Purchasing a car is one of the most significant financial decisions many people make—second only to buying a home. Yet, unlike homes, cars depreciate from the moment they’re driven off the lot. This makes financing them wisely even more critical. While auto loans are common, building a car savings fund allows you to avoid interest payments, reduce long-term costs, and maintain greater control over your budget. The challenge? Doing it without cutting out everything that makes life enjoyable. The good news is that with smart planning and intentional habits, you can save for a car while still enjoying your current lifestyle.

Start with a Clear Goal and Timeline

The first step in building a car savings fund is defining what kind of vehicle you want and how much it will cost. Research average prices for reliable used models or new vehicles within your desired category—sedans, SUVs, electric cars, etc. Include additional expenses like taxes, registration, insurance, and initial maintenance.

Once you have a target amount—say $15,000—determine your timeline. Saving $300 per month gets you there in 50 months; $400 shortens it to under 3.5 years. A clear goal transforms abstract saving into a tangible mission.

Rethink Your Spending Without Cutting Joy

Many assume building a savings fund means eliminating lattes, dining out, or weekend trips. But sustainability matters. If you cut too much, you’ll likely revert to old habits. Instead, focus on value-based spending: keep what brings real joy, eliminate what doesn’t.

For example, if you love coffee but spend $120 monthly at cafes, consider brewing at home most days and treating yourself twice a week. That simple shift could free up $70/month—$840 annually—without feeling deprived.

Review your subscriptions, recurring fees, and impulse purchases. Cancel duplicate streaming services or downgrade phone plans. These micro-adjustments add up quietly, allowing larger lifestyle elements to remain untouched.

