Navigating financial uncertainty after job loss is stressful, but New York State offers a reliable safety net through its unemployment insurance program. Administered by the New York State Department of Labor (NYSDOL), this benefit provides partial wage replacement to eligible workers who are unemployed through no fault of their own. The process may seem overwhelming at first, especially if you're unfamiliar with government systems, but with clear guidance, you can complete your application accurately and efficiently. This guide walks you through every phase—from checking eligibility to receiving payments—with practical steps, real-world examples, and expert-backed strategies.

Understand Eligibility Before You Begin

Before logging into the system, confirm that you meet the basic criteria for unemployment benefits in New York. Not everyone who loses a job qualifies, and understanding these rules upfront saves time and avoids unnecessary denials.

- You must have earned enough wages during your \"base period\" (typically the first four of the last five completed calendar quarters before filing).

- You must be totally or partially unemployed through no fault of your own.

- You must be able and available to work each week you claim benefits.

- You must actively seek suitable employment unless exempt (e.g., due to illness or caregiving responsibilities).

- You must register for work search services at New York State Job Bank.

“Eligibility isn’t just about losing a job—it’s about meeting income thresholds and demonstrating ongoing job search efforts.” — Sarah Lin, Senior Employment Counselor at Legal Aid Society of NYC

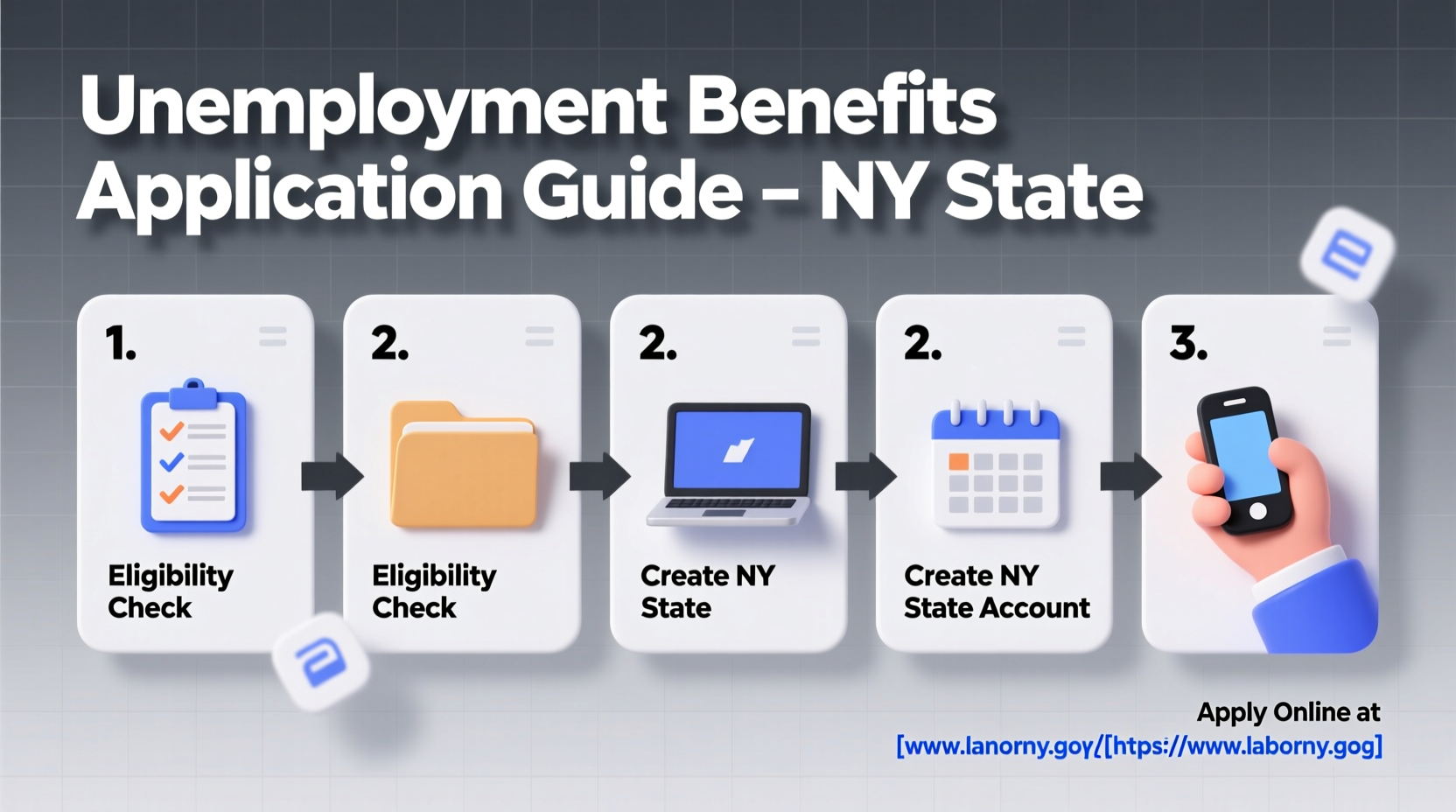

Your Step-by-Step Application Process

Filing for unemployment in New York is done entirely online via the myBenefits account. Here's a chronological breakdown of what to expect:

- Create a myBenefits account: Visit the NYSDOL website and click “Apply for Unemployment Insurance.” You’ll need to provide personal details including your Social Security number, address, phone number, and email.

