Knowing your card balance is essential for managing daily expenses, avoiding overdraft fees, and maintaining financial control. Whether you're using a debit, credit, or prepaid card, staying informed about your available funds helps prevent surprises at checkout or declined transactions. The good news? Modern banking technology makes it easier than ever to check your balance securely—anytime, anywhere. From mobile apps to automated phone lines, there are multiple reliable methods that combine convenience with strong security.

Why Monitoring Your Card Balance Matters

Regularly checking your card balance isn't just about knowing how much money you have—it's a fundamental part of responsible financial behavior. Overlooking your account activity can lead to accidental overspending, late fees, or even fraud going unnoticed for days. By staying on top of your balance, you gain real-time insight into your spending patterns, upcoming bills, and potential unauthorized charges.

According to the Federal Trade Commission (FTC), consumers who monitor their accounts weekly are 70% less likely to experience long-term financial damage from fraud. Frequent balance checks allow you to catch suspicious transactions early and report them before they escalate.

Top 5 Secure Methods to Check Your Card Balance

There’s no one-size-fits-all solution when it comes to checking your card balance. Different situations call for different tools. Below are five trusted and secure methods used by millions of consumers every day.

1. Mobile Banking Apps

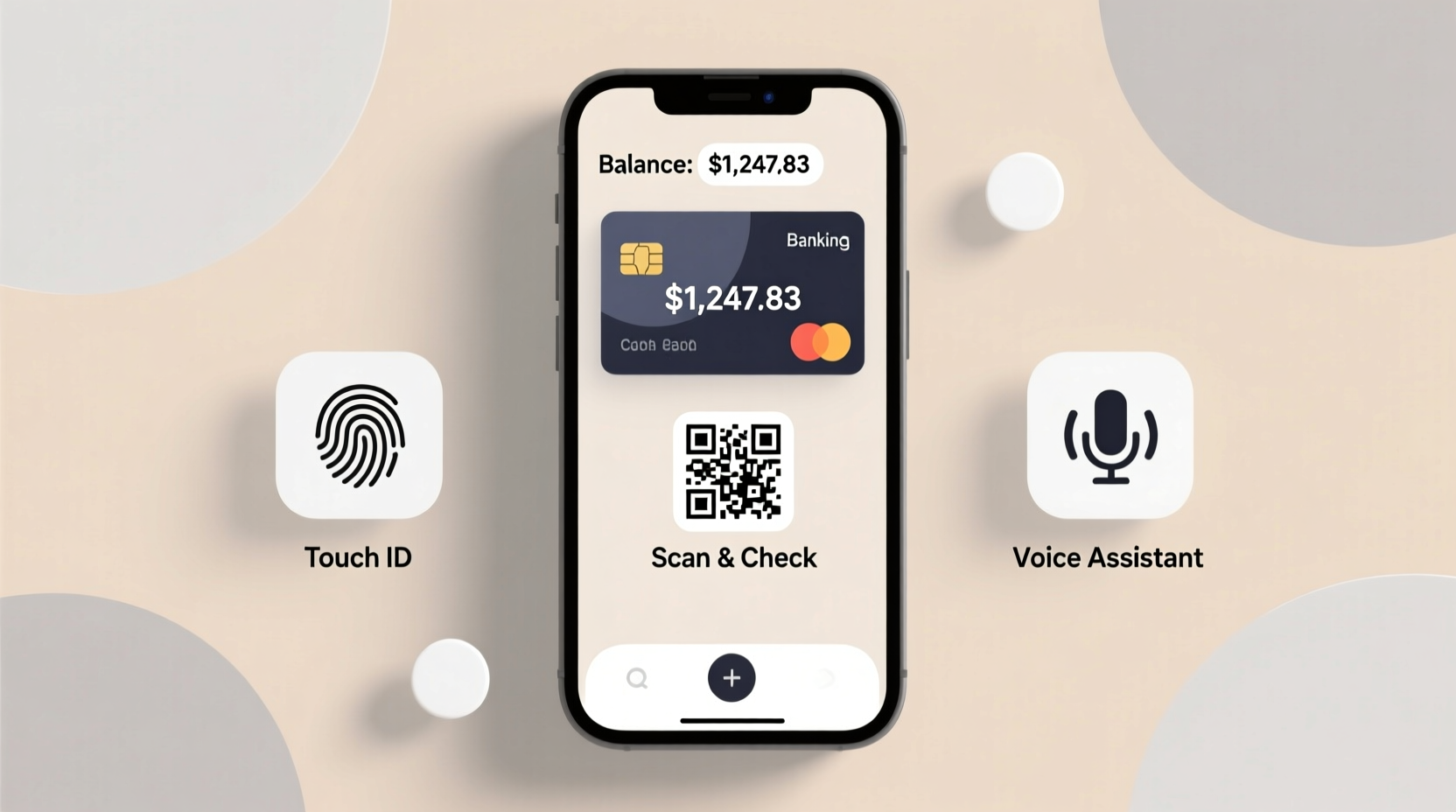

The most popular and user-friendly way to check your card balance is through your bank’s official mobile app. These apps offer real-time updates, transaction history, and alerts—all protected with encryption and multi-factor authentication.

