Buying your first car is a major milestone, but it can feel out of reach if you have no credit history. Without a track record of borrowing and repaying, lenders see uncertainty—and that often means higher interest rates or outright denials. The good news? No credit doesn’t mean no options. With the right approach, preparation, and persistence, it’s entirely possible to qualify for a car loan even as a financial newcomer.

The key lies in demonstrating reliability through alternative means, building trust with lenders, and making smart financial choices from the start. This guide outlines actionable strategies that go beyond generic advice, giving you a clear roadmap to drive off the lot with confidence—even if your credit file is blank.

Understand Why No Credit Is a Challenge

Lenders rely on credit history to assess risk. When you have no credit, they lack data to determine whether you’ll repay on time. Unlike poor credit—which signals past issues—no credit simply means there’s nothing to evaluate. This “credit invisibility” affects nearly 26 million adults in the U.S., according to the Consumer Financial Protection Bureau (CFPB).

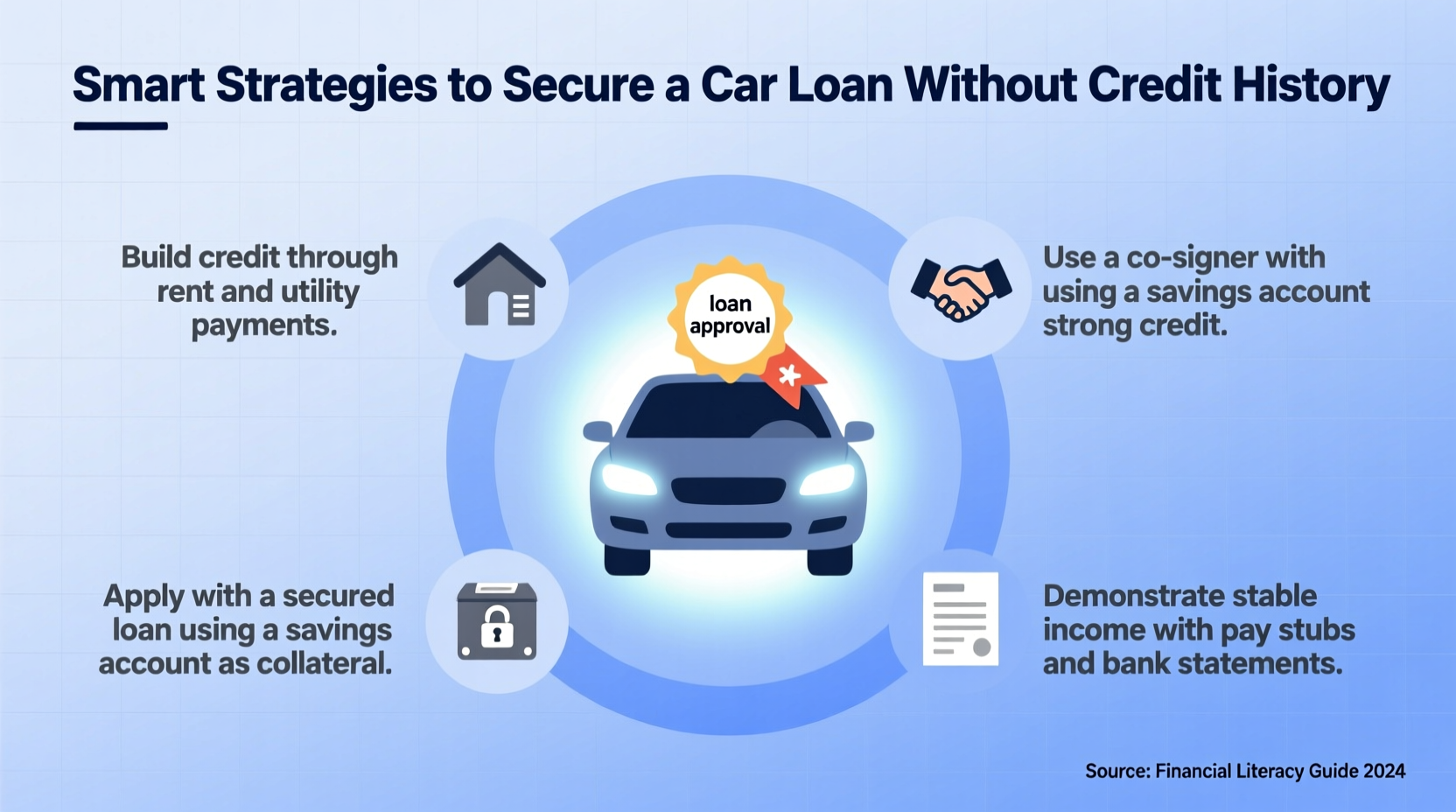

Without a FICO score or credit report, traditional banks may decline applications outright. However, this doesn’t mean you’re disqualified. It just means you need to work smarter: prove responsibility through other avenues, target lenders open to first-time borrowers, and use support systems like co-signers or secured financing.

Build a Foundation Before Applying

Before seeking a car loan, take proactive steps to strengthen your financial profile. Lenders consider more than just credit scores—they look at income stability, employment history, savings, and debt-to-income ratio. Use these factors to your advantage.

