Apple Pay has transformed the way millions of people manage daily transactions. Whether you're buying coffee, shopping online, or sending money to friends, Apple Pay offers a fast, secure, and private payment method. At the heart of this experience is the Apple Card — a digital-first credit card designed exclusively for iPhone users in partnership with Goldman Sachs. Unlike traditional credit cards, the Apple Card lives inside your Wallet app and works seamlessly across devices. But how do you actually get one? This comprehensive guide walks you through every stage: from eligibility checks to activation, setup, and smart usage tips.

Who Can Get an Apple Card?

The Apple Card is available to U.S. residents who meet specific financial and device requirements. Before starting the application process, ensure you qualify:

- You must be at least 18 years old (or the age of majority in your state).

- You need a valid Social Security number.

- Your iPhone must be running iOS 12.4 or later.

- You must reside in one of the 50 U.S. states or Washington, D.C.

- You cannot already have an Apple Card account.

Unlike some premium credit cards, the Apple Card does not require excellent credit, though approval depends on creditworthiness. Many users with fair to good credit have successfully been approved.

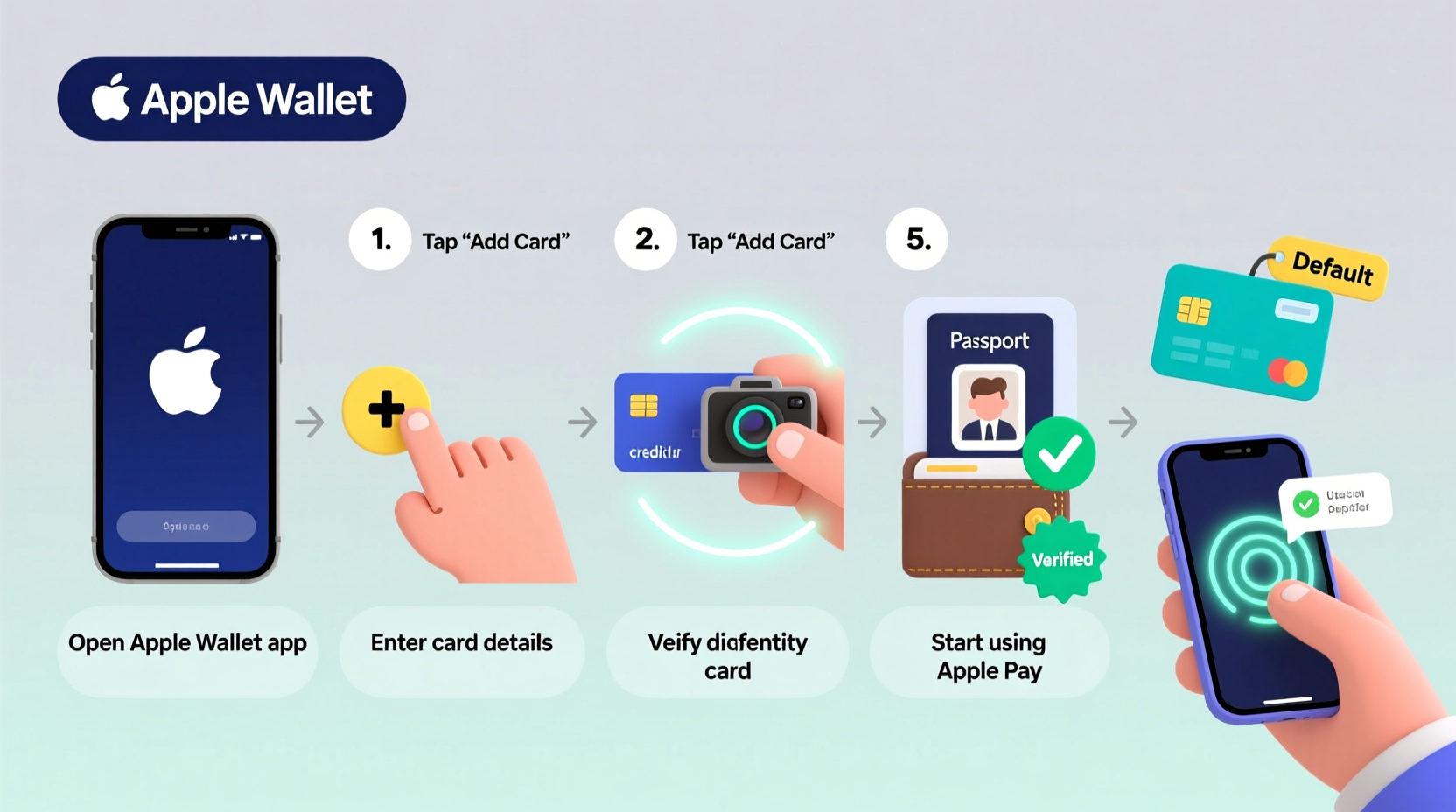

How to Order Your Apple Pay Card: A Step-by-Step Process

Ordering your Apple Card is entirely digital and takes less than 10 minutes. There’s no need to print forms or visit a bank branch. Follow these steps carefully:

- Open the Wallet App: On your iPhone, tap the Wallet app (it looks like a wallet with a chip icon).