- Verify your identity: Complete the ID verification using either your driver’s license/ID card info or answers to security questions.

- Report your base period earnings: Enter all employers from the past 18 months. Include start/end dates, reason for separation, and gross wages (before taxes).

- Register for work search: Link your profile to the NYS Job Bank within 30 days of applying. Failure to do so can delay or stop benefits. <5> Submit your initial claim: Review all information carefully and submit. You’ll receive a confirmation number and a Claim Confirmation Letter by mail or email.

- Wait for determination: Within 10–14 days, NYSDOL will send a “Monetary Determination” letter stating whether you qualify and your weekly benefit amount.

- Certify weekly: Once approved, certify your availability for work every week—even if you haven’t received your first payment yet.

What Happens After Submission?

After submitting your claim, the department reviews it and may contact your most recent employer for verification. If there's a dispute (e.g., your employer claims you were fired for misconduct), you’ll be notified and given a chance to respond. Most determinations are issued within two weeks.

| Timeline Stage | Action Required | Expected Timeframe |

|---|---|---|

| Application Submitted | Wait for Monetary Determination | 7–14 days |

| Determination Issued | Review decision; appeal if needed | Immediate upon receipt |

| Approval Granted | Begin weekly certifications | Same week as approval |

| First Certification | Receive first payment (direct deposit or debit card) | 3–5 business days after certifying |

Avoid Common Mistakes That Delay Benefits

Many applications face avoidable delays due to simple errors. Being aware of frequent pitfalls helps ensure a smoother experience.

- Incomplete employer history: List all jobs held in the past 18 months—even short-term or freelance roles.

- Misreporting separation reason: Be truthful. Saying “quit” when laid off could trigger an investigation.

- Missing weekly certification: Benefits are not automatic. You must certify every Sunday through Saturday cycle.

- Failing to register for work search: This is mandatory and separate from filing your claim.

- Ignoring correspondence: Check your email and physical mailbox regularly for letters from NYSDOL.

Do’s and Don’ts Summary

| Do | Don’t |

|---|---|

| Keep records of all employers and pay stubs | Guess your gross earnings |

| Use direct deposit for faster payments | Wait until the last day to certify |

| Update your contact info immediately | Accept job offers then refuse to start without valid reason |

| Document your job search activities | Leave gaps in your work history explanation |

Real Example: Maria’s Successful Claim

Maria, a retail associate in Buffalo, was laid off in February when her store downsized. Though anxious about bills, she followed a structured approach:

- She gathered her W-2s and recent pay stubs before starting the application.

- She listed all three employers from the past year, including a summer temp job.

- She registered on the NYS Job Bank the same day she filed.

- She set a recurring Sunday evening reminder to certify her weekly availability.

Within nine days, Maria received her Monetary Determination approving $420 per week. Her first payment arrived via direct deposit three days after her initial certification. By staying organized and proactive, she avoided common setbacks and maintained consistent support while searching for new work.

Frequently Asked Questions

Can I apply if I quit my job?

You may qualify if you left for a valid reason such as unsafe working conditions, health issues, or to care for a family member. NYSDOL evaluates these cases individually. Always explain your situation fully and provide supporting documentation if possible.

How much will I get each week?

Your weekly benefit amount depends on your earnings during the base period. As of 2024, the range is $100 to $562 per week. The system calculates this automatically once your claim is processed.

What if my claim is denied?

You have 30 days to file an appeal. Attend any scheduled hearings and bring evidence such as termination letters, emails, or witness statements. Many appeals result in overturned decisions when proper documentation is presented.

Stay Confident Throughout the Process

Applying for unemployment doesn’t reflect failure—it reflects responsibility. You’re taking action to support yourself and your family during a transition. The New York system is designed to help, but it requires diligence. By preparing your documents, understanding the rules, and maintaining accurate communication, you significantly increase your chances of a successful outcome.

“The most confident applicants aren’t those who know everything—they’re the ones who prepare thoroughly and follow instructions precisely.” — James Reed, NYSDOL Outreach Coordinator

Final Checklist Before You Apply

- ✅ Gather Social Security card, driver’s license, and recent pay stubs

- ✅ List all employers from the past 18 months with dates and contact info

- ✅ Confirm your reason for job separation is clearly understood

- ✅ Set up direct deposit banking details (recommended)

- ✅ Plan to register on the NYS Job Bank within 30 days

- ✅ Mark your calendar for weekly certification deadlines

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?