Financial security doesn’t happen overnight. It’s built through consistent choices, smart habits, and a clear understanding of your relationship with money. While saving can feel slow or even impossible when expenses pile up, the right strategies can accelerate progress without drastic lifestyle cuts. The goal isn’t perfection—it’s momentum. By implementing realistic, sustainable methods, you can grow your savings faster and gain confidence in your financial future.

1. Automate Your Savings for Consistent Growth

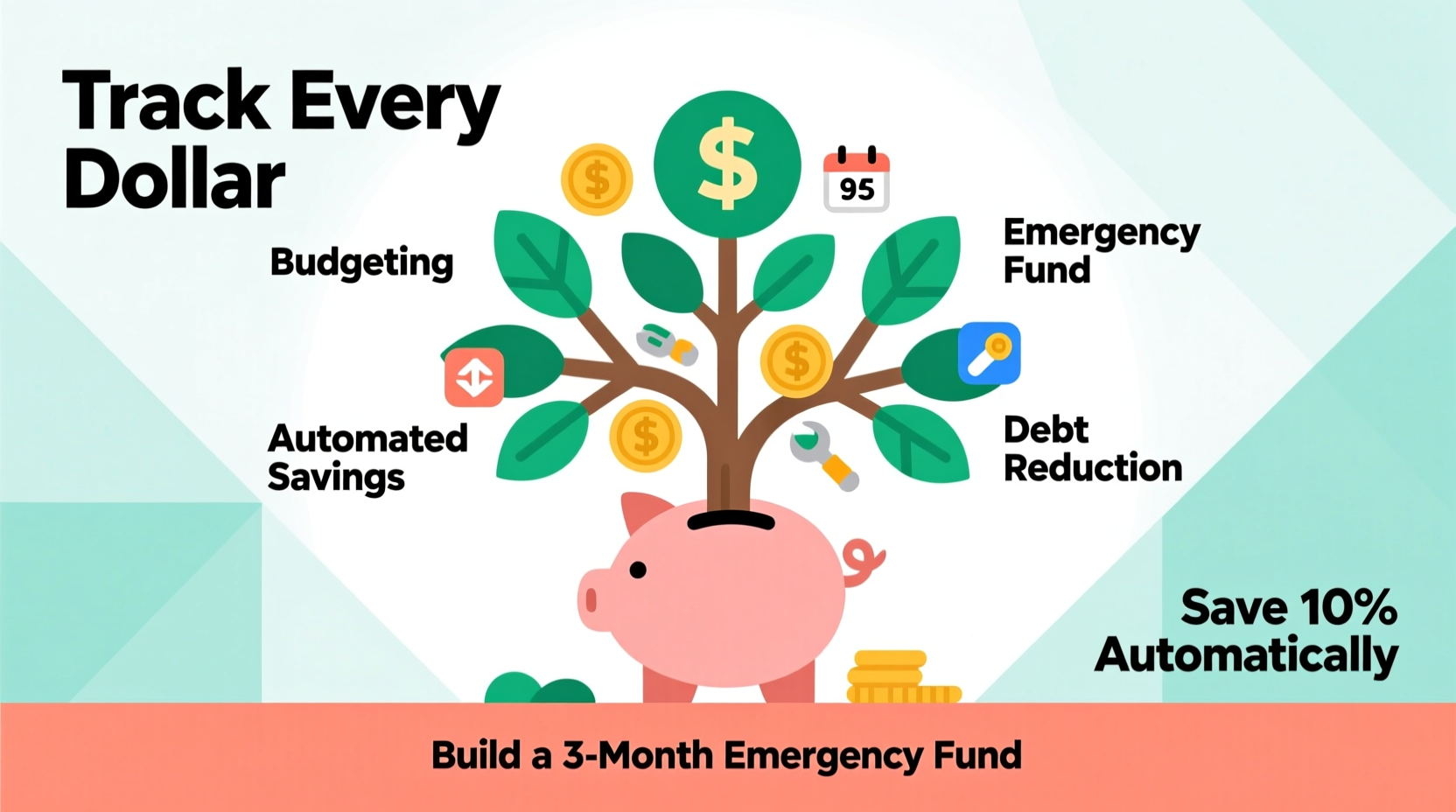

One of the most effective ways to save faster is to remove the need for willpower. When savings are automated, they become invisible—like paying a bill. Set up automatic transfers from your checking account to a dedicated savings account immediately after each paycheck. Even small amounts add up over time, especially when compounded by interest.

Consider using multiple savings accounts for different goals: one for emergencies, another for vacations, and a third for long-term investments. Label them clearly and watch each balance grow independently. This method creates psychological wins as you reach smaller milestones, reinforcing positive behavior.

2. Track Spending to Identify Hidden Leaks

You can’t improve what you don’t measure. Start by reviewing three months of bank and credit card statements. Categorize every expense: housing, groceries, subscriptions, dining out, transportation, and discretionary spending. Look for patterns—especially recurring charges that no longer serve you.