Most major banks like Chase, Bank of America, and Wells Fargo provide intuitive interfaces that display your linked card balances instantly upon login. You can also view recent purchases, set spending limits, and lock your card if needed.

“Mobile banking apps now offer stronger security than in-branch access due to biometric logins and instant fraud detection.” — Lisa Tran, Cybersecurity Analyst at FinTrust Labs

2. Online Banking Portal

If you prefer a larger screen or need to conduct a deeper review of your account, logging into your bank’s website is equally effective. Online portals often provide more detailed reports than mobile apps, including downloadable statements and categorized spending summaries.

To stay secure, always ensure you’re visiting the official bank URL (look for “https://” and a padlock icon) and avoid accessing your account over public Wi-Fi unless using a trusted virtual private network (VPN).

3. ATM Balance Inquiry

For those without consistent internet access, ATMs remain a reliable option. Inserting your card and entering your PIN allows you to view your current balance quickly. Many ATMs also let you print mini-statements showing recent transactions.

While convenient, be cautious of skimming devices. Inspect the card slot and keypad for loose parts or unusual attachments. Use ATMs located inside banks or well-lit, high-traffic areas whenever possible.

4. Text (SMS) Alerts and Balance Services

Some banks offer text-based balance inquiry services. After enrolling, you can send a simple keyword (like “BAL”) to a short code number and receive an immediate reply with your available balance.

This method is ideal for users with basic phones or limited data plans. However, never respond to unsolicited texts claiming to be from your bank, and disable message previews on your lock screen to prevent shoulder surfing.

5. Automated Phone Service

Dialing your bank’s customer service number and navigating the automated voice response system lets you hear your balance without speaking to a representative. This method is helpful when you’re driving or in a situation where typing isn’t safe.

Ensure you’re calling the official number listed on the back of your card or the bank’s verified website. Avoid clicking phone numbers in emails or search ads, as scammers often mimic legitimate contact details.

Step-by-Step Guide: How to Check Your Balance Using a Mobile App

If you're new to digital banking, here’s a clear, step-by-step process to safely check your card balance using a mobile app:

- Download the Official App: Search for your bank’s name in the Apple App Store or Google Play Store. Verify the developer is your actual bank.

- Log In Securely: Enter your username and password. Enable biometric login (fingerprint or face ID) if available.

- Select Your Card: Once logged in, choose the card you want to check from your dashboard.

- View Balance and Activity: Your current balance will appear prominently. Scroll down to see pending and posted transactions.

- Enable Notifications: Turn on low-balance or large-purchase alerts to stay proactive.

- Log Out (Optional): For shared devices, manually log out after each session.

Security Best Practices When Checking Your Balance

While digital tools make balance checks effortless, they also introduce risks if not used carefully. Follow these best practices to keep your information secure:

| Do | Don’t |

|---|---|

| Use official apps and websites only | Click links in unsolicited emails or texts |

| Enable two-factor authentication (2FA) | Share your PIN or password with anyone |

| Update your banking app regularly | Check balances over unsecured public Wi-Fi |

| Review transaction history monthly | Save login details on public or shared devices |

| Set up balance alert notifications | Respond to messages asking for personal info |

Real Example: How Maria Prevented Fraud With Daily Balance Checks

Maria, a freelance designer in Austin, got into the habit of checking her debit card balance every morning while having coffee. One Tuesday, she noticed a $249 charge from an online electronics store she didn’t recognize.

She immediately opened her bank’s app, tapped “Report Fraud,” and froze the card. Within two hours, customer support confirmed the transaction was fraudulent and issued a temporary refund. Because she caught it within 24 hours, she wasn’t liable for any amount. Her routine balance check saved her time, money, and stress.

Essential Checklist for Safe Balance Monitoring

Stay secure and informed with this quick-reference checklist:

- ✅ Confirm you’re using your bank’s official app or website

- ✅ Enable push notifications for transactions

- ✅ Review recent activity at least once per day

- ✅ Use strong, unique passwords and update them quarterly

- ✅ Install app and OS updates promptly

- ✅ Report any unrecognized charges immediately

- ✅ Log out of shared devices after use

Frequently Asked Questions

Is it safe to check my card balance on public Wi-Fi?

No, public Wi-Fi networks are often unencrypted and vulnerable to hacking. If you must check your balance on the go, use your phone’s data connection or a trusted VPN service to encrypt your traffic.

Can I check my balance without a smartphone?

Yes. You can use an ATM, call your bank’s automated phone line, sign up for SMS alerts, or access your account via a computer using the bank’s secure website.

How quickly are balance updates reflected?

Most digital platforms show real-time balances for transactions processed through the bank’s network. However, pending charges may take 24–48 hours to post fully. Always consider pending amounts when budgeting.

Take Control of Your Financial Health Today

Checking your card balance doesn’t have to be complicated or risky. With the right tools and habits, you can stay informed with just a few taps or a quick phone call. The key is consistency and caution—combine regular monitoring with strong security practices to protect your money.

Start today by downloading your bank’s app, enabling alerts, and setting a daily reminder to review your balance. Small actions now can prevent big problems later. Your financial peace of mind is worth the effort.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?