Improving your credit isn’t just about raising a number—it’s about building a foundation for long-term financial freedom. A strong credit profile opens doors to lower interest rates, better loan terms, rental approvals, and even job opportunities in some industries. The good news? Credit improvement is within reach, regardless of your current standing. With consistent habits and informed decisions, you can steadily rebuild or strengthen your credit while cultivating financial resilience that lasts.

Understand How Credit Works

Credit scoring models like FICO and VantageScore assess your financial behavior across several key factors. Knowing what influences your score helps you prioritize the right actions:

- Payment History (35%) – Whether you pay bills on time.

- Credit Utilization (30%) – How much of your available credit you're using.

- Length of Credit History (15%) – The average age of your accounts.

- Credit Mix (10%) – The variety of credit types (e.g., installment loans, credit cards).

- New Credit Inquiries (10%) – How often you apply for new credit.

Focus on these areas strategically, and your score will respond over time. Patience and consistency matter more than quick fixes.

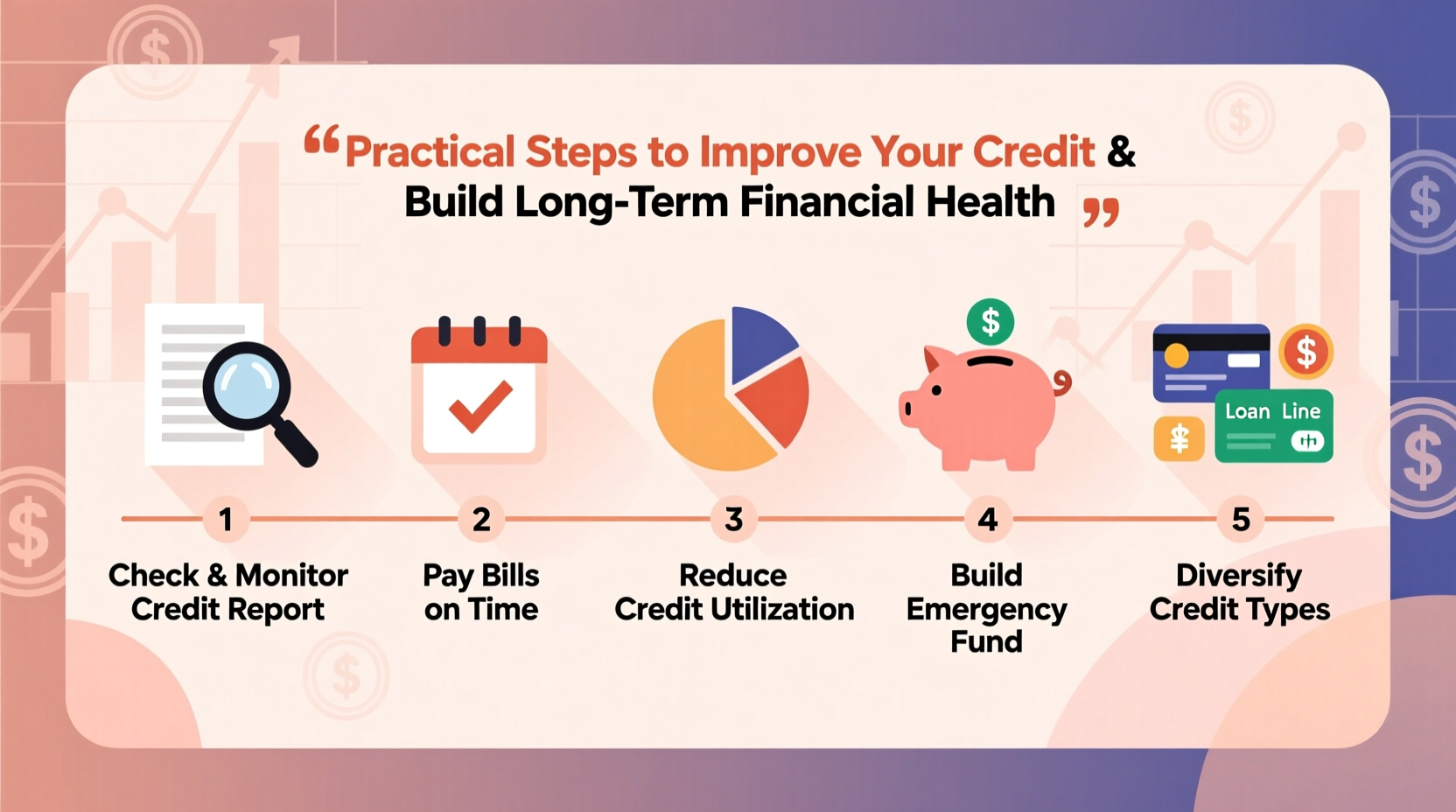

Step-by-Step Plan to Improve Your Credit

Rebuilding or enhancing your credit follows a clear path. Here’s a realistic 12-month timeline to guide your progress:

