Getting a NetSpend card is a smart move for managing your finances without a traditional bank account. Whether you're using it for direct deposit, online shopping, or everyday purchases, the first essential step is activation. Activating your NetSpend card is simple, but doing it correctly ensures immediate access and prevents delays. This comprehensive guide walks you through every stage—from receiving your card to making your first purchase—with practical tips and expert-backed advice.

Why Activation Matters

Activation confirms your identity, links your card to your account, and enables transaction capabilities. Without activation, your card is inactive and unusable. It also helps prevent fraud by verifying that you’re the legitimate cardholder. According to financial security experts at the Consumer Financial Protection Bureau (CFPB), “Prompt activation of prepaid cards reduces the risk of unauthorized use and ensures faster access to funds.”

NetSpend, one of the leading reloadable prepaid card providers, offers fast activation via phone or online. Most users complete the process in under 10 minutes. Once activated, you can set up direct deposit, use your card for purchases, and access mobile banking features instantly.

What You Need Before Activation

Before starting, gather the following information to ensure a smooth process:

- Your NetSpend card (physical or digital)

- The 16-digit card number located on the front

- The 3-digit CVV code on the back

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- A valid government-issued ID (for identity verification)

- Your personal contact details: phone number and email address

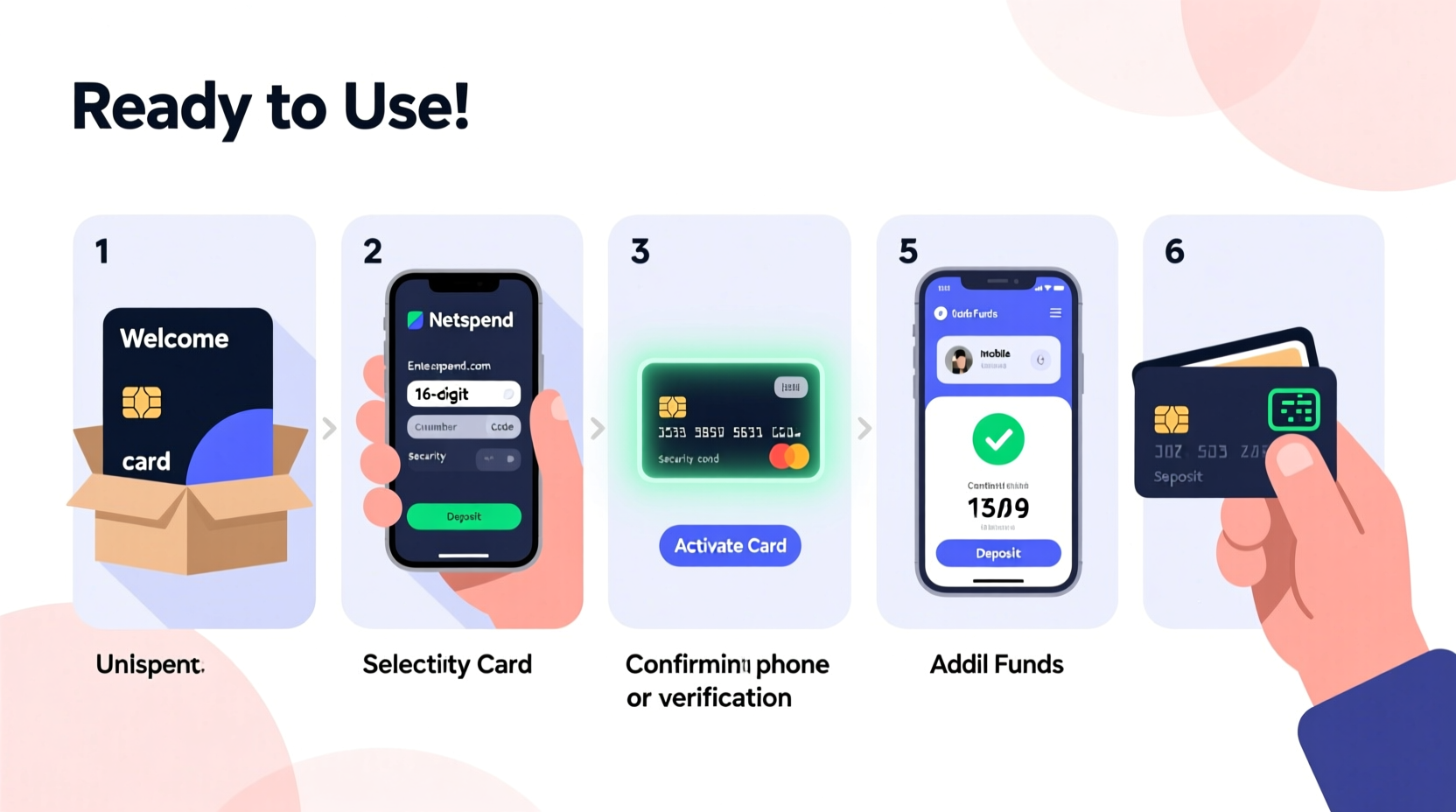

Step-by-Step Activation Process

Follow this clear sequence to activate your NetSpend card successfully.