- Select “Add a Credit or Debit Card”: Tap the plus (+) symbol in the corner, then choose “Continue” when prompted to set up Apple Pay.

- Choose “Apple Card”: You’ll see Apple Card as an option. Tap it to begin the application.

- Verify Your Identity: Enter your full name, date of birth, address, phone number, and the last four digits of your SSN.

- Provide Financial Information: Input your annual income, monthly housing payment, and employment status. This helps determine your credit limit.

- Review Terms and Apply: Read the cardholder agreement and privacy policy. If everything looks correct, tap “Apply Now.”

- Wait for Instant Approval: Most decisions are immediate. If approved, you can start using Apple Pay right away — even before receiving the physical card.

Once approved, you'll receive a digital version of your Apple Card directly in the Wallet app. This virtual card allows you to make purchases instantly via Apple Pay.

Receiving and Activating Your Physical Apple Card

While the digital card works immediately, many users appreciate the titanium physical Apple Card mailed to them within 7–10 business days. It features a minimalist design with your name laser-etched on the surface and no visible card number, CVV, or expiration date — enhancing security.

To activate your physical card:

- Open the Wallet app and locate your Apple Card.

- Tap the three-dot menu (⋯), then select “Card Information.”

- Scroll down and tap “Activate Physical Card.”

- Follow the prompts to confirm delivery and enable use.

After activation, you can use the physical card anywhere Mastercard is accepted. Transactions will appear instantly in the Wallet app with GPS-based location tagging and category labels (e.g., “Groceries,” “Transportation”).

| Feature | Digital Apple Card | Physical Apple Card |

|---|---|---|

| Availability | Instant (after approval) | 7–10 business days |

| Card Number Visibility | In Wallet app under card details | No visible number; stored securely in app |

| Use Cases | Apple Pay, online checkout, in-app purchases | Anywhere Mastercard is accepted |

| Security Level | High (device-specific tokenization) | High (no printed data) |

Maximizing Your Apple Card Experience

Getting the card is just the beginning. The real value comes from leveraging its unique features to build better spending habits and earn rewards.

The Apple Card offers cashback rewards through Daily Cash:

- 3% back on Apple purchases (including App Store, iCloud+, and Apple services)

- 2% back on all Apple Pay transactions

- 1% back on all other purchases made with the physical card

Daily Cash is deposited into your Apple Cash card every night and can be used instantly for future purchases, transferred to your bank, or saved.

“Apple Card isn’t just another credit card — it’s a financial wellness tool. The transparency in spending and automatic cashback help users stay in control.” — Lisa Chen, Fintech Analyst at TechFinance Insights

Mini Case Study: Sarah’s First Week with Apple Card

Sarah, a freelance designer from Austin, applied for the Apple Card after hearing about its no-fee structure and cashback benefits. Within minutes of applying, she was approved and added the digital card to her iPhone. That same day, she bought lunch using Apple Pay at a local café and earned 2% Daily Cash. Three days later, she received her titanium card in the mail, activated it, and used it at a gas station that doesn’t support contactless payments. By the end of the week, she had earned $6.40 in Daily Cash — automatically deposited and ready to use. She also reviewed her spending trends in the Wallet app and noticed she was overspending on dining out, prompting her to adjust her budget.

Essential Tips and Best Practices

To get the most out of your Apple Pay card, follow this checklist:

- ✅ Confirm your iPhone runs iOS 12.4 or higher

- ✅ Check eligibility before applying

- ✅ Apply within the Wallet app — never through third-party links

- ✅ Review credit terms and interest rates before accepting

- ✅ Enable biometric authentication (Face ID/Touch ID) for Apple Pay

- ✅ Activate the physical card upon arrival

- ✅ Monitor Daily Cash earnings regularly

- ✅ Use the Spending tab to analyze weekly/monthly habits

Frequently Asked Questions

Can I add the Apple Card to multiple devices?

Yes. Once approved, you can add your Apple Card to all your compatible Apple devices signed into the same iCloud account. Each device uses a unique Device Account Number for security.

Is there an annual fee or foreign transaction fee?

No. The Apple Card has no annual fee, no late fees (for first-time late payments), and no foreign transaction fees — making it ideal for international travelers.

What happens if my iPhone is lost or stolen?

Immediately mark your device as lost using Find My iPhone. This will suspend Apple Pay and prevent unauthorized transactions. Your physical card can still be used, but you may want to freeze it temporarily via the Wallet app.

Start Smart: Take Control of Your Digital Finances Today

Ordering and setting up your Apple Pay card is more than a tech upgrade — it's a step toward smarter, simpler, and more transparent financial management. From instant approvals to daily cashback and real-time spending insights, the Apple Card blends convenience with accountability. Whether you're new to credit or looking to streamline your digital wallet, now is the perfect time to take action. Open your Wallet app, apply with confidence, and experience a modern approach to everyday spending.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?