Accessing cash when you're short on funds is a common need, but using your credit card at an ATM can come with steep costs. Credit card cash advances often carry high interest rates—sometimes exceeding 25%—with no grace period, plus additional fees that can be 3% to 5% of the withdrawal amount. These charges make traditional cash advances one of the most expensive ways to borrow money. However, with smart planning and alternative approaches, it’s possible to get the cash you need while avoiding or minimizing those punishing fees.

The key lies in understanding how credit card cash access works and leveraging tools and tactics that reduce or eliminate the financial penalties. From merchant workarounds to balance transfers and peer-based solutions, there are several underused methods that offer liquidity without the typical cost burden.

Understanding the True Cost of Cash Advances

Before exploring alternatives, it's essential to understand why standard cash advances are so costly. When you withdraw cash from an ATM using your credit card, three types of fees typically apply:

- Cash advance fee: Usually 3% to 5% of the amount withdrawn, with a minimum fee (e.g., $10).

- High APR: Cash advance interest rates are significantly higher than purchase rates and begin accruing immediately—no grace period.

- ATM or network fees: Third-party ATMs may charge extra for use.

For example, withdrawing $500 could trigger a $15 fee (3%) and start accumulating interest at 26.99% APR from day one. If not paid off quickly, that $500 could cost over $600 in just a few months.

“Most consumers don’t realize that cash advances are treated differently than regular purchases. The interest starts compounding instantly, making them a financial trap if not managed carefully.” — Lisa Tran, Consumer Finance Advisor at BalanceForward Institute

Low-Cost Alternatives to Traditional Cash Withdrawals

Luckily, there are smarter, less expensive ways to convert credit card access into usable cash. These methods require more effort or planning but can save hundreds in fees and interest over time.

1. Use a No-Fee Cashback App with a Reloadable Card

Some fintech platforms allow you to load funds onto a prepaid debit card using your credit card, then withdraw that balance as cash. While direct credit-to-debit card loading is often blocked, certain apps like PayPal, Venmo, or NetSpend permit this under specific conditions.

Here’s how it works:

- Link your credit card to a supported digital wallet (e.g., PayPal).

- Send money to yourself or a trusted contact via the app using your credit card.

- Transfer the funds to a linked bank account or withdraw via an affiliated ATM.

2. Buy Money Orders or Prepaid Cards Strategically

Another workaround involves purchasing reloadable prepaid cards or official money orders with your credit card. Many retailers—including Walmart, CVS, and Western Union—allow credit card payments for money orders, which can then be cashed at banks or check-cashing outlets.

While this method avoids ATM fees, be aware that:

- Not all stores accept credit cards for money order purchases.

- Transaction limits may apply.

- Your issuer might still categorize the purchase as a cash advance.

3. Leverage Balance Transfer Offers with Cash-Out Features

Some credit cards offer promotional 0% APR balance transfer deals that include “convenience checks” or direct deposit options. These checks act like personal loans and can be deposited directly into your bank account.

If used during a 0% intro period (typically 12–18 months), you gain interest-free access to cash—provided you repay before the promotional window ends.

| Method | Avg. Fee | Interest Start | Best For |

|---|---|---|---|

| Traditional ATM Cash Advance | 3–5% + ATM fee | Day 1 | Emergency needs only |

| Balance Transfer Check | 3–5% | After promo period | Planned expenses |

| P2P App + Bank Transfer | 0–2.5% (if instant) | Varies by issuer | Small, urgent cash needs |

