Roth Individual Retirement Accounts (IRAs) are a powerful tool for long-term financial growth, offering tax-free withdrawals in retirement. Yet, not everyone can contribute unlimited amounts. The IRS imposes annual contribution limits—and for good reason. These restrictions are not arbitrary; they reflect broader economic policy goals, fairness in tax treatment, and efforts to prevent wealth concentration in tax-advantaged accounts. Understanding why these limits exist helps savers make smarter decisions and appreciate the balance the tax system attempts to maintain.

The Purpose of Roth IRA Contribution Limits

The Roth IRA was introduced in 1997 as part of the Taxpayer Relief Act, named after Senator William Roth. Unlike traditional IRAs, contributions are made with after-tax dollars, but qualified withdrawals—including earnings—are completely tax-free. This favorable tax treatment makes Roth IRAs highly desirable. However, because the government forgoes current tax revenue in exchange for future non-taxation, it must set boundaries to ensure the program remains sustainable and equitable.

Contribution limits serve several key functions:

- Prevent high-income individuals from disproportionately benefiting from tax-free growth.

- Ensure retirement incentives are accessible across income levels, not just the wealthy.

- Maintain the integrity of the tax code by limiting tax-deferred or tax-exempt compounding.

- Encourage broad-based retirement saving rather than serving as a tax shelter for the affluent.

“Retirement plans like the Roth IRA are designed to promote savings among middle- and moderate-income households, not to provide unlimited tax avoidance for those who already have significant resources.” — Jane Lee, Senior Policy Analyst at the National Institute for Retirement Security

Current Roth IRA Contribution Limits (2024)

For 2024, the maximum annual contribution to a Roth IRA is $7,000 for individuals under age 50. Those aged 50 and older can contribute an additional $1,000 as a catch-up provision, bringing their total to $8,000. These limits apply to the combined total of all IRA contributions—meaning if you contribute to both a traditional and a Roth IRA, your total cannot exceed the annual cap.

| Age Group | Maximum Contribution (2024) | Catch-Up Eligible? |

|---|---|---|

| Under 50 | $7,000 | No |

| 50 and older | $8,000 ($7,000 + $1,000) | Yes |

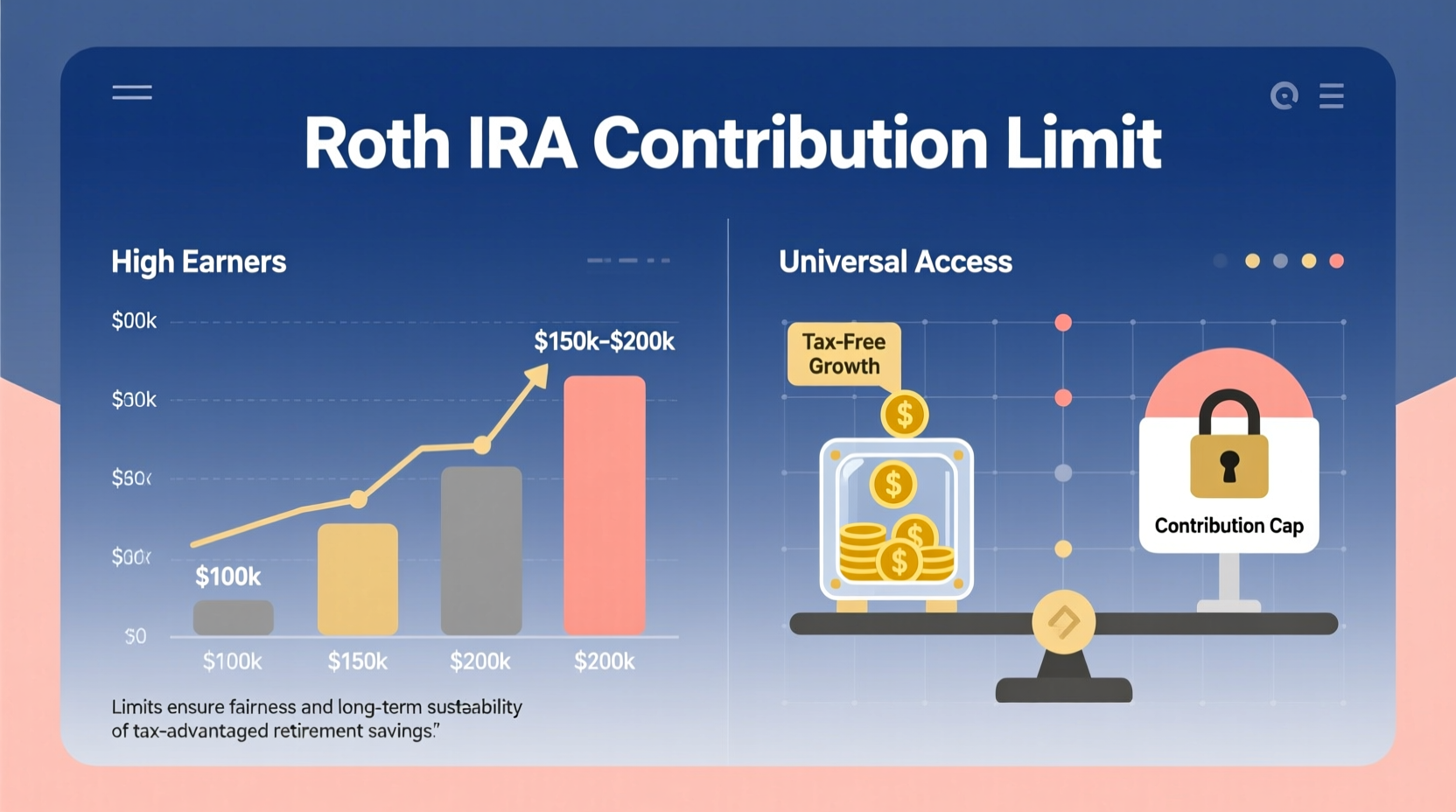

Income also affects eligibility. Even if you fall within the contribution limit, high earners may be phased out or fully excluded from contributing directly to a Roth IRA. For 2024, the phase-out ranges are:

- Single filers: $146,000 to $161,000

- Married filing jointly: $230,000 to $240,000

Those above these thresholds cannot make direct contributions but may still access Roth benefits through a “backdoor” Roth IRA conversion—a strategy involving contributions to a traditional IRA followed by conversion to Roth.