- Month 1–2: Audit Your Credit Reports

Obtain free reports from all three bureaus—Equifax, Experian, and TransUnion—at AnnualCreditReport.com. Review for errors such as incorrect late payments, duplicate collections, or fraudulent accounts. - Month 3: Dispute Inaccuracies

File disputes online with each bureau for any errors. Include documentation and keep copies. Most investigations conclude within 30 days. - Month 4–6: Reduce Credit Utilization

Aim to use less than 30% of your limit—ideally under 10%. Pay down balances aggressively or request credit limit increases (without increasing spending). - Month 7–9: Establish Positive Payment Patterns

Use a secured credit card or credit-builder loan if you have limited or poor credit. Make small purchases and pay them off in full each month. - Month 10–12: Monitor Progress and Expand Responsibly

Check your score monthly. Consider adding one new type of credit (e.g., a small installment loan) to diversify your mix, but only if manageable.

Key Habits for Long-Term Financial Health

Credit repair is not a one-time fix. Sustainable financial well-being requires ongoing discipline. Integrate these practices into your routine:

- Budget Religiously – Track income and expenses using tools like spreadsheets or apps. Allocate funds for debt repayment, savings, and discretionary spending.

- Build an Emergency Fund – Aim for $500 initially, then work toward 3–6 months of living expenses. This prevents reliance on credit during unexpected setbacks.

- Avoid Closing Old Accounts – Closing long-standing accounts shortens your credit history and reduces available credit, which can hurt your score.

- Limit Hard Inquiries – Only apply for credit when necessary. Multiple applications in a short period signal risk to lenders.

“Your credit score is a reflection of behavior, not character. But changing that behavior—even slightly—can dramatically shift your financial trajectory.” — Lisa Johnson, Certified Financial Planner

Do’s and Don’ts of Credit Building

| Do | Don't |

|---|---|

| Pay all bills on time, including rent and utilities (if reported) | Miss payments or make partial payments without arrangement |

| Keep credit card balances low relative to limits | Max out credit cards or carry high revolving debt |

| Use credit monitoring services to stay informed | Ignore your credit reports or assume they’re error-free |

| Apply for new credit sparingly and strategically | Open multiple accounts quickly to “build” credit |

| Consider becoming an authorized user on a responsible person’s account | Co-sign loans unless absolutely necessary and fully trusted |

Real Example: Rebuilding After Medical Debt

Sarah, a 34-year-old teacher, faced a sudden medical emergency that left her with $8,000 in unpaid bills sent to collections. Her credit score dropped from 710 to 580. Determined to recover, she took action:

- She requested her credit reports and confirmed the collection was accurate but outdated—over two years old.

- She negotiated a pay-for-delete agreement with the agency, settling for $5,000 in exchange for removal from her report.

- She opened a secured credit card with a $500 limit, charging only groceries and paying the balance in full monthly.

- She set up automatic transfers to a high-yield savings account to build her emergency fund.

Within 18 months, Sarah’s score climbed to 685. She qualified for a credit union personal loan to consolidate remaining debt at a lower rate. Today, she maintains a 720+ score and uses credit intentionally, never carrying a balance.

Essential Checklist for Credit Success

- ✅ Obtain free credit reports from all three bureaus

- ✅ Dispute and resolve inaccuracies

- ✅ Set up automatic bill payments

- ✅ Keep credit utilization below 30%

- ✅ Avoid unnecessary credit applications

- ✅ Open a secured card or credit-builder loan if needed

- ✅ Build a starter emergency fund

- ✅ Review credit score every 3–6 months

Frequently Asked Questions

How long does it take to improve a credit score?

It depends on your starting point. Late payments stay on record for seven years, but their impact diminishes over time. With consistent effort, most people see noticeable improvements within 6–12 months. Rapid rescoring (for mortgage applicants) can accelerate updates in 7–10 days.

Can I improve my credit without a credit card?

Yes. Alternatives include credit-builder loans from credit unions, rent reporting services like *Experian Boost*, and utility payment tracking through programs like *UltraFICO*. These help establish positive history without traditional revolving credit.

Does checking my own credit hurt my score?

No. When you check your credit report or score yourself, it's considered a soft inquiry and has no effect. Only hard inquiries from lenders during applications impact your score.

Take Control of Your Financial Future

Improving your credit is one of the most empowering financial moves you can make. It starts with awareness, continues with disciplined habits, and grows through persistence. Every on-time payment, every reduced balance, and every smart decision compounds over time. You don’t need perfection—just consistency. Begin today by reviewing your credit report, correcting errors, and setting up systems that support responsible behavior. Financial health isn’t achieved overnight, but each step forward builds momentum toward greater freedom, security, and opportunity.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?