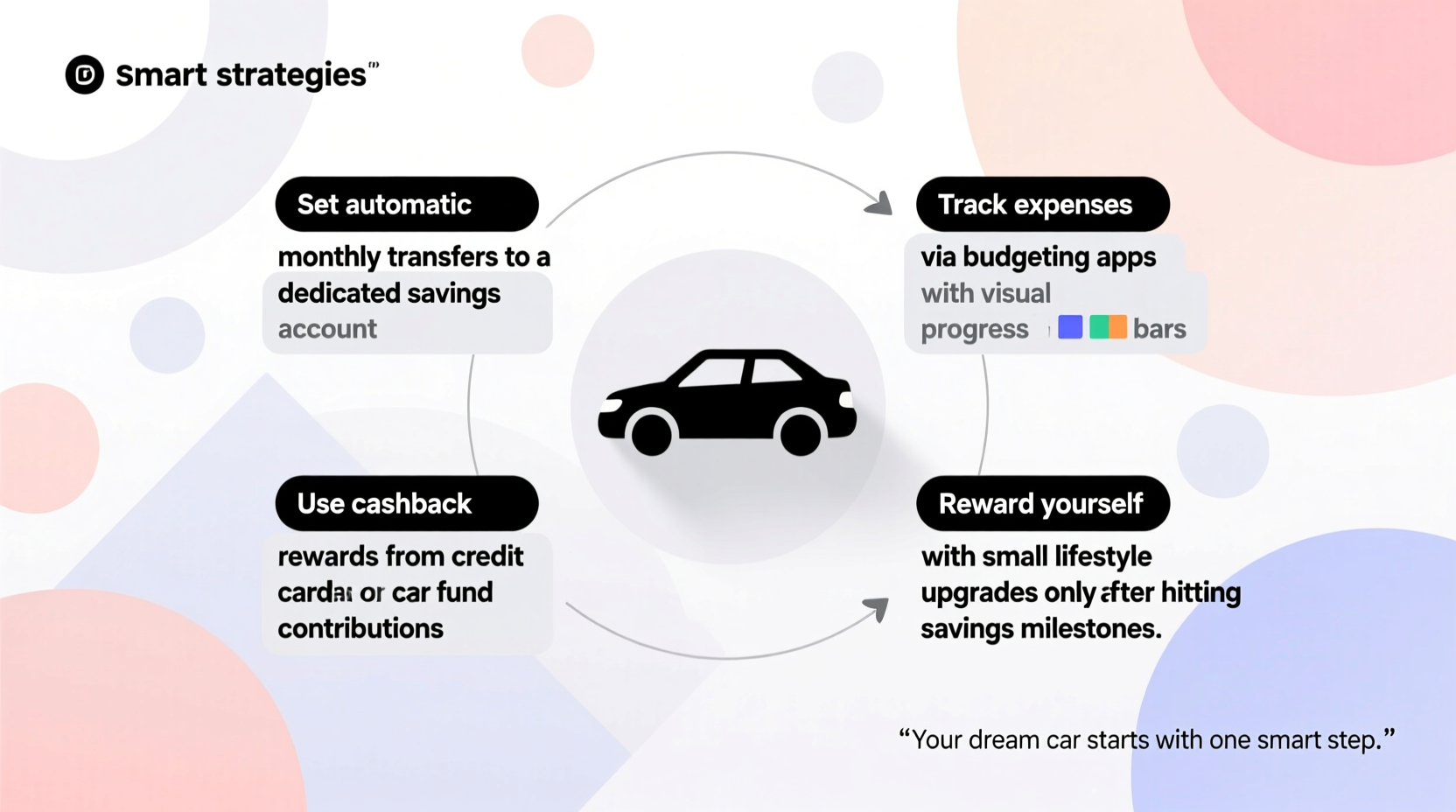

Automate and Optimize Your Savings

Manual transfers are easy to forget or skip. Automation ensures consistency. Set up an automatic transfer from your checking to your car savings account right after each paycheck. Even $100 every two weeks adds up to $2,600 a year—effortlessly.

To accelerate progress, link savings to behavioral triggers. For instance:

- Transfer $20 every time you skip a ride-share and use public transit.

- Add 50% of any bonus, tax refund, or side income directly to your fund.

- Round up daily purchases via banking apps that automatically invest spare change.

These systems harness small wins and incidental income, turning passive behavior into active progress.

“People who automate their savings reach their goals 3x faster than those relying on willpower alone.” — Dr. Lena Patel, Behavioral Economist, Federal Consumer Finance Institute

Boost Income Strategically, Not Exhaustively

You don’t need a second full-time job to save faster. Instead, pursue flexible, low-friction income streams that align with existing skills or hobbies.

Consider driving for a rideshare service 4–6 hours on weekends—just enough to cover a car payment without burnout. Or sell unused electronics, furniture, or designer items online. One person cleared $2,200 in three months by decluttering and reselling through marketplace apps.

Freelance work—writing, graphic design, tutoring—can also feed your fund. Even dedicating five focused hours a week at $25/hour generates an extra $500 monthly.

Mini Case Study: How Maria Saved $10,000 in 18 Months

Maria, a 29-year-old marketing assistant, wanted a reliable hybrid SUV but didn’t want to take on debt. She set a goal of $10,000 in 18 months—about $555 per month.

Instead of cutting her social life, she made strategic swaps: packed lunch four days a week ($75 saved monthly), switched to a cheaper phone plan ($20 saved), and canceled two underused subscriptions ($18). That was $113/month.

She automated $400 into her car fund each payday and committed to earning the rest through side gigs. She tutored Spanish online for 5 hours weekly, earning $125. After taxes, that covered the gap.

In 17 months, she reached her goal—and bought her car outright, avoiding $1,800 in projected interest.

Smart Trade-Offs: The Do’s and Don’ts

Not all frugal moves are equal. Some save real money with minimal impact; others sacrifice comfort for negligible gains. Use this guide to stay balanced.

| Do | Don’t |

|---|---|

| Negotiate recurring bills (internet, insurance) | Skip necessary car maintenance to save now |

| Use cashback apps when buying gas or groceries | Buy a cheaper car that costs more in repairs |

| Optimize grocery shopping with lists and store brands | Overwork yourself to extremes |

| Sell unused items regularly | Delay emergency savings to prioritize car fund |

Step-by-Step Guide to Building Your Car Fund

- Define your car type and target price – research realistic costs including taxes and fees.

- Open a dedicated high-yield savings account – keep it separate and earn modest interest.

- Calculate monthly savings needed based on your desired timeline.

- Identify $100–300 in non-essential spending you can redirect without discomfort.

- Automate transfers right after payday to lock in savings.

- Add income boosters like side gigs or selling items to accelerate progress.

- Review progress quarterly and adjust as income or goals change.

Frequently Asked Questions

Can I still enjoy vacations while saving for a car?

Absolutely. Plan trips in advance and budget for them. Consider shorter getaways or off-season travel to reduce costs. Allocate a small portion of your fun budget—just ensure your car savings aren’t compromised.

Should I use my emergency fund to buy a car?

No. Emergency funds are for true emergencies—job loss, medical issues, urgent repairs. Using it for a car purchase weakens your financial safety net. Build your car fund separately.

Is it better to save for cash or finance a car?

Paying in cash avoids interest and gives you full ownership immediately. Financing may be necessary for some, but it adds thousands in interest over time. If you can delay the purchase to save, you’ll come out ahead financially.

Final Thoughts: Save Smarter, Not Harder

Building a car savings fund doesn’t require extreme sacrifice. It requires strategy, consistency, and clarity. By automating savings, optimizing spending, and boosting income in manageable ways, you can reach your goal without pausing your life. The freedom of owning a car outright—no monthly payments, no interest, no lender calls—is worth the disciplined effort.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?