- Locate your card details: Find the 16-digit number on the front and the CVV on the back. These are required during activation.

- Visit the official website: Go to netspend.com/activate using a trusted device.

- Enter your card information: Input the card number and CVV when prompted.

- Verify your identity: Provide your full name, date of birth, SSN or ITIN, and residential address as it appears on file.

- Create login credentials: Choose a secure username and password for your NetSpend account.

- Review and confirm: Accept the terms and conditions, then submit your information.

- Wait for confirmation: You’ll see a success message and receive an email or text confirming activation.

If you prefer phone activation, call NetSpend’s automated line at 1-866-387-7363. Follow the voice prompts, enter your card details using the keypad, and complete identity verification with a customer service representative if needed.

| Method | Time Required | Support Available | Best For |

|---|---|---|---|

| Online Activation | 5–10 minutes | Email/chat support | Users comfortable with online forms |

| Phone Activation | 10–15 minutes | Live agent assistance | Those needing real-time help |

Troubleshooting Common Activation Issues

Even with careful preparation, some users encounter hiccups. Here are frequent problems and their solutions:

- “Card already activated” error: This may appear if someone tested the card or if you’ve previously attempted activation. Log into your account instead of reactivating.

- Identity verification failed: Ensure all entered details match your official documents exactly. Even a typo in your address can cause rejection.

- Website not loading: Clear your browser cache or try a different browser like Chrome or Firefox. Mobile users should ensure a stable internet connection.

- CVV not accepted: Double-check that you’re entering the three digits on the back, not the four-digit code above your name.

“Always verify that your personal information matches government records exactly—this is the most common reason for activation failure.” — James Reed, Customer Experience Lead at NetSpend

After Activation: Set Up for Success

Once your card is active, take these steps to maximize its utility and security:

Enable Direct Deposit

Use your personalized account and routing numbers (found in your NetSpend app or online portal) to set up direct deposit from your employer or government benefits. Funds typically post one to two days earlier than paper checks.

Download the NetSpend Mobile App

The app allows you to check balances, freeze your card if lost, pay bills, and locate ATMs. Available on iOS and Android, it syncs instantly with your activated card.

Set Up Alerts and Security Features

Turn on transaction notifications via text or email. Enable card lock/unlock functionality to instantly disable your card if misplaced.

Real Example: Maria’s Smooth Activation Experience

Maria, a freelance graphic designer from Austin, received her NetSpend card in the mail on a Tuesday morning. She followed the online activation steps during her lunch break. After entering her card number and SSN, she verified her identity using her driver’s license details. Within six minutes, she received a confirmation email. By 3 PM, she had linked her PayPal account to add funds and used her card to pay for design software. “I was surprised how fast it was,” she said. “By evening, I’d already started using it like a regular debit card.”

Do’s and Don’ts of NetSpend Card Activation

| Do’s | Don’ts |

|---|---|

| Double-check your SSN and card number before submitting | Share your PIN or login details with anyone |

| Activate as soon as you receive the card | Delay activation—your funds won’t be accessible |

| Use the official NetSpend website or app | Click on third-party links claiming to activate your card |

| Keep your card in a safe place after activation | Store your PIN with your card |

FAQ

Can I use my NetSpend card immediately after activation?

Yes, once confirmed, your card is ready for use at any merchant that accepts Visa or Mastercard (depending on your card type). However, if you’re adding funds via bank transfer or check load, those may take 1–5 business days to clear.

What if I lose my card after activation?

Log into your NetSpend account immediately and use the “Lock Card” feature. Then report it lost or stolen through the app or by calling customer service. A replacement card can be ordered for a small fee, and your balance is protected from unauthorized charges.

Is there a fee to activate my NetSpend card?

No. NetSpend does not charge an activation fee. Be cautious of scams asking for payment to activate your card—this is never required.

Final Checklist: Your Activation Roadmap

- Receive your NetSpend card in the mail

- Gather card number, CVV, SSN, and ID

- Visit netspend.com/activate or call 1-866-387-7363

- Enter information accurately and verify identity

- Create secure login credentials

- Confirm activation via email or text

- Set up direct deposit, alerts, and mobile access

Start Using Your Card With Confidence

Activating your NetSpend card is the gateway to financial independence, especially if you're unbanked or prefer cashless transactions. With the right preparation and knowledge, the process is quick, secure, and entirely within your control. Millions of Americans rely on prepaid cards like NetSpend for budgeting, receiving payments, and building spending discipline. Now that your card is active, take full advantage of its features—track your spending, set savings goals, and enjoy the convenience of modern digital finance.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?