Start by gathering proof of consistent income. Pay stubs, tax returns, or bank statements showing regular deposits can reassure lenders you have the means to make monthly payments. If you're a student or new worker, emphasize long-term employment or reliable side income.

Open a checking and savings account if you haven’t already. A stable banking history shows financial responsibility. Make regular deposits and avoid overdrafts. Some fintech lenders now use “alternative data,” such as rent and utility payments, to assess creditworthiness—so paying bills on time matters, even if they don’t appear on a credit report yet.

Step-by-Step: Building Credibility in 90 Days

- Month 1: Open a secured credit card with a deposit (e.g., $200–$500). Use it for small purchases and pay in full each month.

- Month 2: Set up automatic bill payments for phone, rent (if reported), or subscriptions to establish payment consistency.

- Month 3: Apply for a credit-builder loan from a credit union or online lender designed to establish credit history.

These actions won’t give you a full credit score overnight, but they signal intent and responsibility—qualities lenders value.

Leverage a Co-Signer Strategically

One of the most effective ways to qualify for a car loan with no credit is to apply with a co-signer. A co-signer is someone with established credit and income who agrees to take legal responsibility for the loan if you default. Their strong credit profile can help you get approved and secure a lower interest rate.

However, co-signing is a serious commitment. If you miss a payment, it damages their credit too. Choose someone you trust—typically a parent or close relative—and ensure both parties understand the risks.

“Co-signing isn’t just about approval—it’s a shared financial obligation. Both parties must treat it with respect and clarity.” — Laura Simmons, Certified Financial Planner

To protect everyone involved:

- Agree on a repayment plan before signing.

- Set up automatic payments to avoid missed due dates.

- Consider refinancing the loan in your name only once you’ve built credit.

Target the Right Lenders and Loan Types

Not all lenders are created equal when it comes to no-credit borrowers. Big banks often have strict automated underwriting systems that reject thin-file applicants. Instead, focus on institutions that specialize in first-time buyers or offer manual review processes.

| Lender Type | Pros | Cons |

|---|---|---|

| Credit Unions | Local decision-making, flexible criteria, lower rates for members | Membership required; limited branch access |

| Subprime Auto Lenders | Specialize in no-credit or bad-credit loans | Higher interest rates; potential for predatory terms |

| Online Lenders (e.g., Upstart, LightStream) | Use alternative data; fast approvals | May still require minimum credit history |

| In-House Dealership Financing | No credit check; immediate approval | Risk of high APRs and long-term debt traps |

Dealerships offering “buy here, pay here” programs can be a last resort, but proceed with caution. While they approve almost anyone, interest rates can exceed 20%, and repossession policies are often aggressive. Always read the fine print and calculate total loan cost before agreeing.

Real Example: How Maria Got Approved at 19

Maria, a college freshman, needed a reliable car to commute to her part-time job. At 19, she had no credit history. Her parents weren’t willing to co-sign, so she took a different route.

She opened a secured credit card with a $300 deposit and used it for her monthly $25 streaming subscription, paying it off automatically every month. She also saved $1,500 over six months as a down payment. When she applied for a loan at her local credit union, she provided proof of income, bank statements, and her new credit activity.

The credit union reviewed her file manually and approved her for a $7,000 loan at 6.9% APR—far below the average subprime rate. By choosing a modest, fuel-efficient used car and making on-time payments, she built credit quickly and refinanced into a better rate within a year.

Maria’s success came from preparation, patience, and targeting the right lender—not waiting for credit to find her, but creating opportunities to prove herself.

Checklist: Steps to Secure a Car Loan with No Credit

- ✅ Build a small credit history using a secured card or authorized user status

- ✅ Save for a down payment (aim for 10–20% of the car’s price)

- ✅ Gather proof of income and stable employment

- ✅ Research credit unions and online lenders that accept no-credit applicants

- ✅ Consider a co-signer if eligible and trustworthy

- ✅ Avoid high-interest “buy here, pay here” deals unless absolutely necessary

- ✅ Read all loan terms carefully, especially APR and repayment schedule

- ✅ Make on-time payments consistently to build credit after approval

Frequently Asked Questions

Can I get a car loan with no credit and no co-signer?

Yes, but options are limited. Credit unions, community banks, and some online lenders evaluate applicants based on income, savings, and employment. A larger down payment and choosing an affordable vehicle improve your chances.

Will applying for a car loan hurt my credit if I get denied?

A hard inquiry will temporarily lower your score by a few points, but one or two inquiries have minimal long-term impact. Focus on pre-qualifying with soft checks first, which don’t affect credit.

How much car loan can I afford with no credit?

Lenders typically approve smaller loans for no-credit borrowers—often between $5,000 and $10,000. Keep monthly payments below 15% of your take-home pay to stay within budget.

Take Control of Your Financial Journey

Starting from zero credit doesn’t mean staying stuck. Every driver was a first-timer once. By taking deliberate steps—building credibility, choosing the right partners, and avoiding costly pitfalls—you can secure a car loan that fits your life and sets you up for long-term financial health.

Your first car loan isn’t just transportation—it’s the foundation of your credit future. Make it count. Start today by visiting a local credit union, setting up a secured credit card, or having an honest conversation with a trusted co-signer. The road ahead is yours to drive.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?