PayPal’s “Pay in 4” feature has become a popular buy-now, pay-later option for shoppers looking to spread the cost of purchases over time without interest. However, many users report sudden issues when trying to use the service—declined transactions, missing options at checkout, or unexpected eligibility errors. If you’ve encountered these problems, you’re not alone. Understanding the root causes and knowing how to resolve them quickly can save time, frustration, and missed purchase opportunities.

Why Pay in 4 Might Not Be Working

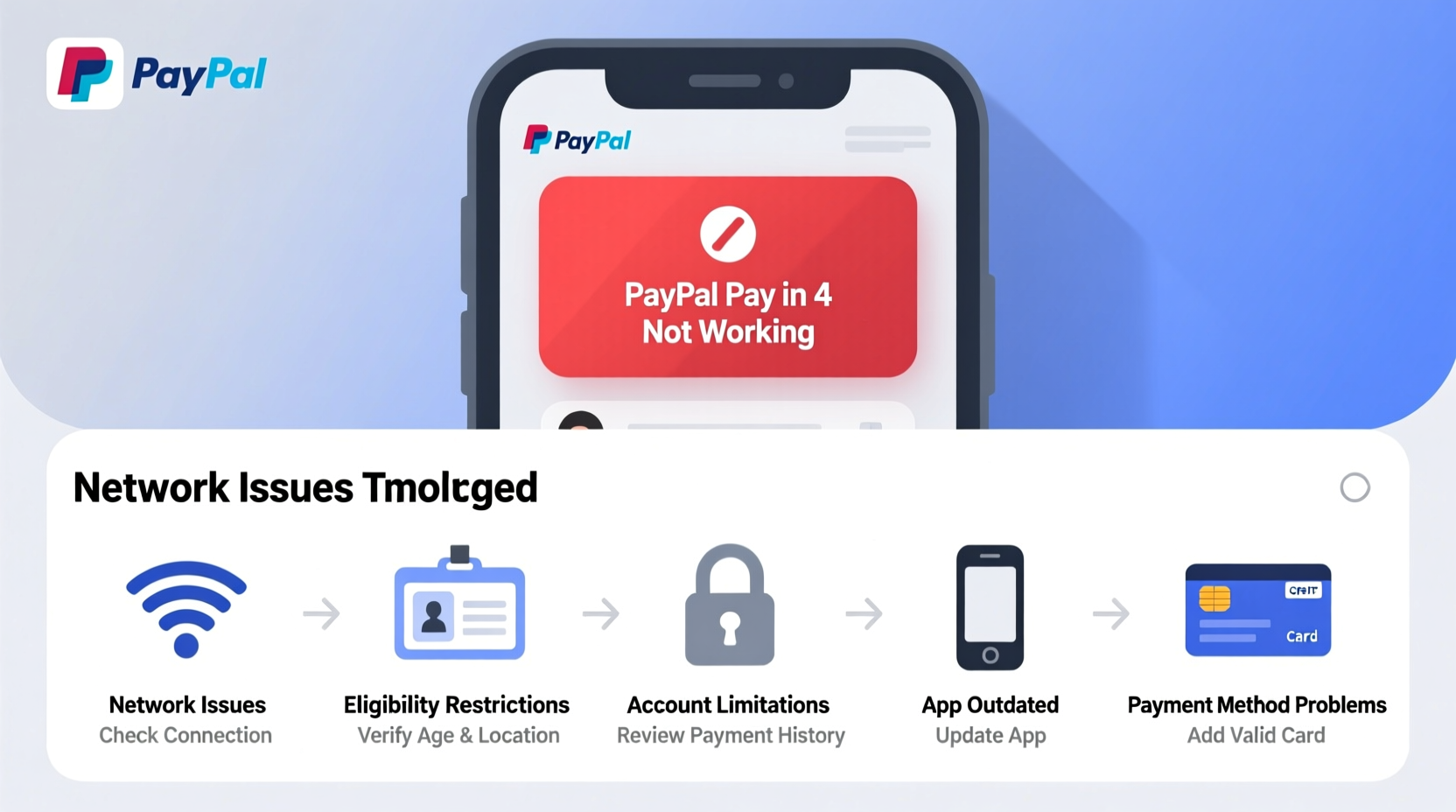

Several factors can prevent PayPal Pay in 4 from functioning correctly. These range from account-specific restrictions to technical glitches on either your device or PayPal’s end. Identifying the exact cause is the first step toward restoring access.

- Eligibility issues: Not all users qualify for Pay in 4 based on credit history, spending behavior, or location.

- Transaction limits: Each user has a spending cap that varies over time; exceeding it blocks further use.

- Unsupported merchant: The retailer may not accept Pay in 4 as a payment method.

- Device or browser problems: Outdated software or cached data can interfere with PayPal’s interface.

- Account limitations: Past late payments or defaults may result in temporary suspension.

Common Technical Issues and Fixes

Even if you're eligible, technical hiccups can prevent Pay in 4 from appearing or processing correctly. These are often solvable with simple troubleshooting steps.

Clear Browser Cache and Cookies

Stored data can corrupt PayPal’s session handling. Clearing your cache forces a fresh connection.

