Wire transfers remain one of the most reliable methods for receiving large or international payments. Whether you're a freelancer, small business owner, or selling high-value goods, knowing how to accept a wire transfer safely is essential. Done correctly, it's fast and secure. Done incorrectly, it can lead to fraud, delays, or financial loss. This guide walks you through the entire process—from setting up your banking details to verifying incoming funds—with expert-backed strategies to protect yourself at every stage.

Understanding Wire Transfers: What You Need to Know

A wire transfer is an electronic method of sending money from one bank account to another. Unlike checks or digital apps like PayPal, wire transfers are typically irreversible once processed. They’re commonly used for real estate deals, business contracts, and cross-border payments due to their speed and reliability.

There are two main types: domestic (within the same country) and international (cross-border). Each requires specific banking information, and fees vary depending on the institution and destination. Most banks charge a fee to receive incoming wires—typically $10–$35 domestically and higher internationally.

“Wire transfers offer finality. Once the money hits your account, it’s yours—but that also means there’s no safety net if something goes wrong.” — Sarah Lin, Senior Banking Advisor at National Financial Services Group

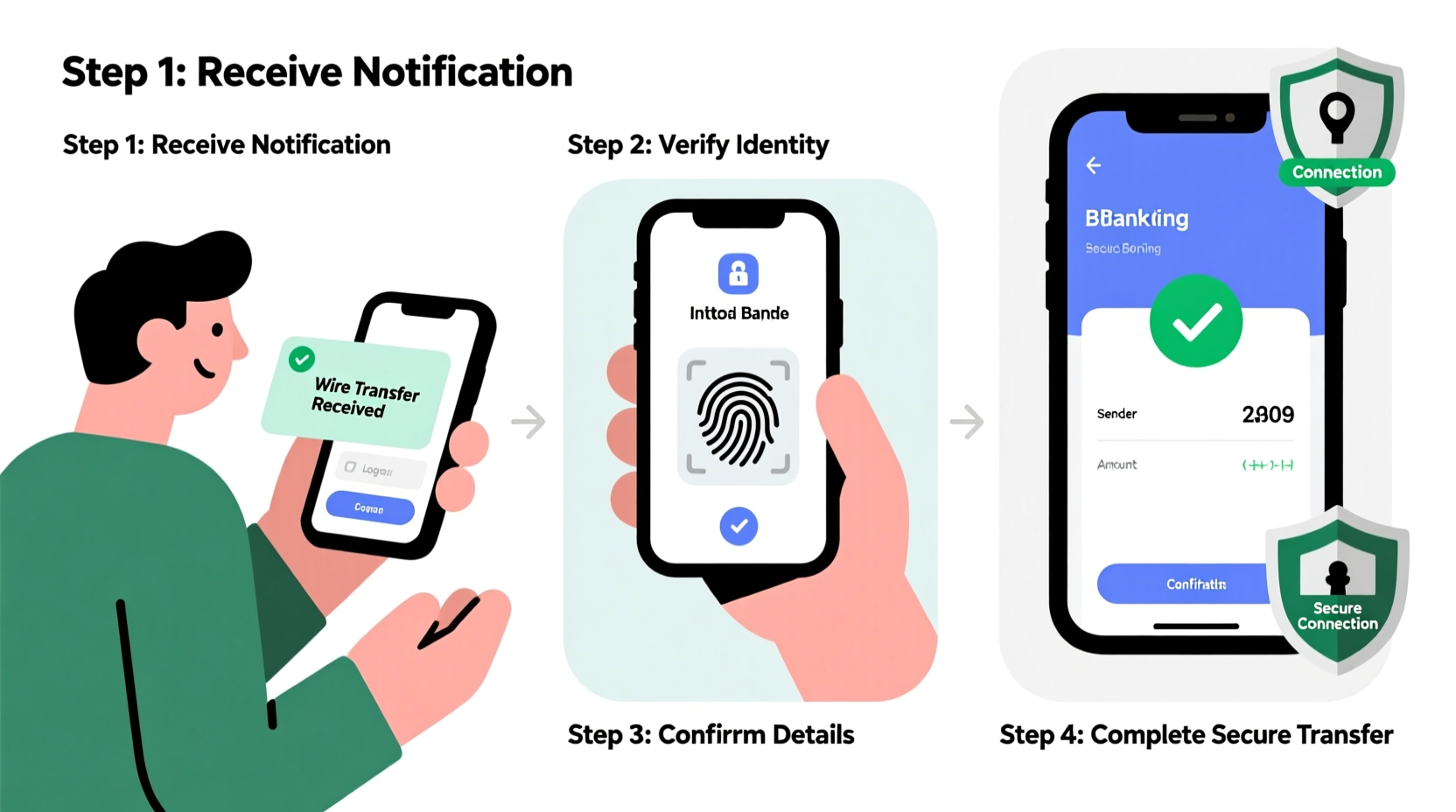

Step-by-Step Guide to Accepting a Wire Transfer

Follow these steps in order to ensure a secure and successful transaction.