| Retail Money Order | $1–$5 flat | Depends on issuer | Under $1,000 access |

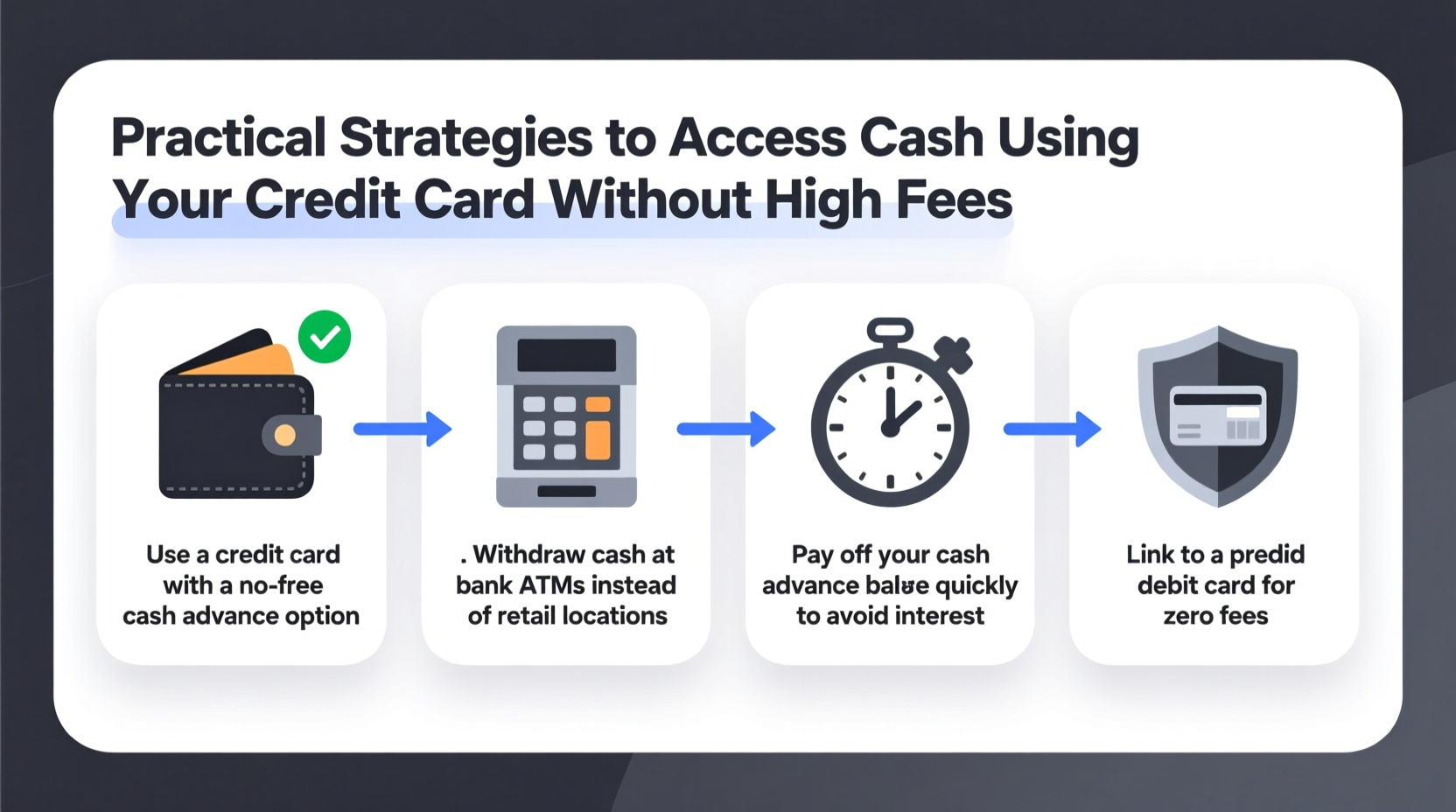

Step-by-Step Guide: Accessing Cash Without High Fees

If you need immediate liquidity and want to avoid exorbitant charges, follow this step-by-step process:

- Check your credit card terms: Review your agreement to see if P2P payments, money order purchases, or balance transfer checks are classified as cash advances.

- Apply for a 0% balance transfer card (if eligible): Choose one with convenience checks and a long introductory period.

- Use digital wallets wisely: Link your card to Venmo or PayPal and send money to a friend who can reimburse you in cash.

- Visit a retailer that accepts credit for money orders: Confirm policy beforehand—call ahead to avoid wasted trips.

- Withdraw through a shared account: If you have joint access to a bank account, deposit funds via app and withdraw at a fee-free ATM.

- Repay promptly: Even if interest-free now, delays can lead to back interest and penalties.

Real-World Example: Avoiding Fees During a Trip

Consider Mark, a freelance photographer traveling in rural Arizona where digital payments aren't always accepted. He needed $300 in cash but didn’t want to trigger a cash advance.

Instead of using an ATM, he sent $300 via Venmo to a friend using his credit card (marked as “Goods and Services”), incurring a 1.9% fee ($5.70). His friend wired the money back through Zelle the next day, which Mark withdrew at a no-fee ATM. Total cost: under $6—compared to a $15 fee plus daily interest from a cash advance.

This method required coordination but saved him over $100 in potential interest over three months.

Checklist: Smart Cash Access Best Practices

- ✅ Confirm whether your credit card treats P2P transfers as cash advances

- ✅ Look for balance transfer offers with convenience checks

- ✅ Test small transactions first (e.g., $20 via PayPal) to verify categorization

- ✅ Use fee-free ATMs affiliated with your bank or network (Allpoint, MoneyPass)

- ✅ Repay borrowed amounts within 30 days to avoid compounding interest

- ✅ Track all transactions to ensure accurate reporting on statements

Frequently Asked Questions

Can I really avoid cash advance fees using P2P apps?

Yes, but cautiously. If your credit card issuer classifies Venmo, PayPal, or Cash App transactions as cash advances, fees and interest will still apply. Always test with a small amount and review your next statement to confirm how it was categorized.

Are balance transfer checks worth using?

They can be, especially during a 0% intro APR period. However, they usually come with a 3%–5% fee. Use them only for planned needs and create a repayment plan to clear the balance before the promotional rate expires.

What happens if my issuer flags a money order purchase as a cash advance?

You’ll be charged the associated fee and interest will accrue immediately. To dispute, contact customer service with proof of purchase and ask for reclassification—but success isn’t guaranteed. Prevention is better: research store policies and issuer rules first.

Final Thoughts: Borrow Smarter, Not Harder

Accessing cash doesn’t have to mean surrendering to high fees and predatory interest rates. With awareness and strategic use of available tools, you can maintain financial flexibility without sacrificing your budget. The goal isn’t to game the system, but to use legitimate features—like balance transfers, digital wallets, and retail services—in ways that align with your needs and minimize cost.

Always prioritize transparency: know how your issuer classifies each transaction, monitor your statements closely, and repay quickly. Over time, these habits build not only short-term liquidity but long-term financial resilience.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?