- Open your browser settings.

- Navigate to Privacy or History.

- Select “Clear browsing data” (including cookies and cached files).

- Restart the browser and log back into PayPal.

Try a Different Device or Browser

If Pay in 4 doesn’t appear on mobile, test on desktop. Some features render inconsistently across platforms. Use updated versions of Chrome, Firefox, or Safari for best results.

Disable Browser Extensions

Ad blockers, privacy tools, or script managers may interfere with PayPal’s JavaScript. Temporarily disable extensions to test functionality.

Check App Version (Mobile Users)

Outdated PayPal apps lack support for newer features. Visit your app store and ensure you’re running the latest version.

| Issue | Possible Cause | Solution |

|---|---|---|

| Pay in 4 option missing | Merchant doesn’t support it | Shop at a participating retailer |

| Payment declined | Exceeded spending limit | Wait for next cycle or reduce cart value |

| Login loop after selection | Bug in browser session | Clear cookies or try incognito mode |

| \"Not eligible\" message | Temporary account restriction | Contact PayPal support |

Account Eligibility and Financial Factors

Pay in 4 isn’t automatically available to every PayPal user. The system evaluates multiple financial and behavioral metrics to determine qualification.

According to PayPal, eligibility depends on:

- Residency in a supported country (currently U.S., UK, France, Italy, Spain, Austria, Belgium, Netherlands).

- Being at least 18 years old.

- Maintaining a good standing with previous Pay in 4 payments.

- Having a linked debit card (credit cards aren’t accepted for repayment).

- No recent reports of fraud or suspicious activity.

If you've missed a prior installment or made a late payment, PayPal may suspend your access temporarily—even if the balance is now paid off. Reinstatement typically occurs after consistent positive behavior, but there's no fixed timeline.

“We assess each customer’s risk profile dynamically. A single late payment doesn’t permanently disqualify someone, but repeated issues will trigger longer holds.” — PayPal Customer Support Spokesperson

Step-by-Step Guide to Restore Pay in 4 Access

If Pay in 4 isn’t working, follow this structured approach to diagnose and resolve the issue:

- Verify Merchant Support: Confirm the store accepts Pay in 4 by checking their payment page or contacting customer service.

- Review Your PayPal Balance: While Pay in 4 uses installments, having a zero balance and no linked funding source can cause errors.

- Check Spending Limit: Log into your PayPal account, go to the Pay in 4 section, and view your current limit and remaining available amount.

- Update Payment Method: Ensure a valid debit card is linked and set as default.

- Test on Another Site: Try using Pay in 4 on a known compatible platform like Walmart or eBay to isolate the problem.

- Log Out and Back In: End your session completely, clear cache if needed, then re-authenticate.

- Contact PayPal Support: If all else fails, submit a request via the Help & Contact section within your account.

Real-World Example: Sarah’s Checkout Failure

Sarah, a frequent online shopper in California, tried to use Pay in 4 to buy new headphones. At checkout, the option didn’t appear. She assumed her account was frozen. After reviewing her PayPal dashboard, she noticed her last payment had been processed two days late due to insufficient funds. Though she’d since added money, the system hadn’t reinstated her full access.

She contacted PayPal support through chat and explained the situation. The agent confirmed a temporary hold due to the late payment but noted it would lift in seven days. In the meantime, Sarah used her debit card directly and scheduled automatic transfers to avoid future shortfalls. One week later, Pay in 4 reappeared at checkout.

This case illustrates how even minor delays can impact service availability—and why proactive communication with PayPal matters.

Troubleshooting Checklist

Use this checklist to systematically resolve Pay in 4 issues:

- ✅ Is the merchant eligible for Pay in 4?

- ✅ Am I logged into the correct PayPal account?

- ✅ Is my device or browser up to date?

- ✅ Have I cleared cache and cookies recently?

- ✅ Do I have a linked and verified debit card?

- ✅ Have I exceeded my current spending limit?

- ✅ Were my last payments made on time?

- ✅ Has PayPal placed any notifications or alerts on my account?

Frequently Asked Questions

Why did Pay in 4 disappear from my account overnight?

Sudden removal usually stems from a late or missed payment, reaching your spending cap, or PayPal detecting unusual activity. Review your transaction history and check for messages in your account inbox.

Can I increase my Pay in 4 limit?

Yes, but not manually. PayPal adjusts limits based on usage patterns, repayment history, and time. Consistently paying on time over several months often leads to gradual increases.

Does using Pay in 4 affect my credit score?

In most cases, no. PayPal does not report Pay in 4 activity to credit bureaus under normal circumstances. However, if an account goes into collections due to non-payment, it may be reported and impact your score.

Final Thoughts and Action Steps

PayPal Pay in 4 is a convenient tool, but its reliability depends on both technical setup and financial responsibility. Most issues are temporary and resolvable with careful attention to account status, browser health, and merchant compatibility.

The key is consistency: make payments on time, keep your app updated, and monitor your spending limit. When problems arise, don’t assume permanent disqualification—most restrictions are designed to encourage responsible borrowing and can be reversed.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?