Why Fairness and Equity Matter in Retirement Policy

Tax-advantaged retirement accounts are public policy tools meant to encourage saving. Without contribution limits, high-net-worth individuals could funnel large sums into Roth IRAs, where investments grow tax-free indefinitely. Over decades, this creates massive disparities in tax savings between the wealthy and average savers.

Consider two scenarios:

- Average earner: Contributes $7,000 annually for 30 years, earning 7% annual return. Total value: ~$700,000—all tax-free upon withdrawal.

- Wealthy individual (unlimited): Contributes $100,000 annually over the same period. Final value: ~$10 million, entirely tax-free.

The second scenario illustrates why unrestricted access would undermine the intended purpose of retirement accounts. The tax benefit becomes less about encouraging saving and more about enabling tax avoidance for those who don’t need incentives to save.

A Real Example: The Impact of Limits on Long-Term Wealth

Meet Sarah, a software engineer earning $180,000 annually. She’s eager to max out her Roth IRA but discovers she’s above the income limit for direct contributions. Instead of giving up, she opens a traditional non-deductible IRA and converts it to a Roth IRA each year—a legal strategy known as the backdoor Roth.

Over 25 years, Sarah contributes $7,000 per year via this method. Assuming a 7% annual return, her account grows to over $500,000—all available tax-free in retirement. Without contribution limits, she might have contributed far more, accelerating her tax-free growth. But the limit ensures that her advantage remains proportionate and aligned with policy goals.

How Contribution Limits Promote Broader Economic Stability

From a macroeconomic perspective, contribution limits help preserve federal tax revenue. While Roth IRAs don’t offer upfront deductions, the government still sacrifices potential investment income taxes over time. Allowing unlimited contributions would compound this loss significantly, especially as more Americans invest in equities through retirement accounts.

Moreover, limits encourage diversification of retirement savings vehicles. When Roth IRAs are capped, higher earners turn to taxable brokerage accounts, 401(k)s, or other investment methods—spreading capital across different parts of the economy and reducing systemic risk.

The IRS adjusts contribution limits periodically for inflation, but increases are modest. For example, the limit rose from $6,000 to $6,500 in 2023 and to $7,000 in 2024. This slow adjustment reflects caution in expanding tax-exempt capacity too rapidly.

Expert Insight on Policy Design

“The Roth IRA limits aren’t about restricting opportunity—they’re about maintaining balance. The system rewards saving, but doesn’t let affluence rewrite the rules. That’s essential for public trust in tax policy.” — Dr. Marcus Tran, Economist at the Urban-Brookings Tax Policy Center

Practical Tips for Maximizing Your Roth IRA Within Limits

Even with restrictions, you can optimize your Roth IRA strategy. Here’s how:

- Automate contributions: Set up monthly transfers to ensure you hit the annual limit without last-minute scrambling.

- Use windfalls: Apply bonuses, tax refunds, or gifts toward your Roth IRA to boost savings efficiently.

- Leverage spousal IRAs: If one spouse doesn’t work, the other can contribute up to $7,000 to a Roth IRA on their behalf, doubling household savings potential.

- Monitor income thresholds: If your income drops in a given year, you may regain eligibility to contribute directly.

Checklist: Maximize Your Roth IRA Legally

- Confirm your modified adjusted gross income (MAGI) qualifies for contributions.

- Determine your annual contribution limit based on age.

- Set up automatic monthly deposits (~$583/month for under 50).

- If over the income limit, explore the backdoor Roth IRA option.

- Coordinate with other retirement accounts to stay under aggregate limits.

- Review your strategy annually during tax season.

Frequently Asked Questions

Can I contribute to a Roth IRA if I already have a 401(k)?

Yes. Having a 401(k) does not disqualify you from contributing to a Roth IRA. However, your income level still determines whether you can contribute directly. The contribution limits are separate—your 401(k) deferrals do not count against your $7,000 IRA limit.

What happens if I contribute too much to my Roth IRA?

Excess contributions are subject to a 6% penalty per year until corrected. To fix it, withdraw the excess amount and any earnings before the tax filing deadline. Otherwise, the penalty applies each year the excess remains.

Do contribution limits include investment gains?

No. The limits apply only to new money you contribute, not to interest, dividends, or capital gains earned within the account. There’s no cap on how much your Roth IRA can grow—only on how much you can add each year.

Conclusion: Work With the System, Not Against It

Roth IRA contribution limits exist to preserve fairness, control tax revenue loss, and ensure retirement benefits are widely accessible—not monopolized by the wealthy. While they may feel restrictive, especially for high earners, they uphold the democratic intent of retirement policy: to reward saving behavior across all income levels.

Instead of viewing limits as obstacles, treat them as guardrails guiding you toward disciplined, long-term wealth building. By contributing consistently, leveraging catch-up provisions, and using advanced strategies like backdoor conversions when appropriate, you can make the most of the Roth IRA within the framework designed to benefit everyone.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?