Many people are surprised to find they’re spending $50–$100 monthly on unused subscriptions or impulse purchases. Canceling two streaming services or skipping weekly takeout can free up hundreds per year. Use this reclaimed money to boost your emergency fund or retirement contributions.

“Most people underestimate how much small, repeated expenses cost over time. A $4 coffee daily is over $1,400 a year.” — Laura Adams, Personal Finance Expert

3. Build a Realistic Budget That Works With Your Life

Budgets fail when they’re too restrictive. Instead of cutting everything enjoyable, design a budget that includes room for both responsibility and reward. The 50/30/20 rule is a flexible starting point: 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment.

Adjust these percentages based on your situation. If you live in a high-cost area, your needs may take 60%. That’s okay—just scale back wants accordingly. The key is intentionality. Every dollar should have a job, whether it’s covering rent, funding a vacation, or building wealth.

| Category | Recommended % | What It Includes |

|---|---|---|

| Needs | 50% | Rent, utilities, groceries, insurance, minimum debt payments |

| Wants | 30% | Dining out, entertainment, hobbies, shopping |

| Savings & Debt | 20% | Emergency fund, retirement, extra loan payments |

4. Increase Income Strategically

Saving isn’t just about spending less—it’s also about earning more. While frugality has limits, income growth does not. Explore side hustles that align with your skills: freelance writing, virtual assistance, tutoring, or selling handmade goods online. Even dedicating five hours a week can generate an extra $200–$500 monthly.

For long-term gains, invest in career development. Pursue certifications, attend networking events, or ask for a raise based on documented achievements. A 10% salary increase can dramatically shorten the time it takes to reach major financial goals.

5. Pay Off High-Interest Debt Aggressively

Debt drains wealth. Credit card interest rates often exceed 20%, meaning every dollar owed grows quickly if unpaid. Prioritize eliminating high-interest balances to stop the financial bleed. Two popular methods are the avalanche and snowball approaches:

- Avalanche Method: Pay off debts with the highest interest rates first while making minimum payments on others. This saves the most money over time.

- Snowball Method: Focus on the smallest balances first. Quick wins build motivation and momentum.

Choose the method that fits your personality. Some thrive on logic (avalanche), while others need emotional reinforcement (snowball). Either way, commit to stopping new debt by using cash or debit for discretionary purchases.

Mini Case Study: How Maria Paid Off $12,000 in 18 Months

Maria, a graphic designer in Austin, carried $12,000 in credit card debt across three cards. She chose the snowball method, listing her balances from smallest to largest. Each time she paid off a card, she rolled the previous payment into the next debt. She also picked up weekend design gigs, adding $800/month toward her goal. Within 18 months, she was debt-free and redirected those payments into a Roth IRA. “It wasn’t easy,” she says, “but seeing each balance hit zero kept me going.”

Step-by-Step Guide to Building Financial Security in 12 Months

- Month 1: Review all accounts and calculate net worth.

- Months 2–3: Create a realistic budget and set up automatic savings.

- Months 4–6: Eliminate at least three unnecessary subscriptions or expenses.

- Months 7–8: Build a starter emergency fund of $1,000.

- Months 9–10: Focus on paying down the highest-interest debt.

- Months 11–12: Increase retirement contributions or open an investment account.

- ☐ Link your bank account to a budgeting app (e.g., Mint, YNAB)

- ☐ Set up automatic transfer to savings (even $25/paycheck)

- ☐ Cancel one unused subscription

- ☐ Check your credit report for errors (annualcreditreport.com)

- ☐ Review insurance policies for better rates

- ☐ Define one short-term savings goal (e.g., $500 in 90 days)

- ☐ Schedule a monthly “money date” to review progress

Frequently Asked Questions

How much should I have in an emergency fund?

Start with $1,000 as a starter buffer. Once out of high-interest debt, aim for 3–6 months of essential living expenses. If your job is unstable or you’re self-employed, lean toward 6–12 months.

Is it better to save or pay off debt first?

Begin with a small emergency fund ($500–$1,000) to avoid borrowing for surprises. Then, aggressively tackle high-interest debt (above 6–7%). Low-interest debt (like student loans under 5%) can be managed while saving for retirement.

Can I save effectively on a low income?

Absolutely. Saving is a habit, not an income level. Even $5 per week builds discipline and grows over time. Combine micro-saving with income-boosting efforts like part-time work or government assistance programs to create upward momentum.

Conclusion: Take Control One Step at a Time

Financial security isn’t reserved for the wealthy. It’s available to anyone willing to make consistent, informed decisions. The strategies outlined here—automating savings, tracking spending, optimizing your budget, increasing income, and eliminating debt—are accessible, scalable, and proven to work. Progress may feel slow at first, but momentum compounds just like interest.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?