- Confirm the Payment Source: Before sharing any banking details, verify the identity of the sender. If it’s a new client or buyer, request official identification, business registration, or a signed agreement. Never provide your banking information based solely on an email or text message.

- Gather Your Bank’s Wire Instructions: Contact your bank directly—via phone or in person—to obtain your official wire transfer details. Do not rely on information pulled from a website unless you’re certain it’s legitimate. These details usually include:

- Your full legal name and address

- Bank name and physical address

- Account number

- Routing number (for domestic U.S. transfers)

- SWIFT/BIC code (for international transfers)

- IBAN (for European and some international accounts)

- Share Information Securely: Never send sensitive banking data over unencrypted email or messaging apps. Use password-protected PDFs, secure client portals, or encrypted communication tools. Include a note reminding the sender to double-check all details before initiating the transfer.

- Wait for Confirmation: After the sender initiates the transfer, it may take 1–5 business days depending on whether it’s domestic or international. Ask the sender for a confirmation number or SWIFT copy (a document showing transfer details).

- Verify Funds Have Cleared: Just because funds appear in your account doesn’t mean they’re available. Some banks display pending amounts immediately. Wait until the money is fully settled—usually within 1–2 business days after arrival—and confirm with your bank that the transfer has cleared before releasing goods or services.

Security Best Practices When Accepting Wires

Fraudsters often target individuals expecting wire transfers by impersonating clients or altering payment instructions. Protect yourself with these proactive measures.

- Use Dedicated Communication Channels: Establish a trusted method of contact with repeat clients (e.g., verified email addresses or phone numbers). Be wary of last-minute changes to wiring instructions, especially if delivered via email.

- Double-Check All Details: Even a single digit error in an account number can redirect funds permanently. Confirm every field with the sender before the transfer is initiated.

- Enable Transaction Alerts: Set up SMS or email notifications from your bank so you’re instantly alerted when a wire arrives.

- Watch for Overpayment Scams: If someone sends more than agreed and asks you to refund the difference, it’s likely a scam. The original transfer may be reversed days later, leaving you liable for the returned amount.

Do’s and Don’ts of Wire Transfer Acceptance

| Do’s | Don’ts |

|---|---|

| Verify the sender’s identity before sharing banking info | Send your account details over public Wi-Fi or unsecured networks |

| Obtain wire instructions directly from your bank | Use Google search results to find your bank’s SWIFT code |

| Keep records of all wire confirmations and correspondence | Delete the sender’s payment confirmation email |

| Wait for full fund clearance before delivering products/services | Release items as soon as a “pending” deposit appears |

Real-World Example: Avoiding a Costly Mistake

Jamal, a freelance web developer based in Atlanta, was hired by a UK-based startup to build a custom e-commerce platform. The client requested his wire details via email. Jamal provided them using a secure file-sharing link, as he always does. Two days later, he received another email from the same address stating, “Our finance team updated our payment system—please use the new account below.”

The new routing number looked slightly off. Instead of replying, Jamal called the client using the number listed on their official website. He discovered the company had no record of the second email. It was a phishing attempt. By pausing and verifying, Jamal avoided sending $7,800 to a fraudulent account.

“Trust, but verify. One phone call saved me thousands.” — Jamal Reed, Freelance Developer

Essential Checklist Before Accepting Any Wire

Use this checklist every time you prepare to receive a wire transfer:

- ✅ Confirmed the sender’s identity through official channels

- ✅ Obtained accurate wire instructions directly from my bank

- ✅ Shared banking details using a secure method (not plain email)

- ✅ Reviewed all numbers (account, routing, SWIFT) with the sender

- ✅ Set up transaction alerts with my bank

- ✅ Agreed on exact transfer amount and currency (especially for international wires)

- ✅ Waited for full settlement before fulfilling obligations

Frequently Asked Questions

How long does it take to receive a wire transfer?

Domestic wire transfers typically arrive within 1 business day. International wires can take 2–5 business days, depending on the country, intermediary banks, and time zones. Delays may occur during holidays or weekends.

Are incoming wire transfers taxable?

Not inherently—but the income associated with the transfer may be. For example, if you receive a wire as payment for consulting work, that amount must be reported as income. Consult a tax professional to understand reporting requirements in your jurisdiction.

What should I do if a wire transfer doesn’t arrive?

Contact your bank with the sender’s confirmation number or SWIFT copy. Banks can trace missing wires using the MT103 form (standard message format for wire transfers). Provide all details promptly. If the error was on the sender’s side (e.g., wrong account number), recovery may require cooperation from their bank and could take weeks.

Final Thoughts: Stay Secure, Stay Informed

Accepting a wire transfer doesn’t have to be complicated—but it does demand caution. With cybercrime rising and social engineering attacks becoming more sophisticated, protecting your financial information is non-negotiable. By following a clear process, verifying identities, and never rushing a transaction, you maintain control over your finances and build trust with legitimate partners.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?