use their iPhone with Apple Pay linked to their U.S.-issued Mastercard.

Both methods work seamlessly at the turnstile. The system doesn’t care whether the user taps a plastic card or a phone—the backend reads the same NFC signal and processes the fare. From the rider’s perspective, both are “contactless.” But only one involves a general-purpose NFC device (the phone), capable of doing much more than transit payments.

This illustrates how infrastructure treats contactless as a functional category, while NFC enables flexibility across platforms and services.

Security Implications: Are They Equally Safe?

Because contactless payments run on NFC, they inherit its security framework—but add additional layers. Here's how protection works in practice:

- Tokenization: Instead of sending your real card number, your phone or card transmits a one-time-use token unique to that transaction.

- D限额 Transactions: Most countries limit contactless payments to small amounts (e.g., £100 in the UK, $100 in the U.S.) without requiring PIN entry.

- Proximity Control: NFC’s 4 cm range prevents long-distance skimming, though early fears about “wallet theft” led to RFID-blocking sleeves (largely unnecessary today).

However, not all NFC uses are equally secure. For example, peer-to-peer file sharing over NFC lacks the encryption standards of payment systems. So while the underlying tech is safe, the application determines actual risk.

Future Outlook: Convergence and Expansion

As digital wallets evolve, the line between NFC and contactless may blur further. Samsung Pay once used MST (Magnetic Secure Transmission) to mimic swipe signals on older terminals, but has since phased it out in favor of pure NFC due to wider adoption of modern POS systems.

Emerging trends include:

- Wearables integration: Smart rings and watches now support full NFC stacks for payments.

- Multi-application hubs: Phones storing IDs, boarding passes, keys, and loyalty cards—all activated via NFC tap.

- Offline capabilities: NFC tags triggering actions without internet (e.g., hotel check-in via room door tag).

Meanwhile, central banks exploring digital currencies (CBDCs) are evaluating NFC as a distribution mechanism for offline transactions—proving its staying power beyond simple convenience.

Frequently Asked Questions

Can I use my contactless card if my phone dies?

Yes. Physical contactless cards operate independently of smartphones and remain functional during power outages or battery failure. However, mobile wallets stored on smartwatches may still work briefly after phone disconnection, depending on setup.

Do all NFC-enabled phones support contactless payments?

No. While nearly all modern Android and iOS devices include NFC hardware, some budget models disable payment functionality. Additionally, regional restrictions or carrier locks may prevent Google Pay or Apple Pay activation.

Is contactless payment slower than inserting a chip?

No—in fact, it’s significantly faster. A tap takes less than half a second, whereas chip transactions average 3–5 seconds due to processing and authentication delays. Speed is one reason retailers aggressively promote contactless adoption.

Final Thoughts: Beyond Marketing Hype

The distinction between NFC and contactless payment isn’t marketing fluff—it’s a matter of layering. NFC is the enabling technology, like electricity powering a lightbulb. Contactless payment is the bulb: visible, useful, and designed for end users. Confusing them isn’t wrong, but understanding the relationship empowers better decisions.

Next time you tap to pay, remember: you’re not choosing between NFC and contactless. You’re benefiting from their synergy. Whether through a card, watch, or phone, the seamless experience is the result of years of engineering convergence—not corporate spin.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?